Today, fraud in the financial sector is no longer surprising. Many citizens who seek to earn quickly and a lot, without having basic knowledge, fall into the hands of scammers. At the same time, scammers often imitate such high-risk markets as binary options and forex. Inexperienced beginners do not even notice the forgery and entrust their money to scammers without looking back. Problems begin when traders want to withdraw their money, and in return receive promises, threats and demands for new deposits. This is exactly the scheme that the newly-minted swindler broker Investing CASE is doing.

The scammer is silent about PAMM accounts

There are some alarm bells that will tell you whether you can trust the broker or not. One of them is related to the use of PAMM accounts. Such accounts provide traders with a high income, and at the same time they do not have to spend time conducting trading operations. Several traders invest in one account, which is managed by the most experienced and skillful of them.

He himself also invests in a PAMM account, so he takes risks deliberate and concludes transactions “as for himself”. Almost all bona fide forex dealers offer PAMM accounts to their clients. And what about Investing CASE? On the Investing CASE website, PAMM accounts are not mentioned even in passing. The reasons are obvious: an experienced trader can wander into the site, who will see through the deception at the moment and spread the notoriety on the Internet (binary options scammers).

The fraudster does not serve legal entities

Investing CASE states that it offers favorable conditions to all clients. But there are no offers for legal entities. Which is strange, because legal entities have a constant cash flow, and their owners are constantly looking for investment options. It is much more profitable for real brokers to work with such clients than to collect a small share from traders – “physicists”. What about scammers? They are rightly wary of enterprises with their in-house lawyers, security services, connections in law enforcement agencies.

There is no access to American stock exchanges

Foreign stock exchanges such as NYSE, AMEX, LSE and others are a real gold mine for traders. Here, traders receive powerful information support, and can also conduct successful trading. Any legal broker provides traders with transactions on these exchanges in order to earn more on profitable transactions together with clients (rating of binary options brokers). However, none of these exchanges are mentioned on the Investing CASE website. Scammers offer their own platform. Where do the quotes come from? Obviously, the numbers are generated arbitrarily, and at the right time they are controlled by crooks in manual mode.

Discrimination of customers in the user agreement

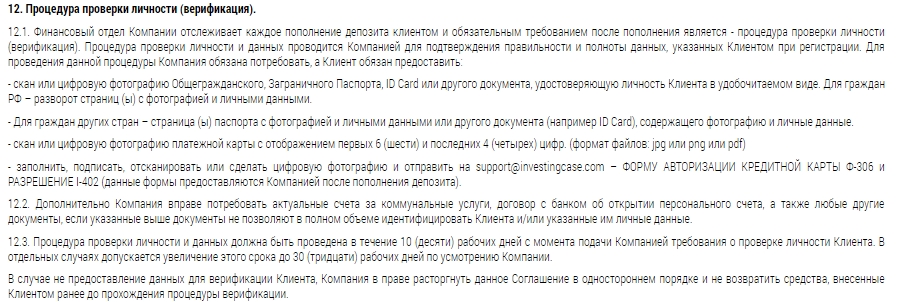

Unfortunately, few of those who start cooperation with fraudulent brokers read the user agreement before they apply for registration or replenish the deposit. They have no time. Scammers are in a hurry to deposit money into the account in order to make a profit faster. At the same time, if you carefully read the Investing CASE user agreement, many unpleasant details emerge. For example, how the verification procedure takes place on the site.

As you can see, a client who has not passed the verification procedure will not receive his deposit back, and in order to go through the procedure, he must provide a photo of his passport and bank cards. The company also requires utility bills. This is the clearest sign that you are dealing with scammers who are afraid of running into US or Israeli citizens. If a person refuses to provide his confidential data, then the pseudo-broker will not withdraw his funds.

Reputation on the Internet

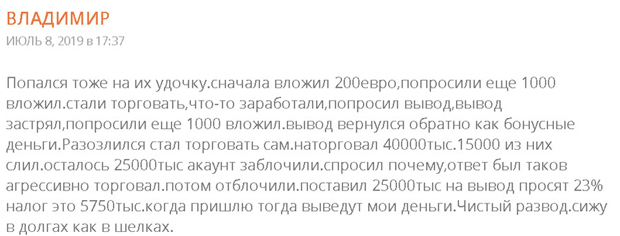

Among the reviews of a fake broker, you can basically see only negativity (complaints about binary options brokers). People complain not only about the missing deposit and the money they invested, but also about the fact that huge amounts have been charged to their credit cards without their knowledge. Many say that scammers requested huge commissions for withdrawing funds, which additionally had to be entered, and after transferring money, the scammers simply stopped communicating (black list of binary options brokers).

The story of one victim

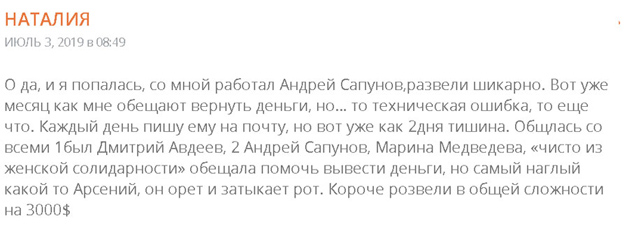

At the beginning of 2019, a woman, due to a difficult financial situation, was looking for additional income on the Internet in order to invest some money and receive income from them. In February 2019, she received a call from Stas Yasenin, a representative of the InvestingCASE trading platform. He offered the victim to receive income from trading on the stock exchange. But an entrance fee of 700 thousand rubles was required. To collect such an amount, the woman had to borrow money from her relatives. By February 27, 2019, she collected the required amount and deposited it into the account from the Sberbank card. This was followed by a verification procedure, during which the fraudsters received her passport and bank card details. In addition, Yasenin demanded that she install the remote access program “ANYDESK” on her computer and give him access. So the scammer was able to control the programs and bank accounts of the victim.

The woman fully trusted Stas Yasenin and performed all operations at his suggestion. However, in early March, one of the deals was a failure. However, the swindler assured that the situation can be corrected if you make a “small” amount, which amounted to 100 thousand rubles. The woman fulfilled the condition and on March 5 sent the required amount, but Stas said that this was not enough and another 50 thousand rubles were needed. The woman was afraid of losing what she earned, so she again went on about the scammer.

After replenishing the deposit, the balance began to straighten out. Things seemed to have gone uphill, so the victim asked to withdraw some of the money from her account. Although Yasenin agreed for the sake of appearance, the woman did not receive the money. The crook said that he sent the money to the bank, and there they were stuck, and in order to receive them, you need to pay a tax of 50,625 rubles. The victim, in desperation, sent the required amount, but the analyst reiterated that this was not enough. The woman explained to Stas that she had no more money, only debts. Then the deceiver began to threaten her with blocking the account and behaved extremely rudely. By disabling the victim’s access, the scammers simply stopped communicating. In total, the woman lost 900,625 rubles (is it possible to return the money from the broker?). Don’t believe these people:

- Stas Yasenin

- Dmitry Avdeev: dmitriy.avdeev@investingcase.com

- Marianna Medvedeva: marianne.medvedeva@investingcase.com

Afterword

Scammers come up with new ways to cheat every day. However, most often they use well-studied schemes and only change phone numbers and Internet sites to find new victims. Check your broker carefully before trusting them with money. Make sure that he has a license from the Central Bank. If you feel the slightest apprehension, it’s best not to give your money to strangers who call you on the phone. Scammers are ready to promise huge and easy money, but in practice they only care about replenishing their pockets. InvestingCASE and its victims are a prime example of this.