It would seem that the time of MMM financial pyramids and MMCIS forex has passed, but there will always be newly-minted traders who crave “freebies”. Especially for such people, newer traps with “free cheese” inside are being developed. Only now this “cheese” is still a little expensive, just an understanding of this fact comes only with time. In 2014, one such office was opened for “well, very global financial turnover.” Thanks to this, it got a cool name Global-finance (website: https://glob-finance.ru/). Apparently, for those who are too lazy not only to work, but also to remember the name of the company to make money.

Believing their customers to be stupid children in advance, the company’s founders spent a couple of million to create a beautiful website filled with clever articles and huge useless spreadsheets. The company is built on the fact that it is possible to put money on the shares of any company that the client likes (stock market). To demonstrate coolness (and globality), the site lists hundreds of partners. Many of them may not even have a clue that they have any relationship with Global-finance. But, since this office is focused primarily on amateurs who are just beginning to understand what’s what, the company is not very worried about revelations. In addition, the “Reviews” section on the official website is a little alarming. You can never find negative reviews from customers here, and this does not happen even with the most famous companies: there were, are and will always be dissatisfied (traders’ complaints).

The fraudulent broker knows his business and has taken the preliminary brainwashing seriously. The articles scattered throughout the resource were clearly written not by the company’s employees, but to order. The same trick was used in the development of the site, not only from the point of view of design, but also from the point of view of psychology. Thus, it does not focus the attention of users on really important things, but in every possible way imposes on them the idea that they will certainly earn a lot of money, stop “working for their uncle” and “go into the sunset” to make the remaining dreams come true.

The traditional scheme of work of the company Global-finance

On the site, the information is presented in a chaotic manner, which is a little confusing for traders who came here for the first time. As a result, the only thing that the user will be able to take away from what he has read is how good the company is, because it offers:

- Transparent as glass, work with the client.

- Immediate growth.

- Taking into account some principles.

- Taking into account any wishes of the client.

- Stay always in touch with the client.

- Help based on personal experience.

That is, you can understand that the scheme of work is very simple, and then there are also continuous positive reviews. Yes, any average client will immediately think that he will be a fool if he does not take advantage of the situation. It seems that a million is already in his pocket, yes … No matter how it is.

Only by registering, he understands where he has gone. Work with the client begins to turn out to be not so transparent. This happens due to the mandatory binding of a personal “analyst”. He begins to impose something that was not prescribed either in the plan or in the contract, and the client blindly believes it. The manager gives answers to questions according to a well-functioning system and does not understand everything (or maybe he just hides a lot). The point about the growth of money is also far from true. It all depends on the client’s first installment and depends entirely on its amount. The broker does not adhere to any principles. The next two points should be mentioned later, and the sixth raises doubts and big questions.

How did a broker deceive his client for a round sum?

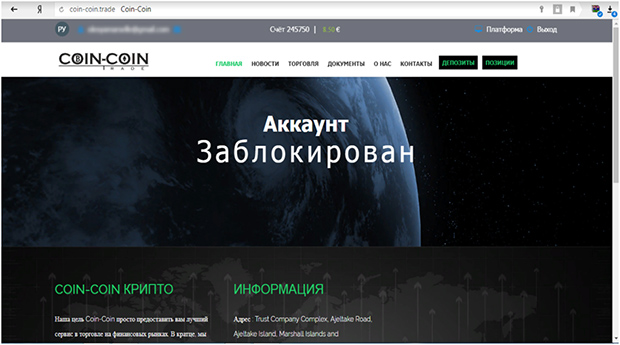

On the Internet there are many stories of those who fell for the bait of this clever scammer. All of them boil down to approximately the same scheme. First, the imposed analyst gives his trader “excellent” advice to work through the Coin-Coin exchanger. Relations have been established with him for a long time, and therefore the money, thus, will be easiest to drain behind the client’s back. However, for fun, the future millionaire is invited to come up with a username and password on his own “to protect his savings.”

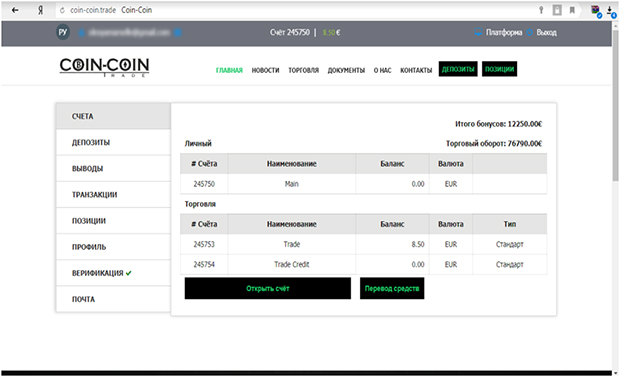

Then the “well-wisher” strongly insists on investing more. He simply does not want to hear any trading ideas from the client. He needs deposits of money and the more of them, the better. Taking into account the wishes and principles continues at the moment when the client’s money comes to an end: the analyst offers to take a loan for 50-100 thousand, without thinking about the consequences. In case of refusal, the most interesting thing comes: the personal account is “suddenly” blocked, and the account is merged by someone overnight on transactions with an incredibly high risk. In your personal account, incomprehensible bonuses are found in some unrealistic amount (is it possible to return money from a broker?).

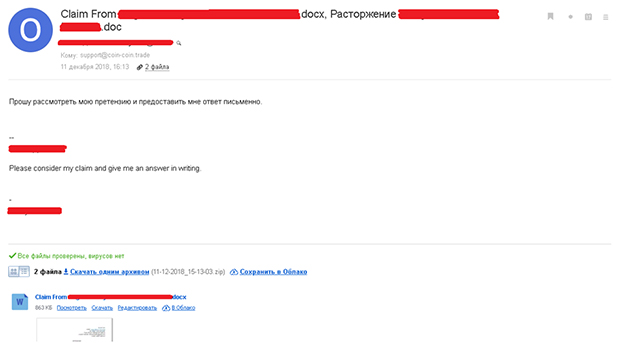

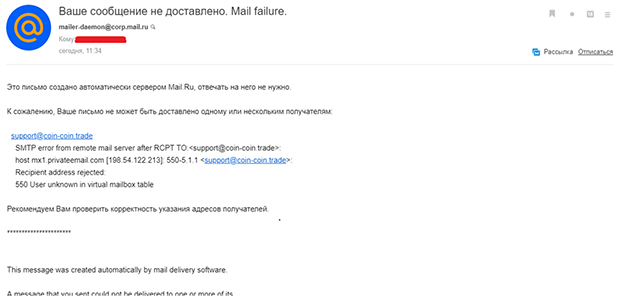

These screenshots were provided by one deceived trader as proof that all of the above is true. Thanks to his naivety and complete trust in the analyst, he lost all means of subsistence. Global-finance ruthlessly left the client with 8 euros on the balance sheet: the broker drained the deposit, and that’s all. On the example of this story, you can demonstrate the fifth and sixth points of cooperation with the company. After discovering the deception, the client was never able to contact his analyst again. Previously, he was always online on Skype and answered phone calls. This time, all contacts were unavailable. In addition, after writing a petition to support, he learned that the email address listed on the official website never existed. The broker deceived the trader according to the standard scheme: he did his “dirty deeds” and went missing (rating of reliable brokers).

The item “Sharing personal experience” remained behind the scenes, causing continuous questions from the client. The trader could not understand what kind of experience he was talking about, if all the “road to success” he was forced to borrow more money and invest. The last straw was a call from a broker with a “recommendation” to put 250 thousand rubles into the account. In case of refusal, he promised to involve the court and collectors in the situation, but the client hung up the phone. There was no doubt that this investment, which the broker was talking about, was another scam (instructions for chargeback on eto-ravod.ru).

Findings

It is quite easy to draw any conclusions here. One thing is clear – the fraudulent activity of the broker is obvious and, if you get into this “sect of goodness and freebies”, nothing can be done. The company will take all the money from the client, and then he will also owe her. This is the policy of Global-finance: it will stop at nothing until it pulls every last penny out of its customers.