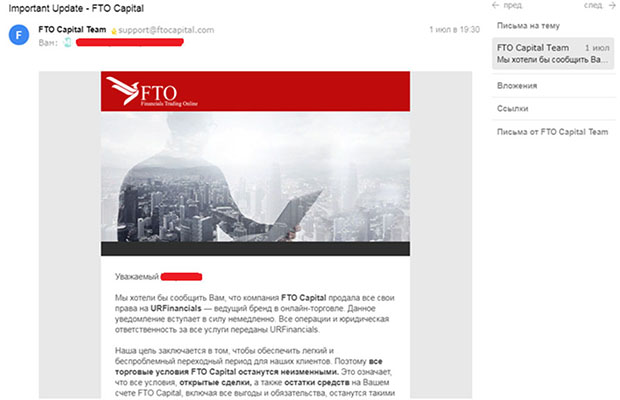

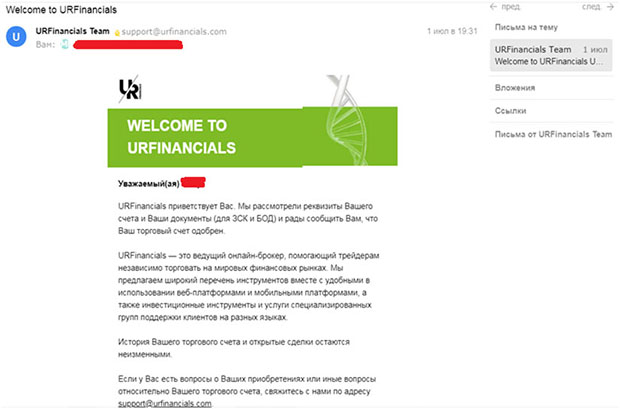

FTO Capital (https://www.ftocapital.com/) is a brokerage company that trades on the forex exchange. Little is known about it, there is practically no information on the Internet. It is known that it was registered in the Marshall Islands. Today, it has changed its name to UrFinancials and successfully continues to deceive customers.

To trade on the stock exchange, FTO Capital offers to open several accounts:

- golden;

- silver;

- platinum.

It also supports Islamic accounts and allows traders to make a profit on the sale and purchase of securities, currencies, indices, precious metals and commodities.

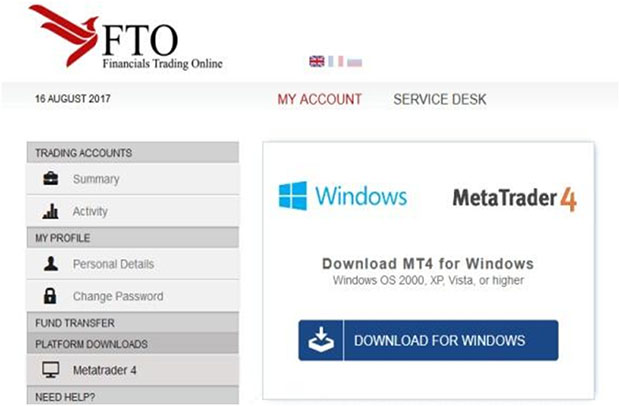

To learn how to trade on the stock exchange, the company offers to open a demo account, for operations – a trading account. Trading is carried out on several types of platforms:

- MetaTrader is the most popular platform among brokers.

- Web terminal – does not require software installation and is a copy of MetaTrader.

- An application on a mobile phone that allows you to trade from a smartphone.

To start trading, you need to register on the ftocapital.com website, and then log in to your personal account using your username and password.

An interesting fact is that the company itself does not have a license that gives it the right to carry out brokerage activities, but it lures customers with the opportunity to trade any instruments without restrictions. It is the lack of permission to conduct brokerage activities that is very alarming, since in such companies it must be mandatory (rating of reliable binary options brokers here).

It is worth thinking about the fact that in the contacts of FTO Capital only the email address and phone number are indicated, and there is no actual address, and nothing is known about the branches and offices.

What lures the company?

First of all, inexperienced traders who want to quickly get a good profit with minimal costs fall on the “hook”. The company promises favorable conditions and a wide range of instruments for trading, as well as qualified services of a broker who will give the client practical advice. The minimum deposit amount is 250 US dollars. However, in practice, this is not the case.

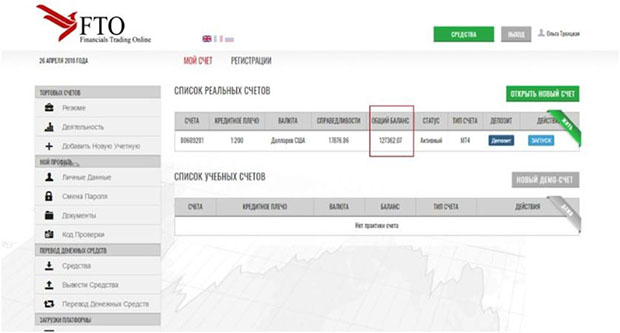

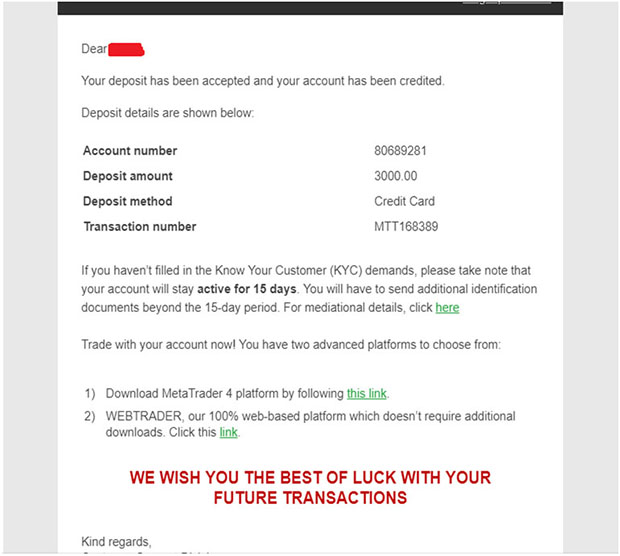

At first, FTO Capital allows the client to earn money, the latter sees how the amount of the deposit on his account grows and begins to invest more of his funds in trading, as, for example, in this case (screenshots from a real account):

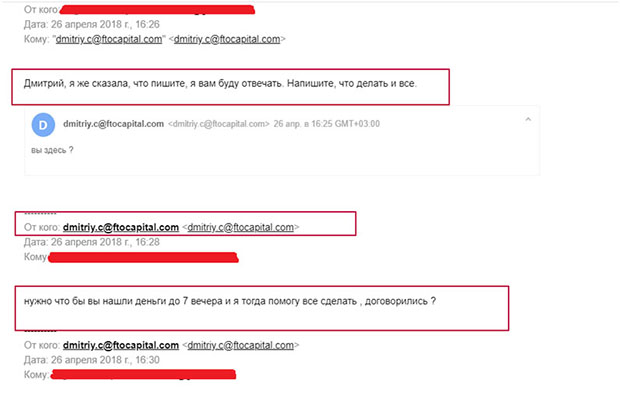

This happens at the request of the company’s managers under different names, such as in this case from Dmitry:

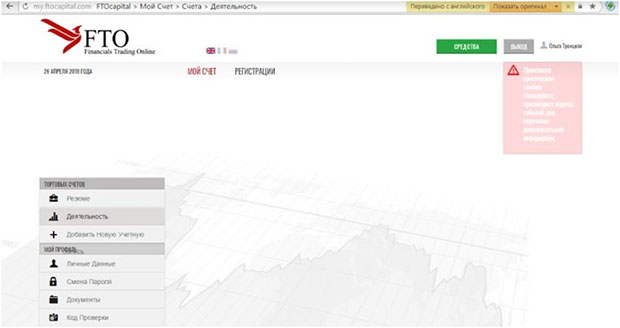

But as soon as an investor submits an application for withdrawal of money, he immediately has problems, for example, his personal account does not work, malfunctions:

Many traders confirm that in rare cases you can withdraw only your first deposit, but it is impossible to make a profit, the broker blocks verification and a trading account.

What motivates the company’s brokers to be fraudulent?

The salary of brokers depends on the commissions that they receive from the investor’s investments and income from the operations performed. That is why it is more profitable for a broker to carry out fraud with the investor’s funds and get the maximum profit than to be content with a small percentage of the client’s profit.

The most common fraud scheme is not to send the client’s funds on an order to the exchange. To conceal the fact of a crime to the investor, the broker says that due to an unsuccessful transaction, the amount on his deposit has decreased.

If the deposit is equal to zero, then the broker usually asks for more injections into the account, supposedly to save the situation, and promises to significantly increase income. Gullible customers agree, replenish the deposit, and the situation repeats itself. Since financial transactions are risky, and all activities take place via the Internet, it is extremely difficult to prove the guilt of the company and return your investments, especially since nothing is known about the location of FTO Capital.

Of course, it is important for the company to maintain its name in order to stay in the market as long as possible, for this it uses advertising, fictitious positive reviews, and also comes up with new conditions for comfortable trading. This scheme works well and when some investors leave, leaving negative recommendations about FTO Capital, new ones come who believe in the integrity of the company.

Problems with withdrawal of funds

Many investors working with FTO Capital brokers are faced with the problem of withdrawing funds. The fact is that when registering a trading account, the company gives bonuses that are superimposed on the principal amount of the deposit. To withdraw funds, you must first work for some time, for example, 1-2 months. Before withdrawing a deposit, you need to go through verification, which is often denied to customers.

If the verification is successful, then when withdrawing funds, the broker sets a limit on the withdrawal amount, arguing that many scammers have divorced. Although such an action is incomprehensible, because the client enters his personal account under his username and password. In some cases, money cannot be withdrawn from the account for technical reasons. For what? The company does not explain.

Is it possible to get a refund from FTO Capital?

Before you start a refund, you need to have proof that the company is really engaged in fraud (is it possible to get money back from the broker?). To do this, you need to record conversations with the broker on a voice recorder, store all correspondence and take screenshots.

To recover funds, you can try to go to court, but the proceedings will last quite a long time, also keep in mind that you need to pay legal costs. If the deposit amount is small, then this option of collecting funds is unprofitable for the investor.

Despite the company’s excuses, it is possible to withdraw your honestly earned funds. The return procedure, chargeback (instructions for chargeback on the eto-ravod.ru), takes place in several stages:

- To begin with, an attempt is made to resolve the dispute mutually. It should be noted that in practice, companies react differently to the appeal of the client’s representatives than to a complaint from him personally.

- All open transactions are closed and if the amount from the deposit is not drained, then the withdrawal request is canceled.

- An application is drawn up for termination of the contract and the provision of brokerage services by FTO Capital with the subsequent return of the deposit to the account, based on the law.

- A claim is drawn up to protest brokerage services, due to their non-performance.

- All evidence of the company’s fraud is attached.

- A claim is drawn up with an indication of the trading account and support of evidence.

- The refund procedure lasts about 10 days, while during this period the client is provided with legal support.

Acting within the framework of the law, deceived traders can get their money back.