Every year, the methods of remote earnings are being improved and now trading in the foreign exchange market has come to the fore as one of the most promising such methods. There are more and more people who make money on the stock exchange. However, such popularity of the industry provokes the emergence of some problems. So, for example, since trading is carried out mainly “from home”, it becomes difficult to personally verify that the partner with whom you are cooperating at this stage is really reliable (rating of reliable brokers).

The network is full of offers of profitable cooperation that come from brokerage companies and single intermediaries, and it is very easy for a trader to “get lost” among them, confused about who can be trusted and who cannot. Perhaps the only source from which a trader can get really relevant and useful information is the community of other traders who have their own success stories and their own stories of failures (traders’ complaints).

A real-life example

I would like to turn to one of these stories right now, because it can help many traders save their time, nerves and, importantly, money. It happened to a trader who for some time (about two months) cooperated with the brokerage company Capital Markets (http://www.cmb.mu). It turned out to be another unscrupulous company, brazenly turning fraud and enriching itself at the expense of the client.

It all started, as usual, well. The trader contacted the company, where he was offered the following terms of cooperation: trading supervised by an analyst in the format of a video conference. With one condition: the trader had to provide the key to his profile to this analyst. This seemed unusual to the client, but the company assured him that nothing bad could happen, and access was necessary in order to control the exchange and carry out operations on time. The trader agreed to the conditions offered by the broker, and at first it seemed to him that he would really be provided with professional support.

But things began to take an unexpected and unpleasant turn. So, when the amount of the deposit became sufficient to use it in cash in any way, and the client sent a withdrawal request to the company, he received a refusal. In addition, the data on the state of the account, which was displayed in the personal account, seemed to be “frozen”. That is, it was impossible to obtain any information about the current state of the account.

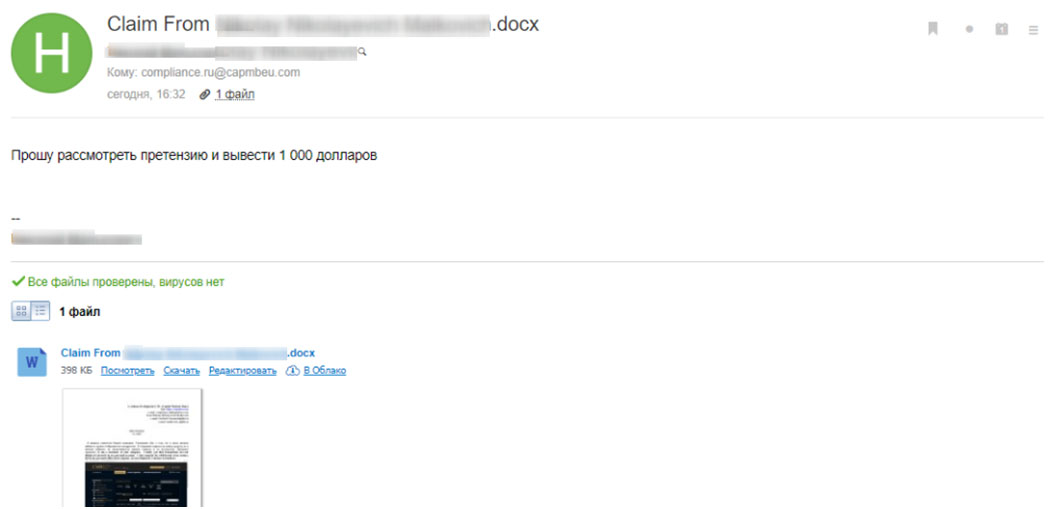

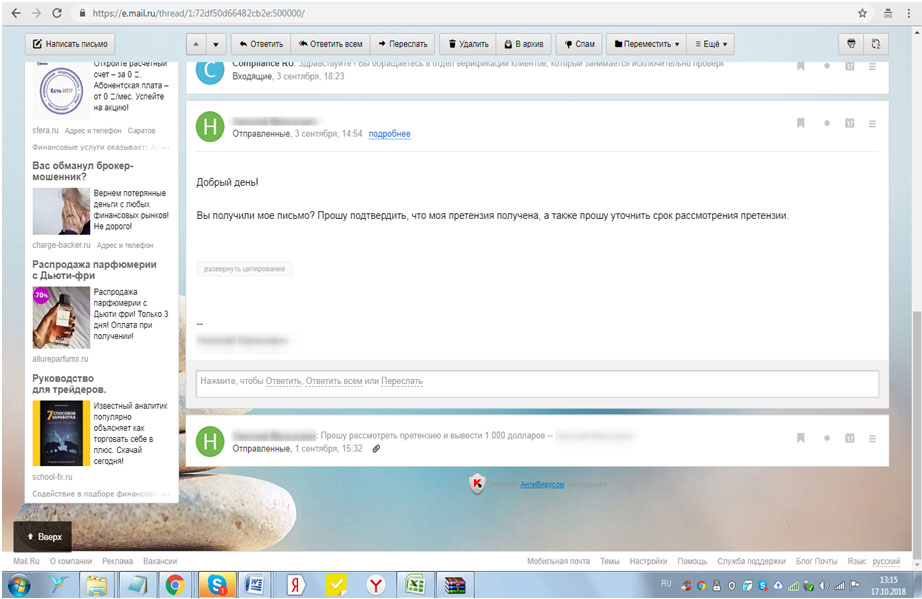

The client sent a claim and the company also ignored it. Then he decided to contact the support service and wrote to the mail, which was indicated in the contacts on the broker’s website. In the letter (screenshot attached), he asked to consider the claim and withdraw the necessary money, since it turned out to be difficult to do this without an intermediary. A few days later, when the answer from the broker still did not come, the trader tried to find out if the claims reached him at all. I wrote the letter again.

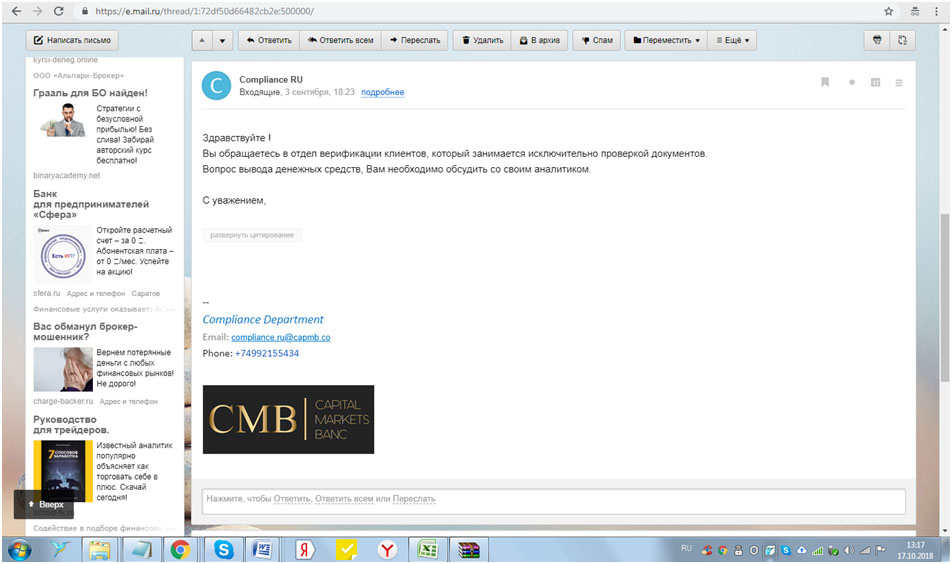

Capital Markets sent a response, where they said that they could not help the client in any way, because he, they say, sends claims and letters of explanation to the information department. This department, as it turned out, does not solve anything in the company at all, but the company did not provide alternative mail or any contacts for contacting support agents. It is not clear what the client should do.

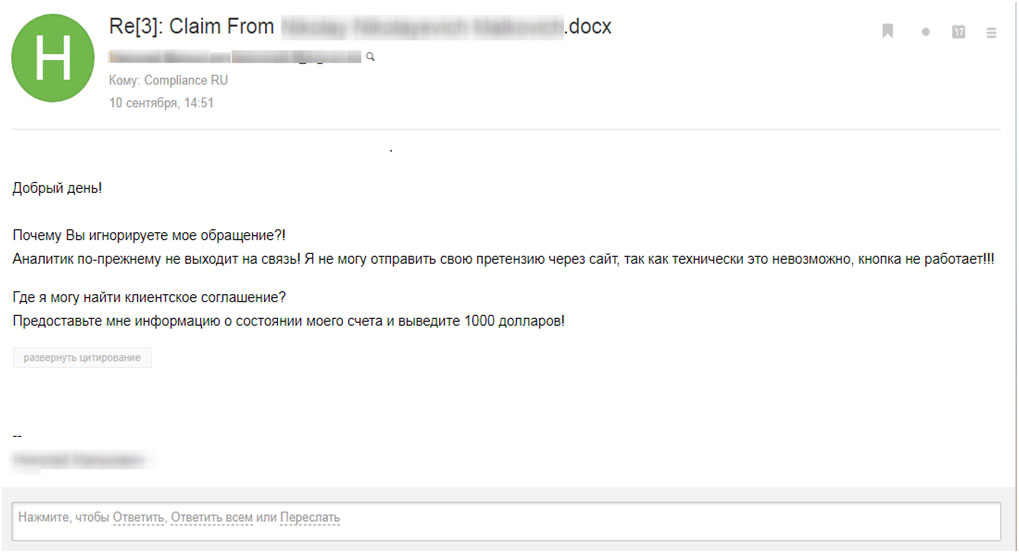

However, the site, wanting to seem more customer-oriented, had the function of “live chat” with a consultant. The feature is wonderful, but its problem is that it doesn’t work. The client noticed this (because he tried to talk to the company’s representatives online – especially since they seemed to be making contact), made a screen recording where the “non-working” of the chat was clearly demonstrated, and sent the letter again.

By this time (about a week had passed since the first claim was sent), the trader began to suspect his partner of dishonesty, and therefore, for safety, he requested documents – a user agreement. It was not on the site, although, according to all the rules of financial companies, it should be.

The company, apparently, suspected the trader that he suspected the company of something, chose the tactics of playing in silence. The client continued to send letters and claims, as the deposit remained “hanging” in his personal account, and it was impossible to withdraw it. However, he did not wait for any documents, or the “revival” of the deposit, or even a simple explanation of what was happening. This behavior of the company gives serious reasons to assume that it, like hundreds of other fraudsters, used a scheme in which an analyst was included. The purpose of such brokers is to earn money from the client’s account. This is done both in order to provide yourself with a solid profit in the future, and so that the client believes in the effectiveness of working with an analyst.

Then, when the trader’s vigilance is dulled a little, the company appropriates his funds. It is quite simple to do this, because the analyst has access to the trading platform, and it is not difficult to block access for the real owner of the personal account. Further, when the client begins to openly express his dissatisfaction with what is happening and send claims, he is ignored. Then they do answer, but this answer does not say anything to the point. But, de jure, there is an answer, which means that the company is getting in touch. It is not clear why these “cat and mouse” were needed if the client was still left without access to his money, and the company could no longer be contacted.

Learn from other people’s mistakes

Unfortunately, almost every trader can become a victim of a fraudulent scheme and there is no panacea for this trouble. The only advice that can be given is to contact only brokers who are licensed, preferably of an international standard. Its presence guarantees insurance and legal assistance in case the broker deceives you. Be attentive to those to whom you trust your money, and let you never come across dishonest intermediaries.