Обзор

Обзор

An experienced microfinance organization offers customers to issue an urgent loan of money in the amount of up to 15,000 rubles.

Читать полный обзорОтзывы трейдеров

Детали

| Брокер | |

|---|---|

| Адрес сайта | |

| Демо счет | |

| Брокер с сигналами | |

| Общий балл |

Полный обзор

Webbankir positions its service as a fast and convenient online lending system (read reviews about MFC Webbankir on the website This is a scam™). Clients become borrowers and receive funds without visiting the office, talking with the operator and other standard procedures.

To get loans, just use a computer or install a special application on your smartphone. The webbanker promises to apply for a loan on the day of application. A guarantee is not required, and consideration of the application takes no more than 5 minutes. Can the service be trusted or is it another hoax?

Why Webbankir?

The online platform belongs to the limited liability company of the same name MFC VEBBANKIR. The organization announced itself in 2012 and since then has been actively providing services in the field of microcredit. All customers need is a stable internet connection, a business phone number, and a valid bank card. With this kit, you can quickly get borrowed funds from anywhere in the world.

To the website

Webbanker is a convenient, functional and fast service. The creators of the project use innovative technologies and make their services as accessible as possible. To solve a financial problem, you do not need to go to a bank branch or visit the office of an MFI.

Get

How to get money in Webbanker is indicated on the main page of the webbankir.com website. The resource will introduce you to the company, partner organizations and well-deserved awards. Dozens of organizations cooperate with Webbankir, which confirms the integrity and reliability of the service. The company works with popular payment systems, mobile operators and even banking structures. Customers can receive and return money in any convenient way. The creators of the electronic lending system took care of the comfort of borrowers. For those who actively use a smartphone, a mobile application is available for download. It does not differ in functionality from the official website of the organization. It works online and offline. The system looks thoughtful and stable. But is everything really that smooth?

Term loans of money from webbankir.com

You can’t get large sums in the Webbanker MFI, but this is how many microfinance organizations work. They must make sure that the client is reliable and solvent. If the borrower justifies the trust, the credit limit will increase. After the first debt is returned, the client can receive a larger amount. The most important thing is to return the money on time, and with a stable Internet and a bank card, this is as easy as shelling pears. Webbankir helps in difficult financial situations. Loans are available even to unemployed people, for this you need to register with the Employment Center. The company also offers services to pensioners, and on preferential terms. The daily rate is 1.5% of the loan amount.

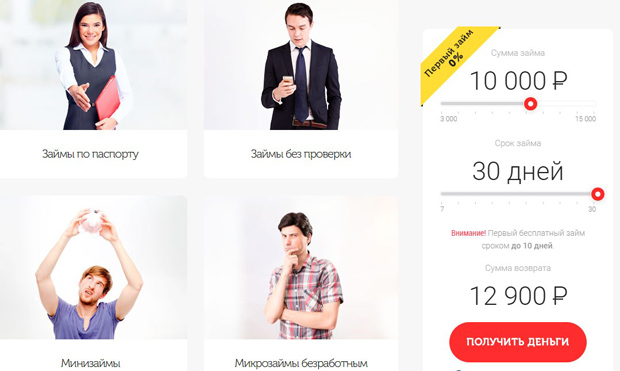

Conditions for granting money loans

The Webbankir service issues amounts up to 15,000 rubles. The minimum is 1000 rubles. It will not be possible to take more than 15 thousand rubles, this is the maximum level. Even calculating a loan with a larger amount will not work. However, this is how much is missing for people who have spent money and are looking forward to a salary. Buyers are also not used to leaving more than 10,000 rubles at a time in stores. So 15,000 rubles should be enough.

To get a loan, you need to provide a passport and specify the details of a bank card. An online calculator will help you find out the total amount of debt. It is enough to enter the loan amount and the repayment period. The system will automatically calculate the loan amount. After the fourth successful appeal to the company, the prolongation option will be available in your personal account for many types of loans. If you are applying for an online loan for the first time, proceed as follows:

- Visit the official website of the webbankir.com service and fill out the form.

- After making a decision, sign the contract by entering the code from the SMS message.

- Get borrowed funds in the way selected in the questionnaire.

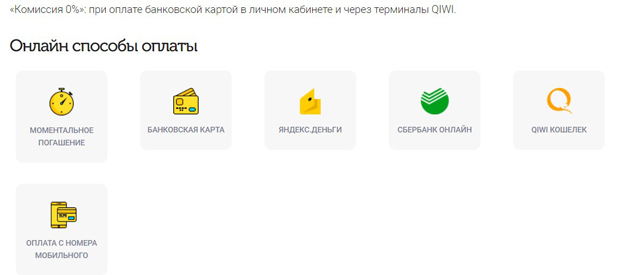

Money comes to the Yandex.Money electronic wallet, to the bank card, through the Contact payment system. The process of lending to Webbanker takes half an hour. 30 minutes is enough to fill out and send a questionnaire, wait for a response, sign a contract and receive money.

Try

The services of the service are available to all citizens of Russia. The system operates in all localities of the country. Loans can be obtained by persons whose age is from 19 to 100 years. To find a great offer from Webbanker, use the “Site Map”. Download the “Types of loans” tab and you will see all the available options. Among them there are offers for unemployed citizens, for pensioners, for working borrowers. Webbankir also specializes in POS loans. Previously, such products were issued only by banking organizations. Now MFIs have a similar right. Targeted loans are used to purchase a product or pay for a specific service. Interested in POS loans? Take a look at the “Company Policy” section. It provides comprehensive information on this issue.

How do I get my Webbankir money back?

It is convenient to issue and repay loans at Webbankir. You can deposit cash through terminals, payment systems and even send it by postal order. Online calculations are carried out through EPS, a mobile application, and a personal account. You can transfer money from electronic wallets, bank cards. The service does not charge a commission for refunds.

The list of available options for crediting funds is presented on the official website of webbankir.com. Instructions have been drawn up for each method. Go to the “How to repay a loan” tab to get acquainted with the debt repayment algorithm. You will learn how to repay borrowed funds, as well as specify the commission of a particular bank. If you decide to pay by card, get ready for additional expenses. There should be no problems with debt repayment. The instructions are drawn up in as much detail as possible, each step of the borrower is described.

Complaints against the Webbanker

Is the service as convenient as it seems at first glance? There are a lot of options for calculating, there are also many types of loans. Customers note the functionality of the service, some users respond enthusiastically about the work of Webbankir. Other borrowers leave negative ratings. What don’t customers like? Excessive intrusiveness of staff. It is worth taking out a loan once to get constant calls from managers. Employees of MFIs begin to call on the first day of delay.

Other complaints include the limitation of the credit limit. People ask for 15,000 rubles, but the service approves only half. This is a fairly common practice among MFIs and applies to new clients. Customers complain about the leakage of personal information. Contact numbers of borrowers are transferred to third parties, the same services and MFIs. The number of calls is increasing and you no longer want to work with Webbanker.

Previously, customers complained about the long processing of applications, but the technical problem was resolved. Now all stages of online lending last no more than half an hour. Other complaints came to the fore, for example, cutting limits, intrusiveness and carelessness of managers. In general, there are no critical comments on the service. The company operates stably, the percentage of approval of applications is high, although the amounts are small. But regular customers can count on the maximum limit and preferential terms.

Regulation and licenses of LLC MFC “VEBBANKIR”

Are you going to take out an online loan? Have you checked the microfinance organization? Can the electronic lending system be trusted? Legal documents and information from the regulator will help answer these questions.

License & Regulator

The online service is owned by MFC Webbanker LLC. Information about the organization is presented on the website in the tab “Recipient of financial services”. Documents confirming the official status are in the section of the same name, as well as on the “Certificates” page. Information about the creditor is in the state register of Russian MFIs. The webbanker works in a legal status, credits users legally.

- Read Federal Law No. 151-FZ of July 2, 2010 “On Microfinance Activities and Microfinance Organizations” as amended on the websites: consultant.ru, garant.ru;

- State Register of Microfinance Organizations (download from website cbr.ru, Webbankir – line 271);

- Documents from the site webbankir.com: “Recipient of financial services” (view), “Information on the terms of microloans” (view), “Information on the conditions of pos-microloans” (see), “Rules for the provision of microloans” (see).

Support

The MFI has customer support. There are several ways to contact the operator service. Consultants are ready to communicate in instant messengers. You can use social networks and even the YouTube service. The company’s accounts contain educational information and advertising publications. If you have a specific question, contact an employee via online chat. Go to the official website of the service, find the chat icon and write a message in the window that opens.

User Agreement webbankir.com

The relationship between the lender and the borrower is governed by the current legislation and the loan agreement. The webbanker enters into an agreement with each client to whom he transfers funds. If the debtor signs the bank on paper, then in the case of online lending, it is enough to enter the code from the SMS message. Such confirmation indicates that the client agrees with the terms of the contract and the loan. You can get acquainted with the documents in advance through the “Site Map”. Take a look at the “Recipient of Financial Services” section to learn more about the company, its location and legal status. The same tab contains recommendations for borrowers: individuals and legal entities.

Before applying for a loan, read about debt restructuring. This is a topical issue that worries most borrowers. Familiarize yourself with the features of debt restructuring in advance.

Specify the percentage of delay. After all, if you are late in paying the debt, you will incur additional financial costs. It is better to pay your debts on time.

Is Webbankir a scam?

Webbankir is a reliable financial assistant. The brand has been represented in the microcredit market for 7 years. The Webbankir service is suitable for online lending, credit checks, loan insurance, money transfers, and even utility bills. There are many opportunities for customers, but there is also a risk of technical failures in the electronic system. After all, Webbanker is an electronic system. If you have any problems, contact support immediately. Operators will tell you how to act in this situation.

Conclusion

Webbankir is suitable for quickly solving financial problems. You can leave a request on the site and receive money by online transfer in 30 minutes. The idea is good, but the execution is far from ideal. There may be technical failures on the site, and there are shortcomings and errors in the work of managers. If you decide to cooperate with MFIs, be careful and careful, read the documents and repay debts on time. Such a conscious approach will help to avoid penalties for delays and unforeseen situations. If you have something to say about Webbankir, then leave feedback and share your experience of cooperation with potential borrowers.

Брокер