ADX Indicator

Description

Many of us dream of financial independence, try to change our lives, being in search of work and opportunities for additional income. There are many job options online, but in fact it is difficult to understand how honest the employer is with you and where to find help if he does not pay the promised remuneration. What to do in such a situation, you ask? There is a way out and, if you really want more out of your life, you can achieve it.

Binary options trading is gaining momentum for a reason, becoming more popular. People trust trading – this is a highly paid and at the same time legal job; Leading trading platforms always fulfill their obligations by paying money. Only trading will allow you to get the first real money in 30 seconds and increase it as much as you need.

Binary options are available, you don’t need any work experience here, you just need to start trading. Serious traders make trading the main source of income, constantly working on their skills: they test trading strategies, look for profitable signals, study new indicators, monitor profitable bonuses, and always monitor the current ratings of brokers. Even more useful material awaits you on our resource. Today’s review is devoted to the Average Directional Movement Index indicator.

The Average Directional Movement Index (ADX) is a popular technical indicator authored by the famous trader Wells Wilder (who created a large number of instruments, for example, ATR and RSI), who described the new tool in the book “New Concepts of Technical Trading Systems” in 1978.

This indicator is indispensable for confirming quality signals in profitable trading strategies. It is called universal, because. It provides valuable information about market activity, the nature of trading, when to trade and when it is better to avoid buying binary options.

One of the main advantages of the tool is that it is equally highly effective on any time intervals, it can be used both in turbo trading and in long-term transactions. Initially, it was created as a market trend indicator, accurately indicating the strength and direction of the market trend. Despite the fact that the ADX is considered a trend indicator, it is able to work in any state of the exchange.

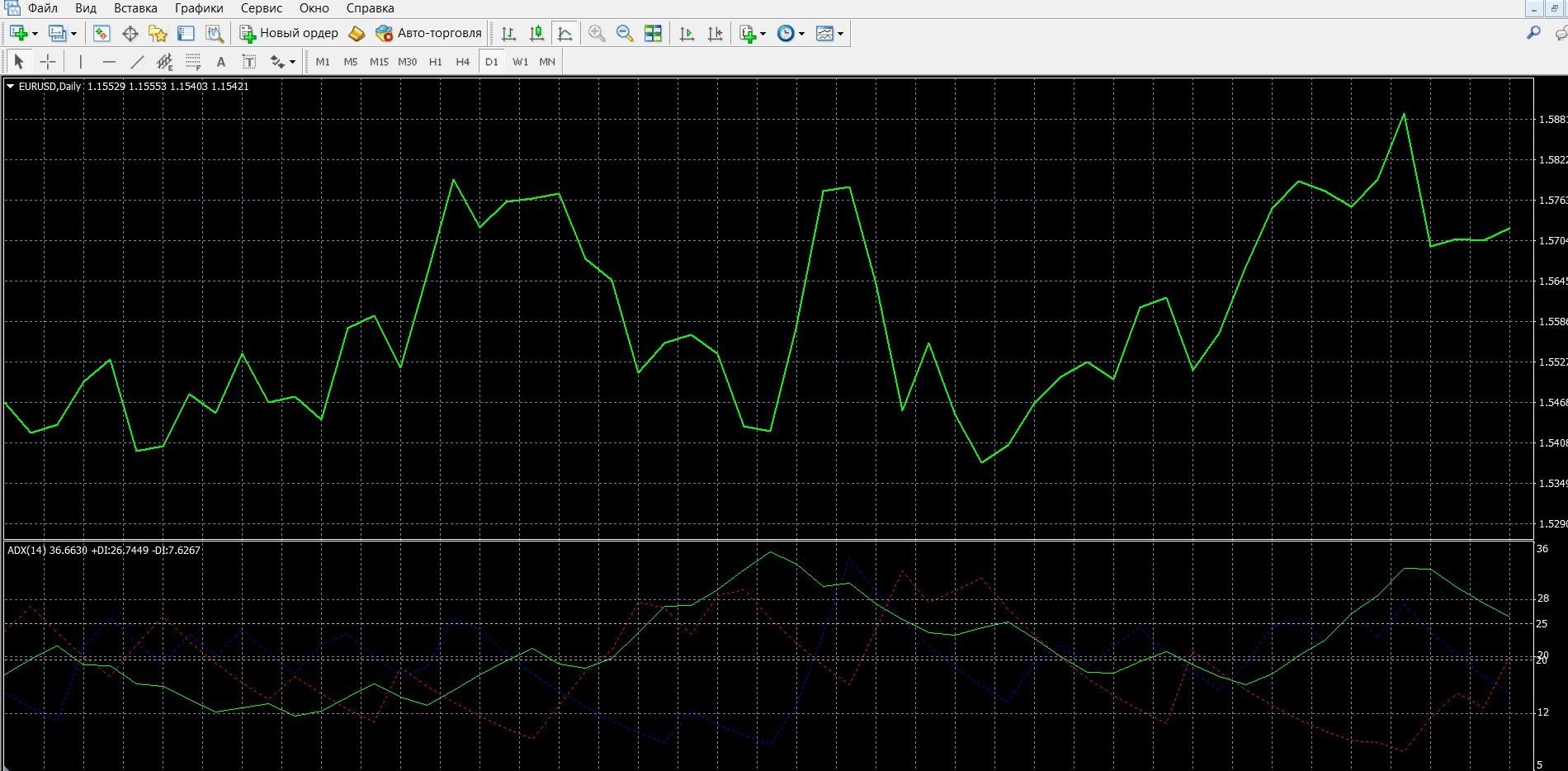

You can learn more about the features of ADX in the MetaTrader 4 terminal in the image below. You can also easily download the MetaTrader 4 platform and study the tool in more detail.

How does the ADX indicator work?

Being one of the most effective tools for technical analysis, ADX is undoubtedly one of the most popular indicators among traders. It consists of three lines, which, when combined, create a powerful Index of the average direction of movement:

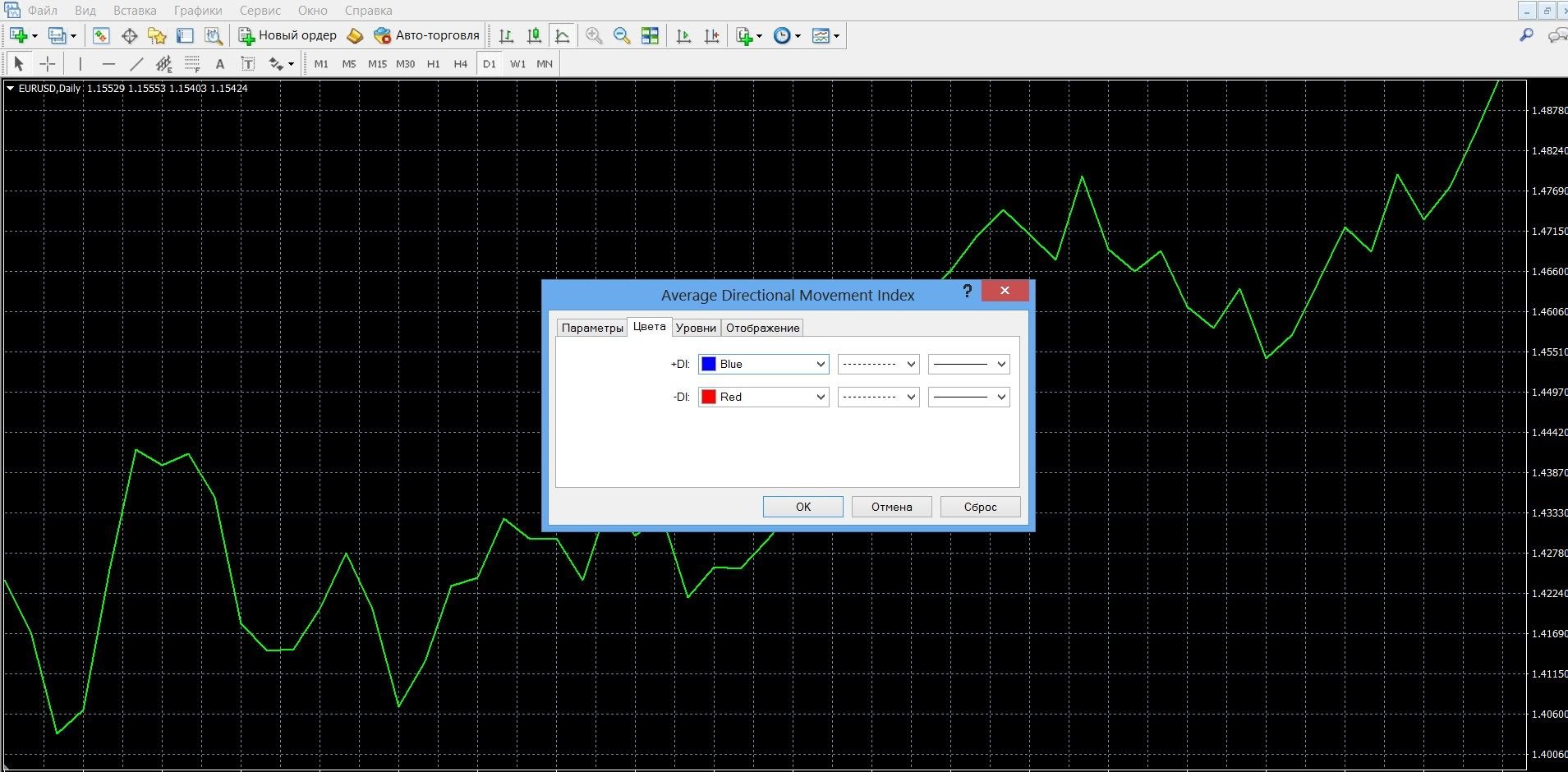

- +DI – smoothed blue line, shows upward trends;

- -DI – smoothed red line, shows downward trends;

- A green signal line showing the direction of the trend.

The easiest way to trade in this case is to compare these lines. The author of the indicator advised buying options if +DI rises above -DI, and selling them when +DI falls below the -DI line.

The instrument’s signals range from 0 to 100, which provides ample opportunities for analytics. To work, levels 40 (if the indicator is located above it, we have a strong trend in front of us) and 20 (if the indicator is located below it all the time, we have a correction in front of us), which are considered key in determining the beginning of a strong momentum or attenuation of a trend.

Despite the fact that more professional traders work with ADX, beginners should also pay attention to it, because this tool is able to give simple and accurate signals (for example, when the ADX grows, there is an uptrend in the market; when it falls, on the contrary, there is a downtrend). The use of the indicator will significantly increase the effectiveness of the work.

The formula for calculating the indicator:

ADX = SUM ((+DI – (-DI)) / (+DI + (-DI)), N) / N, where:

N is the number of periods used for calculation;

SUM (…, N) — sum for N periods;

+DI is the value of the positive directional index indicator;

-DI is the value of the negative directional index indicator.

Info taken from metatrader5.com website

ADX Indicator Signals

+DI and –DI intersection signals

- If +DI (blue) moves up and crosses the -DI line (red) from bottom to top, this indicates a reversal to an uptrend, you can buy call options,

- If the -DI line (red) moves up and crosses +DI (blue) from bottom to top, this indicates a reversal to a downtrend, you can buy put options.

Trend signals of +DI and –DI lines

- If the +DI line (blue) is above the –DI line (red), while the ADX itself is growing, this is an uptrend, you can buy CALL options,

- If the –DI line (red) is above the +DI line (blue), while the ADX itself is growing, this is a downtrend, you can buy put options.

ADX Line Trend Signals

The ADX does not provide information about the direction of the trend, the direction of movement is determined by DI+ and DI-.

- If the ADX line itself has an upward direction, the trend is gaining strength, you can buy call options,

- If the ADX line has a downward direction, the trend is fading, you can buy put options.

ADX location signals at levels 20 and 40

Levels 20 and 40 are key indicators for determining the beginning of a strong momentum or attenuation of a trend, depending on the location of the ADX:

- The location of the ADX above the 40 mark is a strong trend, you can buy CALL options,

- Finding the ADX to the level of 20 indicates a weak trend, you can buy put options.

Do I need to install the ADX indicator in your platform?

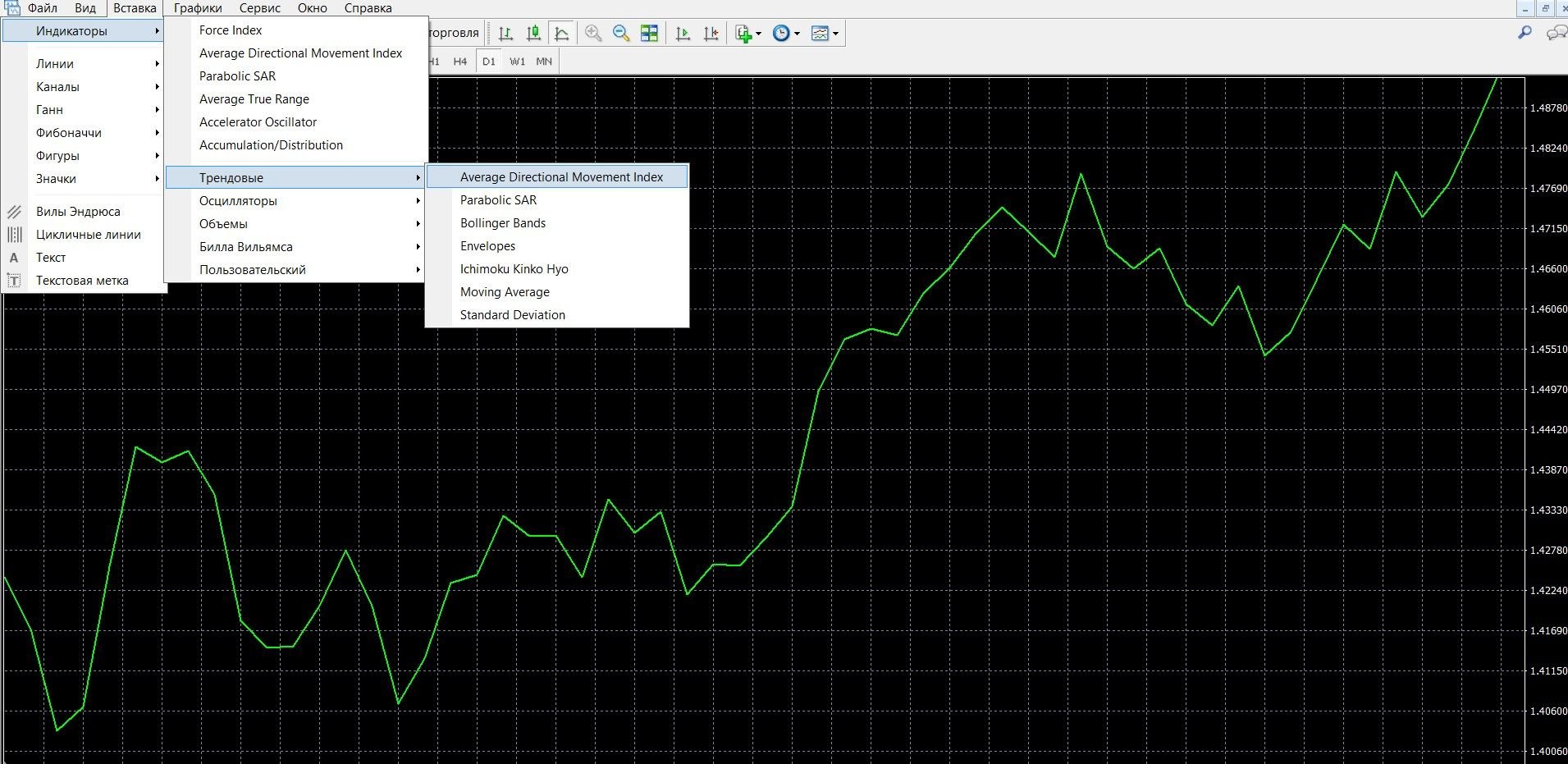

ADX is a standard technical analysis tool that is included in most modern broker terminals, and it is also available in MetaTrader 4. To add the ADX to the price chart, do the following:

- Click the “Insert” tab in the top menu of the platform

- Select the tab “Indicators” – “Trend” – “Average Directional Movement Index”.

- The indicator is added to the chart, you can work.

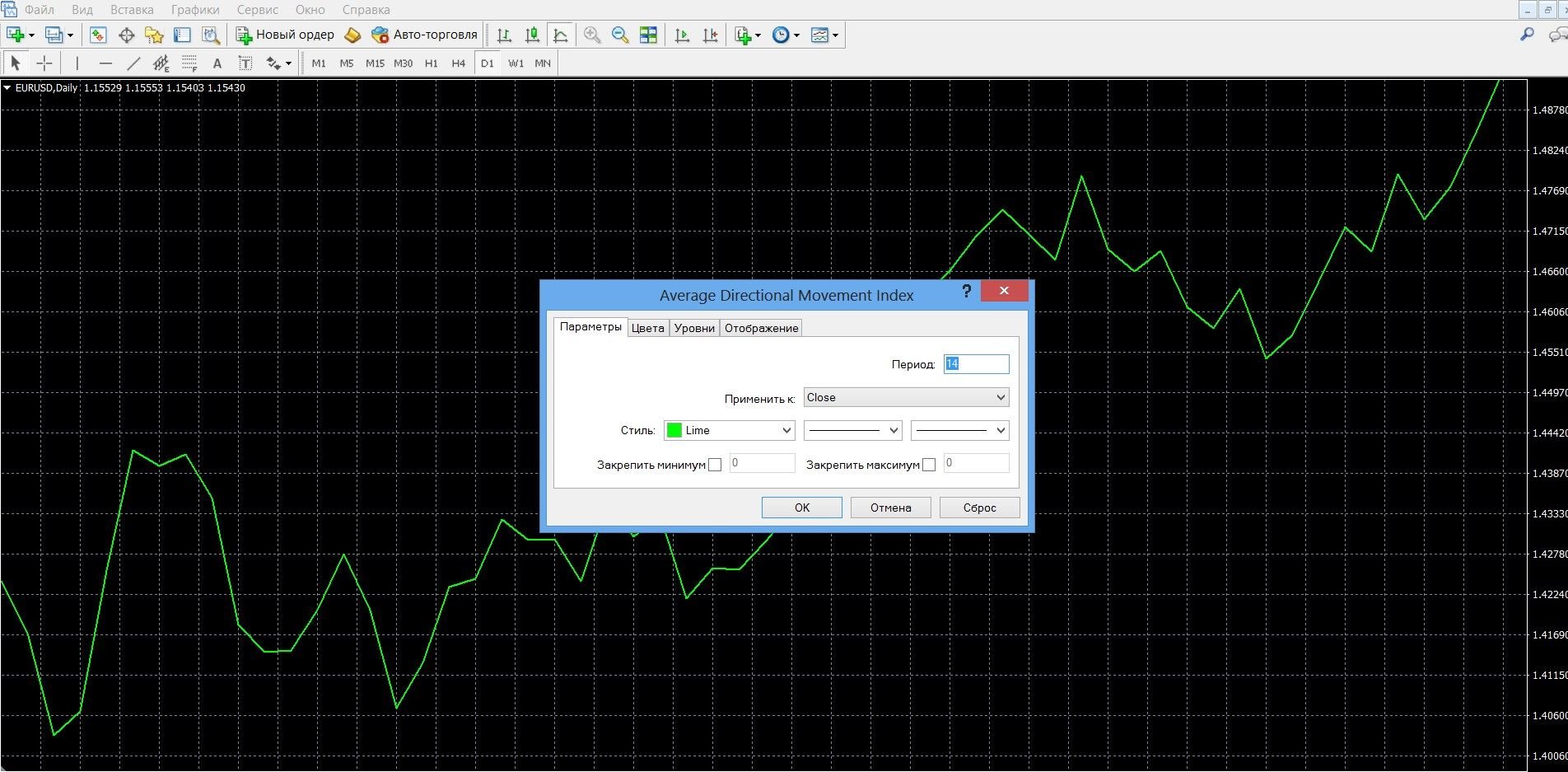

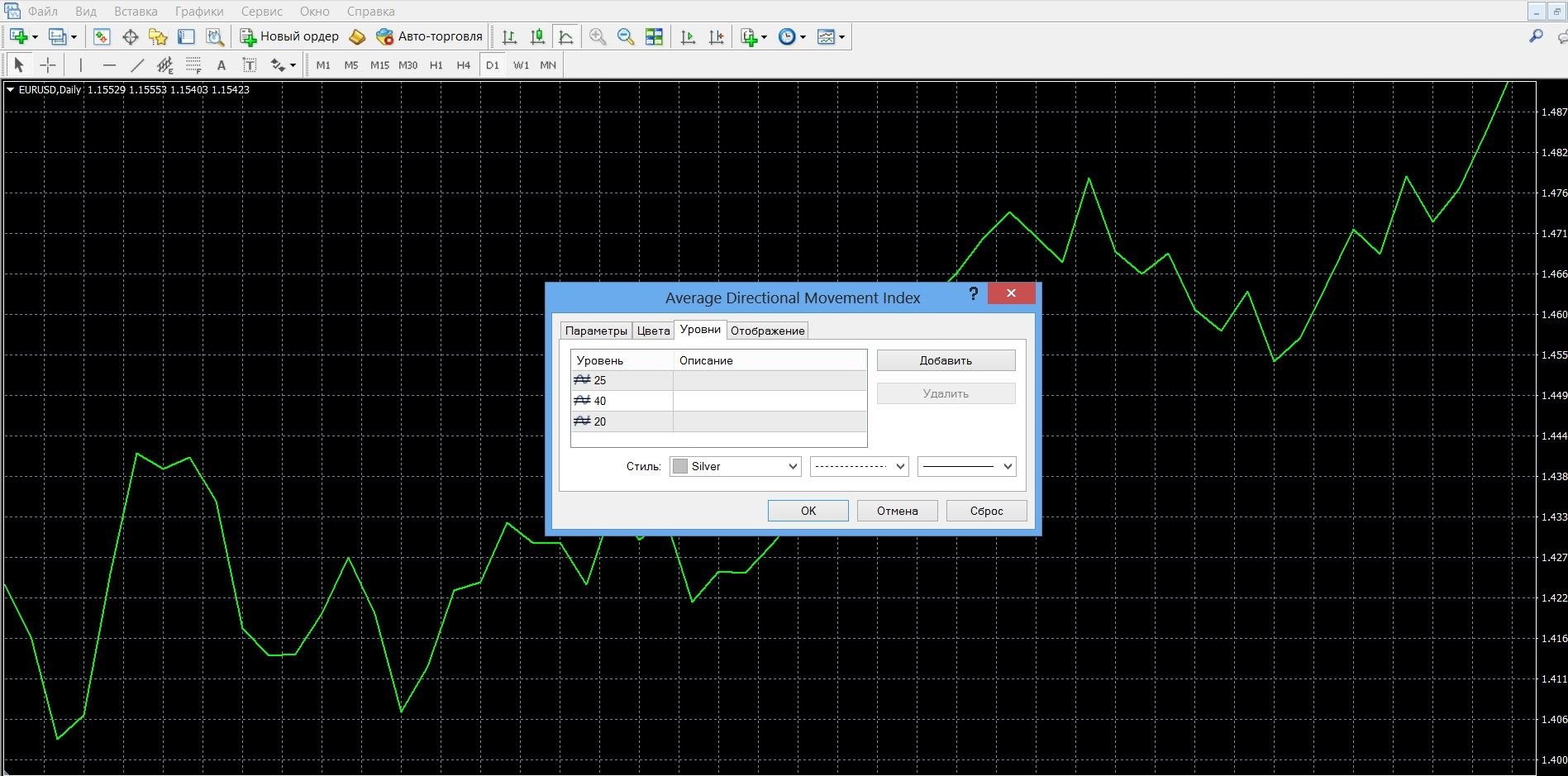

When you add an indicator, you will see a window of additional settings:

- Visual settings.

- Period (its standard indicator is 14; for aggressive trading, the period can be reduced, then its signals will be frequent; by increasing it, you will get lagging, but high-quality signals).

- Levels.

- “Apply to” is an indicator that determines the type of price against which calculations are made (lows, highs, closing or opening prices, etc.).

If your platform doesn’t have an indicator, download it here.

Application of the indicator for binary options

ADX is one of the most popular and powerful market analytics tools, using which you can find out a large amount of valuable information about the current state of the market. For example, about entering and exiting the market, about the possibility of developing a trend and its strength – all this will help you choose trading tactics and get the most out of trading.

The indicator several times facilitates the process of making a decision on buying or selling options, allowing you to significantly optimize the process of working on the exchange. The index qualitatively determines the presence and strength of a trend based on positive (+DI) and negative (-DI) indicators, showing the exact moments of acquiring CALL and PUT options.

What the ADX is able to define:

- direction and force of movement;

- moments of purchase of CALL and PUT options;

- unstable market situations, sideways trend;

- Moments to exit the market.

The ADX is included in a whole range of profitable strategies and indicators, for example, the Directional Movement System (DMS), which analyzes price ranges – that is, the distance from the maximum to the minimum of a period, for example, a day. This system calculates where and how much the price range shifts in relation to the previous period.

Since the indicator is lagging behind with signals, most often traders combine it with other tools that minimize its errors (MACD, Stochastic, Fractals). This is an excellent trend tool that can become a real profitable trading strategy in the skillful hands of a professional, an integral part of fundamental analysis. There are many trading systems based on the indicator on the network, as well as its modernized versions.

Rules for concluding transactions (screenshots)

Trading at the signal of crossing the +DI and –DI lines

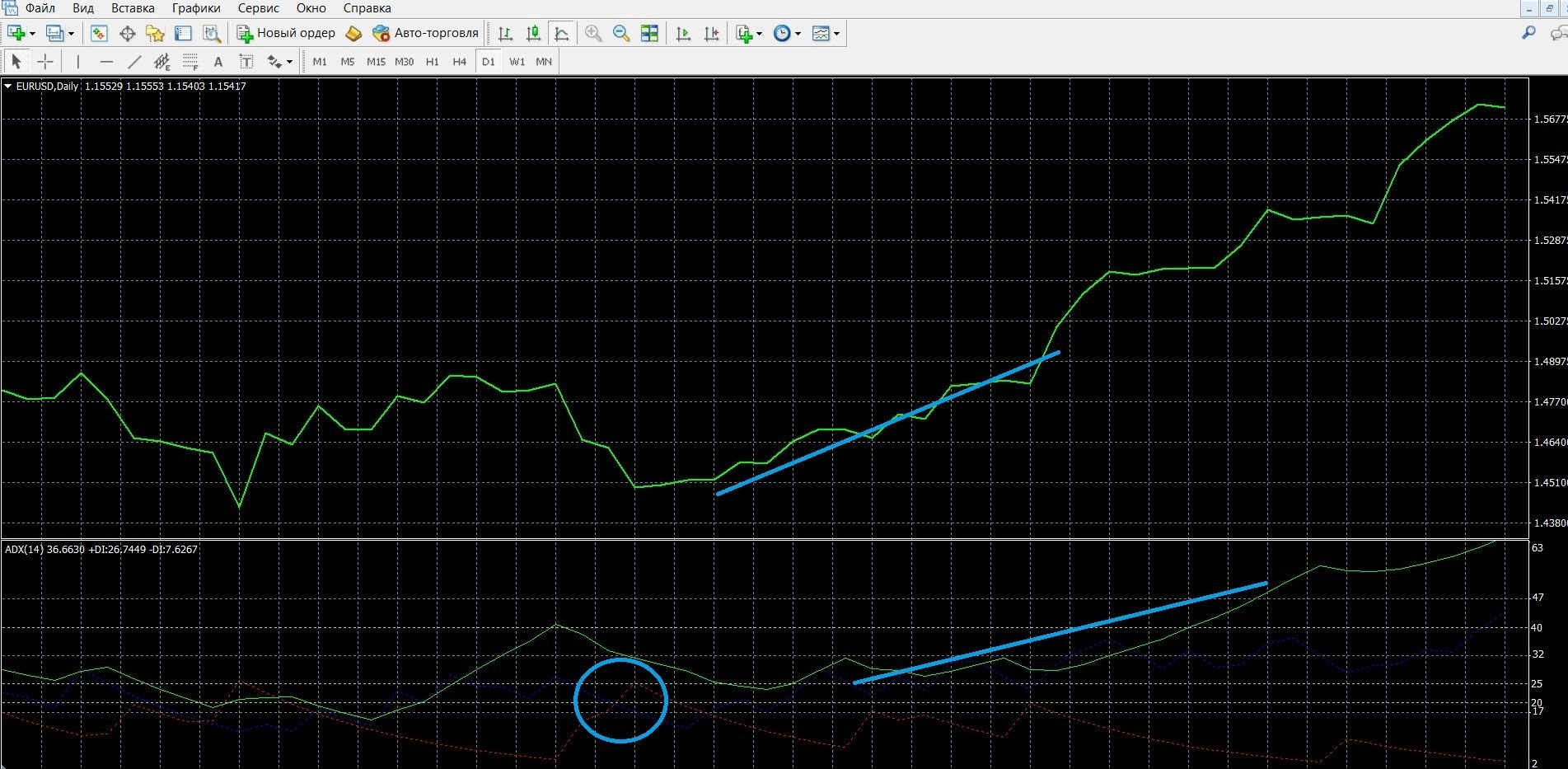

If +DI (blue) moves up and crosses the -DI line (red) from bottom to top, this indicates a reversal to an uptrend, you can buy CALL options. In the image below, you can observe an upward trend in the MT4 terminal:

Place a CALL bet with the Binomo broker by going to the binomo.com website, prepare an option for trading, indicating:

- Option

- Expiration

- Amount

- Prediction: up

- Next, by clicking the “buy” button, expect the results:

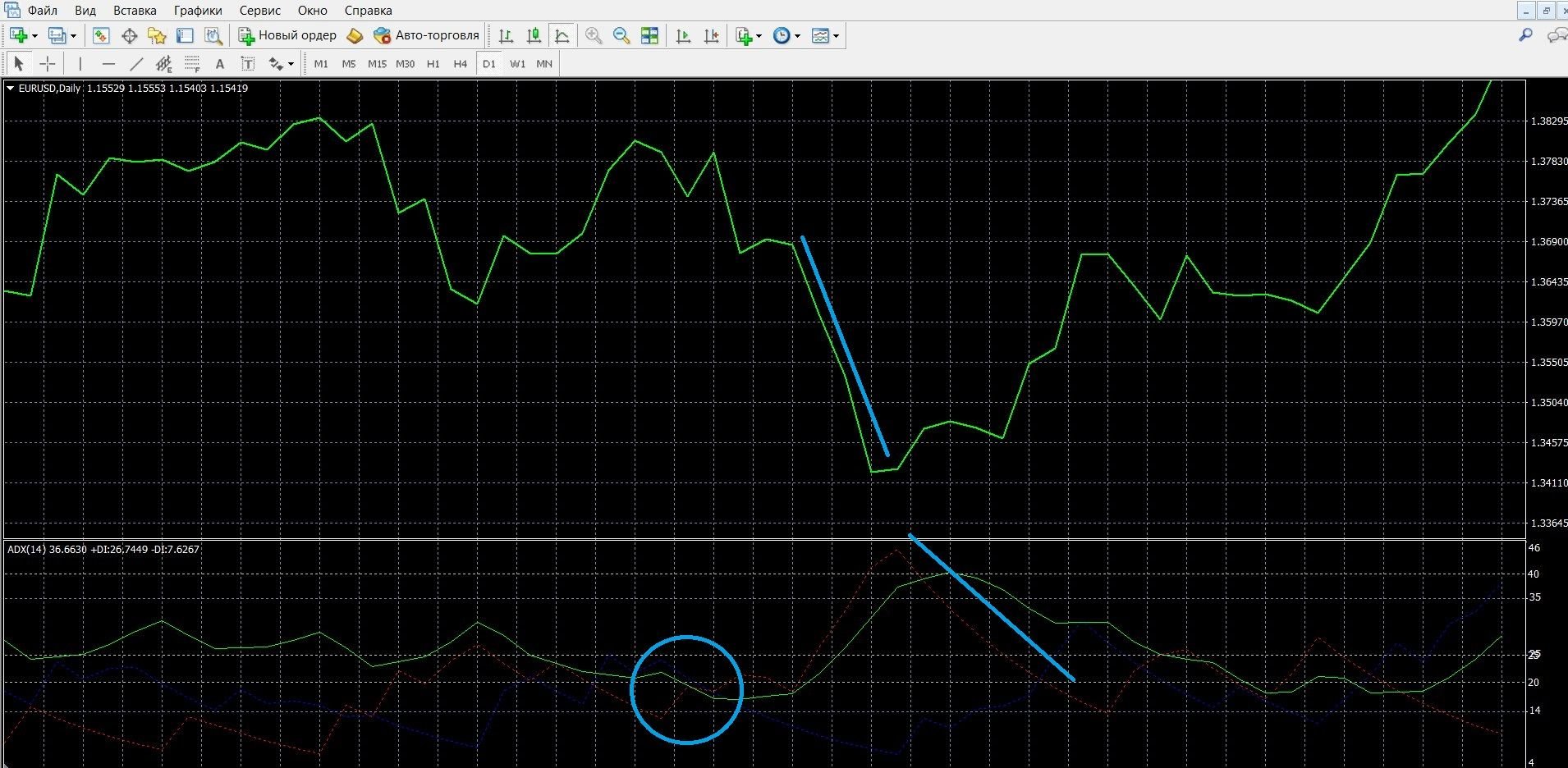

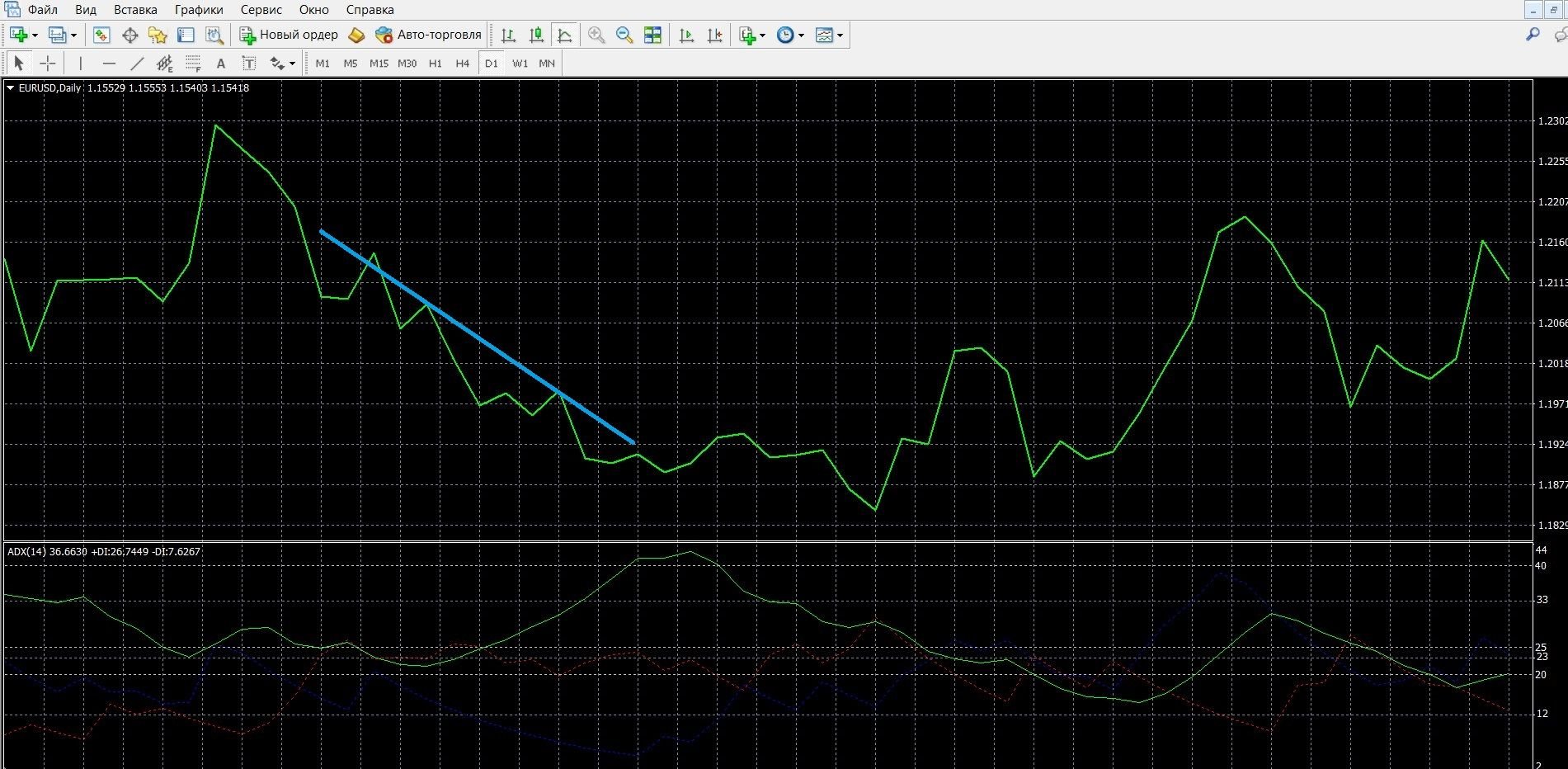

If the -DI line (red) moves up and crosses +DI (blue) from bottom to top, this indicates a reversal to a downtrend, you can buy put options. In the image below, you can observe a downward trend in the MT4 terminal:

Place a PCI bet with the Binomo broker by going to the binomo.com website, prepare an option for trading, indicating:

- Option

- Expiration

- Amount

- Prediction: down

- Next, by clicking the “buy” button, expect the results:

Trading with a trend signal of the +DI and –DI lines

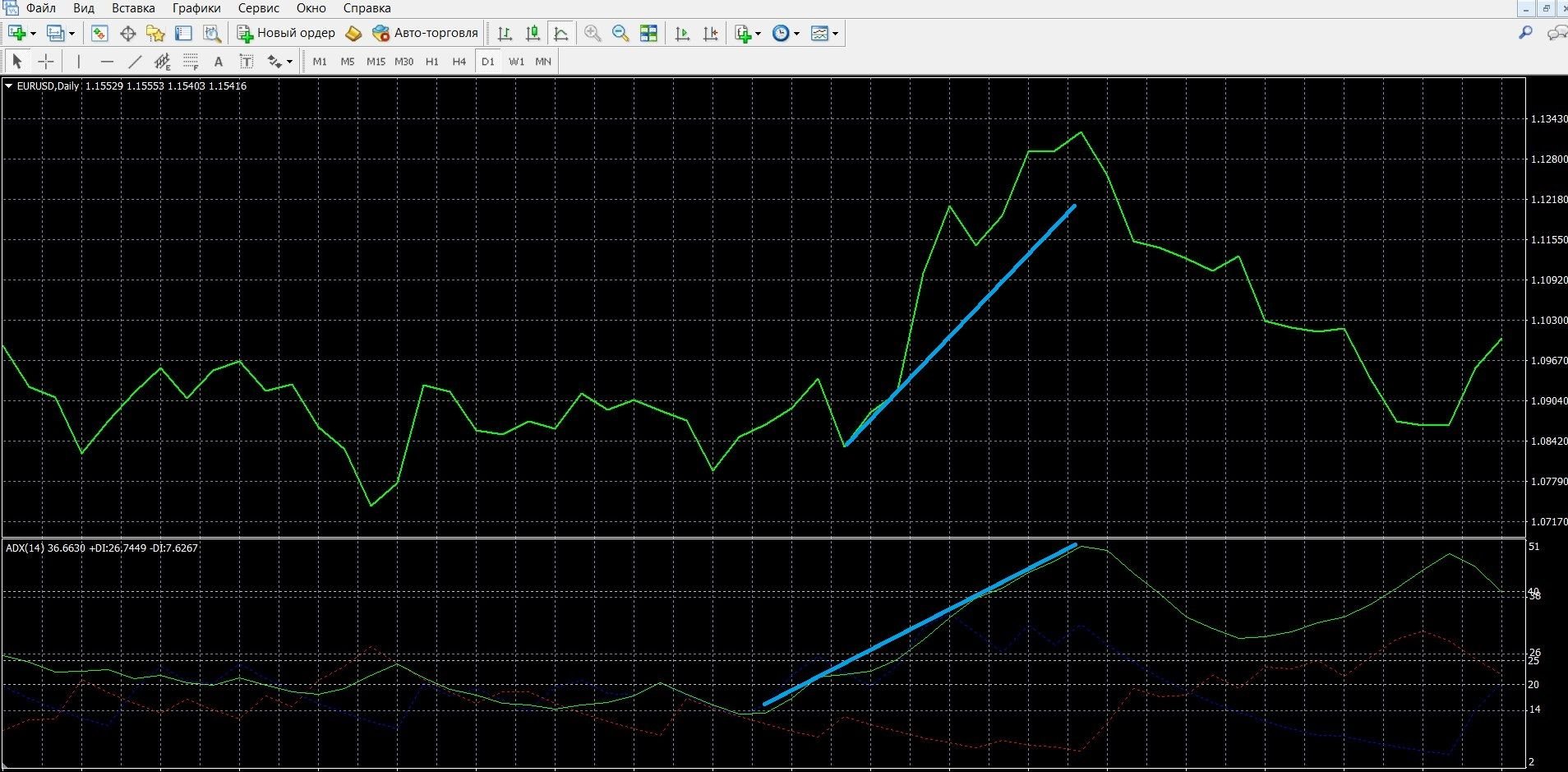

If the +DI line (blue) is above the –DI line (red), while the ADX itself is growing, this is an uptrend, you can buy CALL options. In the image, you can observe an upward trend in the MT4 terminal (you can buy CALL options on the binomo.com website, the instructions are presented above):

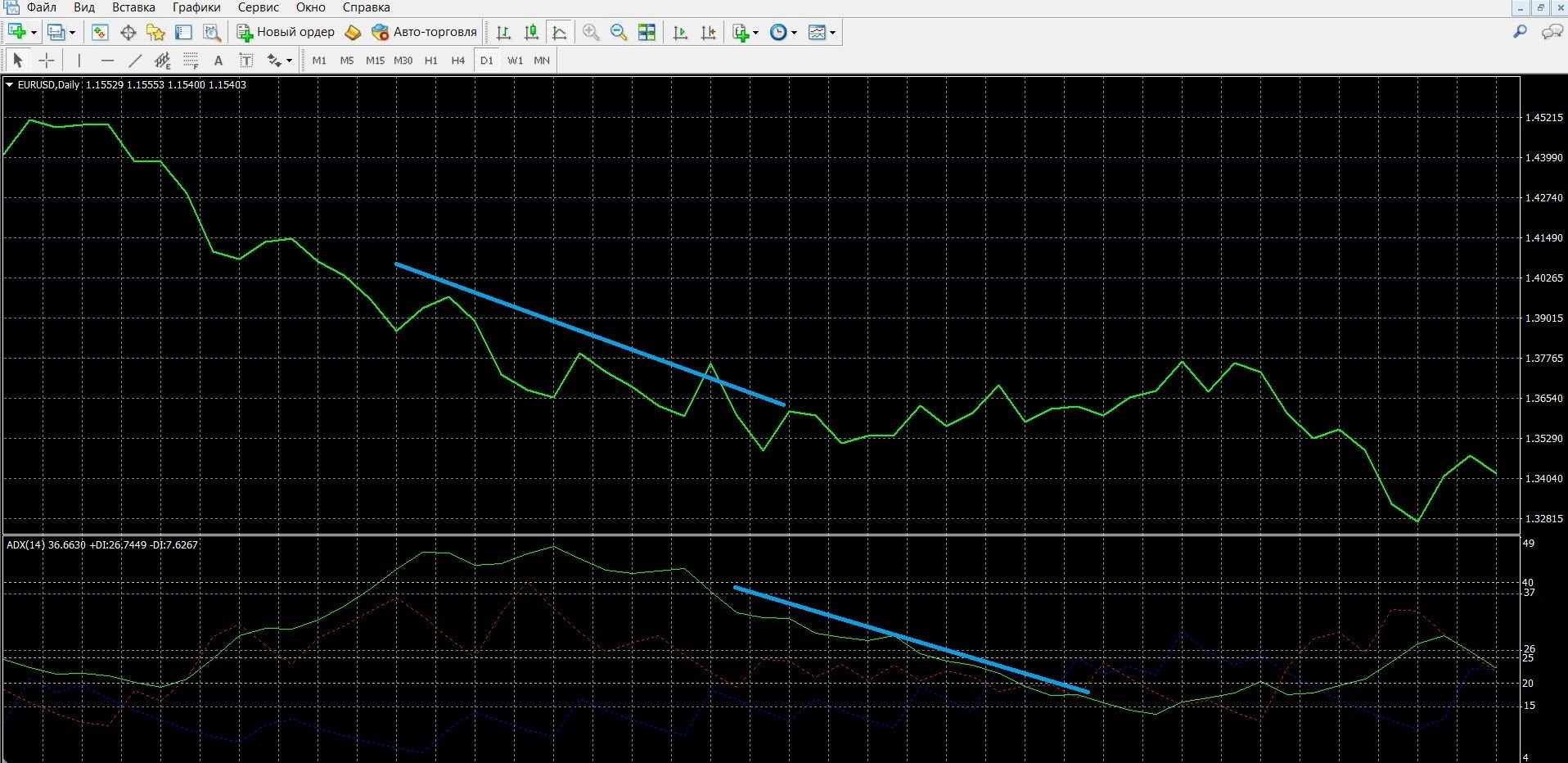

If the –DI line (red) is above the +DI line (blue), while the ADX itself is growing, this is a downtrend, you can buy put options. In the image, you can observe a downward trend in the MT4 terminal (you can buy PCI options on the binomo.com website, the instructions are presented above):

Trading on the trend signal of the ADX line

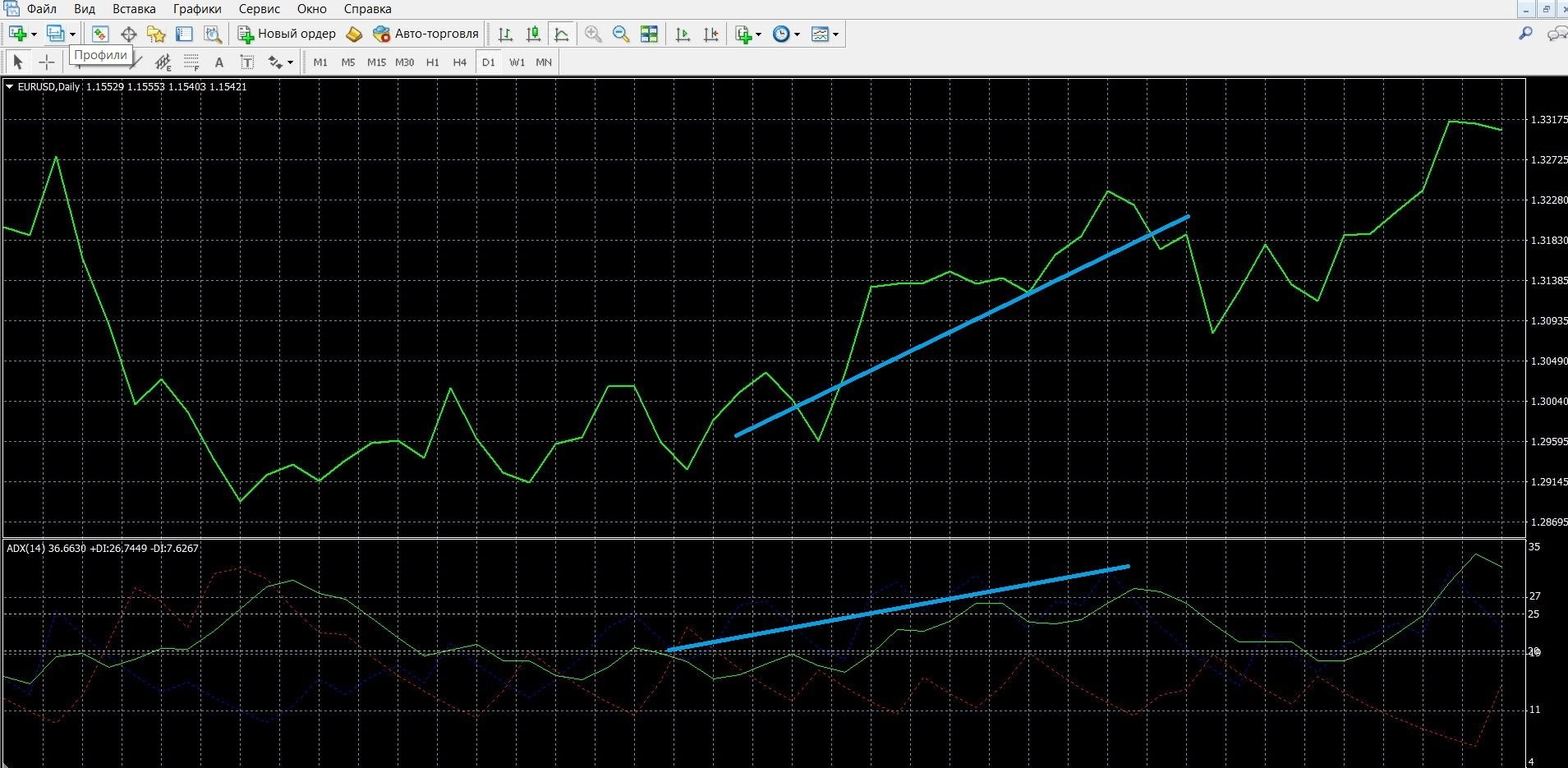

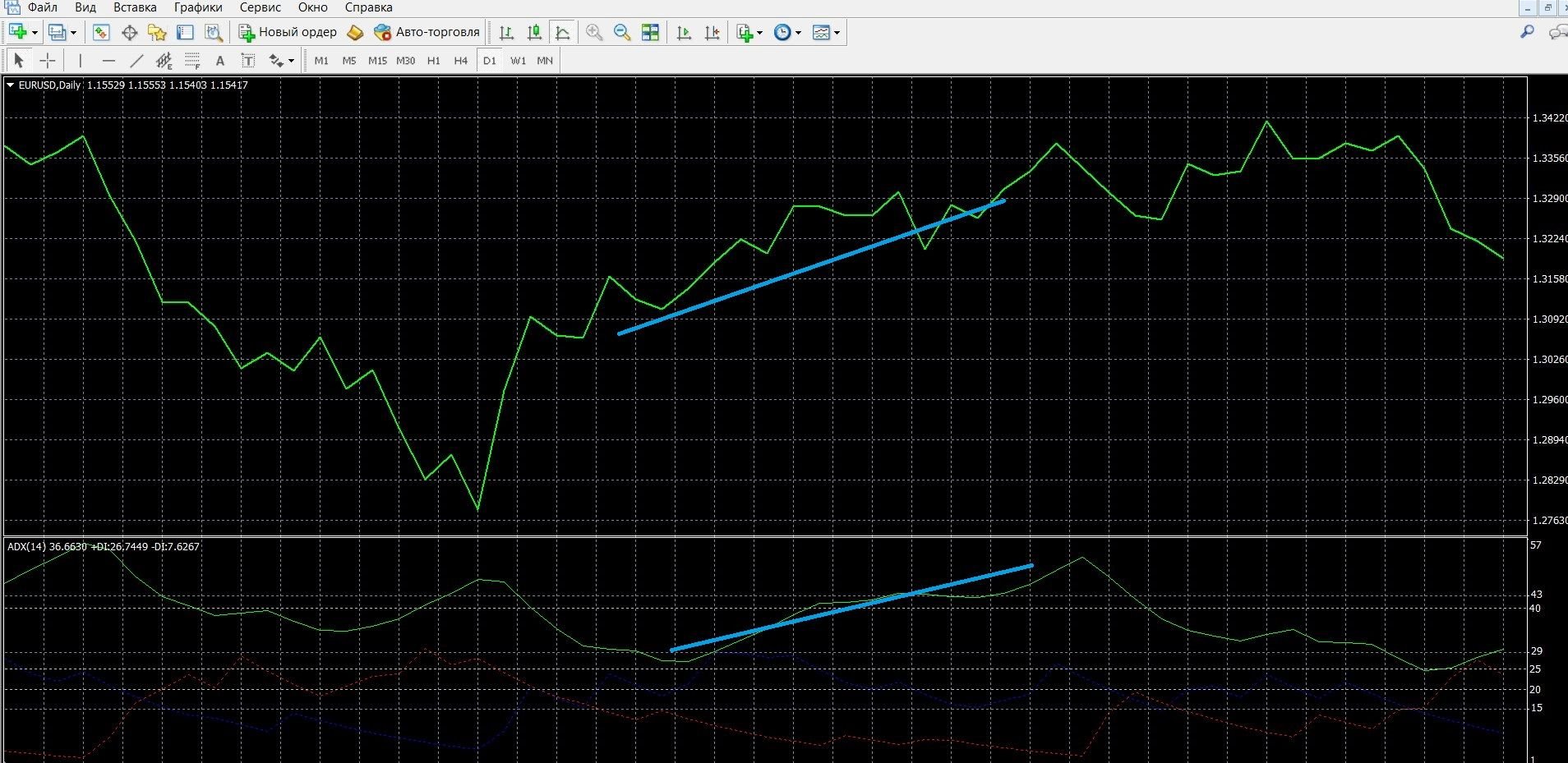

If the ADX line itself has an upward direction, the trend is gaining strength, you can buy CALL options. In the image, you can observe an upward trend in the MT4 terminal (you can buy CALL options on the binomo.com website, the instructions are presented above):

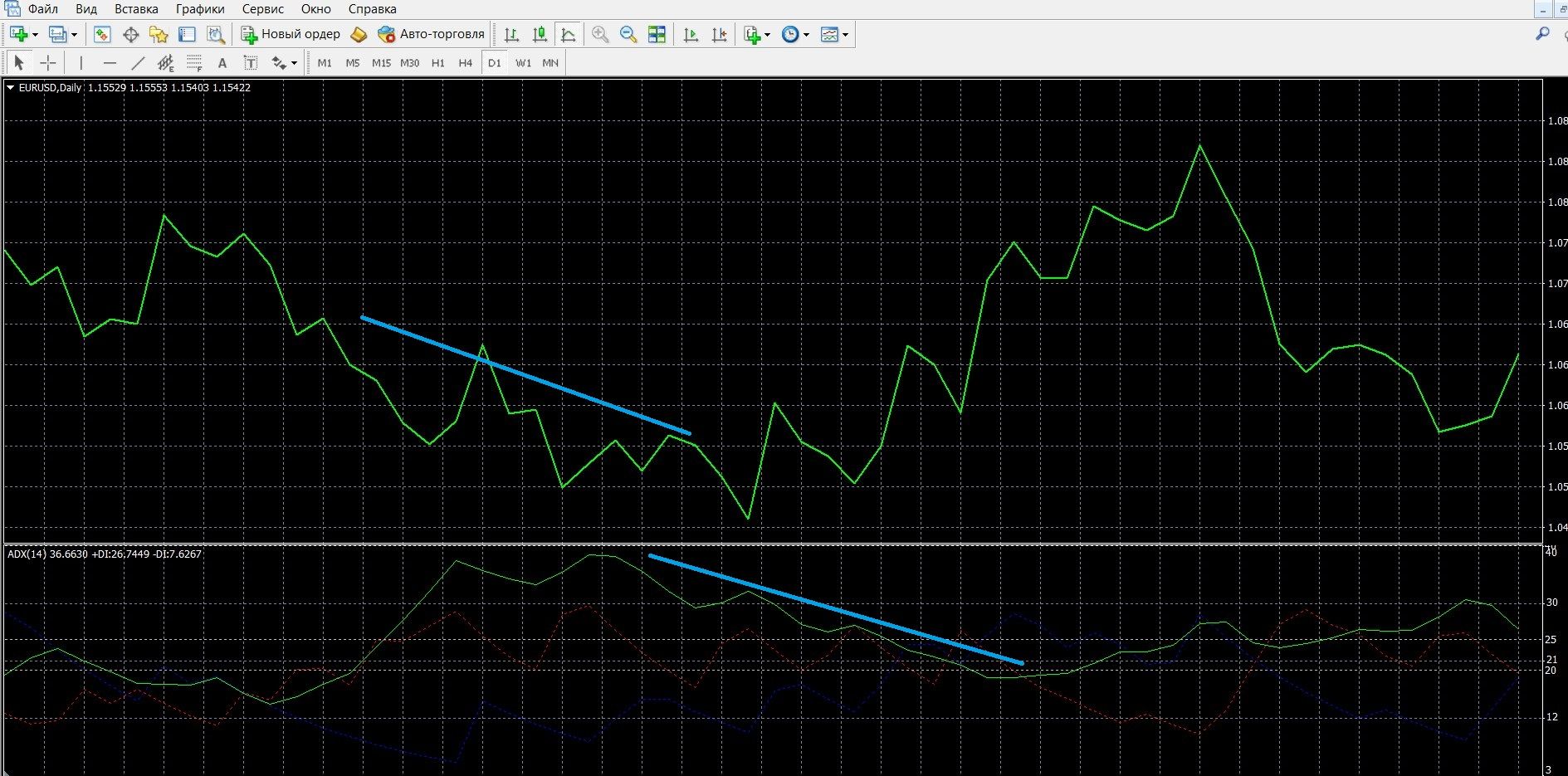

If the ADX line has a downward direction, the trend is fading, you can buy put options. In the image, you can observe a downward trend in the MT4 terminal (you can buy PCI options on the binomo.com website, the instructions are presented above):

Trading at the signal of the location of the ADX at levels 20 and 40

The location of the ADX above the 40 mark is a strong trend, you can buy CALL options. In the image, you can observe an upward trend in the MT4 terminal (you can buy CALL options on the binomo.com website, the instructions are presented above):

Finding the ADX to the level of 20 indicates a weak trend, you can buy put options. In the image, you can observe a downward trend in the MT4 terminal (you can buy PCI options on the binomo.com website, the instructions are presented above):

Money management

It is not for nothing that money management is considered one of the main tools for effective trading on the stock exchange. Proper use of it can make trading successful and effective, and profits – consistently high. Not only professionals, but also beginners of options should work with this concept.

Minimum capital: when trading binary options, it is worthwhile, when buying specific assets, to use a minimum deposit for this; the value of one asset should not exceed 5% of the amount of funds in the account; Trade low-cost assets, the acquisition of which will not affect the state of the deposit in the event of a losing trade. Using these rules on the stock exchange, you will save your capital.

Minimum deposit: when trading binary options, it is worth buying options that are able to maintain the state of your deposit; when purchasing an option, do not transfer your entire account to it; Your deposit should last for a long time, which will ensure long-term trading with the opportunity to receive even more income. Using these rules on the stock exchange, you will be able to save and increase the capital of the deposit.

Minimum options: when trading binary options, it is worth purchasing a minimum of assets; This applies to newcomers to the exchange who do not yet have significant trading experience and should be included in trading gradually; After gaining experience, you can increase the number of assets. Using these rules on the exchange, you can achieve more from trading.

Minimum of emotions: when trading binary options, you should work in the right emotional mood; do not forget that success in trading is a sobriety of mind and balanced clear decisions; Emotions should not prevail over the trader, otherwise they will start working against the result. Using these rules on the stock exchange, you will be a successful trader.

Expiration

Expiration (from the English Expiration, “end”) is the moment of the end of trading in a specific asset, which occurs after the exchange participants have indicated forecasts in the system and can finally find out about their effectiveness. Expiration is also considered one of the main concepts of trading, without the correct use of which it is difficult to get the most out of options trading.

Types of options:

- Ultra-short options – 30 seconds – 5 minutes.

- Short-term options – 10 minutes – several hours.

- Medium-term options – a day – a few weeks.

- Long-term options – a month – six months.

Is it allowed to extend the expiration?

It is allowed, but not with all brokers. This profitable feature makes it possible during trading, with the specified wrong decision, to extend the expiration time and reduce your losses.

Expiration rules:

- If you are just trying your hand at the binary options exchange, trade long-term trades that are more stable, have a minimum of risks.

- If this is not your first time working on the stock exchange and is considered a professional, trade such transactions that are more comfortable for you and give you a good income.

- If, trading on the options exchange, you want to get instant income, choose short-term transactions that can bring earnings in 30 seconds.

- If, trading on the options exchange, you want to get a stable income, choose long-term transactions that can bring decent earnings.

Expiration in strategies with ADX

Expiration at the signal of the intersection of the +DI and –DI lines

Short-term trading: allowed; the signals of the intersection of the +DI and –DI lines in turbo trading conditions are quite good; In order to avoid false signals, use additional indicators.

Medium-term expiration: recommended; signals obtained at the intersection of the +DI and –DI lines, high-quality at such a time interval, will allow you to get a good income; In order to avoid false signals, use additional indicators.

Long-term expiration: recommended; signals received at the intersection of the +DI and –DI lines are of sufficient quality at such a time interval; To improve your performance, combine the indicator readings with fundamental and technical analysis.

Expiration at the trend signal of the +DI and –DI lines

Short-term trading: allowed; the trend signals of the +DI and –DI lines in turbo trading conditions are good and allow you to get a decent income during the trading session; In order to avoid false signals, use additional indicators.

Medium-term expiration: recommended; market trend signals that show the +DI and –DI lines, are of high quality on such a time interval, and will allow you to get a good income; In order to avoid false signals, use additional indicators.

Long-term expiration: recommended; trend signals that show the +DI and –DI lines, which are high-quality for such a long trade; To increase your results, combine the indicator readings with data from fundamental and technical analysis.

Expiration when the trend signal of the ADX line

Short-term trading: allowed; ADX line trend signals work great in express trading, allowing you to get a decent income during the trading session; In order to avoid false signals, use additional indicators.

Medium-term expiration: recommended; trend signals shown by the ADX, profitable on such a time interval and will allow you to get a good income; In order to avoid false signals, use additional indicators.

Long-term expiration: recommended; high-quality trend signals that the ADX demonstrates, with long-term trading, will allow you to get a good income; Improve your performance by combining indicator readings with data from fundamental and technical analysis.

Expiration at ADX location signal at levels 20 and 40

Short-term trading: allowed; market trend signals of the ADX line work great in express trading, allowing you to get good earnings for an intense trading session; In order to avoid false signals, use additional indicators.

Medium-term expiration: recommended; signals of the market trend of the ADX line with such expiration are reliable and will allow you to get a good income; In order to avoid false signals, use additional indicators.

Long-term expiration: recommended; high-quality trend signals of the ADX line are quite reliable and allow you to conduct good trading on such long intervals; To improve your performance, combine the indicator readings with data from fundamental and technical analysis.

If you want to achieve better results in binary options trading, use expiration correctly. To do this, work in the terminal of the Binomo broker, which offers expiration from 30 seconds to 1 day. Right now, start working with expiration by going to the binomo.com website.

Downloads

MetaTrader 4 (MT4) platform – download.

ADX indicator for the MT4 platform – download.