Обзор

Обзор

The company offers a number of profitable programs for issuing urgent loans of money in the amount of up to 1,000,000 rubles with any credit history.

Читать полный обзорОтзывы трейдеров

Детали

| Брокер | |

|---|---|

| Адрес сайта | |

| Демо счет | |

| Брокер с сигналами | |

| Общий балл |

Полный обзор

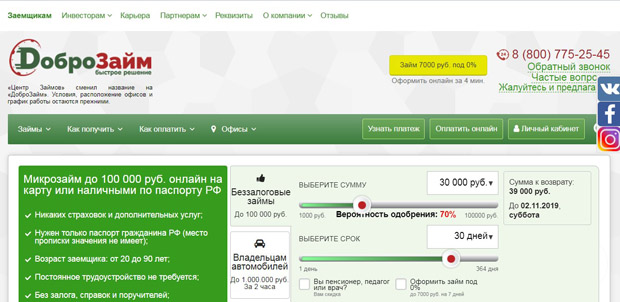

MFC “DobroZaym” is a federal network of MFI offices in different regions of Russia, which was established in 2011 (read reviews about MFC “DobroZaym” on the website This is a scam™). The presence of official registration and membership in SRO “MIR”, the absence of hidden commissions, payment only for the days of actual use of the loan, a large number of customer reviews – all this is an undoubted plus and confirms the reliability of the company.

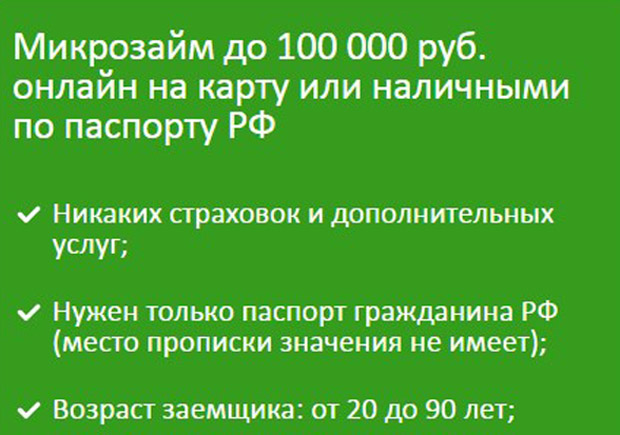

The company issues loans in the amount of up to 100,000 rubles without collateral, and car owners can receive up to 1,000,000 rubles in just 2 hours. A nice addition will be the opportunity to get a loan both in the form of cash and by bank transfer, as well as with delivery. Let’s try to figure out whether Dobrozaym is another divorce or is it a company that should be trusted.

Why DobroZaym?

The company “DobroZaym” began its work in 2011. At the moment, 65 offices have been opened, 500 people work in the IFC . To improve the efficiency of work and reduce the time for consideration of applications, the company has developed its own service scheme. As a result, you can get an urgent loan easily and simply without unnecessary insurance and additional services.

This can be a significant plus if there are financial problems that need to be quickly resolved. For example, there was not enough money for a gift, you need to purchase medicines, promptly pay for repairs or pay for the services provided. It is enough to contact the company’s office, leave a request by phone or directly on the dobrozaim.ru website. After half an hour, you can get money on the card or use courier delivery. Even the presence of a bad credit history will not interfere with the issuance of a loan. Refunds can be made using payment terminals, bank transfer, electronic payment or cash at the company’s office. In addition, customers are given the opportunity to use the “Care Service”, which can be contacted with comments and suggestions, questions and problems.

Term loans of money from dobrozaim.ru

Loyal requirements, simple conditions, speed of service, differentiated interest rate for using a loan – all these are characteristic features of the work of DobroZaym. Especially for clients, the company has developed various types of loans, among which the client can choose the best option, taking into account his own financial interests and capabilities.

Learn more

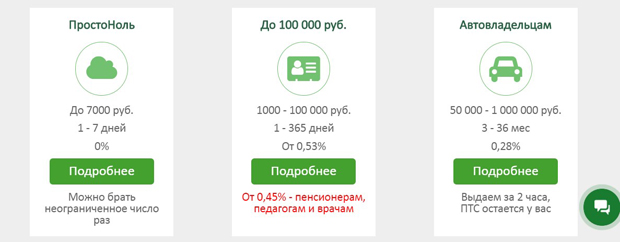

Urgent loan “Prostonol” – up to 7000 rubles for up to 7 days with the receipt of money in cash or with their transfer to the card.

Anyone can get up to 100,000 rubles for up to 365 days. At the same time, the interest rate is from 0.53% per day, and social loans have been created for certain categories of clients (doctors, teachers, pensioners). The interest rate on them is at the level of 0.45%.

Owners of personal vehicles can count on loans from 50,000 to 1,000,000 rubles. The loan term can range from 3 to 36 months. Along with these loans, the company offers to obtain borrowed funds to improve credit history.

Conditions for granting money loans

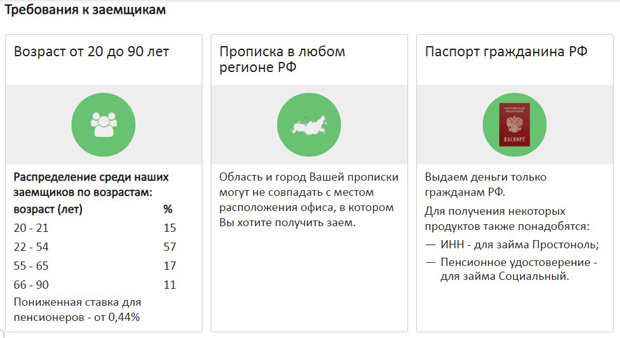

Getting a loan is quite easy and simple. The company’s requirements for borrowers are minimal:

- age from 20 to 90 years;

- availability of registration in the region of the office;

- passport of a citizen of the Russian Federation.

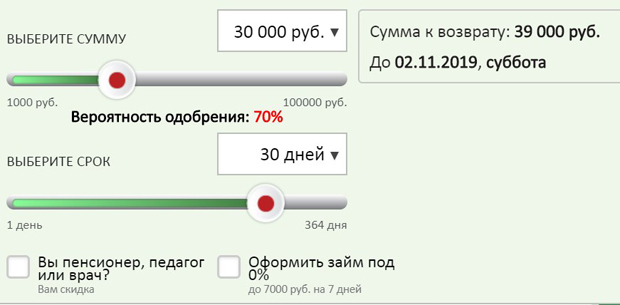

If necessary, additional documents may be requested, for example, a pension certificate. You can evaluate your own capabilities and conditions using a simple calculator, which is posted on the main page of the site. To do this, just enter the necessary information in the appropriate fields. As a result, an approximate calculation will be made, the terms of return are indicated, as well as the final amount. When considering an application from a car owner, the cost of the car is estimated and a pledge agreement is drawn up. At the same time, the car itself and the TCP remain with the borrower, the registration of CASCO, the presence of guarantors and certificates is not required. An important condition is proof of ownership of the car.

How to apply for a loan of money?

To fill out an application, you can contact the office, fill out a questionnaire on the dobrozaim.ru website, or call the hotline. When placing an application on the site, you must enter your phone number, as well as personal data. You can simplify the procedure for placing an application for a loan if you log in through your personal account. This feature is available to users who have previously contacted the company.

How to return money to MFC “DobroZaym”?

Customers are obliged to make refunds in full and on time. To do this, you can use one of the most convenient ways. When choosing a method, it is necessary to take into account the speed of transactions for the transfer of funds, as well as the size of existing commissions. Some payment systems make transfers immediately, and some may delay funds for a day, which can disrupt the payment schedule. In addition, the size of the commission increases the financial burden on the borrower to pay for services for the use of borrowed funds.

Complaints against dobrozaim.ru

When studying the feedback from DobroZaym customers, one can note the presence of both positive and negative comments. The negative attitude on the part of customers is caused by the following points:

- the need to form a package of documents;

- incompetence or rudeness on the part of the company’s employees;

- a large amount of personal data that must be provided when filling out the application;

- cases of disclosure of confidential information.

It can also be noted that the negativity is directed at specific divisions of the company. As for the positive aspects, the authors of the reviews noted:

- efficiency of service;

- gifts from the company;

- the ability to make payments on the ICC website;

- user-friendly interface and access to information in your personal account;

- fast loan transfer;

- no overpayments and additional payments.

Dobrozaim Regulation and Licenses

The activities of microcredit companies are regulated by the norms and provisions of the current legislative acts. The study of this information will allow potential clients to get an idea of the essence of the transactions, the mechanisms used to conduct them, the rights and obligations of the parties.

License & Regulator

The company “DobroZaym” has been operating on the market since 2011, has an extensive network of offices in different cities and regions, as well as official certificates issued during registration. All information about the company is freely available on the “Legal Information” page. The list of certificates posted in this section includes:

- IFC Registration Certificate: 2110177000192;

- certificate of state registration of OGRN: 1117746346244;

- certificate of registration of TIN: 7728771940;

- certificate of membership in SRO “MiR”: 77000032.

- Read Federal Law No. 151-FZ of July 2, 2010 “On Microfinance Activities and Microfinance Organizations” as amended on the websites: consultant.ru, garant.ru;

- State Register of Microfinance Organizations (download from website cbr.ru, DobroZaym – line 827);

- Documents from the DobroZaym website: “Information on the conditions for the provision, use and repayment of a consumer loan (microloan) of LLC MCC DZBR” (look), “Rules for the provision of debt restructuring to LLC MCC DobroZaym Quick Solution” (look), “Personal Data Processing Policy of MCC DobroZaym Quick Solution LLC” (download), “Rules for the provision and servicing of consumer loans (microloans) of LLC MCC DobroZaym Quick Solution” (download).

Support service of MFC “DobroZaym”

According to the information provided on the official website of the dobrozaim.ru, you can get help, consult on issues of interest, and also contact the organization in one of the following ways:

- toll-free: 8 (800) 700-84-18;

- by e-mail: info@dobrozaim.ru;

- using an internal online chat on the company’s website.

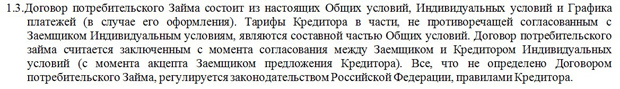

Dobrozaim User Agreement

The company’s work is regulated by legislative acts and internal regulations, which are enshrined in the relevant documents. To learn more about the key conditions, learn more about the application procedure, the process of its consideration, approval, methods of issuing loans and the conditions under which borrowed funds are provided, you can study the terms and conditions of granting loans, as well as the provisions of the loan agreement. When studying the general terms and conditions, it should be noted that along with the general conditions, individual conditions are developed specifically for each client, which become an integral part of the contract.

In addition, the terms and conditions spell out the procedure for early repayment of the loan. When repaying part of the debt, an updated payment schedule is drawn up.

One of the important points is the intended use of the loan.

It is also necessary to take into account additional conditions, which include information on debt restructuring (deferral of repayment of principal, interest), including the conditions under which it can be made.

The rules for granting deputies list the conditions on the basis of which the applicant may be denied a loan.

The types of information that may be requested by the company to analyze the financial situation of the applicant and assess its solvency in terms of repayment of payments are prescribed.

Important points that are specified in the loan agreement are restrictions on early repayment of the loan. These data, along with information about the penalty, give an idea of the rights of the borrower and the lender, situations that may arise between the parties.

Is “DobroZaym” a scam?

The information presented in the previous paragraphs, together with a long period of work in the market of microfinance organizations, testifies to the reliability of DobroZaym and its rich experience in working with clients. Over the 8 years of its existence, the organization has been able to create a whole network of offices, as well as develop competitive conditions for working with clients. An additional advantage is the availability of official registration and certificates. All this allows us to assert that MCC “DobroZaym” is not a scam, but a company with many years of experience in providing microfinance services, which offers loans to individuals on favorable terms.

Conclusion

Summarizing the above information, it should be noted that the company ” DobroZaym” has been operating in the market since 2011, it includes offices in different cities and regions. The list of the company’s services includes loans on different terms, which are focused on different social groups of the population, which allows everyone to choose the best option, taking into account personal requirements and financial capabilities. When re-applying, customers can take advantage of indulgences. A tangible advantage can be the ability to conclude transactions online, as well as the availability of courier delivery of funds.

Брокер