Congratulations to everyone on the last working week of July. There is not much news today, so we check the Economic Calendar at the following time:

- UK: 13:00.

- Eurozone: 11:00 a.m.

Let’s move on to the review of trading signals.

Forecast for the EURUSD asset

Analysis H 4:

The general trend is neutral.

The price is approaching the level of 1.1000 (resistance).

- MACD: in the negative zone.

- RSI: increases.

Recommendations for M 5 – H 1: at the end of last week, the value of this pair sank slightly. Today we expect a recovery. We focus on the level of 1.1000 and after breaking through it, we are looking for buy entries.

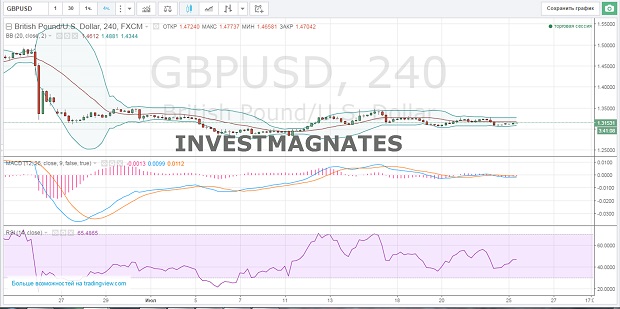

Forecast for the GBPUSD asset

Analysis H 4:

The general trend is neutral.

The price is approaching the level of 1.3160 (resistance).

- MACD: close to zero.

- RSI: increases.

Recommendations for M 5 – H 1: until 13.00 we do not take any actions, we expect the reaction of the pair to the news. If nothing significant happens, we are guided by the level of 1.3200. We buy only after it is broken.

Forecast for the USDJPY asset

Analysis H 4:

The general trend is neutral.

The price is approaching the level of 106.00 (support).

- MACD: close to zero.

- RSI: decreasing.

Recommendations for M 5 – H 1: key levels 106.70 and 107.00. After reaching them, we enter the sale.

If you work with a trusted broker, you can always count on prompt assistance even in the most unpredictable situations.

Have a great week!

Tagged with: Binary Options Signals • Binary Options Signals • Binary Options Trading Signals