Price Change Channels (PCU) indicator

Description

The advantages of trading attract more and more active Internet users who are looking for work on the network. Options allow you not only to get decent real money, but also to become a freelancer and earn where it is convenient for you: at home, on the beach, on an airplane or by the fire. Only trading makes it possible to get the first money in 30 seconds. Here you yourself influence your income, trade exactly as much as you need funds.

Having reached the first earnings, professionals improve their knowledge, study the principles of the market, always look for productive strategies and indicators, study reviews of oscillators and broker ratings. All this material necessary for a trader is on our portal, and to become a real professional, go to our resource and study it. Today we will tell you about the Price Change Channels indicator.

The Price Change Channels (PCU) indicator is one of the simple but very effective trend trading tools, the author of which is the famous creator of the wave theory Ralph Nelson Elliott, although it is also known that the first version of the tool was developed by trader Richard Donchian. The PCU is based on the desire of the market, despite its dynamics, to always come to an average price that would suit all participants in the trade – both buyers and sellers.

Such an indicator is the moving average indicator, around which in this case the flexible price change channel itself is built. Its width is constantly changing, which is affected by market volatility: if the exchange is completely at rest, the indicator narrows, if the exchange is dynamic and shows a change in trends, the channels expand. In the role of a moving average, you can use all its variants SMA, EMA, MEMA, etc.

One of the advantages of the indicator is that it is a very accurate tool that allows you to get a good income. Its application is also very simple, and to start working with it, you just need to set the settings correctly.

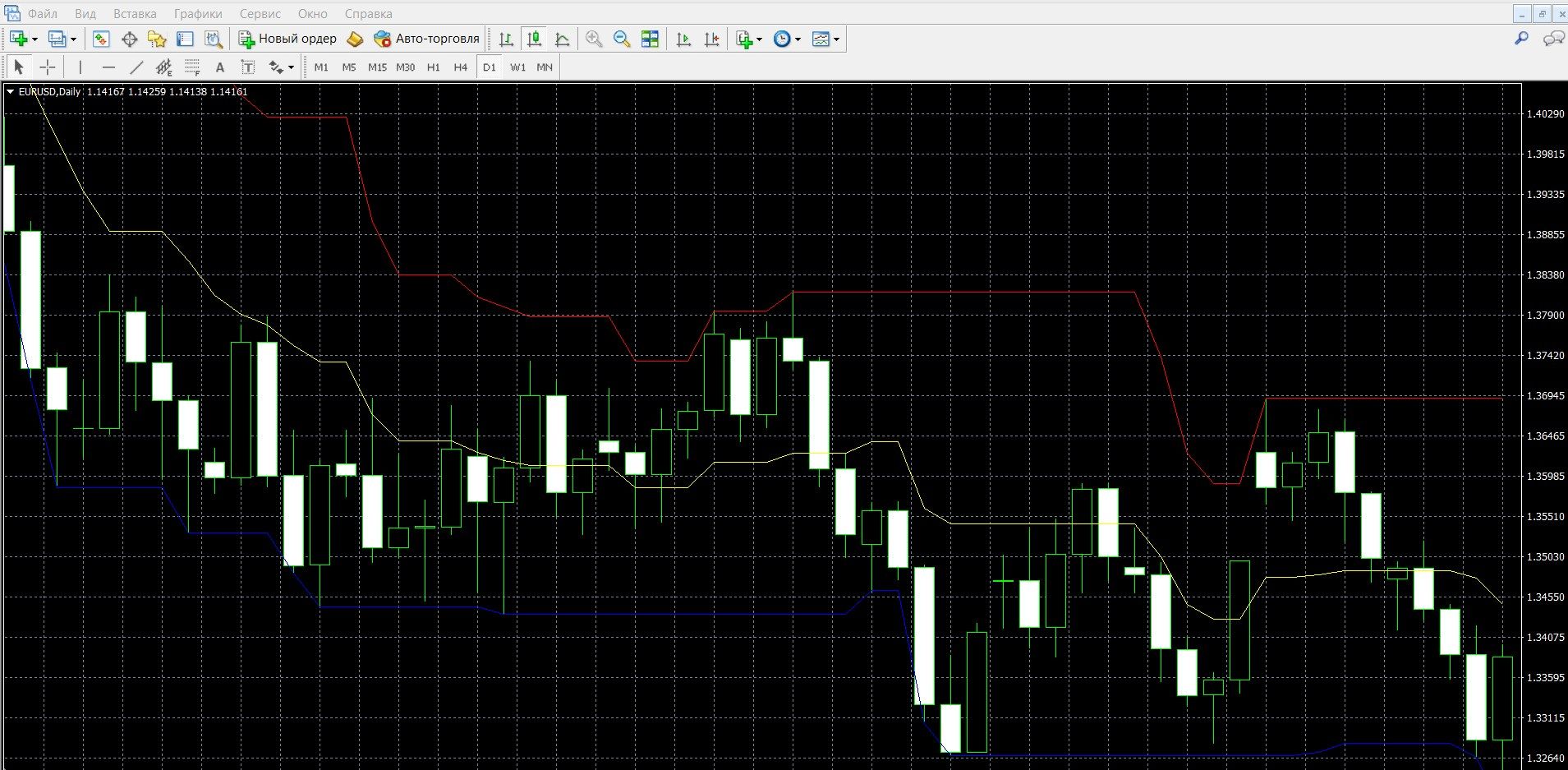

You can see what the PCU looks like on the MetaTrader 4 price chart in the image below. You can also download the MetaTrader 4 platform and work with the indicator.

What is the working principle of the PCU indicator?

The indicator is popular with traders, has simple principles of operation, and is very convenient to use. The peculiarity of the tool is that all market movements eventually rush to the average value. The instrument has the structure of a channel, its boundaries are the price, and in the center is one of its main elements – the moving average, it is around it that the market dynamics unfolds.

One of the main elements of the analysis of market dynamics is the study of price deviations from its moving average, this is volatility. The channel is constantly changing, and all market fluctuations eventually tend to their average value: if the volatility indicator has increased, the boundaries expand, which is a signal of imminent changes. So, the Channel resembles a price envelope.

The PCU is very similar to another popular tool, the Bollinger Bands. If the indicator is built correctly, then within itself it contains 95% of market prices and only 5% go beyond the boundaries. As with the Bollinger Bands, the trader expects the price to rebound from the boundaries of the channel (support and resistance levels) and places bets:

- if the price mark, tending to the lower limit, then bounces off it, market participants buy call options;

- if the price, tending to the upper limit, then bounces off it, market participants buy put options.

PCU Calculation Formula

PChi = max ([Hi-n; Hi]) – upper line (resistance);

PCli = min ([Li-n; Li]) – bottom line (support);

PCmi = (PChi+PCli)/2– middle line;

n is the period of the Price Channel indicator.

Info taken from website ru-trade.info

Indicator signals:

Trend signals

The so-called internal strategy for working with Channels:

- When both boundaries of the indicator (upper and lower) grow and never decrease, this is an uptrend, a signal to buy a call option,

- When both boundaries of the indicator (upper and lower) are declining and never growing, this is a downtrend, a signal to buy a put option.

Signals of support and resistance levels

Sufficiently strong and reliable signals:

- If the price mark is close to the lower limit, this means that it will soon reverse, it is worth buying a call option,

- If the price mark is close to the upper limit, it means that it will soon reverse, it is worth buying a PUT option.

Do I need to install a PCU indicator in your platform?

PCU is a non-standard options trading tool, it is not included in the basic set of MetaTrader 4 indicators. You can download it quickly and for free here. How easy it is to install files in MT4, you can read here.

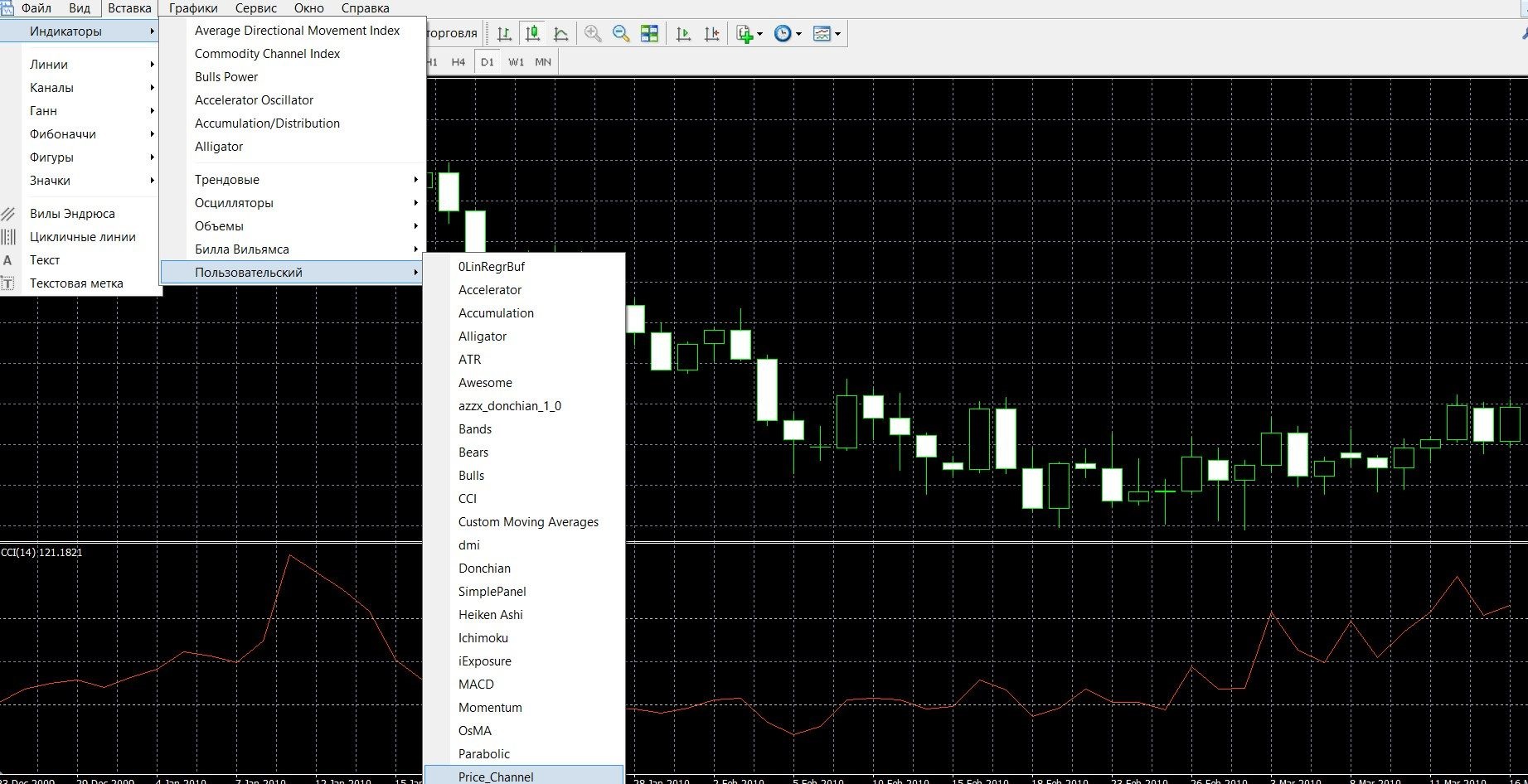

After installation, add the indicator to the price chart, for this:

- Click the “Insert” tab in the top menu of the platform

- Select the tab “Custom” – “Price Channel”.

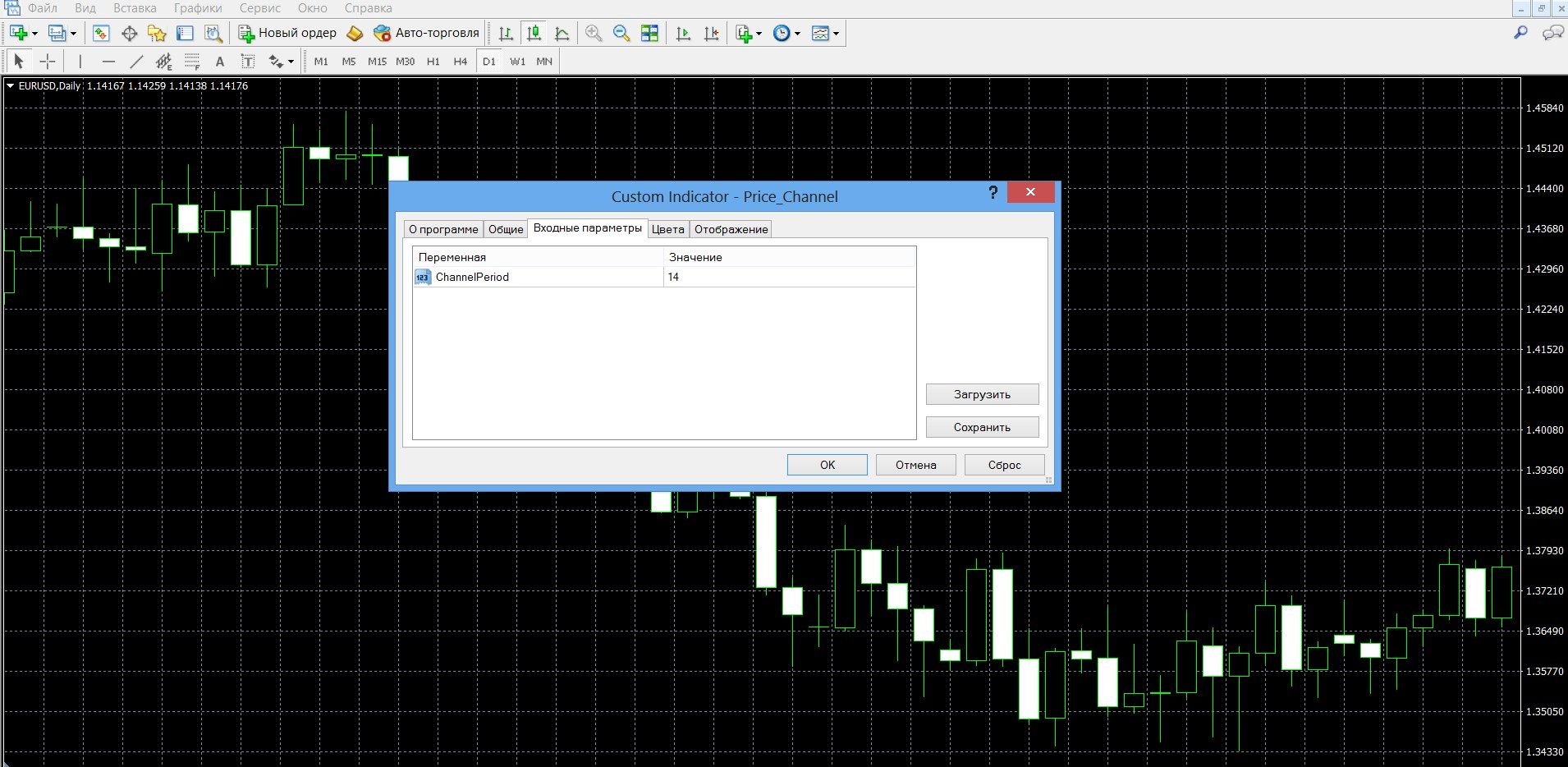

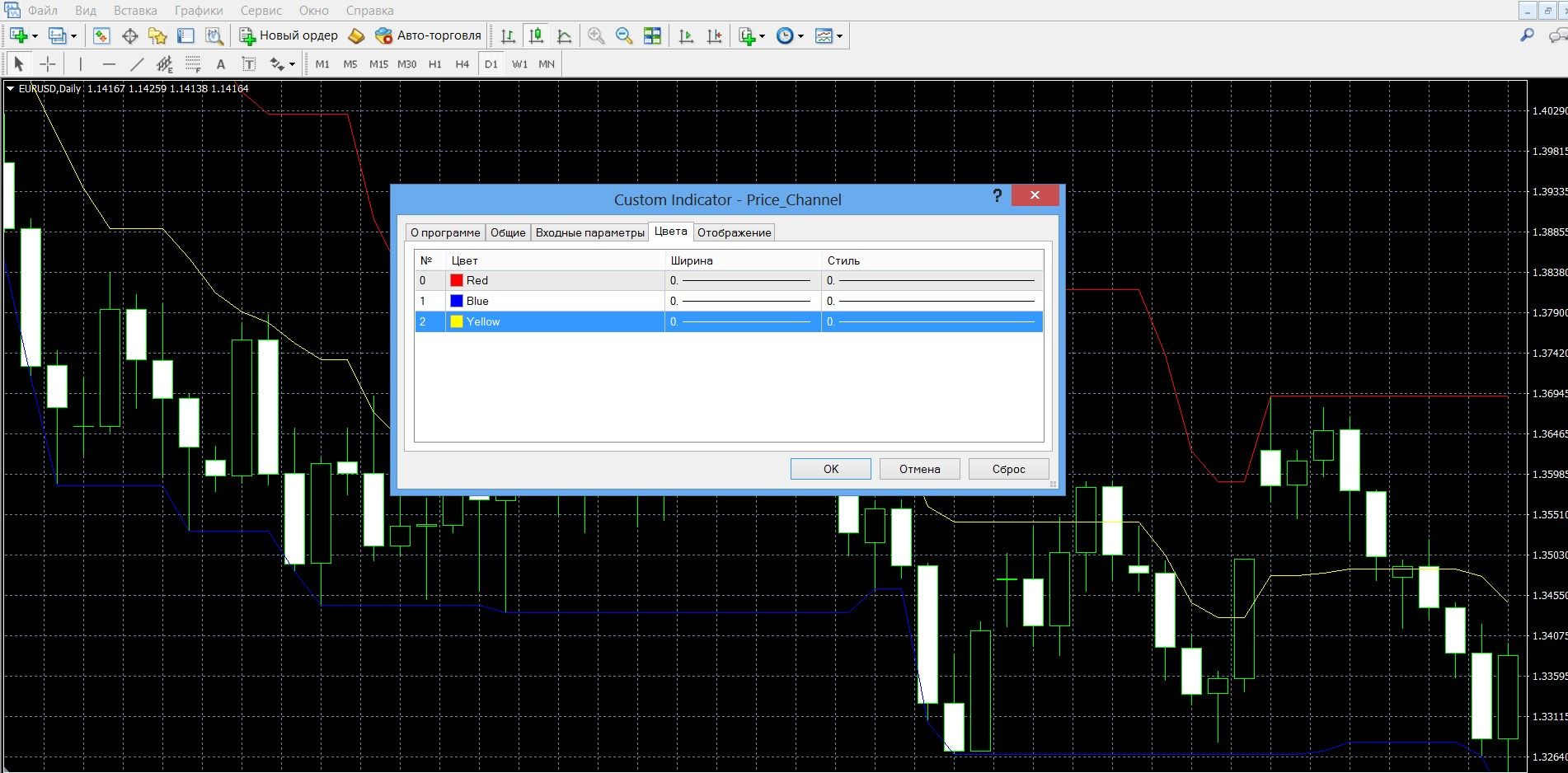

The main parameter of the tool on which the effectiveness of the work depends is the period. The standard period indicator is 14, but you can set your settings according to your strategy.

Application of the indicator for binary options

Price change channels are one of the simple and understandable, but interesting indicators of binary options, which shows good results, especially when used as part of a trading strategy. Most often, traders rely on support and resistance levels in their work.

Proper use of the tool will allow you to react in time to the exit of the price chart beyond the boundaries of the channel, which are high-quality signals. PCU can be used by both beginners and professional market players. Such advantages allow you to apply its data in different markets, in Forex, in stock markets, in binary options trading, etc.

Thanks to the tool, you do not need to manually outline the channels, everything happens automatically, which eliminates subjectivity on the part of the trader. It quickly determines the state of the market and the peculiarity of its trend. The indicator finds signals by taking into account local support and resistance levels. Therefore, all work is built around these signals.

Such trading is simple and understandable even for a beginner. It is worth remembering that only with the right setting, the indicator will become a real profitable strategy. Nevertheless, it is recommended to use it with other confirming trend tools in order to increase the quality of signals and increase the effectiveness of work.

Rules for concluding transactions (screenshots)

Trading with a trend signal

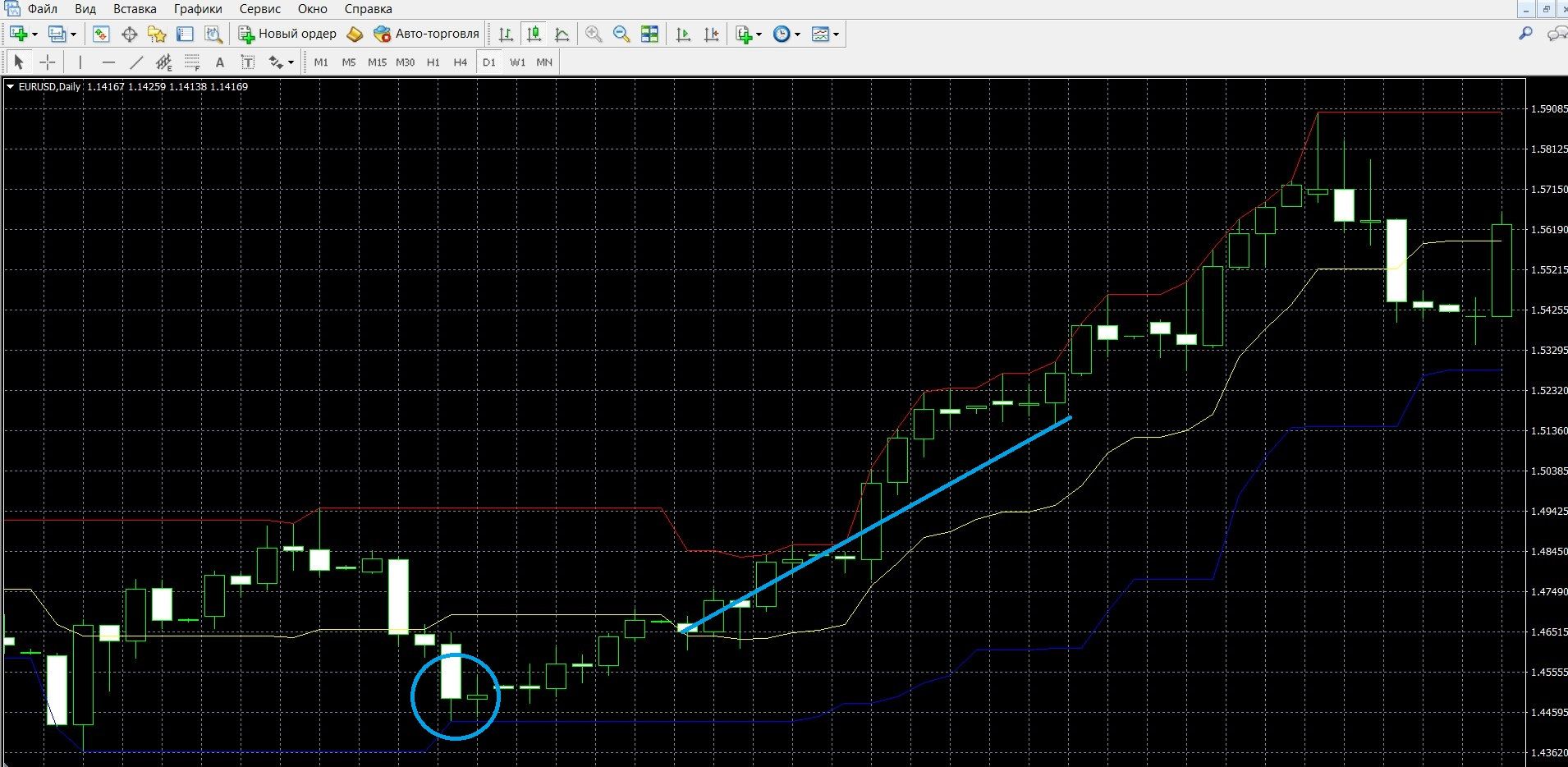

When both PCU boundaries (upper and lower) rise and never fall, this is an uptrend, a signal to buy a call option. In the image below, you can observe the upward trend of the market in the MetaTrader 4 trading terminal:

Taking advantage of the trend, make a CALL bet with the Finmax broker, for which go to the finmaxbo.com website and prepare an option, indicating:

- Type of option

- Expiration date

- Amount

- Prediction: up

- Next, click the “buy” button and wait for the results of the forecast:

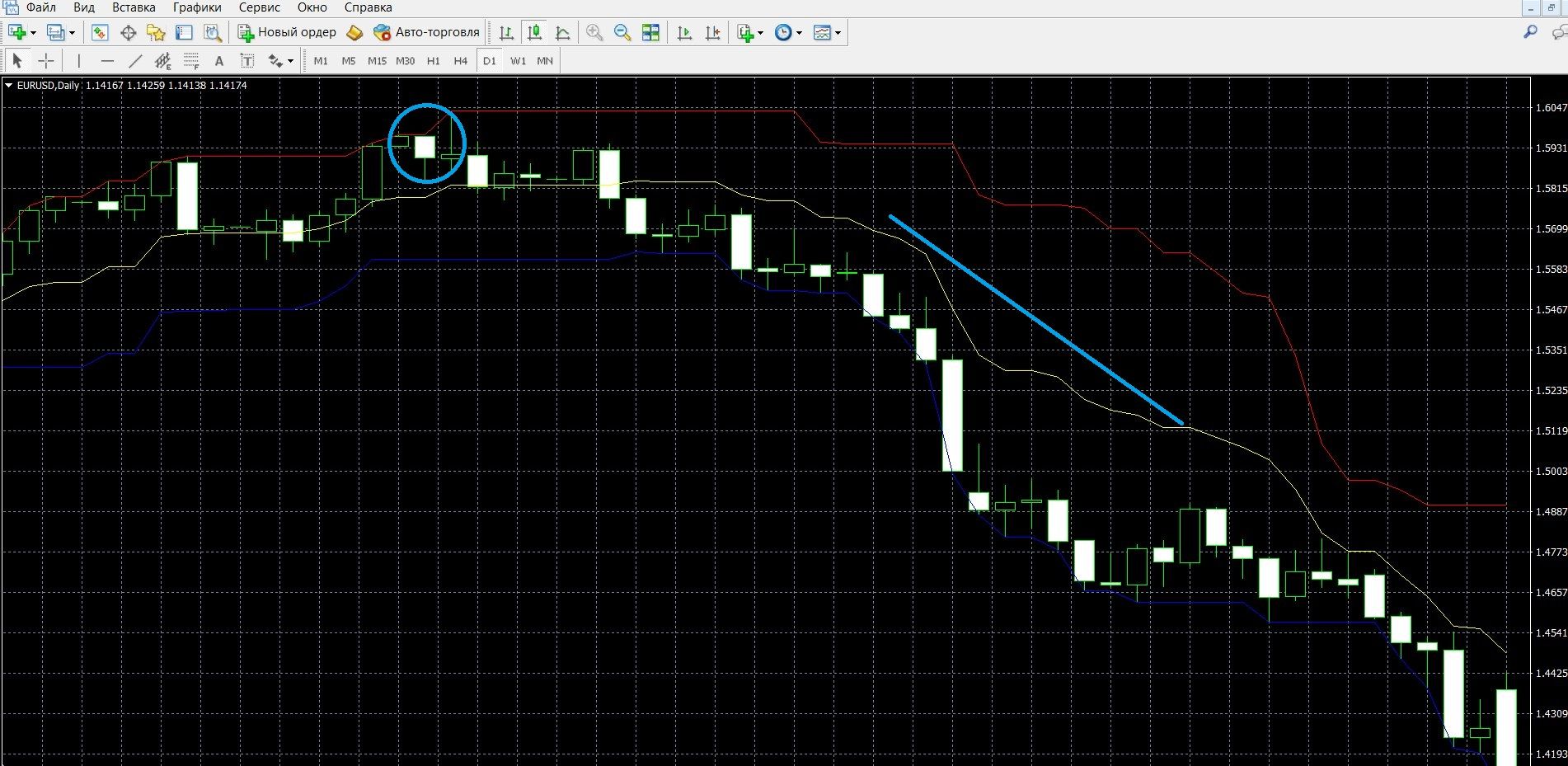

When both PCU boundaries (upper and lower) are declining and never rising, this is a downtrend, a signal to buy a put option. In the image below, you can observe the downward trend of the market in the MetaTrader 4 trading terminal:

Taking advantage of the trend, place a PCI bet with the Finmax broker, for which go to the finmaxbo.com website and prepare an option, indicating:

- Type of option

- Expiration date

- Amount

- Prediction: down

- Next, click the “buy” button and wait for the results of the forecast:

Trading with a signal of support and resistance levels

If the price mark is close to the lower limit, it means that it will soon reverse, it is worth buying a call option. In the presented image, you can see the expected uptrend in the MT4 terminal (taking advantage of the trend, place a CALL bet on the finmaxbo.com website, the instructions are indicated above):

If the price mark is close to the upper limit, it means that it will soon reverse, it is worth buying a PUT option. In the presented image, you can see the expected downtrend in the MT4 terminal (taking advantage of the trend, place a PUT bet on the finmaxbo.com website, the instructions are indicated above):

Money management

Money management is a basic, basic concept in trading, with the use of which you can significantly change the efficiency of trading. If you are thinking about a stable income from options trading, first of all, implement the possibilities of money management, which will allow you to correctly adjust your money management. So, these rules can be the beginning of your profitable strategy.

Minimum capital: when participating in transactions, use the minimum funds to buy an option; So, the purchase of an option should not be more than 5% of your deposit; Try to participate in the purchase of options at the lowest price, it should be less than the deposit. Using such simple rules in trading, you can save your capital.

Minimum deposit: when participating in transactions, use the deposit sparingly; So, when buying an asset, do not transfer the funds of all capital to it; Try to keep the deposit, given that it will be useful to you in further work. Using such simple rules in trading, you will be able to save the capital of the deposit.

Minimum options: when participating in transactions, use a minimum of options to buy, so, start with a minimum number of transactions (2-3 assets); This rule applies to more beginners in options; As soon as you become more experienced, then you can gradually increase the number of assets. Using such simple rules in trading, you will be able to build your work in options much more productively.

Minimum of emotions: when participating in transactions, always use a serious attitude to analytical work, where balanced accurate decisions are needed; So, remember that in this case, one experience in trading is not enough, emotions and mood are what directly affect your performance. Using such simple rules in trading, you can achieve more in trading.

Expiration

Expiration is the moment of the end of the next trading in options, when all participants in the transaction learn about the results of their forecasts. This concept is also one of the basic in trading, it will directly determine the success of your trading. A correct and conscious attitude to expiration will be a productive strategy that will help to achieve the desired result from trading.

Types of options:

- Ultra-short options – 30 seconds – 5 minutes.

- Short-term options – 10 minutes – several hours.

- Medium-term options – a day – a few weeks.

- Long-term options – a month – six months.

Is it allowed to extend the expiration?

It is allowed, not in all popular trading platforms. If, during trading, you suddenly realize that you have indicated an incorrect forecast, you just need to extend the expiration, reducing your possible losses.

Expiration rules:

- For beginners in trading, participation in long-term transactions is more suitable, which will give the necessary stability and minimal risk of losses.

- For experienced market players, such an expiration is more suitable, which makes their trading the most comfortable. Also, when choosing a broker, it is worth considering the possibility of using the expiration extension function during trading, which can reduce your losses.

- For those who need instant income, it is better to choose short-term trades for trading, which are able to give income from the transaction in 30 seconds.

- For those who value stable capital, it is better to choose long-term trades for trading, which are characterized by calm trading, as well as the opportunity to get a good income.

Expiration in strategies with PCU

Expiration at a trend signal

Short-term trading: allowed; PCU, perfectly determining the state of the market trend, gives high-quality signals; in order to reduce false signals, use trend indicators; Be aware of the risks of turbo trading.

Medium-term expiration: allowed; The PCU, perfectly determining the state of the market trend, is able to generate many signals; to search for high-quality signals, use additional indicators; Such expiration provides a calmer trading with a minimum of risks.

Long-term expiration: allowed; The PCU, accurately determining the state of the market trend, generates a lot of signals; to search for high-quality signals, use additional trend indicators; When predicting a trade, apply knowledge of fundamental, technical analysis and profitable strategies, which will provide decent capital.

Expiration at the signal of support and resistance levels

Short-term trading: allowed; the indicator, accurately determining the state of the market trend, generates high-quality signals; in order to reduce false signals, use trend indicators; Always be aware of the risks of turbo trading.

Medium-term expiration: allowed; the indicator, accurately determining the market trend, is able to generate many signals; to search for high-quality signals, use additional indicators; Such expiration provides a calmer trading with a minimum of risks.

Long-term expiration: allowed; The PCU, accurately determining the market trend, generates a lot of signals; to search for high-quality signals, use additional trend indicators; When predicting a trade, use your knowledge of fundamental, technical analysis and profitable strategies, which will provide decent capital.

Expiration in the “PCU+MACD

Short-term trading: allowed; the indicator, determining the state of the market trend, generates high-quality signals; to reduce false signals, use trend indicators; Be aware of the risks of express trading.

Medium-term expiration: allowed; the indicator, determining the trend of the market, generates a lot of signals; to search for high-quality signals, use additional indicators; Such expiration provides a calmer trading with a minimum of risks.

Long-term expiration: allowed; The PCU, accurately determining market trends, generates a lot of signals; to search for high-quality ones, use additional indicators; When predicting a trade, rely on knowledge of fundamental, technical analysis and profitable strategies, which will provide decent capital.

Actively immersing yourself in the study of trading, do not forget to pay attention to the expiration, which will allow you to reach the desired performance. Get acquainted with all its types when working in the convenient terminal of the Finmax broker, where you can conveniently use the expiration from 30 seconds to six months. By going to the finmaxbo.com broker’s website, you are already starting to build your profitable trading strategy.

Downloads

MetaTrader 4 (MT4) platform – download.

PCU indicator for the MT4 platform – download.