The main source of new customers for World Trust Invest (website: http://www.worldtrustinvest.com/) is advertising on social networks. It was after seeing a post about a quick return on investment in trading in financial markets that one of the traders became interested in the offer and decided to go to the official website to get acquainted with detailed information. Not finding anything worthwhile, but only seeing standard and fuzzy phrases about income, profits and the history of the company, I decided not to waste my time. However, a repeated post on another social network literally forced him to contact the manager of the company, which influenced his further actions.

World Trust Invest: a scheme to deceive traders

All managers of the company have one distinctive feature, when talking, they seem to hypnotize the interlocutor and incline to positive results of cooperation, of course, only on their part. The thing is that the lack of information about the size of the minimum deposit, payback periods and methods of earning is fully compensated by managers who explain all this in an intelligible and simple form. The firm can offer its clients to start with a minimum deposit amount, which even novice traders can afford, as well as the payback period of these funds within 7 days. In fact, the scheme will be something like this: you will replenish your account, and when you realize that an “honest” broker has drained the deposit, it will be too late (traders’ complaints).

The main sources of profit for the company are online trading in the financial markets of precious metals, CFD contracts and forward contracts, as well as a whole list of investment proposals. All this for a person who is not savvy in financial terms is difficult to perceive information, but not quite a large deposit allows you to try yourself in investing, where you just need to analyze the initial information and expect a payback period. By the way, it was this method that the client was pushed by the manager.

Trader’s story

Having decided to carry out a transaction for the purchase and sale of one of the many currency pairs and investing money, using the advice of the broker’s manager, who helped in every possible way in explaining the main elements of the work, which led the trader to the first income, which lasted throughout the day. During this period, the client’s account doubled and the cunning broker immediately offered additional replenishment of the deposit, which would allow you to open a bonus account from which it was possible to carry out third-party and independent transactions. The client agreed and replenished his deposit, hoping for an increase in profits. In fact, the client was deceived by a fraudulent broker, which will become clear after a couple of days.

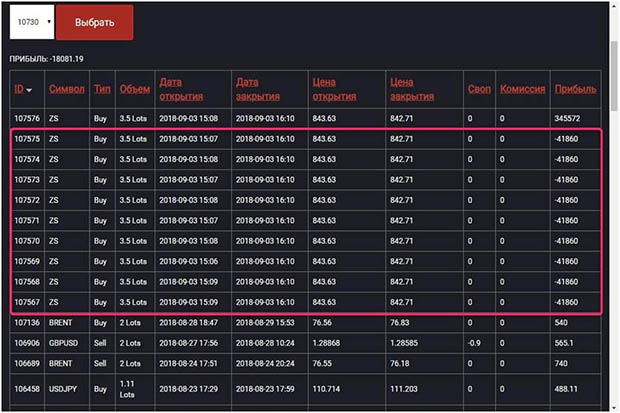

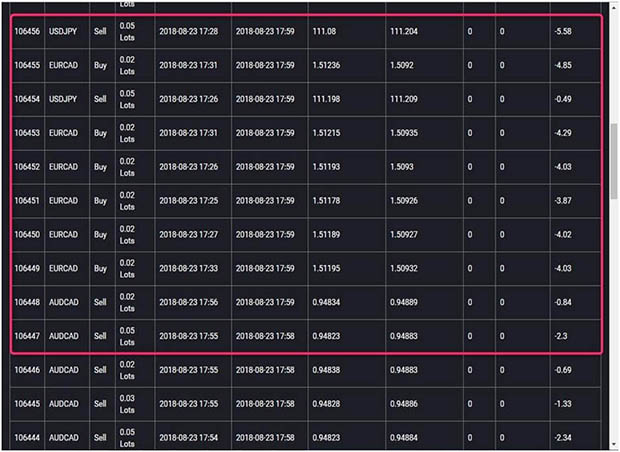

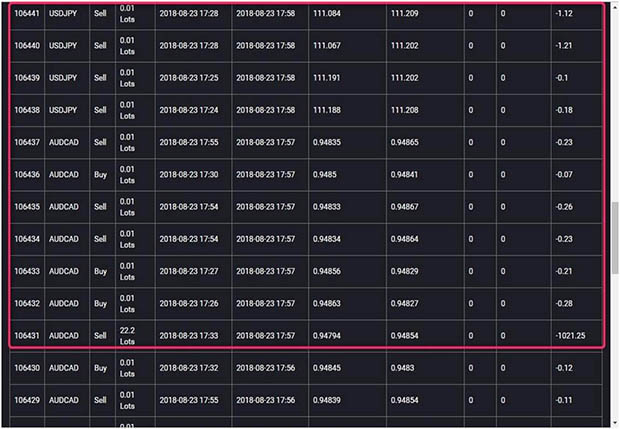

The success of trading, even without the participation of the broker’s manager, greatly increased the deposit of the trader, who was simply happy to cooperate with such a company. But one day happiness changed to confusion, and she changed to anger. Realizing that it was necessary to withdraw at least part of the money in order to feel his success, the client called the broker and learned how to make the first withdrawal, to which he received the answer that until the bonus account passed the minimum cycle of transactions, of which there were still 5, there would be no withdrawal. The unsuspecting client continued trading, but after this call, there were no more profitable trades. All transactions were closed exclusively in the red and seriously reduced the client’s account during the day (photos 1, 2, 3).

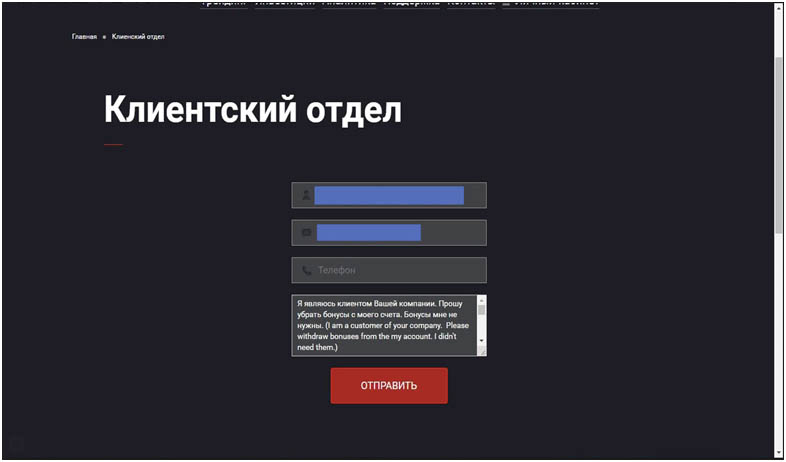

The call to the broker did not yield results, since the manager explained the same thing as before. Therefore, the client decided to demand that bonuses be withdrawn from his account, since he did not need them, for which he used the site’s dialog box (photo 4).

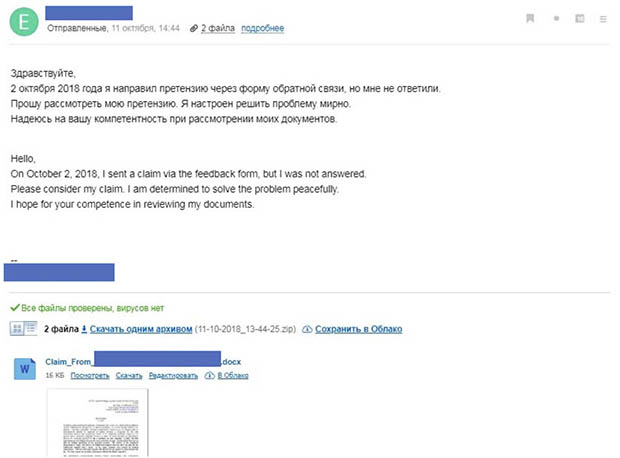

There was no action on the part of the company the next day, so the trader wrote a letter to the support service, attaching a written complaint to it (photo 5).

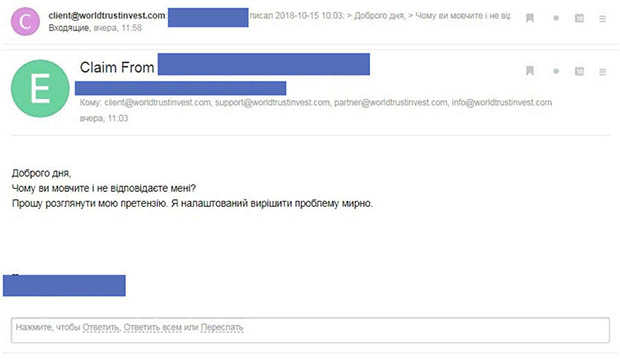

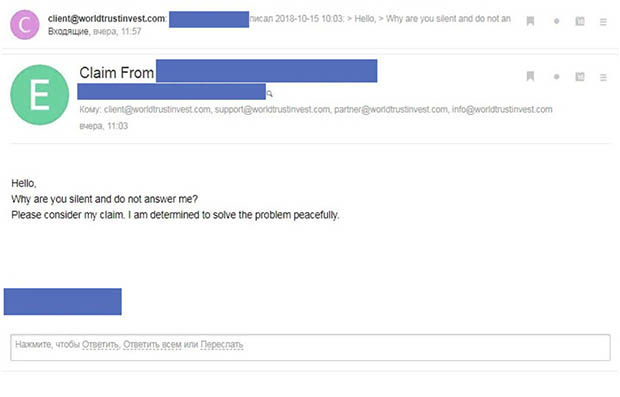

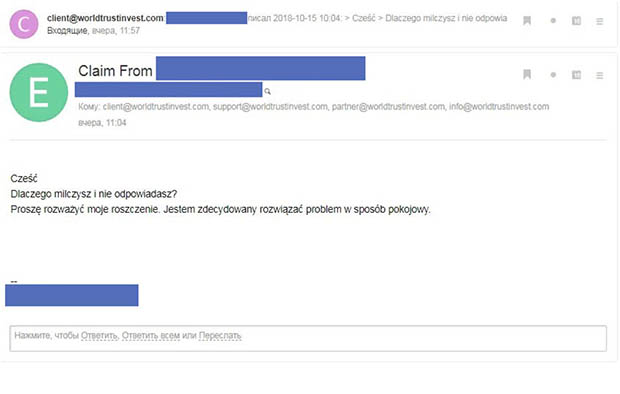

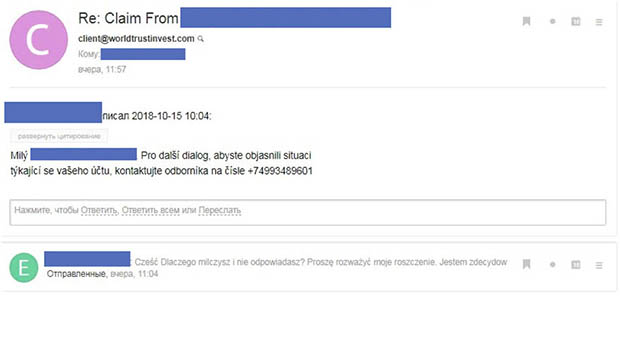

A day later, there was no answer to him, which made the client extremely angry, since his account already consisted of a double-digit figure. The trader decided to write repeated letters in different languages with demands to clarify the situation and return his funds (photos 6, 7, 8, 9, 10).

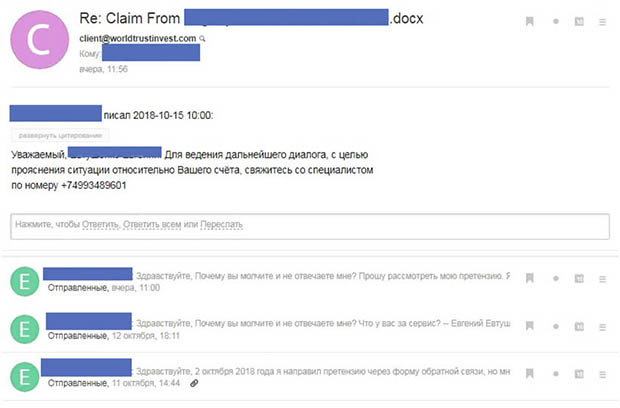

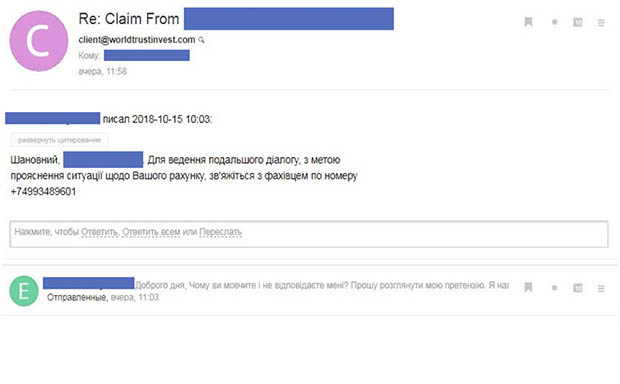

The company has already decided to respond to such an onslaught and provided him with a contact phone number to find out all the nuances of his account (photos 11, 12, 13, 14).

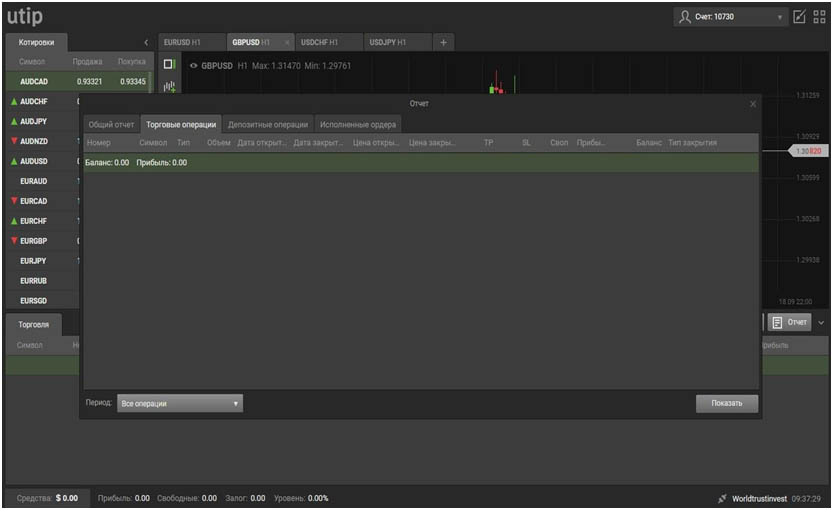

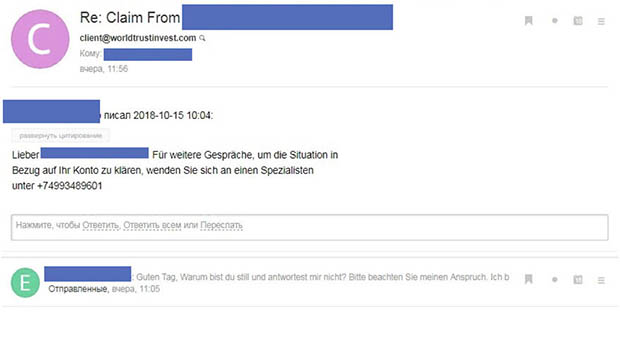

By calling, the trader learned from the manager that his transaction history was empty (photos 15, 16).

Surprised at how quickly the broker carried out the divorce, the client saw that his balance was already empty, both the main and bonus (photo 17).

Attempts to prove his innocence in this and demands for a refund did not end in anything, and in the end the client was left with nothing.

Methods of protection

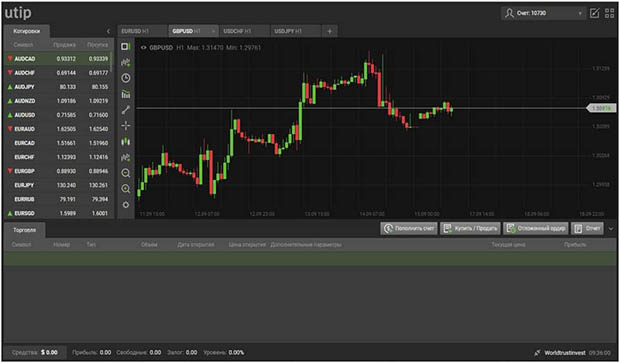

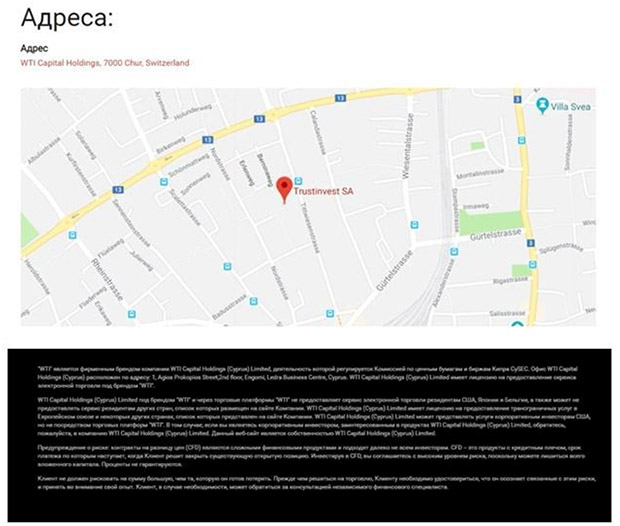

To prevent deception, you must first check the company’s website, which has a lot of conflicting information. The data of the main page indicate that the company is registered in Cyprus, and the “Contacts” section indicates that the place of registration of the company is Switzerland (photo 18).

In general, there is an ambiguous attitude towards Cyprus in the world of earnings in financial markets, since it is in this country that there is no extradition and companies registered here can deceive people around the world with almost impunity, which 97% of organizations registered here do (is it possible to return money from a broker?).

Next, you should try to find the location of the office in Russia, which, when carrying out financial activities in the country, is simply obliged to be according to the law. But here, too, an unpleasant surprise awaits the trader, since there is no mention of this in any section of the site. Looking ahead, it is worth noting that communication with the manager is possible only by phone and e-mail, which is also alarming. The lack of specific information about the minimum deposit amount, payback periods and specific operations in the foreign exchange and financial markets should also make customers doubt how fair everything is here (rating of reliable brokers).

Findings

As you might expect, the financial broker deceived the trader, so it should be understood that such companies that have foreign registration are not the best way to invest their savings. In addition, the lack of official offices in the country and one way to contact company representatives should also suggest the fraudulent motives of such brokers. In the event that such an option as blocking an account and completely ignoring messages did occur, you should contact law enforcement agencies, as well as the bank from which the payment was made, to try to make a chargeback.