Binary options trading has become more and more popular lately. In addition to the fact that the activities of most brokers are certified and the companies fulfill all the promises to the user, you really earn real money. Trading is almost the only way to make money quickly and unlimitedly on the Internet: this also applies to express trading, which allows you to make a profit in 30 seconds, and to long-term options. Everything that you received during trading, you can immediately withdraw in a convenient way and spend it on your needs.

How to become successful in options and achieve the maximum – many traders, having mastered the system, begin to seriously think about this issue. To become a professional, you need to know the peculiarities of the market, be able to use oscillators correctly, test new strategies all the time, be conscious of choosing a terminal, constantly studying the ratings of market brokers . You can find all this information on our portal. Improve and achieve more in trading, and we will help you with this. Today we will talk about the Parabolic SAR trend indicator, and we also recommend that you familiarize yourself with the indicator for the forex market (https://eto-razvod.ru/forex-indicators/parabolic-sar/)

Parabolic SAR is a technical trend indicator developed in 1976 by financier Wells Wilder, who also created the popular DMI and RSI. For the first time, the author wrote about the new indicator in his work “New Concepts in Technical Trading Systems”. More often, this oscillator is called Parabolic.

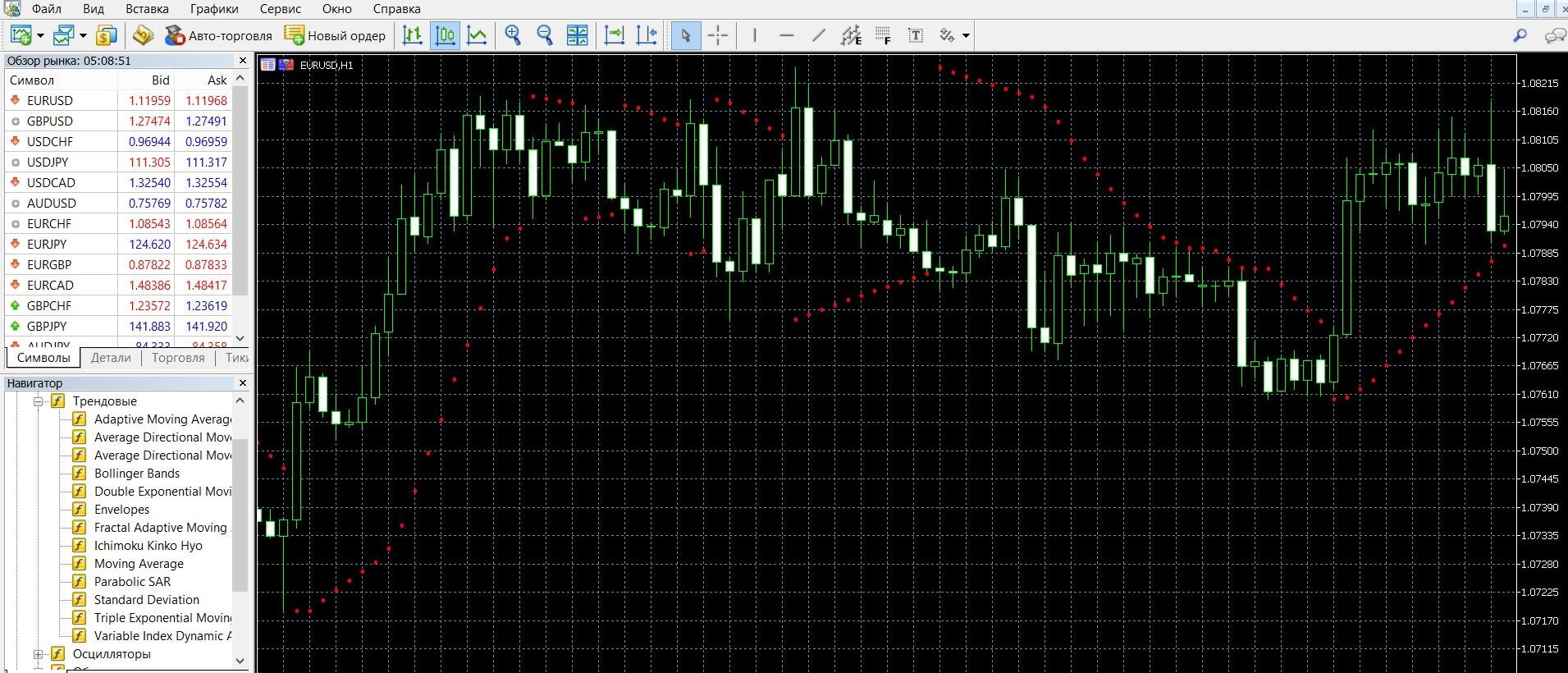

At the heart of this reliable system is the SAR (Stop and Reverse) indicator, which is the “stop and reversal” price. Its advantage is the most accurate forecast of market dynamics. In the case of an uptrend, the Parabolic SAR indicator is below the current price values, in the case of a downtrend, on the contrary, it is higher. In addition, this tool is able not only to show the directions of trends, but also to determine the moments of their potential reversal. At the same time, it shows its best results with a pronounced trend. During a flat market, a large number of false signals arise and you should refrain from working with it at these moments. You can see what Parabolic SAR looks like on the MetaTrader 4 (MT4) platform in the image below. You can also download the MetaTrader 4 platform and get acquainted with the oscillator in practice.

How does the Parabolic SAR indicator work?

The parabolic stop and reversal system has the form of a parabolic curve, which is formed from points calculated based on the values of the corresponding candlestick. Hence the name Parabolic SAR, visually the indicator is presented on the chart in the form of dots placed above or below the price, depending on the market trend.

Due to the acceleration factor, the instrument quickly responds to market dynamics, especially in the case of trend strength. The basis of this system is the “stop and reversal” indicator. The signals of the instrument are based on the price chart, while in many respects it is similar to a simple moving average. The difference between Parabolic SAR is that it moves with great acceleration and changes position relative to the price. The indicator was developed in order to, using the data of the development of the trend and quickly adapting to the new trend, get a good income, which traders can successfully use today.

Calculation formula for Parabolic SAR

For long positions:

- SAR (i) = SAR (i – 1) + ACCELERATION * (HIGH (i – 1) – SAR (i – 1))

- For short positions:

- SAR (i) = SAR (i – 1) + ACCELERATION * (LOW (i – 1) – SAR (i – 1)), where:

- SAR (i – 1) — the value of the Parabolic SAR indicator on the previous bar;

- ACCELERATION — acceleration factor;

- HIGH (i – 1) — the maximum price for the previous period;

- LOW (i – 1) — the minimum price for the previous period.

Info taken from www.metatrader5.com website

Signals of the Parabolic SAR indicator:

Trend signals:

- If the indicator is located below the price chart, we have an uptrend in front of us, you should buy a CALL option;

- If the indicator is located above the price chart, we have a downtrend in front of us, you should buy a PUT option.

Reversal signals:

When the price crosses the Parabolic SAR, a gap (reversal) occurs, this is a signal that the next values of the indicator will be opposite (above or below the price).

- If the intersection of the price and the indicator occurs at the bottom of the chart, this is a signal of an approaching uptrend, you should buy a call option;

- If the intersection of the price and the indicator occurs at the top of the chart, this is a signal of an approaching downtrend, you should buy a PUT option.

Do I need to install the indicator in your platform?

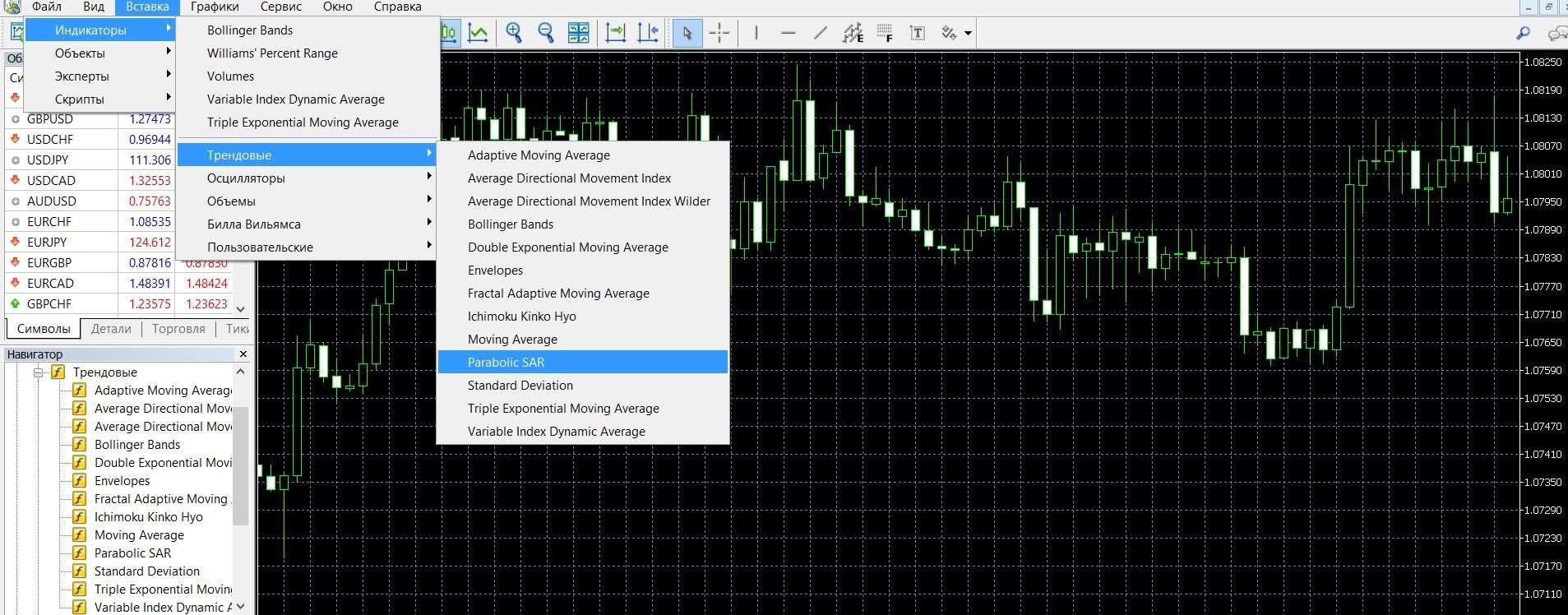

Parabolic SAR is a standard indicator, it is included in most trading terminals, including MetaTrader 4. To add it to the main price chart, you must:

- Click the “Insert” tab in the top menu of the platform.

- Select the tab “Indicators” – “Trend”.

- In the drop-down menu, select “Parabolic SAR”.

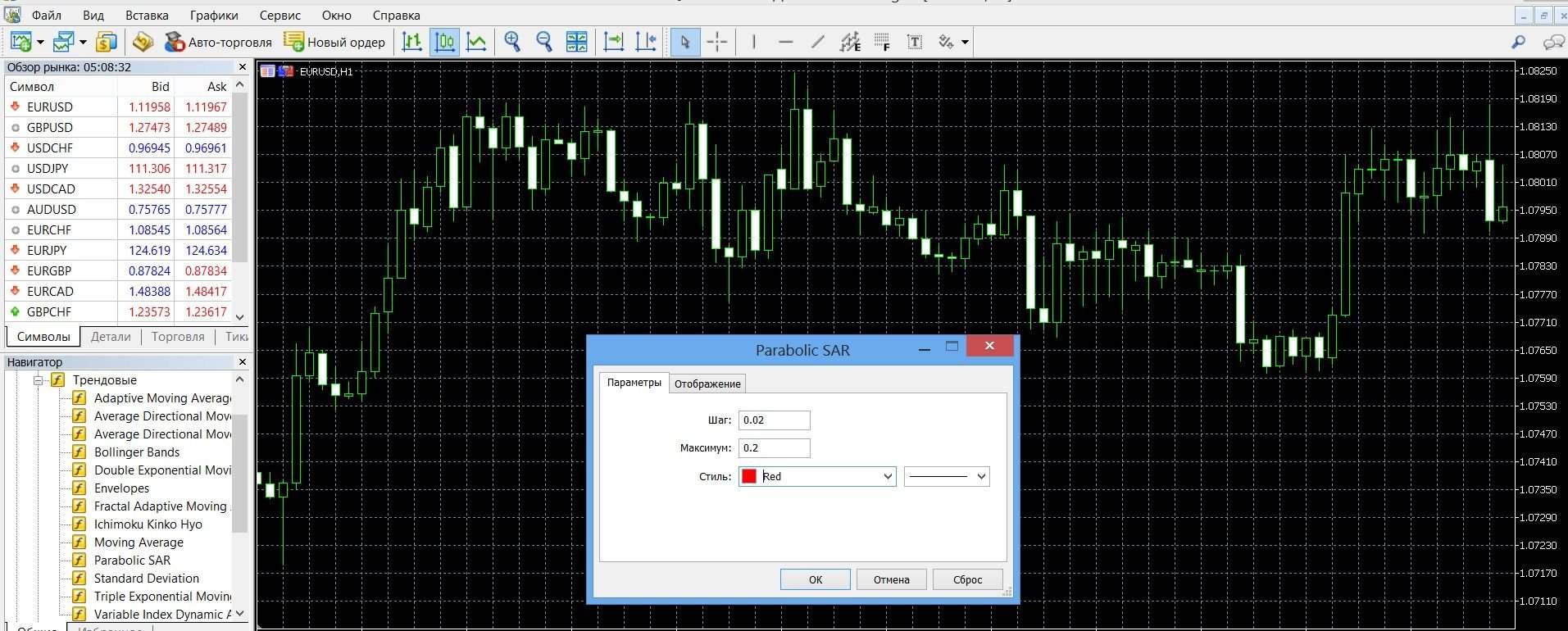

To work, you can use both the standard settings of the tool and change them according to your strategy. The main settings in this case will concern the sensitivity parameter, which affects the quality of the signals. By default, this parameter is set to 0.02: the higher it is, the more signals will be received, including false ones; The lower it is, the fewer signals, including false ones.

If your platform doesn’t have an indicator, download it here.

Application of the indicator for binary options

It is important for any trader today to find a serious stable tool for determining the moment of development of trends. But it is important to see its end, it is also an opportunity to earn good money. Such a unique and effective tool for determining the end of a trend is the Parabolic SAR. In the event that the trend is approaching a reversal, the distance between the price and the indicator is reduced, the smaller it is, the greater the probability of a price reversal.

Also, this tool is widely used in trading to find signals (confirmation or refutation) of trend dynamics, as well as sideways movement. A clear trend is an important condition for the correct operation of the indicator, because It is then that it gives timely signals of the dynamics of the trend: weakening or a possible reversal. Like all trend indicators, it is more effective in a pronounced bullish or bearish trend. In the case of a sideways movement of the market, it is not recommended to trade: there are many signals, most of which are false.

Parabolic SAR points can be used as a guide for setting stop losses: when a point appears that occurs above the uptrend or below the downtrend, you should move the stop loss indicator to its level. So, in the event of a price reversal, you will not lose anything and will even be able to fix your income. Professionals advise the use of Parabolic SAR at time intervals from H1, because. At smaller intervals, its operation is less stable due to numerous market “noises”. It is also important to take into account the slight delay of the oscillator, so trades are closed without waiting for the price to cross the points; Here it is enough to see a tight approximation.

Before opening a position, it is worth checking the indicator signals using other tools, for example, Bollinger Bands, Stochastic, MACD, ADX , etc. Parabolic SAR is a fairly advanced indicator that is more suitable for professionals, allowing you to get the most out of options trading.

Rules for concluding transactions (screenshots)

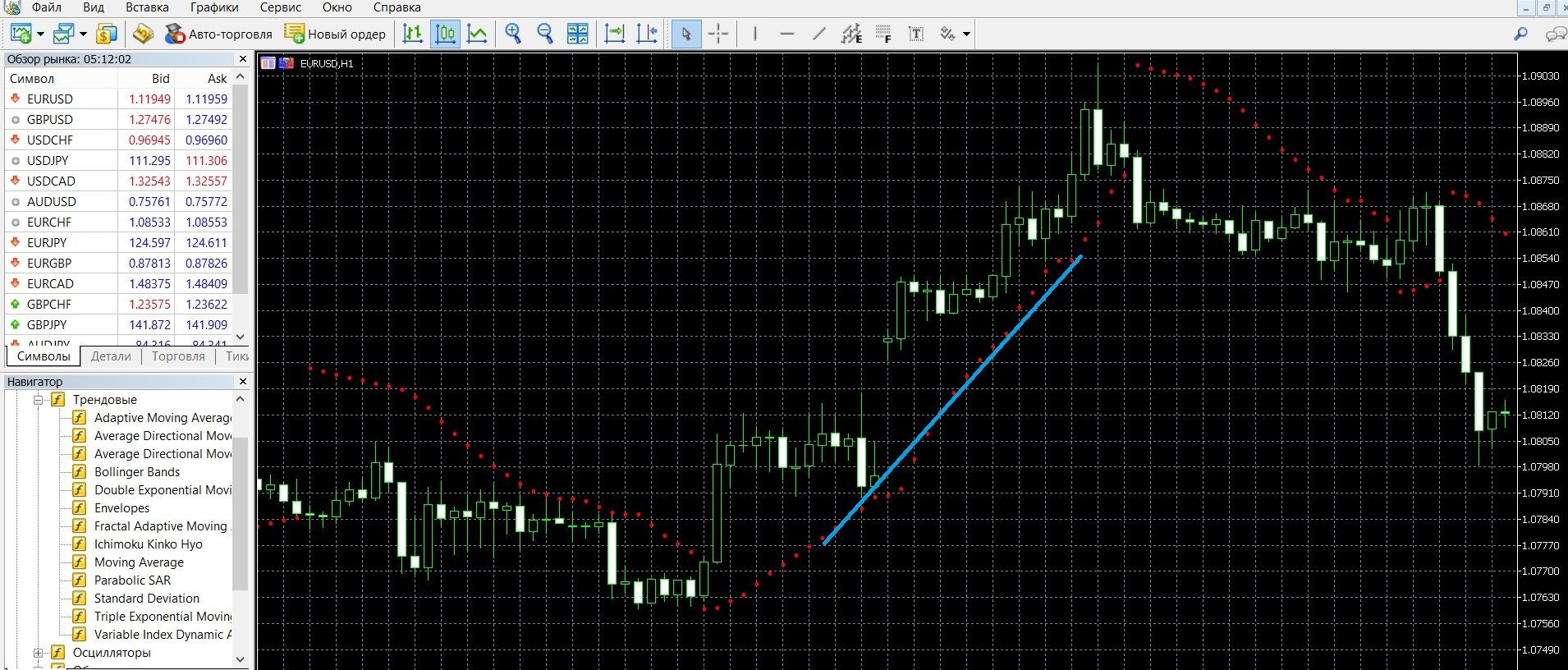

Trading with a trend signal

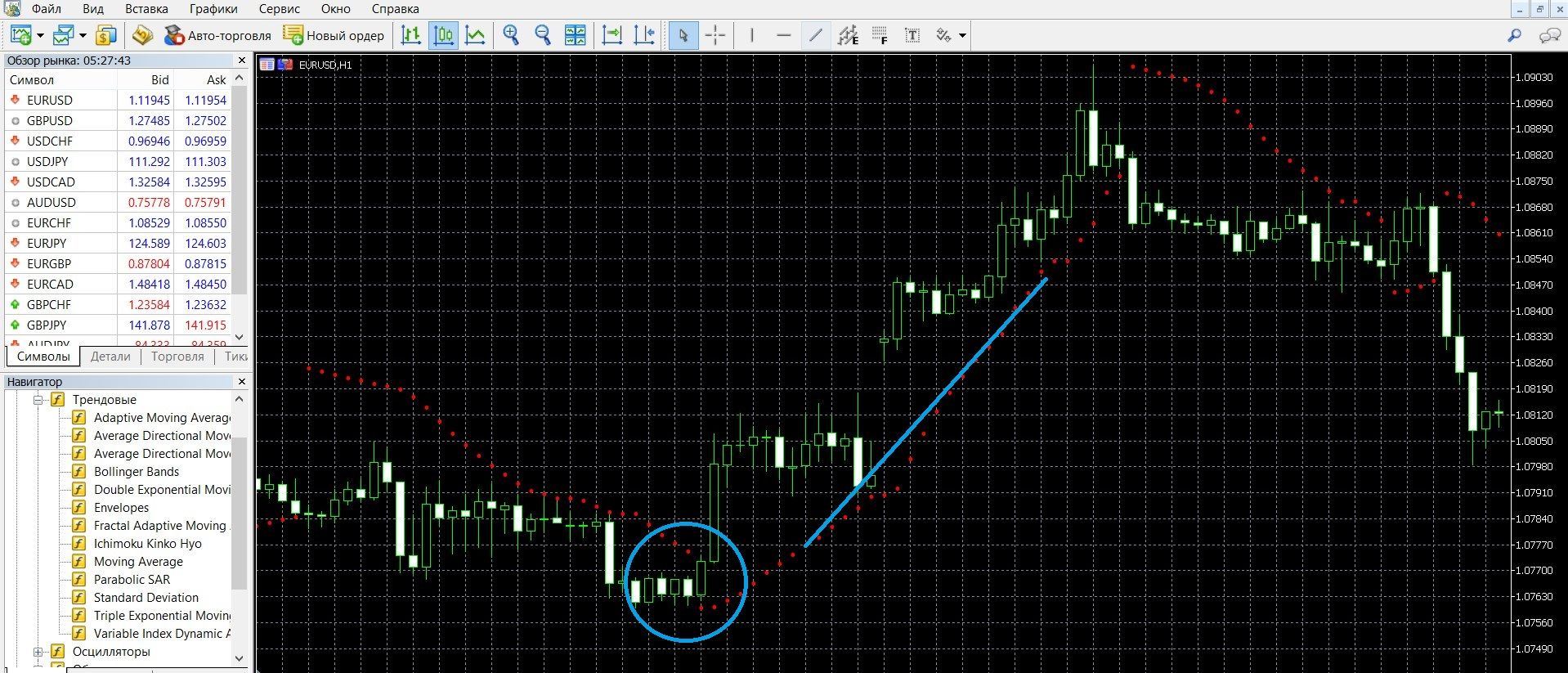

If the indicator is located below the price chart, we have an uptrend in front of us, you should buy a CALL option. In the image, you can observe an upward trend on the MetaTrader 4 platform:

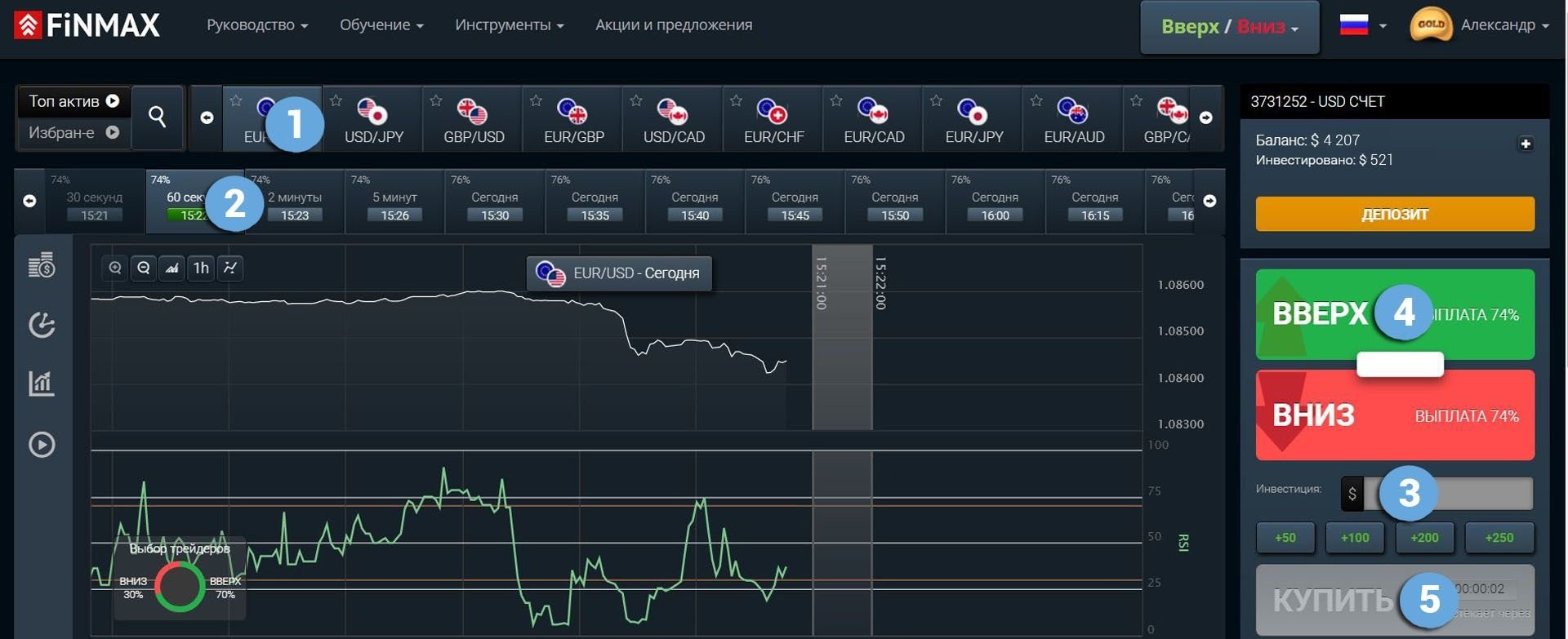

Using this signal, you can make a profitable CALL bet with the Finmax broker, for which you need to go to the finmaxbo.com website and prepare an option for the transaction, indicating:

- Option.

- Expiration.

- Amount.

- Forecast: up.

- Next, it remains only to click on the “buy” button and wait for the results:

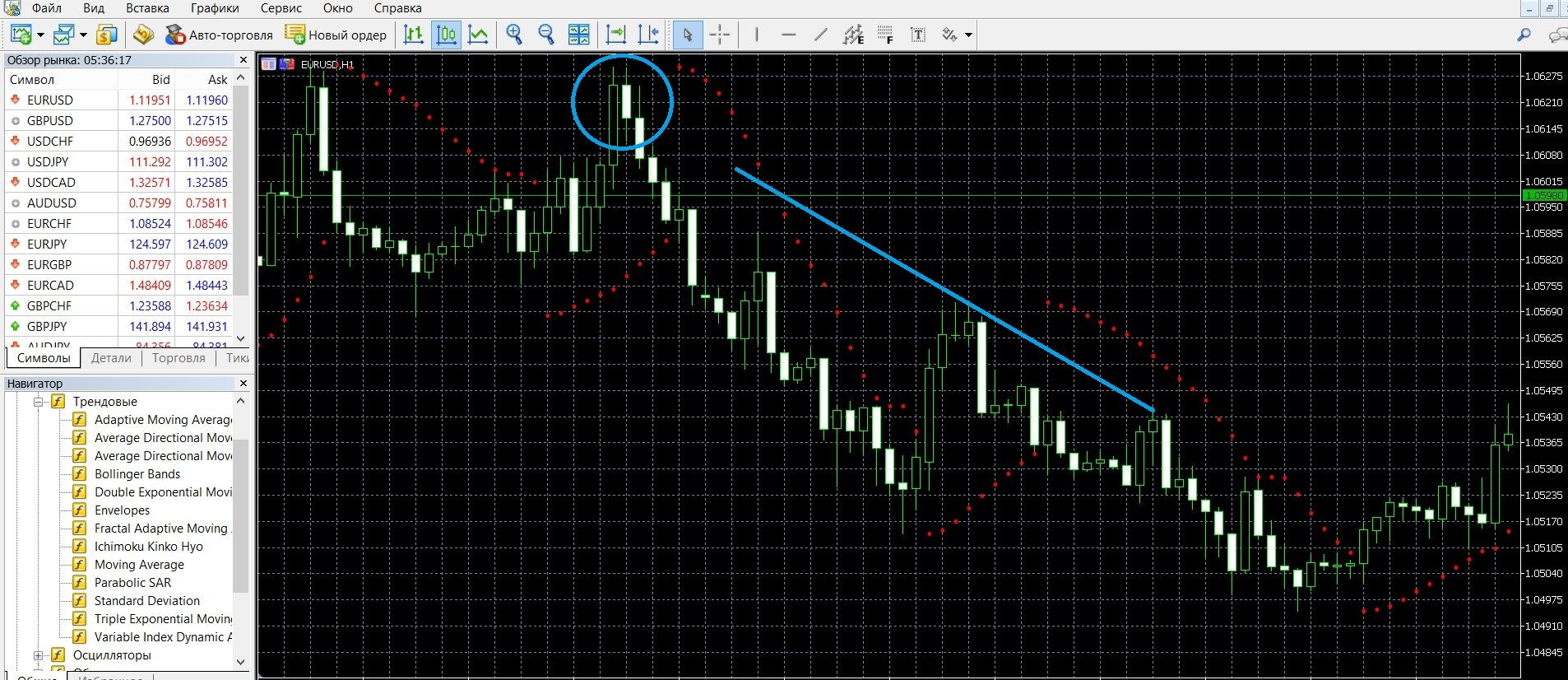

If the indicator is located above the price chart, we have a downtrend in front of us, you should buy a PUT option. In the image, you can observe a downward trend on the MetaTrader 4 platform:

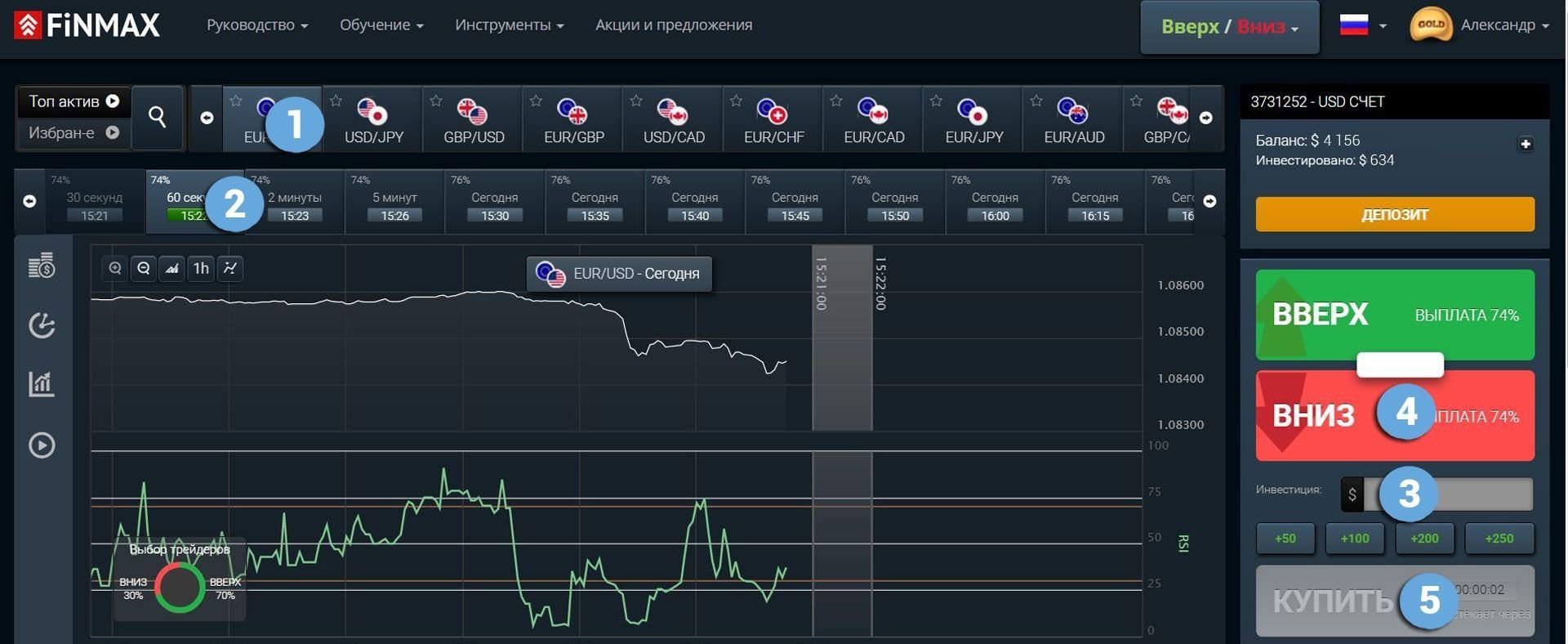

Using this signal, you can make a profitable PCI bet with the Finmax broker, for which you need to go to the finmaxbo.com website and prepare the option for the transaction, indicating:

- Option.

- Expiration.

- Amount.

- Forecast: down.

- Next, it remains only to click on the “buy” button and wait for the results:

Trading on a reversal signal

If the intersection of the price and the indicator occurs at the bottom of the chart, this is a signal of an approaching uptrend, you should buy a CALL option. In the image below, you can observe an uptrend on the MetaTrader 4 platform (take advantage of the moment and place a CALL bet on the broker’s website finmaxbo.com, instructions are presented above):

If the intersection of the price and the indicator occurs at the top of the chart, this is a signal of an approaching downtrend, you should buy a PUT option. In the image below, you can observe a downtrend on the MetaTrader 4 platform (take advantage of the moment and place a PUT bet on the broker’s website finmaxbo.com, instructions are presented above):

Money management

The concept of money management can be considered with absolute certainty as the key to successful work in trading. If you plan to make a stable income from options, this is what you will have to work with in the first place. And it doesn’t matter who you think you are, a professional or a beginner, if you pay attention to money management, you can easily build an effective system for managing your capital: how to spend money on your account with savings, how to use them in trading so that they do not end at a certain point, depriving you of the opportunity for further trading. These and many other issues can be solved by the rules of money management:

- Trading with a minimum of money: we recommend spending the minimum possible funds on a transaction; allocate no more than 5% of the amount in the account for these purposes; Participate in options whose prices are less than your capital. By applying these simple basics in trading, you will save your capital.

- Trading with a minimum deposit: we recommend that you spend the deposit as little as possible; you should not bet all the capital on the purchase of one option; It is important for you to understand that the funds can still come in handy; In general, a deposit requires a conscious thoughtful approach: after transferring a certain amount to the account, immediately select the free part from it, which can be used in trading and go beyond its borders. By applying these simple basics in trading, you will save your deposit.

- Trading with a minimum number of assets: recommended, this mostly applies to options beginners, initially participate with 2-3 assets; And only after you get used to the market, feel more confident, you can increase the volume of the investment portfolio by working with several transactions. By applying these simple basics in trading, you will tune in to work productively with options.

- Trading without emotions: we recommend that when working in the market, always tune in to a serious tone; It is worth remembering that, in addition to experience, your mood also affects the results of trading; It has been proven that excessive emotions interfere with productivity, do not allow you to concentrate, make a correct forecast, correctly analyze the situation, and monitor the status of the deposit. By applying these simple basics in trading, you can achieve success in options.

Expiration

Also, with absolute certainty, it is the key to your success in trading. Expiration is the moment when the trading of an asset ends, and participants see the results of their work and whether funds will come to their deposit. You can even say that the correct work with expiration is a whole profitable strategy that will help you get a stable income.

Types of options:

- Ultra-short options – 30 seconds – 5 minutes.

- Short-term options – 10 minutes – several hours.

- Medium-term options – a day – a few weeks.

- Long-term options – a month – six months.

Is it allowed to extend the expiration?

Not allowed in all terminals. If suddenly during trading you see that an incorrect forecast is indicated, extend the expiration, reducing your losses.

Expiration rules:

- For traders taking their first steps in options trading, we recommend working initially with long-term expirations, the big advantage of which is stable trading with minimal capital risks.

- For traders who have extensive experience in trading, it is important, when choosing an expiration each time, to be based on which trading style is more convenient and comfortable. When choosing a broker, first find out whether it is allowed to increase the expiration during trading, which can minimize losses in case of incorrect outcomes.

- Market participants who need instant income should choose a short-term (a minute – a few hours) expiration, which will bring income in 30 seconds. At the same time, always remember the risks of such trading.

- Market participants who need a stable income should work effectively with long-term expiration, which has a calm trading style, is more predictable and less risky.

Expiration in strategies with Parabolic SAR

Expiration at a trend signal

Short-term trading: allowed, despite the fact that it is quite risky; In this case, it is recommended to use confirmatory trend indicators.

Medium-term expiration: also allowed; Such trading, using confirmatory indicator signals, will allow you to get a good income.

Long-term expiration: also allowed; Such trading will allow, in addition to using trend indicators, to apply knowledge in the field of fundamental analysis, which will not only get a decent income, but also minimize risks.

Expiration at a reversal signal

Short-term trading: allowed, despite the fact that it is considered the riskiest; In this case, it is necessary to use confirmatory trend indicators.

Medium-term expiration: also allowed; Such expiration, using the confirming signals of indicators and entire trading systems, will allow you to get a good income.

Long-term expiration: also allowed; Such trading will allow, in addition to the opportunity to use indicators and trading systems, will allow you to apply knowledge in the field of fundamental analysis, which will not only give a decent income, but also minimize your risks.

Expiration in the “Parabolic SAR+MACD” strategy

A reliable but very simple strategy using the Parabolic SAR and MACD indicators. Despite the fact that it is easy and simple to work on it, the income will be substantial, especially if you trade with an expiration from M15 to H1 (from 15-minute to one-hour expiration). To place a bet, you need to follow the signals of both instruments and, if they match, buy CALL or PUT options.

Short-term trading: allowed in this strategy, thanks to confirmation signals from the MACD, it will allow you to avoid false signals and, in the case of scalping, get a decent income for the session.

Medium-term expiration: also allowed; such expiration, using MACD confirmation signals, will allow you to get a good income.

Long-term expiration: also allowed; such trading will allow, in addition to the opportunity to take advantage of reliable MACD signals, it will allow you to apply knowledge in the field of fundamental analysis, which will not only give a decent income, but also minimize your risks.

Expiration in the “Parabolic SAR+Stochastic“ strategy

A simple but reliable and profitable strategy using Parabolic SAR and Stochastic Oscillator. In this case, the confirming role lies with the Stochastic indicator, so you can easily avoid false signals. To place a bet, you need to follow the signals of both instruments and, if they match, buy CALL or PUT options.

Short-term trading: allowed in this profitable strategy, thanks to the confirmation signals, Stochastic will allow you to avoid false signals and get a decent income. Medium-term expiration: also allowed; such an expiration, using Stochastic confirmation signals, will allow you to get a good income.

Long-term expiration: also allowed; such trading will allow, in addition to the opportunity to use reliable Stochastic signals, it will allow you to apply knowledge in the field of fundamental analysis, which will give not only a decent income, but also minimize your risks.

When starting your steps in trading, pay special attention to working out the issue of using expiration in order to determine a comfortable trading style for you. The convenient terminal of the broker we recommend Finmax will help you with this. Among its advantages, we especially highlight the presence of a functional platform with a convenient personal account, the possibility of an expanded choice of options and expiration dates (from 30 seconds to six months), etc. Think about your profitable strategy now by going to the broker’s website finmaxbo.com.