We present you a series of detailed reviews of binary options indicators, the purpose of which is to acquaint you with the basics of trading and teach you how to properly apply its tools in your work. Study our reviews, create your winning strategy and get the most out of options trading. Today we will tell you about one of the popular indicators that is widely used in the market and is found in many strategies – the Simple Moving Average. What are its features and advantages compared to other instruments, as well as how to effectively manage your capital and work correctly with expiration – read about all this in our material. You can also familiarize yourself with the trading strategy for the Moving Average “Three” (https://eto-razvod.ru/blog/strategy/three/).

The Moving Average (MA) indicator is one of the most popular on the market. accurately shows the dynamics and behavior of trends. Most modern analysis tools are based on data and the principles of MA (MACD, RSI, Ichimoku, Alligator etc.). The advantage of the Moving Average is that it shows the exact movement of the market in real time. And according to these data, it is possible to make a forecast of its dynamics. The uniqueness of the indicator lies in the fact that it can be used in different formats and modifications: as the main trend indicator or as a filter trading signals.

Why is the indicator called “moving”? This name accurately reflects its peculiarity, which consists in the constant change in the values of calculations: when new prices arrive, the old ones are automatically discarded, the numbers “slide”, and the MA itself depends on price dynamics. It shows its average value for a specific period, that is, the smoothing method for the period. The Moving Average allows you to follow the trend, signaling its birth or completion, it is not for nothing that it is called the “trend line”.

Since the MA data is based on price averaging, the moving average is lagging, it cannot predict the movement of the asset, but it shows the main trend very well. Therefore, it is the simplest and most visual trend indicator. In binary options trading, it is customary to talk not about a moving average, but about a moving average, meaning not a value, but a line on the chart. The moving average is one of the main indicators that will allow you to achieve the best result from trading. It is not for nothing that well-known market experts, C. Lebo and D. Lucas, owns the saying: “Most of the real money, even more than with all other technical indicators combined, is earned today using moving averages.”

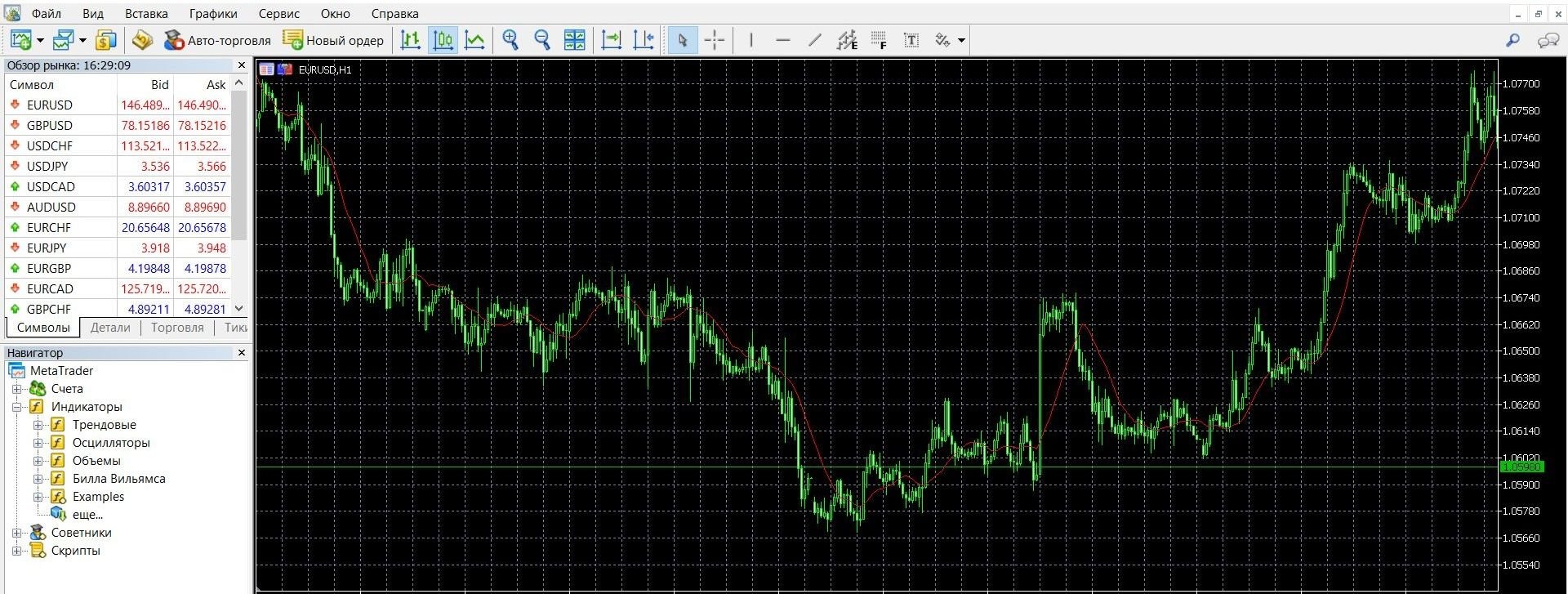

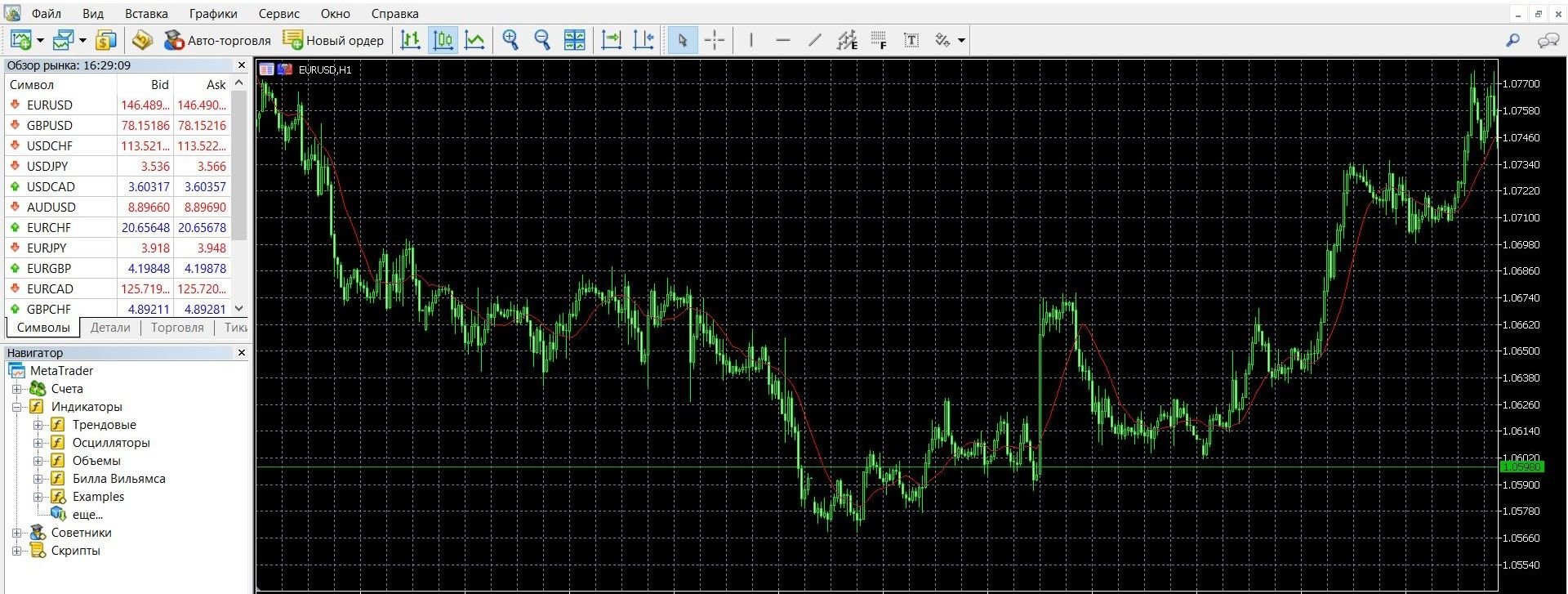

The MA indicator is a curved red line that runs along the price chart. You can see how it looks on the MetaTrader 4 (MT4) platform in the image below. In addition, you can download the MetaTrader 4 platform and get acquainted with the indicator in practice.

How does the MA indicator work?

MA is one of the first indicators used in options trading; This is an effective tool that shows market dynamics, identifies trends and confirms support and resistance levels. Its data is used on stock exchanges, today it has not lost its significance, being one of the main ones in the formation of trading strategies, new indicators and advisors. Among the advantages of MA: it is easy to use, understandable, multifunctional. It is also worth remembering its disadvantages: sometimes the signals are late, false data is shown.

MA is the usual arithmetic average of the price for the period, some indicator of the equilibrium of supply and demand of the market. The shorter the moving average, the shorter the period of equilibrium. The smaller the period parameter is set, the faster the instrument signals a new trend, but at the same time it makes more false signs. The larger the period parameter, the slower the new trend is determined, but at the same time there are fewer false fluctuations. And yet, when working with MA on the terminal chart, it is recommended to use several tools that are convenient for you at the same time in order to see a reliable signal. There are also many trading strategies based on the Moving Average, which make it work more efficiently. It is often more effective to use moving average options in strategies:

- Simple Moving Average (SMA) is a simple moving average.

- The Exponential Moving Average (EMA) is an exponential moving average.

- Smoothed Moving Average (SMA) is a smoothed moving average.

- Linear Weighted Moving Average (LWMA/WMA) is a linear weighted moving average.

Indicator signals:

1. The intersection of the price and the moving average line:

- If the price breaks through the MA from the bottom up and closes above the moving average, this is a buy signal.

- If the price breaks through the MA from top to bottom and closes below the moving average, it is a sell signal.

2. Intersection of two or more moving average lines:

- If the fast MA crosses the slow MA from the bottom up, this is a signal to buy an option.

- If the fast MA crosses the slow MA from top to bottom, this is a signal to sell the option.

The formula for calculating the indicator

SMA = SUM (CLOSE(i), N)/N, where:

- SUM — sum;

- CLOSE (i) — closing price of the current period;

- N is the number of calculation periods.

Info taken from www.metatrader5.com website

Do I need to install MA on your platform?

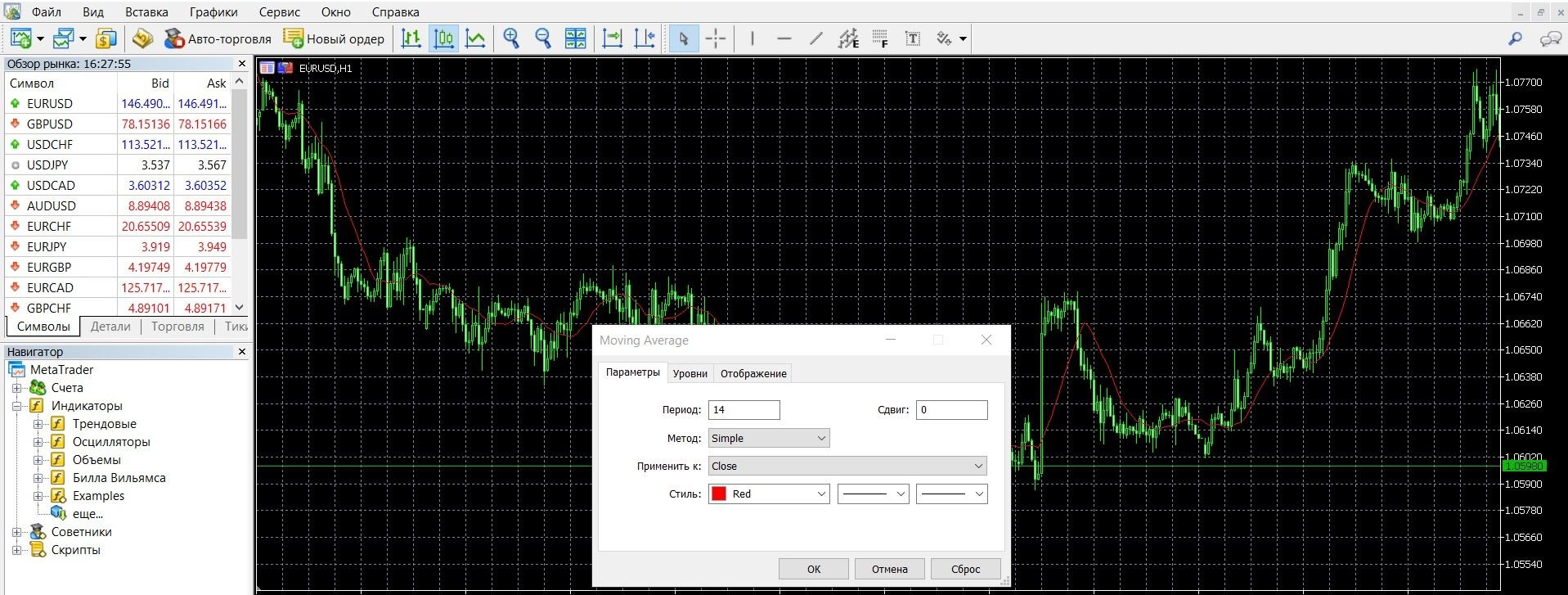

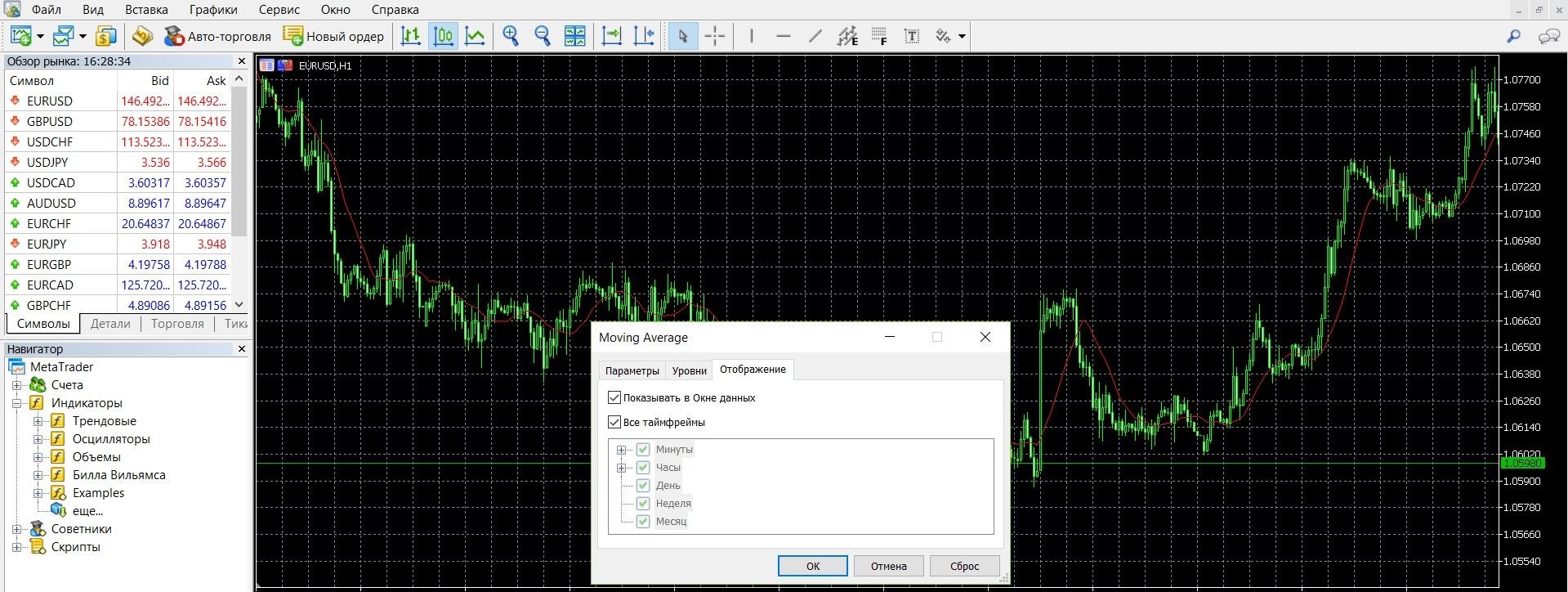

Moving Average is a classic trading tool, it is included in most modern trading platforms, and it is also available on the MetaTrader 4 platform. After you add it to the price chart, a settings window will appear where you can work with the following data:

- Period – the number of bars to calculate. More often, the following data is set: 8, 12, 21 (for short-term trading) or 150, 200, 365 (for long-term trading).

- Method – the type of indicator.

- Apply to: – formula for calculating the MA indicator; the best option is Close.

- Style – the choice of color, properties and thickness of the line.

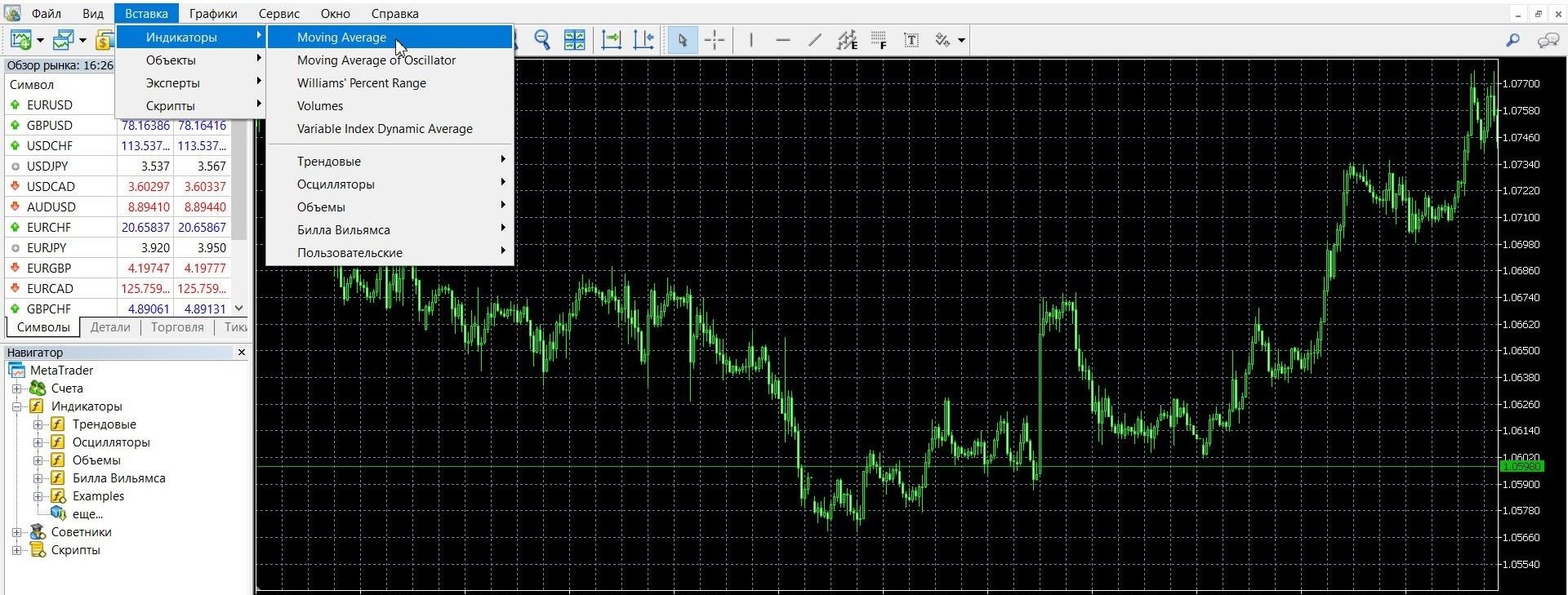

To add MA to the price chart on the MetaTrader 4 platform, follow these steps:

- Click the “Insert” tab in the top menu of the platform.

- Select the “Indicators” tab.

- In the drop-down menu that opens, select the “Trending” tab.

In the drop-down menu that opens, select Moving Average. The tool is added to the chart, you can work:

If your platform doesn’t have MA, you can download it here.

Application of the indicator for binary options

MA is used to detect a trend (upward, downward), to confirm its presence in the market. Today it is a popular technical analysis tool that shows the average value of the price of a particular period, reflects its direction and strength, which is used in practice by traders. Often, market players use it as a support and resistance level, the breakout or rebound of which gives strong signals to open trades. Also, the indicator determines the side of the trade: if the line is directed upwards, then it is worth buying only the option, if downwards, then only selling.

It is worth remembering that the Moving Average does not predict a trend change, but only reports a signal that has already appeared. Warning of the beginning of a new trend or its reversal, it cannot show the reaction of the market itself. The moving average is a lagging indicator, it follows the dynamics of the asset and indicates the emergence of a new trend or its reversal after the start of the movement. Different types of Moving Average are used for different purposes. If a simple moving average is late with information, the exponential average tends to break out faster, better reflects trends.

Rules for concluding transactions (screenshots)

The intersection of price and the moving average line

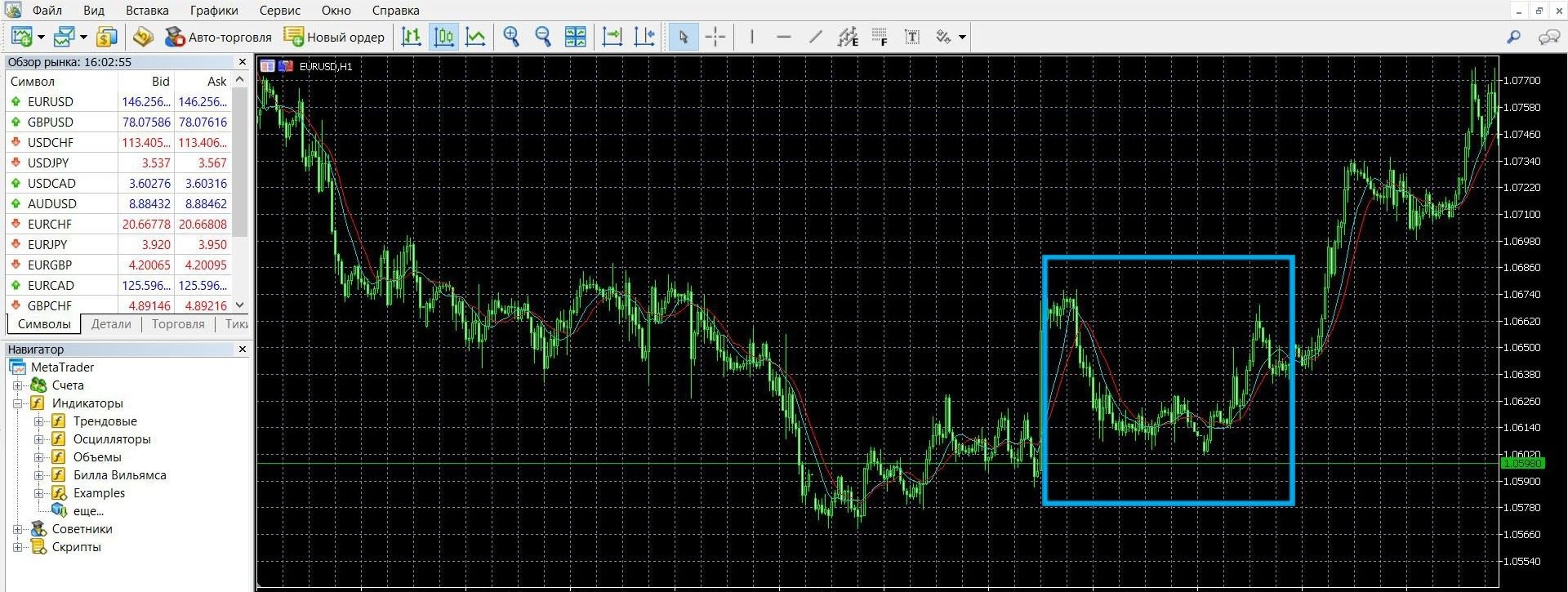

If the price breaks through the moving average from the bottom up and closes above it, this is a signal to buy a call option. In the image below, you can see the upward trend on the MetaTrader 4 platform:

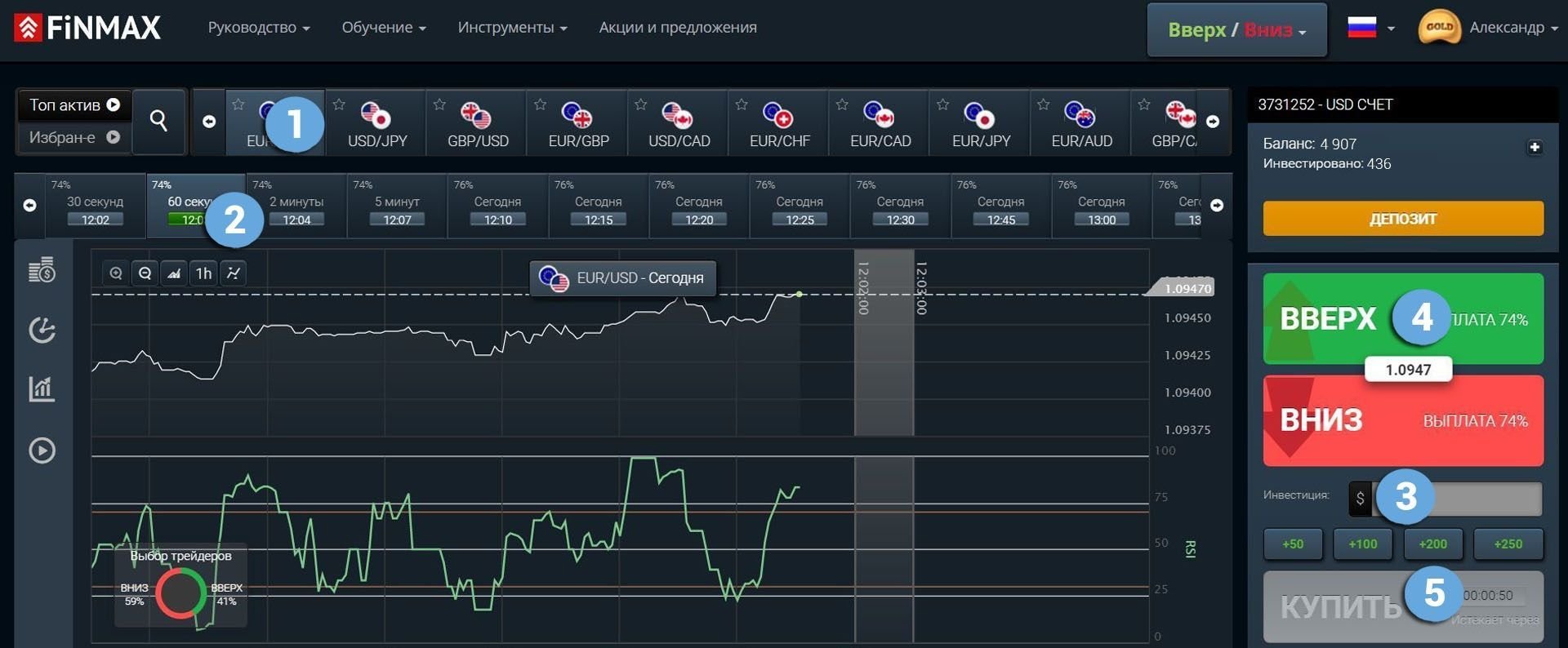

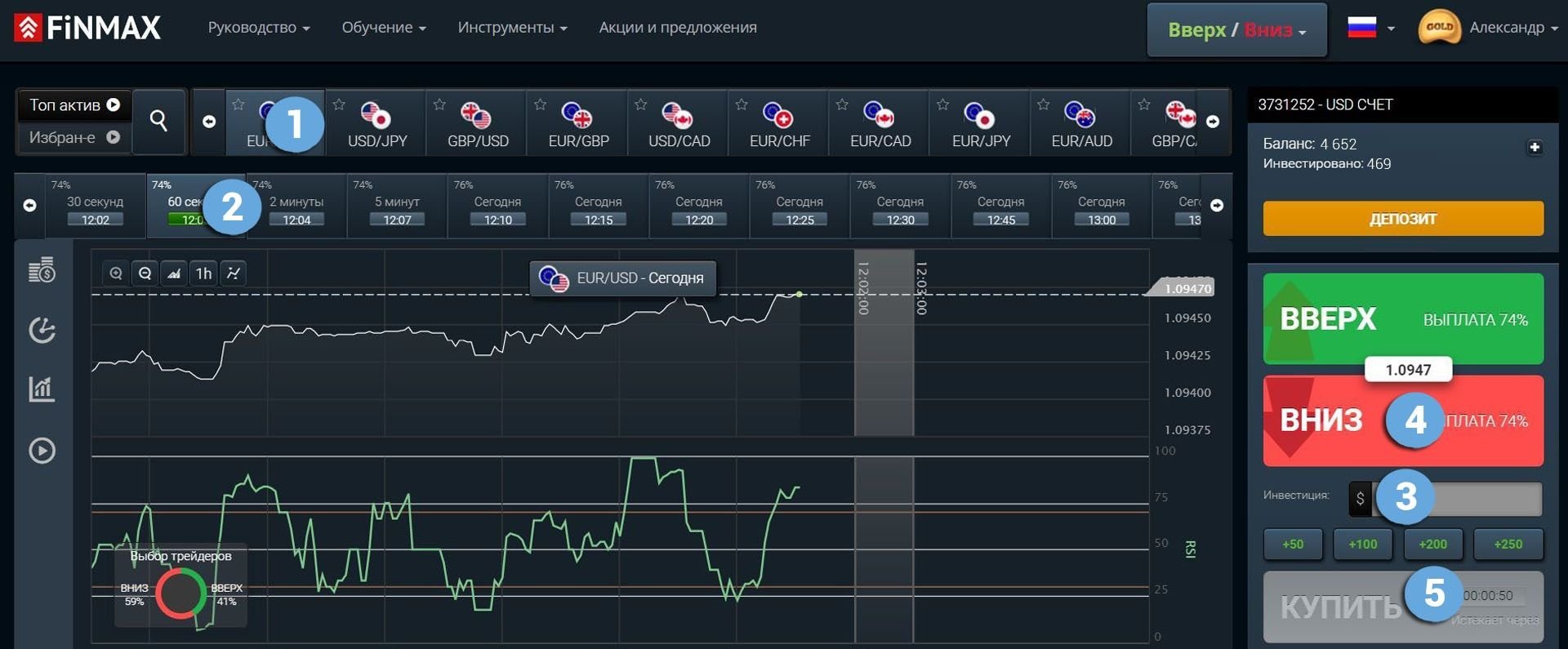

Take advantage of the upward price trend and place a CALL (up) rate with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and prepare an option, indicating in the system:

- Type of asset.

- Expiration.

- The size of the bet.

- Movement forecast: UP.

- Click the “buy” button and wait for the result.

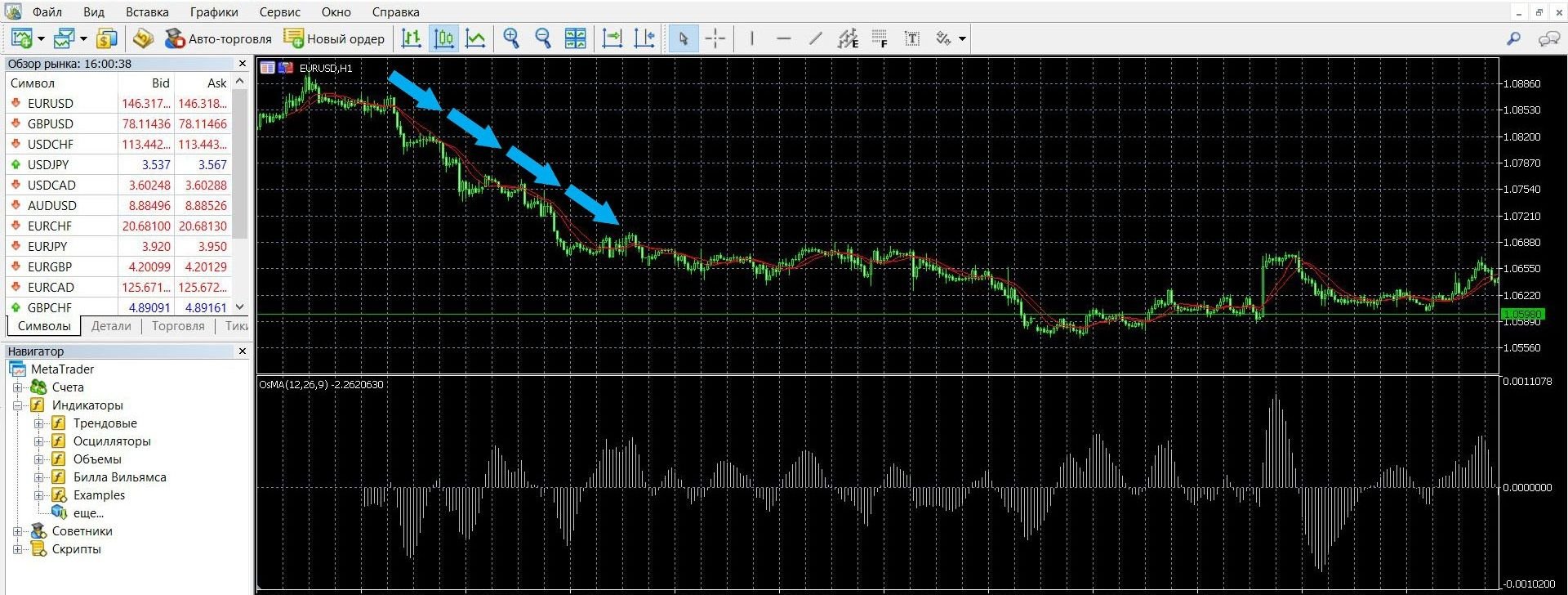

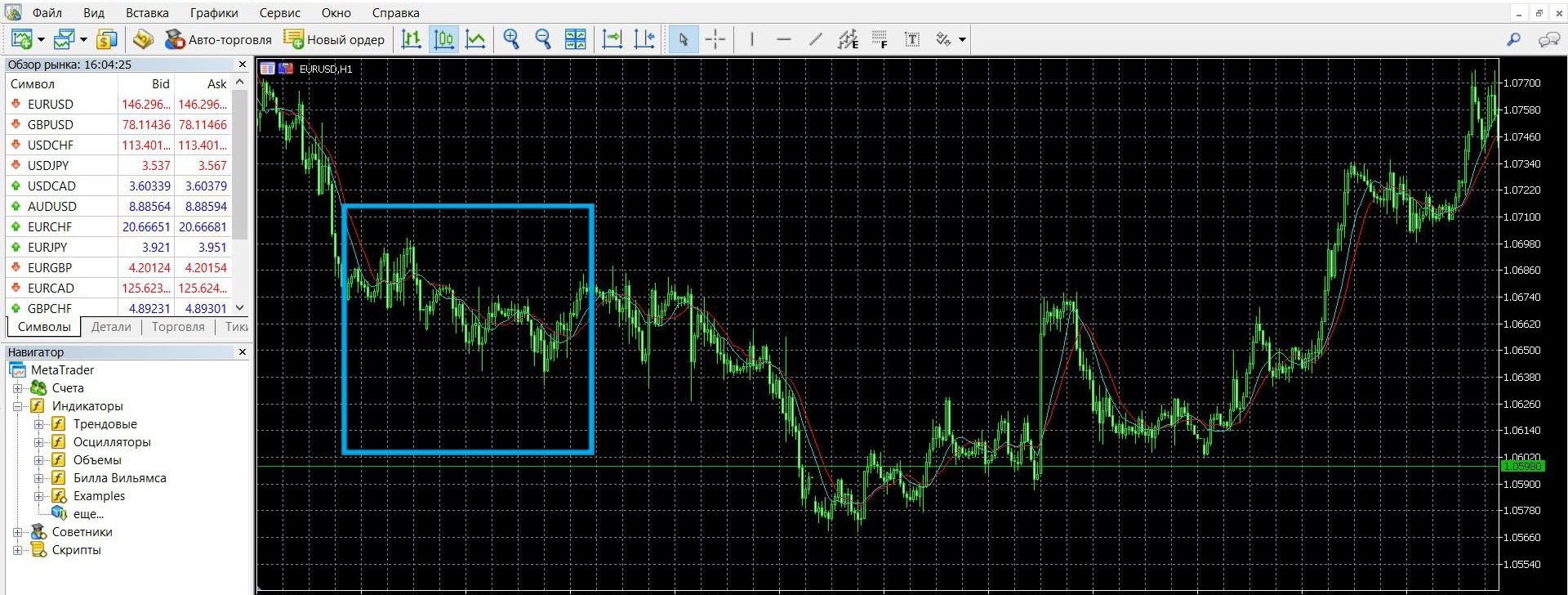

If the price breaks through the moving average from top to bottom and closes below it, this is a signal to sell a PUT option. In the image, you can see the downward trend on the MetaTrader 4 platform:

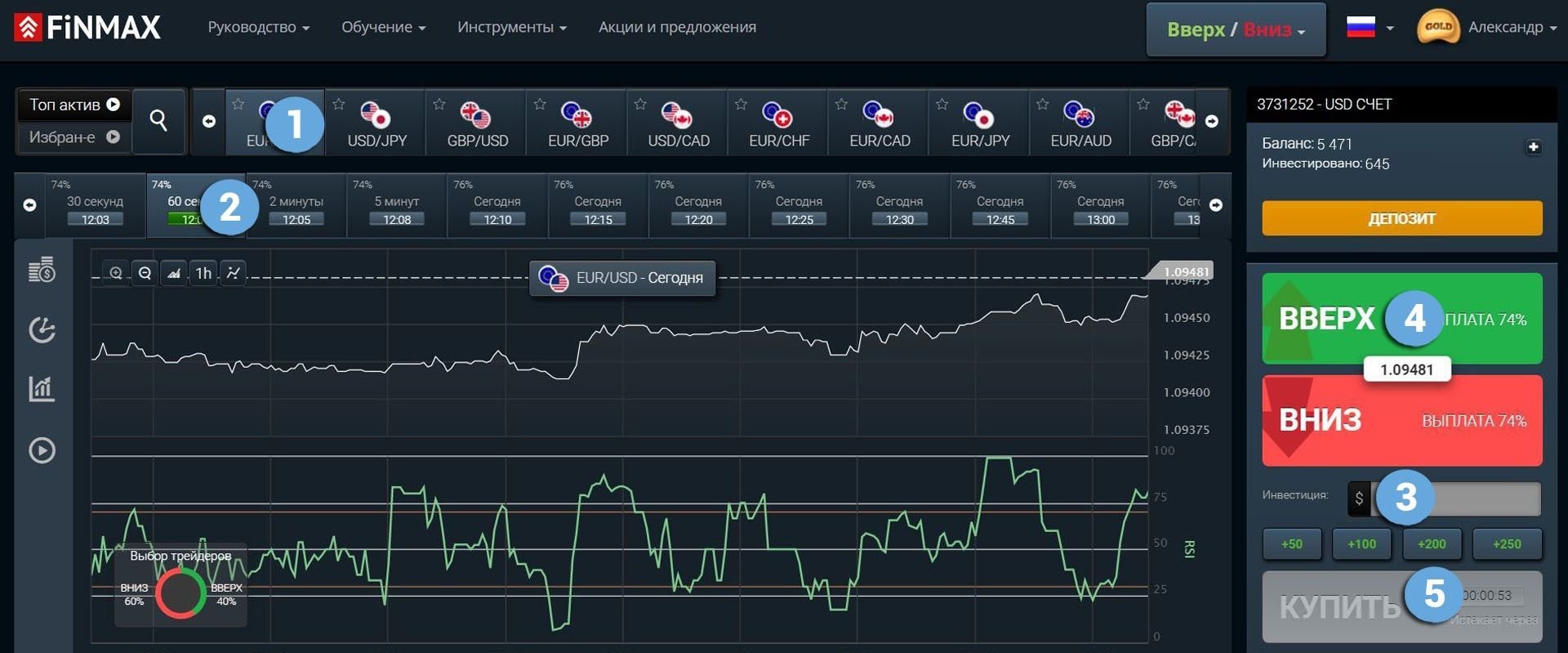

Take advantage of the downward trend in price and make a PUT (down) rate with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and prepare an option, indicating in the system:

- Type of asset.

- Expiration.

- The size of the bet.

- Movement forecast: DOWN.

- Click the “buy” button and wait for the result.

Intersection of two or more moving average lines

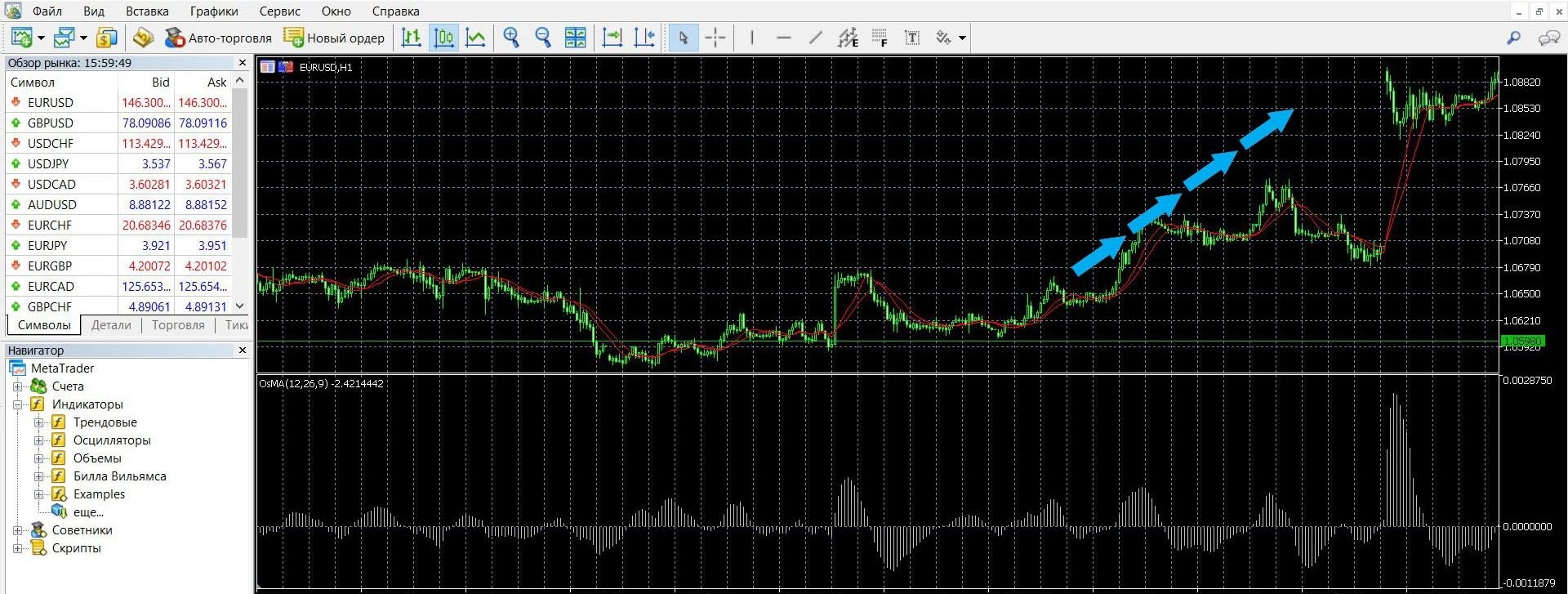

If the fast MA crosses the slow one from the bottom up, this is a signal to buy a call option. In the image below, you can see the upward trend on the MetaTrader 4 platform:

Take advantage of the upward price trend and place a CALL (up) rate with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and prepare an option, indicating in the system:

- Type of asset.

- Expiration.

- The size of the bet.

- Movement forecast: UP.

- It remains to click the “buy” button and wait for the result of the bet.

If the fast MA crosses the slow one from top to bottom, it is a signal to sell the put option. In the image, you can see the downward trend on the MetaTrader 4 platform:

Take advantage of the downward trend in price and make a PUT (down) rate with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and prepare an option, indicating in the system:

- Type of asset.

- Option expiration.

- The size of the bet.

- Movement forecast: DOWN.

- Now it remains to click the “buy” button and wait for the result of the bet.

Money management

In order for binary options trading to be not only profitable, but also consistently bring you income, one successful strategy is not enough. Such work always has risks and uncertainty, it is impossible to calculate all the results in advance. Therefore, experienced traders suffer losses, but their success is that the income from profitable transactions still covers the costs, they always remain “in the black”.

How to minimize losses and keep funds in the account? This will help the concept of “money management” – effective money management, which is recommended to get acquainted with the basics immediately from the first steps in trading. In order for the trading results to be successful, it is necessary to think over the work with capital, this is what the rules of money management are for:

Minimum bets. Minimum funds

Start trading with a minimum of funds. Bet no more than 5% of the deposit on the option. Participate in lots, the prices of which are lower than the funds in the account, otherwise after the first option you may be left without money and the opportunity to trade. When choosing a broker, stop at the one that will guarantee the best income. So, careful attitude to funds will allow you to save money and, in case of loss, you can continue to trade.

Minimum deposit

Start trading with a minimum deposit. Transfer the bare minimum of funds to the account, this will save your overall budget. Do not put the entire deposit on trading at once, even before starting work, you should determine for yourself the limit that you can spend on options, then you just have to stick to it. So, with careful attitude to the deposit, you will always have funds and you will be able to recoup in case of failure.

Minimum assets

Start trading with the minimum possible number of instruments. Trade 2-3 assets, which will allow you to gradually master the market opportunities and work more efficiently. When you feel confident in your abilities, you can increase your workload. Investing in a large number of assets leads to a loss of money, because There is a large burden on the deposit.

Minimum emotions

Start trading with a serious work mindset. In trading, you need balanced actions, in-depth analysis, and the need to remember the risks. Excessive emotionality is both a bad and, on the contrary, an excited mood that will interfere with concentration on the work process.

Minimum trades

Start trading using a reliable “rule of three”: three transactions with any outcome are enough and the player’s mind is turned off, there is a great desire to return or increase funds. By succumbing to feelings and emotions, you risk losing money on deposit. By exiting the market after three trades, you will not only save your capital, but also discipline yourself.

Expiration

One of the basic concepts in trading is expiration. Success in options trading and income stability depend on it. If you do not treat it carefully, it will be difficult to achieve a good result. Thinking through the timing of options each time and predicting the outcome of the transaction, market players are waiting for the end of trading in order to understand what gave them the choice of expiration, whether the funds in the account will be replenished.

Expiration (from the English Expiration, “expiration, end”) is the moment when the term of the transaction ends and the result of the auction becomes clear: winning or losing. In order for trading to bring maximum earnings, it is necessary to take into account the rules of money management in your work, find a reliable broker and strategy, and also remember the features of expiration.

Types of options:

- Ultra-short options – 60 seconds-5 minutes.

- Short-term options – 15 minutes to several hours.

- Medium-term options – from 6 hours a day.

- Long-term options – a day or a few months.

Is it possible to extend the expiration of options?

Can. It is worth remembering that this is not allowed by all trading platforms.

Expiration rules:

- If you are only taking your first steps in trading, you should choose a long expiration. This will guarantee the reduction of risks and unpredictability of trading, which are characterized by fast transactions.

- If you are thinking about minimizing risks, choose a broker carefully, it is worth working on such trading platforms where an increase in the expiration period is allowed.

- If you want to get income faster, participate in a short-term (a minute – a few hours) expiration, but remember its risks.

- If you want to get a stable income, participate in long-term expiration, which will guarantee a good income.

Expiration in MA strategies

Strategy at the intersection of price and the moving average line

Short-term trading: possible, able to bring good results with proper forecasting; Expiration is unpredictable and more like a lottery.

Recommended expiration: from 5 minutes to several hours; It will allow you to see the trend in full force, to feel the dynamics of the market.

Long-term expiration: recommended; A trader will have time not only to use technical analysis in a similar time period, but also to connect macroeconomic indicators about the market to work.

Strategy at the intersection of two or more moving average lines

Short-term trading: allowed; in the case of a correct prognosis, it can bring positive results; It is worth remembering its risks and unpredictability.

Recommended expiration: from 5 minutes to 1 hour; The more time a trader has, the more opportunities he has for analysis, which can affect his forecast. Here you can not only see the dynamics of the trend, but also use the data of the indicators.

Long-term expiration: recommended; It will help you see clearer signals and make a correct forecast based on macroeconomic data about the market.

Strategy for beginners “EMA + Stochastic + RSI”

A very simple and straightforward strategy for options beginners. In the work, you will need two Moving Averages EMA, Stochastic and RSI. The key entry signal will be shown by the EMA indicator, RSI and Stochastic act as confirmation of trade entry.

Short-term trading: it is possible, if the forecast is correct, it will bring a good income; It is necessary to remember the unpredictability of the result with such an expiration.

Recommended expiration: from 30 minutes to several hours; During this time, you will be able to understand the behavior of the market and its forces; The price is more predictable.

Long-term expiration: also recommended; In this strategy, the use of such expiration will allow you to get a clearer signal and make a correct forecast based on macroeconomic data.

ADX + MA Strategy

A simple but effective strategy that can be used by traders regardless of their experience. Two indicators are used here: Moving Average and ADX (Average Directional Movement Index). Buy signal: the candle closes above the MA, the ADX is above the 20 level.

Short-term trading: it is possible, in the case of a correct forecast based on these indicators, it will allow you to get a decent profit; Such expiration is characterized by the unpredictability of the outcome of transactions.

Recommended expiration: from 5 minutes to several hours; It is worth remembering that the more time you have, the more efficiently you can work and, accordingly, make the right forecast based on technical analysis data.

Long-term expiration: recommended; The trader will have time to connect all the accumulated experience to work and make the correct forecast based on the indicators of the instruments, technical analysis and the macroeconomic situation.

The “Two MAs” Strategy

A simple strategy that always follows the trend. Here you will need two MAs with periods of 21 (short) and 60 (long). Moving averages will act as a filter: when the short is located above the long one, this is a buy signal, in the opposite case, a sell.

Short-term trading: allowed, able to bring a good income; It has a high degree of risk, reminiscent of a lottery.

Recommended expiration: from 5 minutes to several hours; It will allow you to consider the dynamics of the market, feel the development of the trend in full force, the forecast can also be affected by technical analysis data (indicators, strategies).

Long-term expiration: recommended; It will allow you not only to feel the trend of the asset, but also to use all your opportunities in order to make the right forecast and get a good income: this is technical analysis, macroeconomic data.

In order to test all expiration options in practice, we recommend using the platform of a reliable broker Finmax, for this you just need to go to the finmaxbo.com website. The advantage of this solution is that you have a choice of expiration from 30 seconds to six months. You will not only check the strategies listed in our review, find the most comfortable for yourself among them, but you will also be able to get a good income.