The main reason why novice binary options traders drain their deposits is not at all erroneous forecasts, but the absolute absence of “money management”. The inability to competently manage your trading capital in combination with the desire for quick enrichment leads to loss of money and disappointment in trading. Let’s consider what money management is and why a trader needs it.

So, money management is a set of rules by which you can avoid losing a deposit. The fact is that, even using the most accurate strategy for trading options, it is impossible to close 100% of transactions with a profit. Moreover, often even the most effective strategies stop working due to inexplicable and unpredictable market situations and bring losses to traders. In such cases, your main task is to be able to sit out unprofitable periods with the least damage to your deposit.

Simple math and money management rules

As you know, on average, one option can get from 65% to 90% of the profit, which is determined by the type of trading asset, the type of option and the current market situation. The damage on a losing trade is always 100%, and even if the broker (rating of the best brokers) has a partial rebatement (return of a certain part of the losses), it will not help to save capital if too large an amount was invested in the transaction. For example, you have $100 in your account, and you are going to invest $25 in each trade. That is, in fact, you will be able to make only 4 trades, and if all of them are unsuccessful, you will merge your deposit. And even if you have chosen a profitable strategy, under unfavorable market conditions or your lack of understanding of the market situation, after 4 unprofitable trades you will go bankrupt.

The basic rule of money management is that the maximum amount of each transaction should not exceed 5% of the volume of your trading account. That is, if you have $100 in your account, then the size of the option should be only $5 (100*5/100). At the same time, 5% is the maximum of your risk in one option, whereas with more risky trading, it is recommended to reduce this risk to 2% of the deposit size (scalping, using martingale or averaging). In fact, the larger the amount in your trading account, the lower the percentage of risk should be – this way you will eliminate the psychological effect of trading for a large amount of funds.

If the amount of your deposit is only $ 10-20, then another rule applies – it is necessary to conclude transactions of the minimum possible size before increasing the deposit amount to the size that allows you to comply with the above rules. For example, with the above capital, you should make 1-dollar trading bets.

Also note that it is necessary to calculate the size of each new transaction. That is, with a deposit of $100 and 5% risk, you will not have 20 trades. If calculated correctly, $5 is the sum of only the first trade, and if it is unsuccessful, the amount of the next trade should be $4 (fractional numbers should be rounded). If, for example, you have $1000 in your account, then the amount of the first transaction should be $50, the amount of the second $47, and the amount of the third should be $45. Thus, each time you need to take 5% of the amount of your account at the moment. As a result, after three unsuccessful trades, you lost $142. That’s probably decent money for you. And imagine that you would lose more if you constantly risked 5% of the initial amount of capital or even increased the risk in each option to 10-20%. Moreover, you would lose even less if you risked only 2% of the deposit volume in each transaction.

Flexible Money Management for Binary Options

It is worth noting that in competent money management, not only the arithmetic skills of the trader and strict adherence to all the rules play a role, but also the availability of the opportunity for the correct calculation of risks, which the binary options broker must provide. For example, if the minimum deposit amount with a broker is $100, and the minimum transaction amount is $25, then you will not be able to comply with the rules of money management. To correctly calculate the risks, you will have to deposit at least $500 into your account.

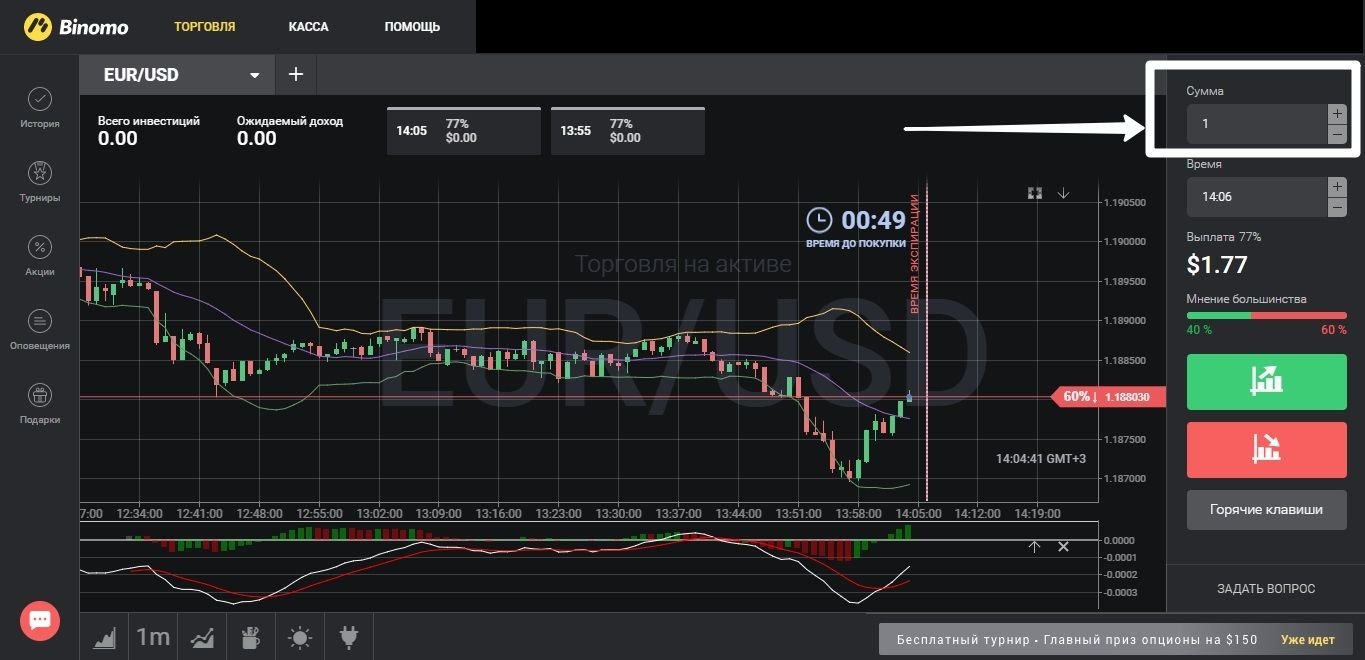

If you do not have such an amount of funds, and do not want to drain your deposit with such large trading rates during the day, then your option is brokers with a minimum deposit, where you can start trading with $10, and the minimum transaction amount starts at $1. For example, Binomo has the following trading conditions:

In fact, you can choose how much to replenish your trading account, while you will always competently manage your capital, having the opportunity to enter into transactions from $1.