EFI indicator

Description

Additional income is needed in order to support the budget. The search for part-time jobs, the combination of several jobs is a reality, which is based on the dream of financial independence. Remote work from the Internet is also one of the most common options for earning extra money. Most often, the network is looking for a simple income, but for this reason it is problematic to find a bona fide employer.

Binary options trading is becoming a more popular way to make money every year, which then turns into the main one. At the same time, it is trading that allows you to legally get real money with turbo trading in 30 seconds.

Binary options are reliable, and, having tried the market opportunities for the first time, players begin to seriously think about changing their lifestyle, develop their own trading strategy that allows them to reach a stable income: they constantly test automated robots and trading systems, look for profitable signals, new indicators, monitor promotions and bonuses, study broker ratings. All this, as well as even more useful material, can be found on our website. Today’s review is devoted to the Strength Index indicator.

The Elder’s Force Index (EFI) is a popular technical indicator developed by renowned trader Alexander Elder to measure the strength of price movement based on direction, volume and size data. For the first time, the author spoke about the instrument in 1993 in his work “How to Play and Win on the Stock Exchange”, which is still a real bestseller today.

Proving the idea that the trend must necessarily be confirmed by trading volumes, the Strength Index accurately determines the strength of buyers in an uptrend and the strength of sellers in a downtrend. According to the author of EFI, it is worth smoothing its signals with moving averages in order to get accurate information about the dynamics of the main market participants.

Today, it is widely used by traders, common in trading systems, works easily and simply, allowing you to get a good income from options trading. Professionals confidently consider it one of the most accurate indicators of the exchange.

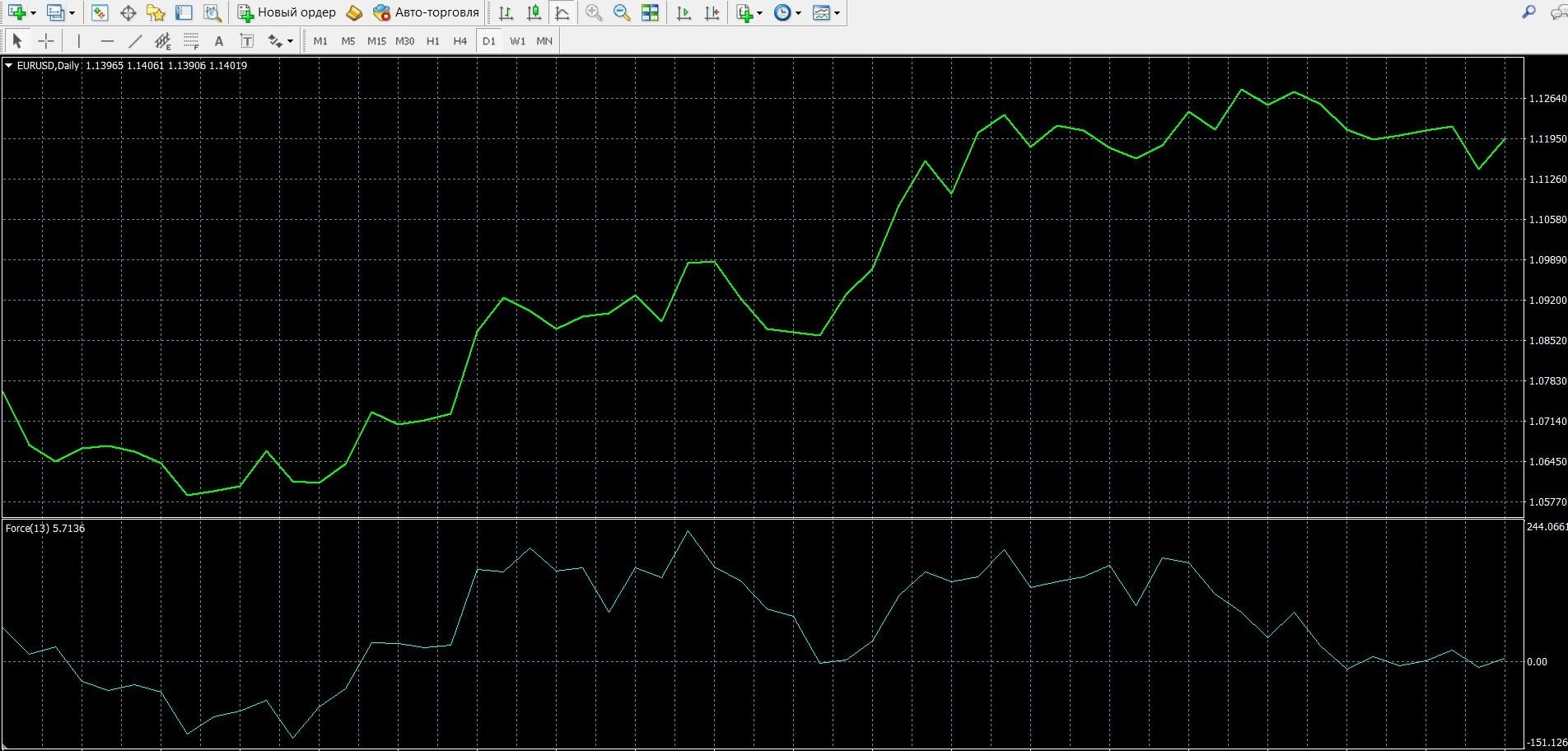

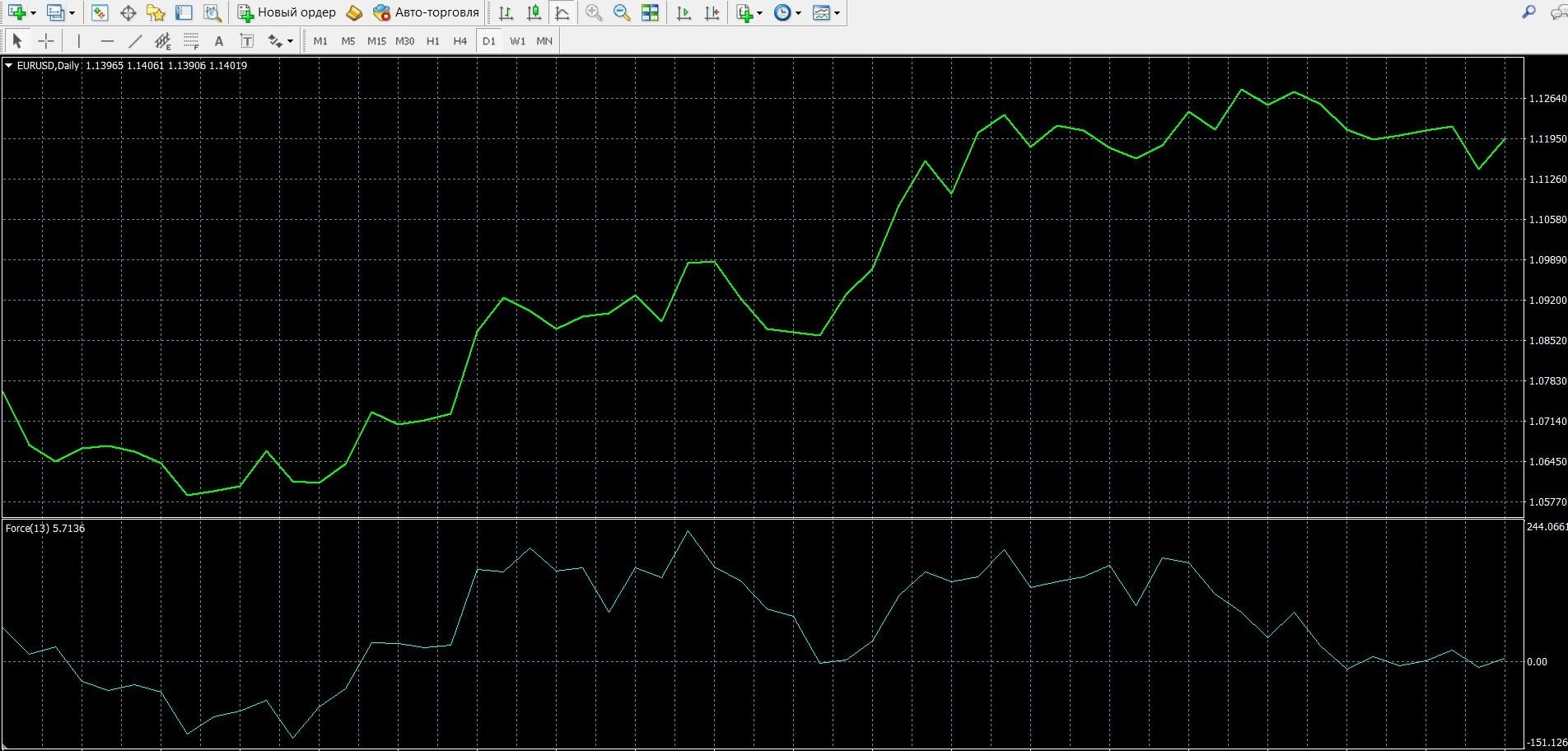

You can learn more about the possibilities of EFI on the price chart of the MetaTrader 4 terminal in the image below. You can also easily download the MetaTrader 4 platform and learn how the tool works in practice.

How does the EFI indicator work?

The Elder’s Force Index identifies the driving forces of the market at a particular moment using data:

- about the direction of price change (trends),

- about the range of motion,

- on the indicator of trading volumes (involvement of market participants).

According to Dow’s theory, market trends are confirmed by volumes, which is what Elder was guided by when creating the tool. When displaying data, the Strength Index takes into account the opening and closing prices and tick volume for a specific period. The results are displayed in the form of a broken graph, which is plotted at the zero line:

- If the indicator of the cost of closing the bar is higher than the previous one, the forces are positive,

- If the closing value is lower than the previous one, the forces are negative.

The greater the differences in prices, the greater the strength indicator will be. The greater the market volume of trades, the greater the strength.

When interpreting an instrument, it is important to consider what type of movement is used: short-term or medium-term trading. Most often, it is recommended to use it on daily charts, it is medium-term trading (13 periods) that most accurately shows the dominant forces of the market: bulls or bears. In addition, the tool performs well in short-term trading. In this case, it is worth remembering the increased sensitivity of the tool and combining its data with additional tools.

The formula for calculating the indicator:

FORCE INDEX (i) = VOLUME (i) * ((MA (ApPRICE, N, i) – MA (ApPRICE, N, i-1))), where:

FORCE INDEX (i) — Strength Index of the current bar;

VOLUME (i) — volume of the current bar;

MA (ApPRICE, N, i) — any moving average of the current bar for N periods:

simple, exponential, weighted or averaged (smoothed);

ApPRICE — applied price;

N is the smoothing period;

MA (ApPRICE, N, i-1) — any moving average of the previous bar.

Info taken from metatrader5.com website

Indicator signals

Trend signals

- If the EFI is located above the zero level and reaches a new height, then this indicates an uptrend, you should buy call options,

- If the EFI is below zero and falls to a new depth, this indicates a downtrend, you should buy put options.

Trend confirmation signals

- If, during the growth of the EFI positive trend, it falls below zero and rises again, this is a signal that the trend will continue to rise, it is worth buying call options,

- If, during the fall of the EFI, it rises above the zero line and continues to fall to a new depth again, this is a qualitative signal of a downtrend, it is worth buying put options.

Signals of divergence of EFI with price

- With a divergence signal that occurs in an uptrend, price highs are not confirmed by the behavior of EFI, this is a warning about a possible trend change, it is worth buying call options,

- With a convergence signal that occurs in a downtrend, price lows are not confirmed by the behavior of EFI, this is a warning about a possible trend change, it is worth buying put options.

Do I need to install the EFI indicator in your platform?

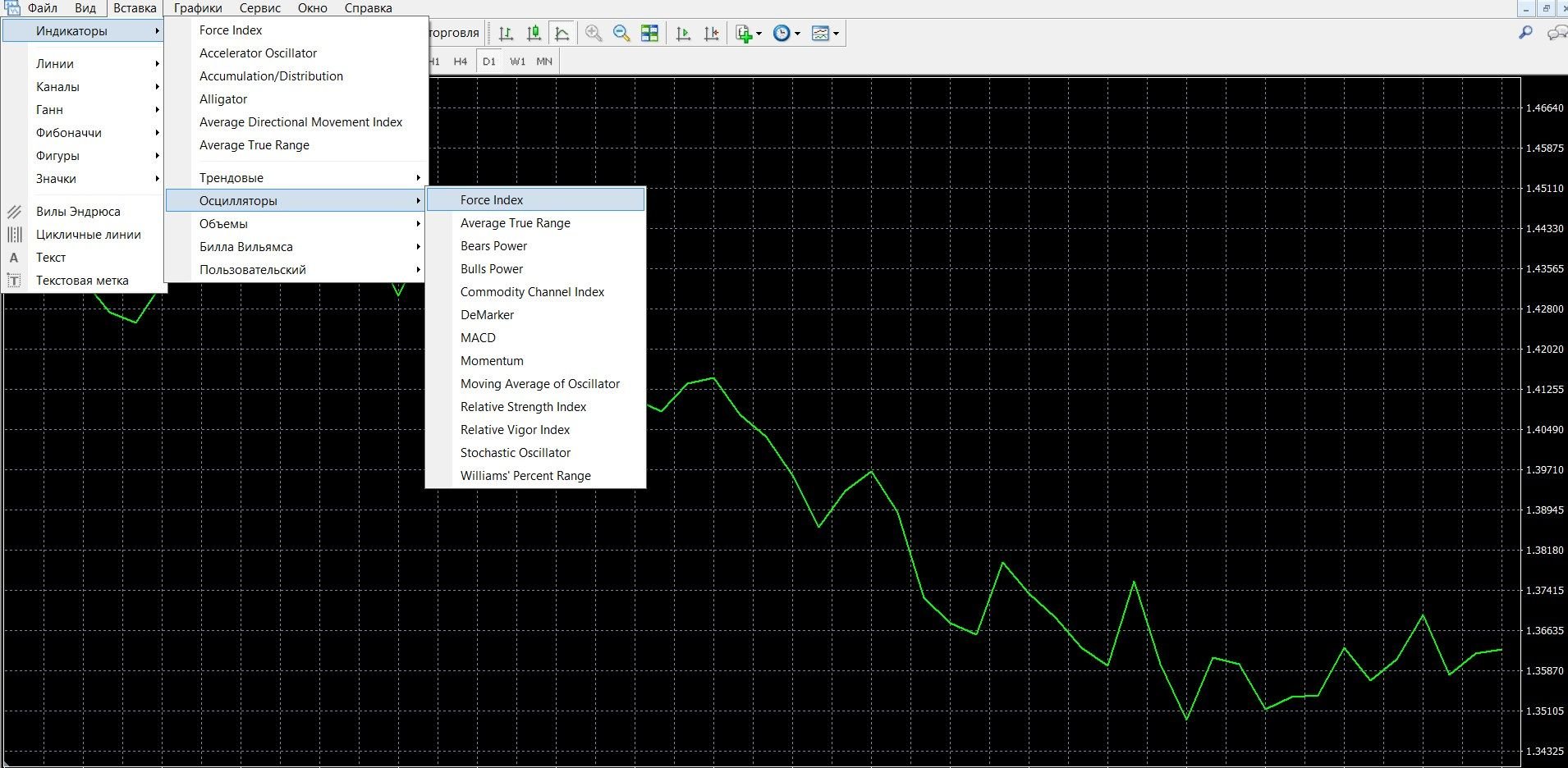

The Strength Index is a classic technical analysis tool that is available in most trading terminals, including MetaTrader 4. To add it to the main chart, you must:

- Click the “Insert” tab in the top menu in the MT4 terminal

- Select the tab “Indicators” – “Oscillators”

- In the drop-down menu, select “Force Index”.

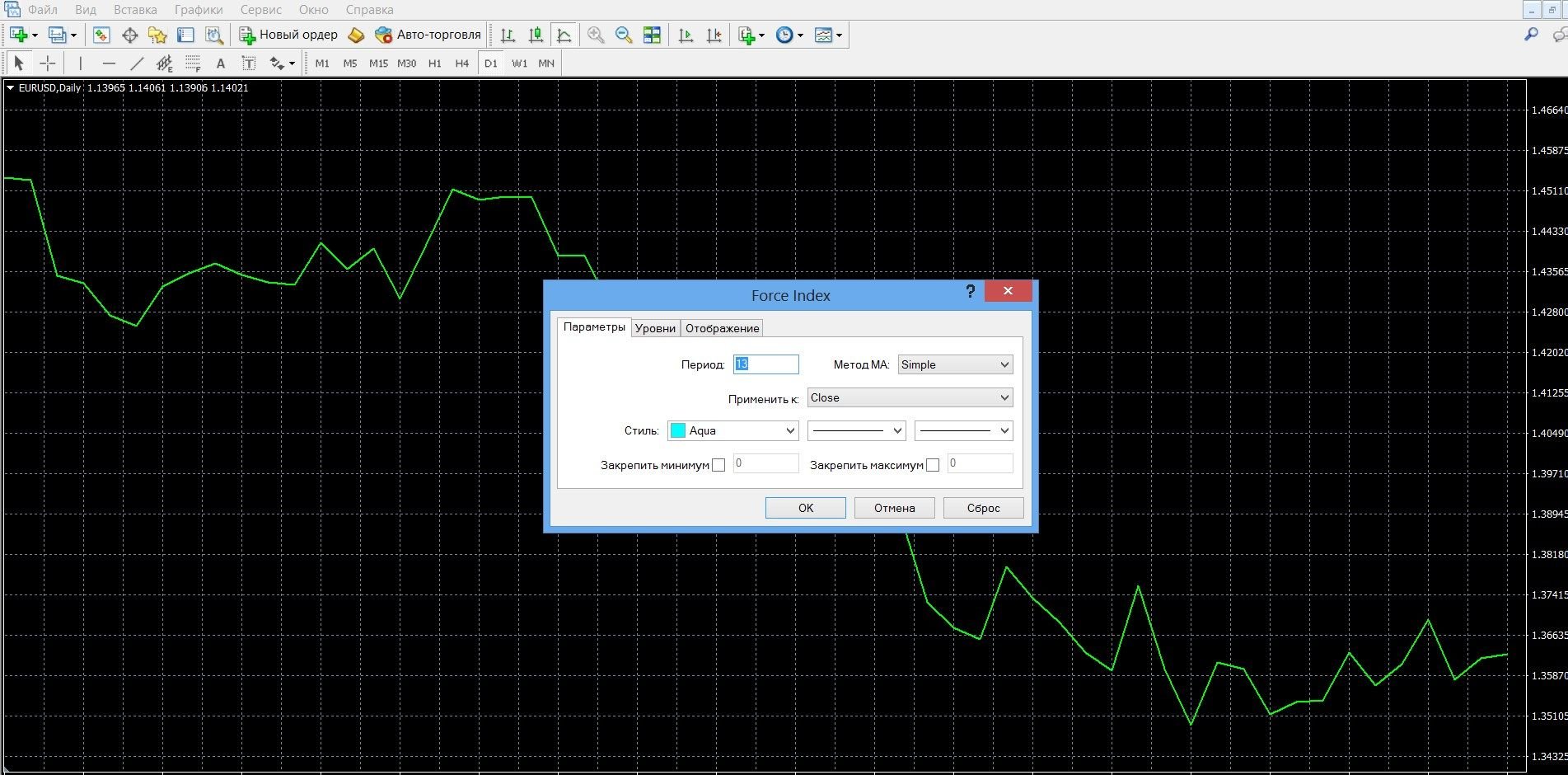

After completing these steps, a window will automatically open with settings that you can change for yourself:

Visual settings (color, appearance and line thickness)

Main settings:

- The period that determines the quality of the signals: if you increase the period, the values will be smoothed. If you reduce its indicator, sensitivity to recent price changes will be increased. By default, the default period is 13, recommended for more accurate work by Elder.

- The MA method allows you to influence the smoothness of the instrument in order to more easily see market trends.

If your terminal does not have an indicator, you can download it for free here.

Application of the indicator for binary options

The Strength Index accurately reflects the strength of the current trend – bearish in a downtrend and bullish in an uptrend. It is customary to use it both in its pure form and in combination with additional tools to obtain a reliable signal. The tool makes it possible to find a profitable entry point for a trade:

- If its line has reached positive values, we have an upward trend,

- If, on the contrary, the line of negative indicators indicates a downward trend,

- Finding the line at zero is a sign of lateral movements.

Using EFI settings, you can work with both long-term (longer period) and short-term trends (lower period value). Traders also use it to identify divergences (divergence and convergence), which are considered a reliable signal of a change in the trend of the exchange.

Force Index is one of the simplest and most convenient tools for technical analysis, it is common both in binary options and in the Forex market. One of the main advantages of the indicator is that it fully takes into account the necessary factors to demonstrate the exact position of the market, which makes it possible to consider it one of the most effective tools. Tk. It is used to calculate the volume of transactions, and in the market there is only the concept of “tick volume”, which does not always coincide with real data, it is worth carefully interpreting its signals.

Rules for concluding transactions (screenshots)

Trading with a trend signal

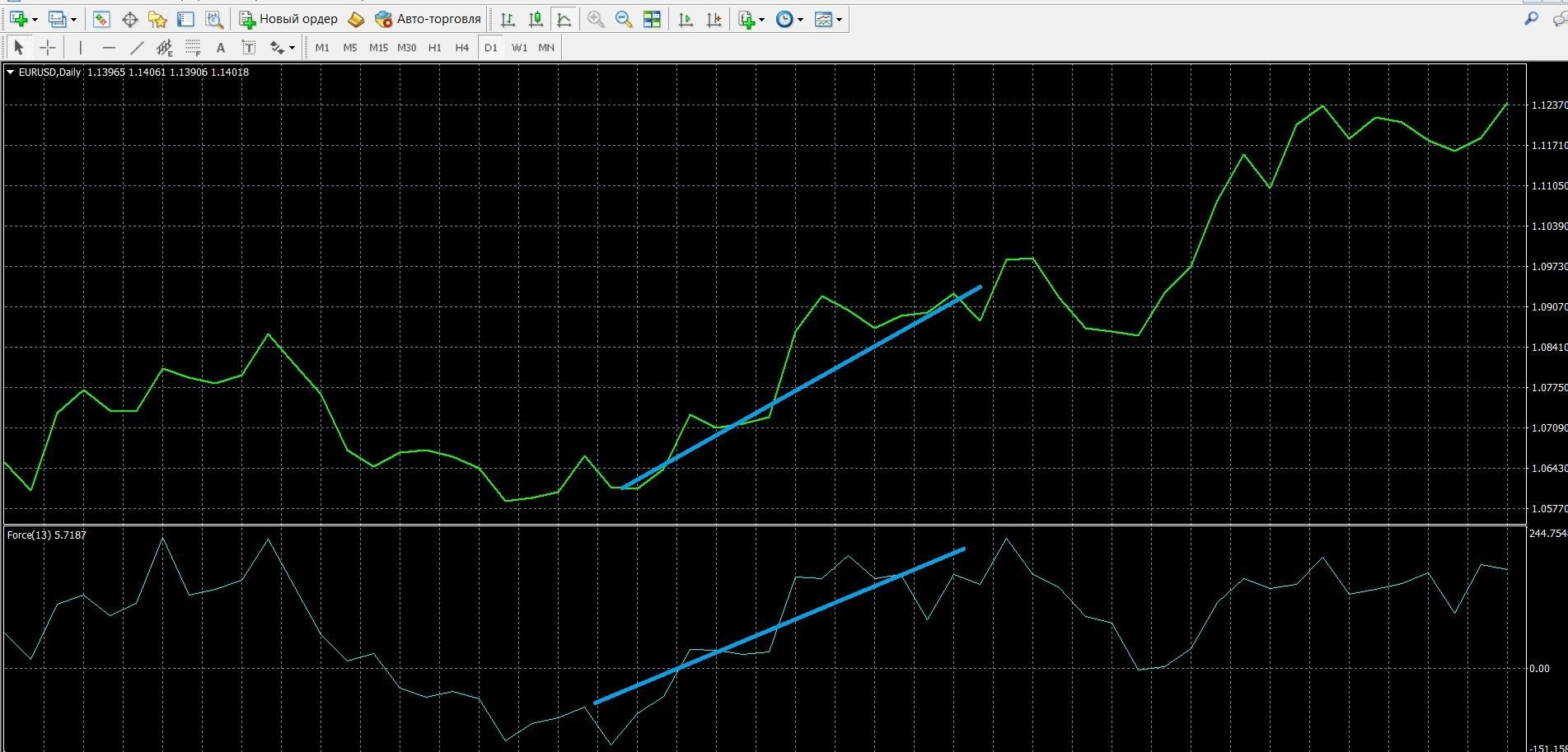

If EFI is located above the zero level and reaches a new height, then this indicates an uptrend, you should buy call options. In the image below, you can observe the upward trend on the MT4 chart:

You can place a CALL bet with the Olymp Trade broker by going to the olymptrade.com website and preparing an option, indicating:

- Type of option

- Expiration date

- Amount

- Prediction: up

- Next, click the “buy” button and wait for the results of the forecast:

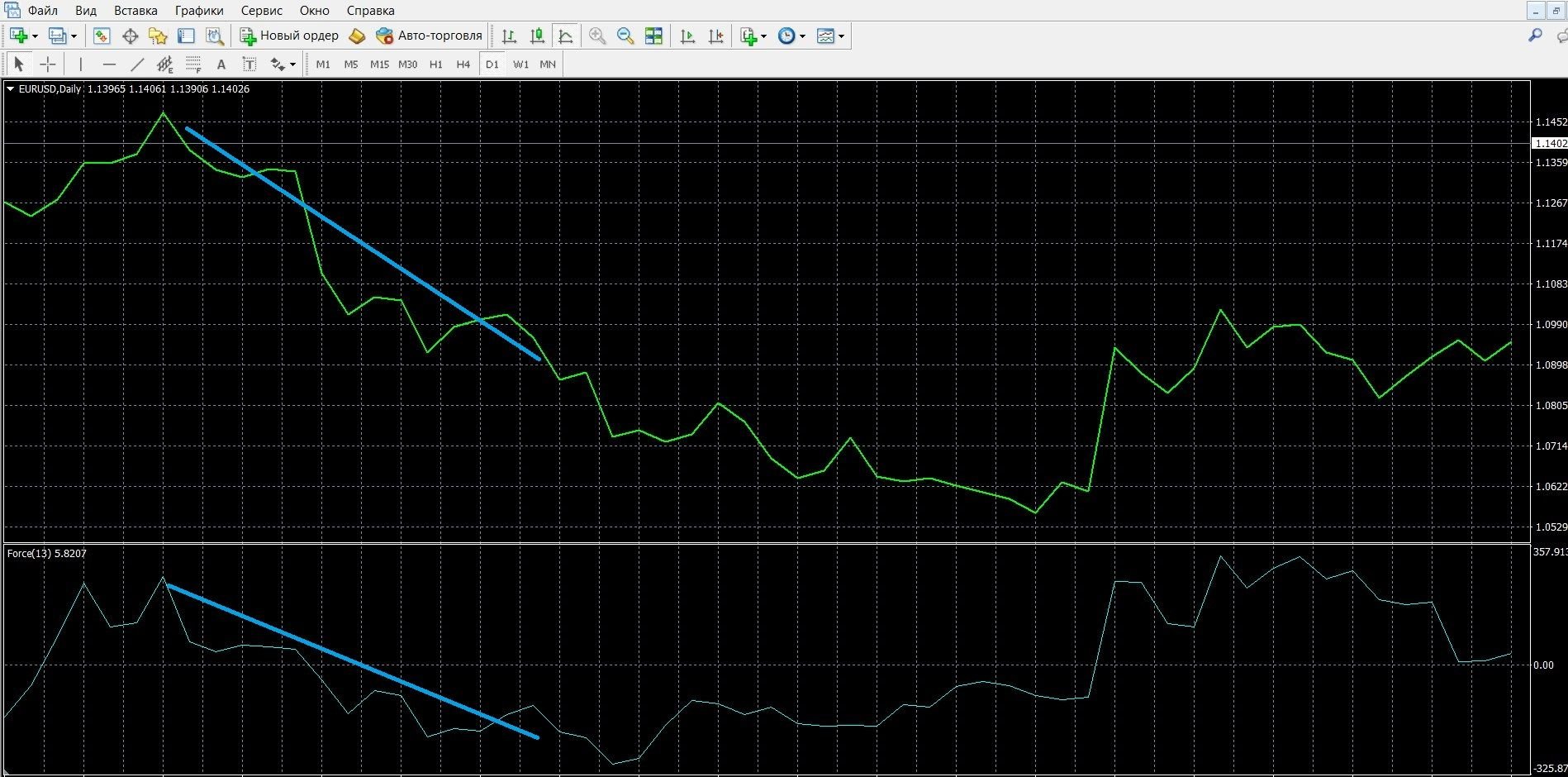

If the EFI is below zero and falls to a new depth, this indicates a downtrend, you should buy put options. In the image below, you can observe the downward trend on the MT4 chart:

You can place a PCI bet with the Olymp Trade broker by going to the olymptrade.com website and preparing an option, indicating:

- Type of option

- Expiration date

- Amount

- Prediction: down

- Next, click the “buy” button and wait for the results of the forecast:

Trading on a trend confirmation signal

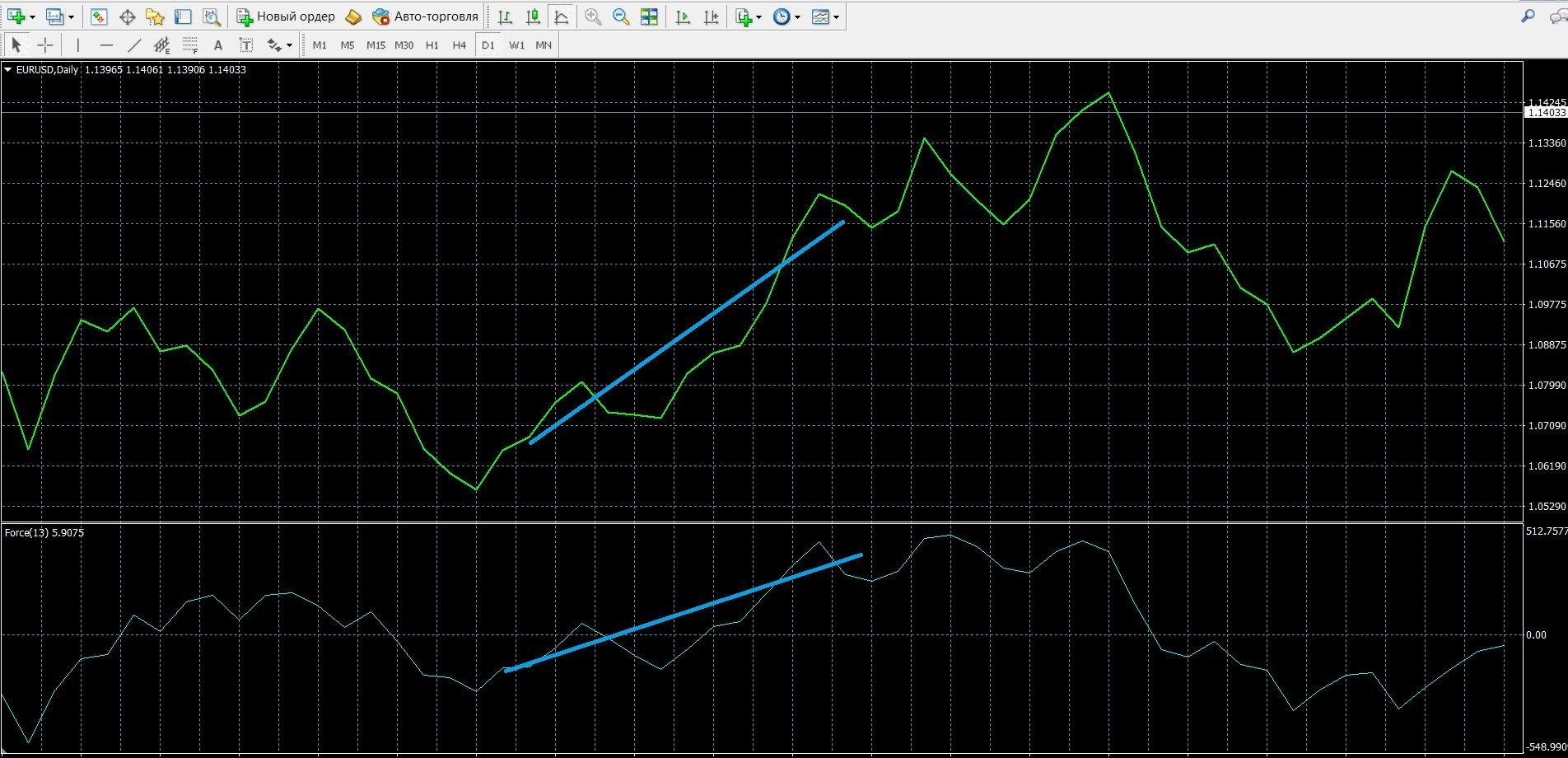

If, during the growth of the positive EFI trend, it falls below zero and rises again, this is a signal that the trend will continue to grow, it is worth buying call options. The image below shows the uptrend in the MT4 terminal (you can place a CALL bet on the olymptrade.com website, the instructions are listed above):

If, during the fall of the EFI, it rises above the zero line and continues to fall to a new depth again, this is a qualitative signal of a downtrend, it is worth buying put options. The image below shows the downtrend in the MT4 terminal (you can place a PCI bet on the olymptrade.com website, the instructions are listed above):

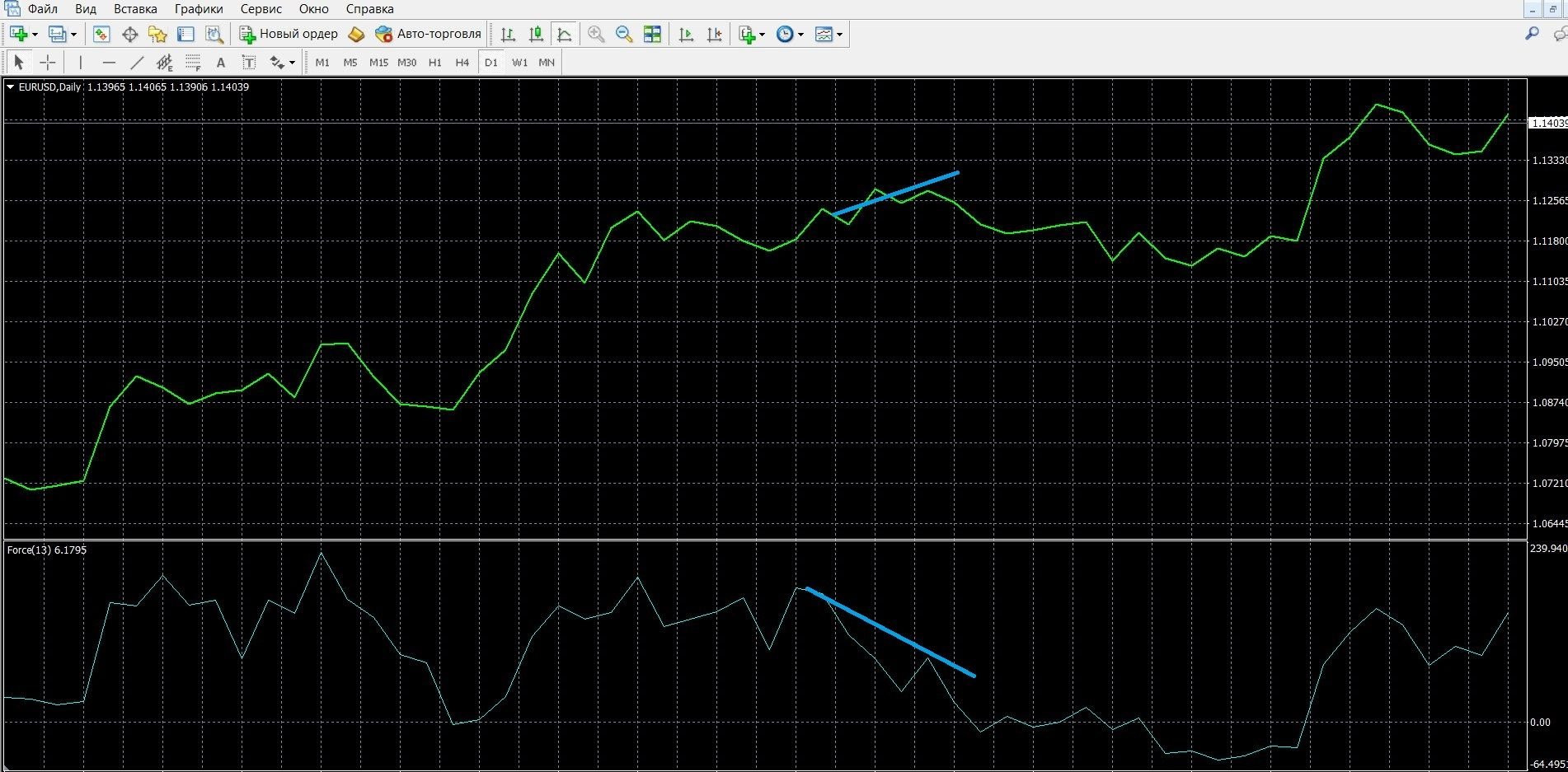

Trading with a signal of divergence between EFI and price

With a divergence signal that occurs in an uptrend, price highs are not confirmed by the behavior of EFI, this is a warning about a possible trend change, it is worth buying call options. The image below shows the divergence in the MT4 terminal (you can place a CALL bet on the olymptrade.com website, the instructions are listed above):

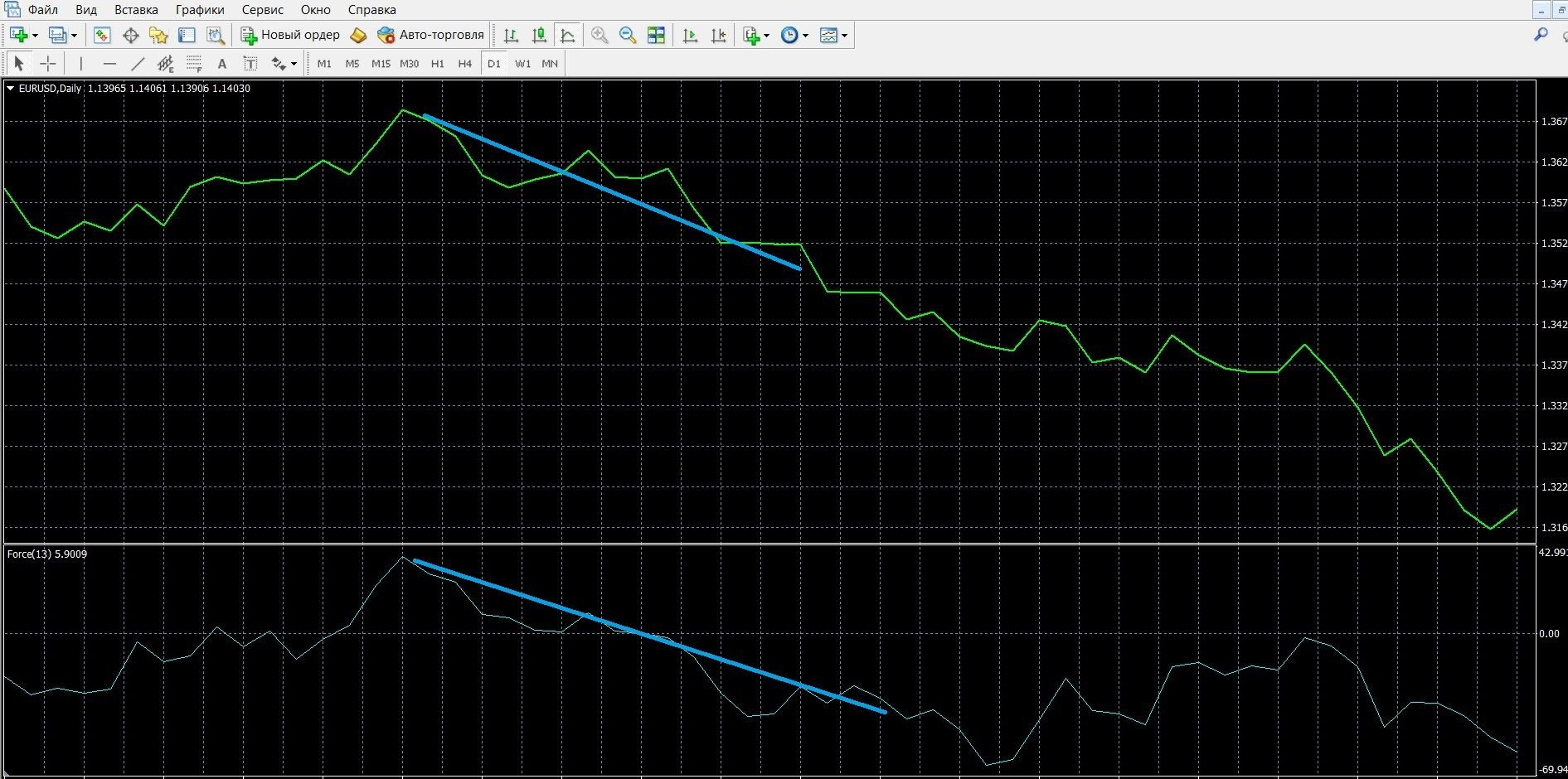

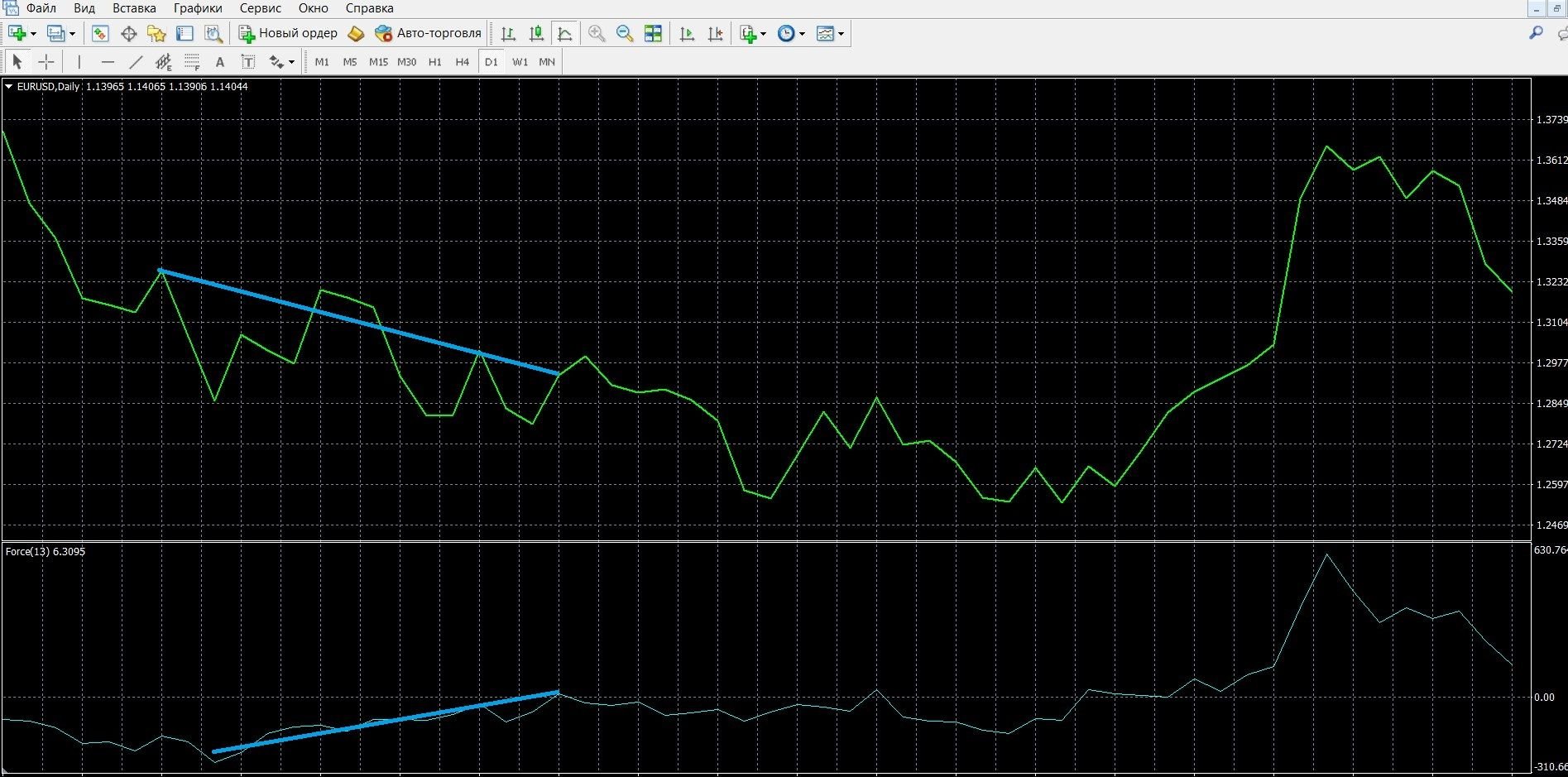

With a convergence signal that occurs in a downtrend, price lows are not confirmed by the behavior of EFI, this is a warning about a possible trend change, it is worth buying put options. The image below shows convergence in the MT4 terminal (you can place a PCI bet on the olymptrade.com website, the instructions are listed above):

Money management

As one of the main tools of trading on the stock exchange, which directly affects the success of work, money management helps to quickly and easily achieve the best result in options trading. It is with this concept that beginners in trading should get acquainted in the first place. He is also an indispensable assistant to professional players, helping them to realize the receipt of a stable income.

Minimum capital: when trading options on the stock exchange, it is recommended to bet a minimum capital on the purchase of an asset; at the same time, the value of the asset does not exceed 5% of the account size; It is worth trading inexpensive options, the purchase of which does not significantly affect the size of the deposit in case of a losing trade. By trading options using these rules, you will save your money as much as possible.

Minimum deposit: when trading options on the exchange, it is recommended to trade such transactions that maintain a positive state of the deposit; when buying a specific asset, do not transfer the entire deposit to it; On the contrary, try to work with the deposit in such a way that it lasts for a long time, allowing you to trade and earn even more. By trading options using these rules, you will save your deposit for a long time.

Minimum options: when trading options on the stock exchange, it is recommended to start buying a minimum of assets, for example, 3; This applies more to new exchange players who have no trading experience; Later, becoming more experienced, you can easily increase the number of transactions, but then you will be more confident and experienced. By trading options using these rules, you will become more productive.

Minimum of emotions: when trading options on the stock exchange, it is recommended to always start working with a serious positive attitude; It is worth remembering that successful options are your clear informed decisions based on analytics; Only successful trading experience will not be enough here, it is the emotional part that can bring a good income or, conversely, deprive you of it. By trading options using these rules, you will achieve much more in trading.

Expiration

Expiration is the end of trading in a specific asset, when exchange participants have set their forecasts based on strategies and tools, and now learn about the result of their decisions. This is also the main concept of working in the market, the correct use of which can make trading more productive.

Types of options:

- Ultra-short options – 30 seconds – 5 minutes.

- Short-term options – 10 minutes – several hours.

- Medium-term options – a day – a few weeks.

- Long-term options – a month – six months.

Is it allowed to extend the expiration?

It is allowed, but well, for all platforms. This is a convenient feature that makes it possible during trading, with the specified incorrect forecast, to extend the expiration time and thereby reduce your losses.

Expiration rules:

- If you are just mastering the possibilities of trading and do not have trading experience, choose long-term trades for trading, the most stable, characterized by minimal risks of loss.

- If you already consider yourself a professional in trading, choose for trading the expiration that is most comfortable for you and gives you the necessary income.

- If instant income is important to you from trading on the stock exchange, choose a short-term expiration that will bring the first real money in 30 seconds.

- If a stable income is important to you from the exchange, choose a long-term expiration for work, which will bring you reliability during trading and decent money.

Expiration in strategies with EFI

Expiration at a trend signal

Short-term trading: possible; Despite the fact that turbo trading is characterized by increased risks, using EFI with additional tools, you can achieve a good result.

Medium-term expiration: recommended; EFI works better and demonstrates trend signals in this particular time period, allowing you to study the trend and make profitable bets; You should always double-check the indicator signals using other tools.

Long-term expiration: possible; in this case, EFI signals should be checked with the help of additional tools, technical and fundamental analysis.

Expiration at trend confirmation signal

Short-term trading: possible; Express trading is characterized by increased risks, so only using EFI with additional tools can you achieve a good result.

Medium-term expiration: recommended; EFI works better and demonstrates high-quality trend confirmation signals in such a time period, allowing you to study the market and make profitable bets; You should always double-check the indicator signals using other tools.

Long-term expiration: possible; in this case, EFI trend confirmation signals should be checked with the help of additional tools, technical and fundamental analysis.

Expiration when there is a signal of divergence of EFI with the price

Short-term trading: allowed; EFI is capable of issuing high-quality divergence signals; It is recommended to supplement it with other tools.

Medium-term expiration: recommended; EFI is able to produce good signals on a given interval, determines the moments of divergence and convergence; It is recommended to supplement it with other tools.

Long-term expiration: allowed; EFI is good at showing price discrepancies; it gives productive trading; It is worth double-checking its data with additional indicators and strategies, materials of technical and fundamental analysis.

Starting to work in the binary options market, separately study the features of expiration, which can improve trading results. To do this, we recommend choosing a convenient terminal of one of the popular brokers Olympus Trade, which offers expiration from 1 minute to 1 hour. Go to the official website of the broker olymptrade.com right now and start working more productively.

Downloads

MetaTrader 4 (MT4) platform – download.

EFI indicator for the MT4 platform – download.

Tagged with: Binary Options Indicator