It seems to me that it is in the power of this portal to change the whole life of a trader, both for the better and for the worse. There are people who put their heart and soul into helping us become better traders. And then there are the trolls, the ones who say no, the fake gurus, the haters, the ones who yell at the corners with no idea about trading, or accidentally lead us astray. All this depends entirely on how we know how to distinguish the wheat from the chaff.

I suggest focusing on the positive side, and doing something nice for everyone, especially for beginners, in this case we are talking about pointing them in the right direction for profitable trades. This is the sole purpose of this publication.

I would like to invite all earning traders to talk only about their general methodology. Everyone should respect the fact that those who make money from trading are entitled to their own trading secret, how to make money, unless they are residual generous in sharing their secrets of their own free will. So, please don’t ask anyone to share with you the secrets of profitable trading and the details of a strategy that helps you make money.

This publication is not a reason to attack or ridicule the methods used by others to trade. If it makes a profit for them, then they don’t need your assessment. And to ridicule what eventually turns into truth is to call on yourself the same.

So, I’ll start and talk about where my research has led me:

I have been trading Forex for a considerable period of time. In different directions. On demo and real accounts. But my study continues and never ends. I love Forex in the same way that someone might love to solve a Rubik’s Cube. This is a great puzzle that I intend to put together. And I’ve been studying Forex for many years, so I can say that I have chosen the following more general strategies, out of the millions of strategies that can be offered to you. There are INFINITE variations among each category of strategies, but it seems to me that these are the cream of all the strategies that are used in Forex.

Trading on price action

The price is king, and you directly depend not on price indicators, but solely on it. This is absolutely open trading, and entry and exit are determined solely by the price movement. When using this strategy, traders use the price as an indicator. The reason for this type of trading is that the price samples themselves repeat human behavior. For traders using this strategy, anything that interferes with the price on the chart destroys their trading. Therefore, they will never use indicators such as heiken ashi, a break on 3 lines, or any other that can be superimposed on the image of the price movement. The only way to understand the movement of the market for a trader using trading on the action of the price is the price itself.

Trend Trading (Trend Trading)

The basis for the development of this strategy was the fact that historically the price moves in the direction of a certain trend. There are 3 main types of movement in the Forex market: up the trend, down the trend, to the sides. Trend traders always take advantage of the moment when price moves up or down, but suffer when price stagnates or stops. They rely very heavily on trend indicators to help get rid of the noise visible on the chart. Any indicators that will cover the actual price, or only present the general direction of price movement, are valuable information for traders using Tren in trading. But all trend indicators are delayed indicators. And those who try to predict the future by any means of calculation will never lead to constant profits.

Breakout/Support and Resistance/Supply, Supply and Trading Volume ( Breakout/Support )

The reason for such trading is that the price historically either breaks out of the stopping period or bounces off a certain level. Traders believe that there are certain price zones in which the price will either break through a certain limit or bounce back. Traders also take advantage of this situation by setting their positions at the ends of the consolidation or stop period. Traders try to capitalize on price reactions at certain levels, taking into account oversell or overbuy areas. They expect that they have a fairly good understanding of supply, supply, volume, which are the cause of the emergence of consolidation levels, indicators of when a breakout / rebound will occur, in which direction prices will move further. They use a limited number of indicators to confirm, as such traders tend to trade with understanding.

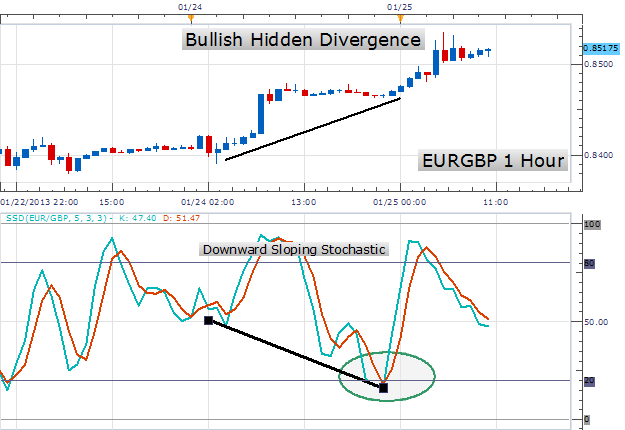

Divergence Trading

The basis of this type of trading is that the movement of oscillators often does not follow the real price movement. The price can make higher peaks, and indicators can make lower peaks. These discrepancies often result in good trading signals being generated. Traders rely on the use of indicators in order to make the basic decision to enter and exit trades. They are constantly looking for the best indicators that display accurate and hidden divergence. Often they use multiple oscillators as additional confirmation.

Basket Trading

The principle of this type of trading is that there are certain trading correlations between currency pairs. This correlation is not 100% constant, but when certain currency pairs move in the same direction, they are often followed by associated pairs. In the case of multiple currencies, trend trading is used. So, traders using this strategy see several charts at the same time, and make decisions based on many data. They can trade one or more currencies at the same time. The main task for such a trader is to understand when traditional pairs are likely to move in unison. Like traders using a trend strategy, they often use tag indicators in order to determine the direction of movement of multiple currency pairs. Sometimes even they realize that all associated pairs are moving in the same direction, and then it is quite difficult to perceive them as separate pairs when each of them is already moving in its own way.

Combo Trading

Traders using this strategy are the riskiest traders. They combine everything they can work with. Often they suffer from information overload and paralysis of analytical skills, since different methods can give conflicting signals. This type of trading requires incredible concentration, this method is very difficult for beginners.

EA Trading (

EA Trading)

Traders using this strategy have found their limits and automated their strategies using a trading robot. Trading still requires human intervention and monitoring. I’m still trying to find a robot that works all the time and consistently makes a profit.

So, my conclusions: this is by no means a definitive list, the topic is open for discussion. And, of course, very often the boundaries are superimposed, so in most cases it is enough just to combine some methods to find your own boundaries.

As it turned out, some well-known strategies do not make a profit all the time, among them such as: the Martingale strategy, the grid system, the hedging system, etc. Arbitrage, although risk-free, is a fairly modern and advanced strategy, and may not be available to most hotel traders.

I propose to share a common methodology that will simplify trading for each of us, and make investmagnates.com the best binary options portals in the world.

Rating of binary options brokers