Binary options trading involves a high level of risk. A trader can lose his money if he does not have enough knowledge and experience. If the trader has enough binary trading skills, then the result is positive. This only happens when trading with an honest broker, namely a broker that has no influence on trading results.

Binary options trading is gaining momentum. And while other countries are thinking about whether to recognize this type of activity as legal or not, Cyprus began to issue licenses to brokers. CySec is one of the most popular licenses among brokers. How to determine if a broker is certified and if the license is genuine?

Often on the Internet you can find Binary brokers are scammers who pretend to be binary options brokers and make money from traders’ losses. It is almost impossible to start making money with such binary brokers. Therefore, you need to choose a binary options broker with a license and which is controlled by the state financial market supervisory authority.

What is a regulated broker?.

Regulation of the financial market and financial activity takes place under the supervision of state bodies, in order to ensure the protection of the interests of the trader and the invested funds. A regulated binary options broker meets the requirements and standards that are designated by the state and are prosecuted by law. With a license, the broker is obliged not to mislead the investor and cannot act against the interests of the trader. For their part, the regulatory authorities monitor and defend the interests of the trader. In simple words, so that the result of the trader depends only on himself and no one could influence it.

A regulated binary options broker has all the necessary permits and licenses, and also complies with all the standards imposed by government agencies on companies of this type.

When you are looking for a broker, you will most often come across brokers registered in Cyprus and licensed by CySec. This is due to the fact that the financial regulators of Cyprus are loyal to binary options, Forex, and the Cypriot authorities are interested in attracting investment to the country.

The Cyprus Securities Commission is part of MiFID, which means that brokers licensed in Cyprus can operate in all European countries.

Russian traders may argue that if a broker is registered in Cyprus, then if he violates any part of the agreement, the trader has nowhere to turn. That is, practically a Russian trader, more precisely, a non-European trader, does not care whether the broker has this same Cypriot license or not.

But this is only a superficial look. In fact, since the broker has received a license, it means a lot. Firstly, the company has enough money, so much so that the extra hundred or two belonging to the trader will not make the weather for the company’s budget. That is, it makes no sense for a broker to spoil his reputation just to pocket your money.

Having a license also means that the broker technologically meets the highest requirements. So when working with a licensed broker, it all depends solely on the trader – to earn or lose. The main thing is to avoid a scammer.

What is CySEC?

CYSEC CYPRUS SECURITIES AND EXCHANGE COMMISSION- THE CYPRUS SECURITIES COMMISSION IS PART OF THE EUROPEAN MIFID REGULATOR. RESPONSIBILITIES AND OBLIGATIONS OF THE REGULATOR: SUPERVISION AND CONTROL OF THE CYPRUS STOCK EXCHANGE AND FINANCIAL TRANSACTIONS.

The work of financial brokers and investment organizations. Control and management of licenses of companies providing investment services. Granting licenses to companies, brokers and financial advisers Punishment and penalty for violations of the rules to brokers, brokerage firms, investment advisers.

SOME BINARY OPTIONS BROKERS BUY A LICENSE, NOT FROM A REGULATOR, BUT FROM AN INTERMEDIARY. THEREFORE, THEY ARE NOT 100% CONTROLLED.

What, how and who is protected by the broker’s regulation

The most important question of the regulation of binary options: “

Who and how does the regulator protect?”

If you look at it, these are European regulators of financial markets that are not related to the former Soviet republics. Theoretically, if you are not treated fairly, you have nowhere to turn. The rules of conduct and taxation apply only to European countries. However, if a

binary broker has a license

, it means that they have money, and they will not “throw” traders. Just because of the reputation.

The second important point is that if there is a dispute, the binary options trader can send a complaint. It will be reviewed and a request will be sent to the broker to sort it out. If a binary options broker has a license, it also means that it is technologically, meets the highest standards and the results of trading depend only on the trader himself. All account insurance is irrelevant.

- Read also: Licensed Binary Options Brokers and Why Do We Need a Regulator

IT IS VERY IMPORTANT TO REMEMBER THAT AN HONEST BROKER CANNOT PROMISE YOU 100% EARNINGS. A BROKER IS AN INTERMEDIARY FOR TRANSACTIONS, BUT NOT IN ANY CASE AN ADVISOR FOR TRADING

Difference Between Regulated Broker and Unregulated

The main differences between a regulated and non-regulated broker can be highlighted The aggressiveness of the sales department – a regulated broker provides a service, while a broker without a license wants to get the trader’s money. This is noticeable from the first seconds of the conversation, when a representative of the brokerage company tries to aggressively force you to make a deposit.

- Promise – a regulated broker does not have the right to promise earnings, but must clearly show the full picture of the risks and opportunities, an unregulated broker promises to help the trader earn a lot and quickly.

- Technological parameters – only a regulated broker can be sure that there will be no failures and the broker is fully responsible. Not only that, these companies have strong technical support teams that monitor the monitors for 24 hours.

- Withdrawal of funds and protection of finances – unregulated binary options brokers are not afraid of liability, so they delay or do not withdraw money to traders at all. If such a situation occurs, the trader cannot go anywhere.

How to determine that a broker is a scammer.

SO, THE MAIN THING IS TO DETERMINE WHICH BROKER IS HONEST AND WHICH IS A SCAMMER.

We have identified 10 main signs by which you can identify a fraudster:

- Neither on the website nor on the documentation provided (if any), you cannot find which company owns the broker. If you cannot determine the owner company, then the broker is most likely unreliable.

- It is difficult or impossible to contact customer support. Before registering, and certainly before making a deposit, try to contact the broker’s support service on the site. And imagine that you have a problem, and you need to solve it as quickly as possible. If the service suits you, you can register, but if not, then think before opening an account and making a deposit with this broker.

- So, you’ve reached out to customer support. Do not rush to rejoice. Ask them a question or two. Listen to how they answer, whether they are talking in vain, whether they are trying to solve the problem. It is also important that employees speak your language. You won’t solve the problem if they answer you in Chinese, will you?

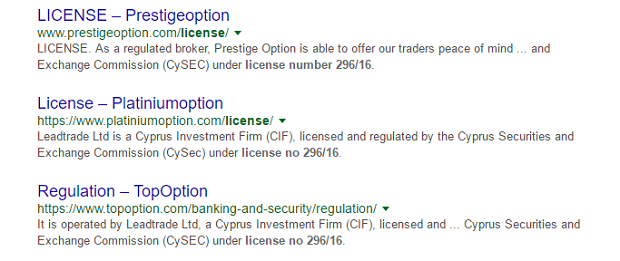

- The company avoids questions about the regulations. Most companies are not regulated, but if they try to present you with contradictory information, if employees cannot answer basic questions, if they try to pass one off as another, say, issue a business license number issued in Cyprus as a CySec license. It is worth working with a company that will explain in an accessible and honest way that at this stage companies of this kind are licensed, but not regulated.

- The company promises you a 100% win. This is already a red flag indicating that the company is a scammer. Trading is a risky event, like any other type of trading. No scheme or strategy will give you the opportunity to earn absolutely always.

- You can’t track your trading history, and it’s not just about the fact that you earned, say, 50% more than last month, but about all the details of the transactions you make. This concerns, however, not so much brokers as warning systems or companies.

- The broker will claim that you will be able to earn a certain amount in a certain amount of time. It is impossible to predict the result of trading.

- A company without a reputation. Well, except that you like to take risks by buying a pig in a poke.

- A company with a bad reputation. If someone has problems, then you are not immune from them.

- There are not enough good reviews. Yes, many reviews are ordered by the same brokers, but you also need to pay attention to reviews. Look for a company that offers free but good resources for its traders, that offers a variety of options to choose from, that has spent a certain amount of time and resources to make trading comfortable.

Well, as we have already mentioned, the broker must have a license. The most common is the Cyprus CySEC license. The Cyprus Securities and Exchange Commission (CySEC) is the Cypriot regulator of the financial and investment market. It is also the first regulator in the binary options market. While the rest decided whether to regulate or not, Cyprus legalized this instrument and provided regulation. And he makes good money on it, by the way. That is why mostly brokers have a Cypriot license and jurisdiction.

And after Cyprus joined the European Union, brokers were able to legally work in the market of all countries that are members of the European Union. The requirements for applicants for licensing have become even more stringent and have become fully compliant with European legislation.

Requirements of the regulator for obtaining a license:

First of all, in order to obtain a license, it is necessary that the broker has a representative office in Cyprus. But this alone is far from enough. The broker is also obliged to:

- work in the market for more than 3 years;

- have a modern trading platform and create conditions conducive to the work of traders;

- have a certain number of trading accounts;

- make an initial membership fee (no less than from 3 to 130 thousand euros);

- comply with all requirements of the regulator regarding its financial stability.

THE REGULATOR ALSO HAS THE RIGHT TO INTERFERE IN THE MANAGEMENT OF A BROKERAGE COMPANY, FREEZE ITS ACCOUNTS, TERMINATE OR RESTRICT THE COMPANY’S ACTIVITIES, REQUEST INFORMATION FROM LAW ENFORCEMENT AGENCIES, AND EVEN INITIATE CRIMINAL PROSECUTION.

A compensation fund is formed from the membership fees of brokers. So if suddenly the broker goes bankrupt or for any other reason cannot or does not want to pay the trader’s funds, then the trader will receive payments from the compensation fund.

The list of licensed companies can be checked on the website of the Cypriot regulator. However, the difficulty lies in the fact that it is difficult to find the right company there. And the brokers themselves are in no hurry to advertise information about the license. But you need to find a license, and then check its number with the data on the official website of CySEC.

Inference:

Regulated binary brokers protect the trader. Trading with brokers who have a license, a trader can be sure that the results of trading depend only on himself. We do not claim that all brokers without a license are scammers, but the fact remains that among them there are more cases of working against a trader.

It is best to be confident from the start and only trade with a regulated binary options broker.

The advantages for traders in working with licensed brokers are obvious:

- The trader is protected from illegal actions of the broker. The broker is controlled by the financial regulator, and the license must be constantly updated. It just leaves no room for scams.

- The broker allows the trader to trade in a comfortable environment.

- The safety of funds in the event of bankruptcy of the broker is guaranteed by the compensation fund.

But the most important thing is that such a broker will not deceive the trader, because then the regulator will simply stop his legitimate activities. That is why you should choose exclusively licensed brokers.

OPEN AN ACCOUNT WITH A REGULATED BROKER