Stochastic Oscillator Strength Index (StochRSI)

Description

We present another detailed review of binary options oscillators for our readers . Study our materials, try your hand at trading and get the most out of trading in the financial market. Today’s review will be devoted to one of the interesting indicators Stochastic Strength Index (StochRSI), which is very popular among market players. What are its features and advantages, why you should use it in trading, as well as tips on money management and expiration – all this you will learn from the article.

The Stochastic Relative Strength Index (StochRSI) is a technical analysis indicator that appeared in 1994 thanks to the work of traders Stanley Kroll and Tushar Chand. This indicator is a great hybrid consisting of two oscillators: the Strength Index and the Stochastic. These tools are quite effective alone, and in one instrument they provide higher accuracy of trading signals, reliability and reliability – the properties that are so lacking in the financial market. The indicator consists of two powerful tools:

Stochastic is a common tool for trading in the financial market, taking into account all extremes and closing levels on a specific time scale. Stochastic is volatile, reaches the overbought-oversold limits faster than the RSI, and it is also able to show more divergences between the price and the indicator line than the RSI indicator. On the chart, the oscillator is represented by two curves.

The Relative Strength Index (RSI) is one of the important oscillators that determines the level of movement strength (strength and weakness), which also takes into account the overbought-oversold assets. The RSI differs from Stochastic in that it is a slow indicator. Today, trading with RSI is a fundamental tool used by analysts of any banks and investment funds.

The tool did not appear by chance:

RSI in most cases is in the range of 70-30, and does not give market participants signals to enter a trade. Accordingly, because of such data, the indicator is impractical, and in order to get a buy signal, traders will have to wait weeks for the result. Stochastic, on the contrary, is more often located in the overbought-oversold zone. By connecting the two instruments together, we see the indicator from the indicator where Stochastic will find the overbought-oversold RSI indicator.

As a result, the Stochastic Strength Index (StochRSI) is one of the best and most reliable technical analysis indicators today, which has taken the best from Stochastic and RSI to accurately show periods of excess supply and demand. The signals of this instrument have become more qualitative, it is very simple to interpret them: when level 20 is crossed by a line from bottom to top, this is a buy signal; When the level of 80 is crossed by a line from top to bottom, we have a sell signal in front of us.

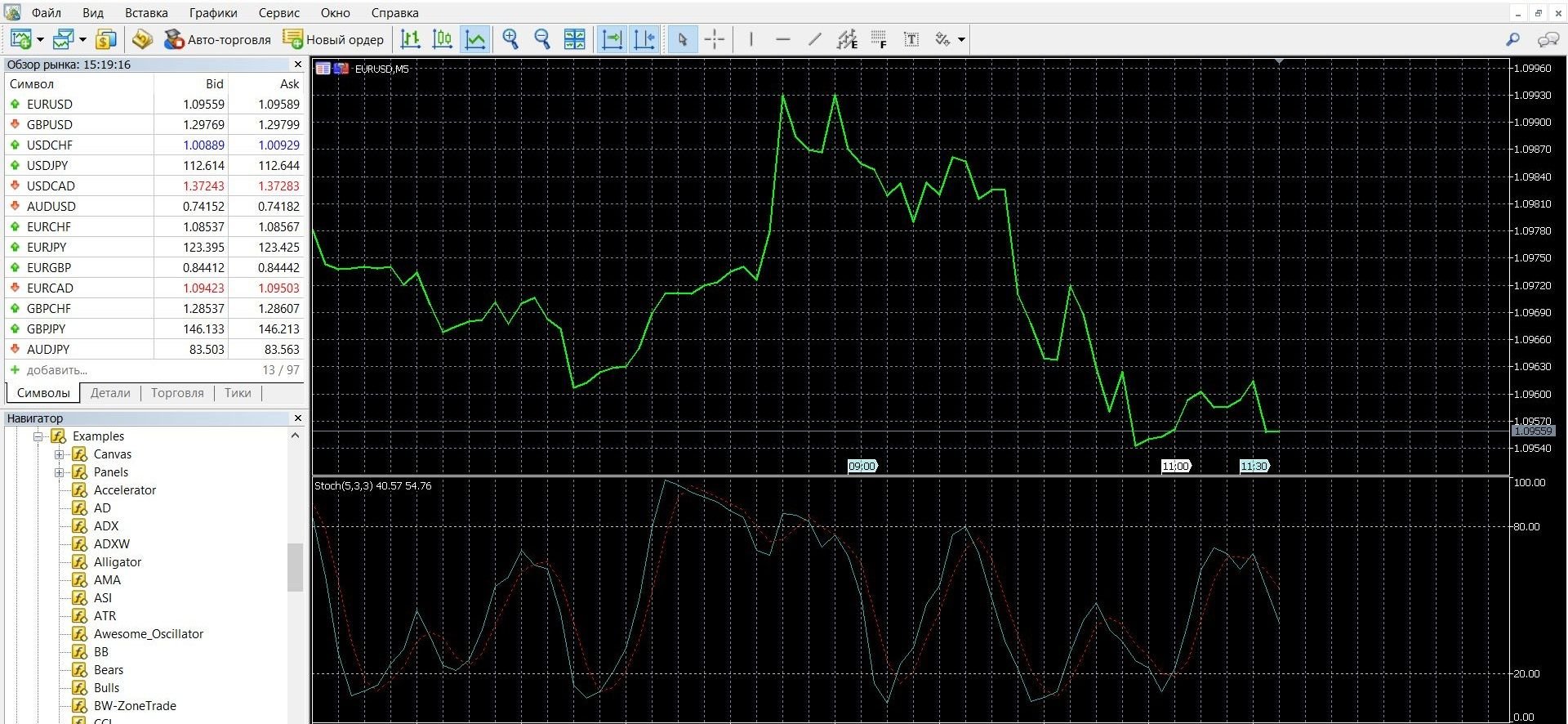

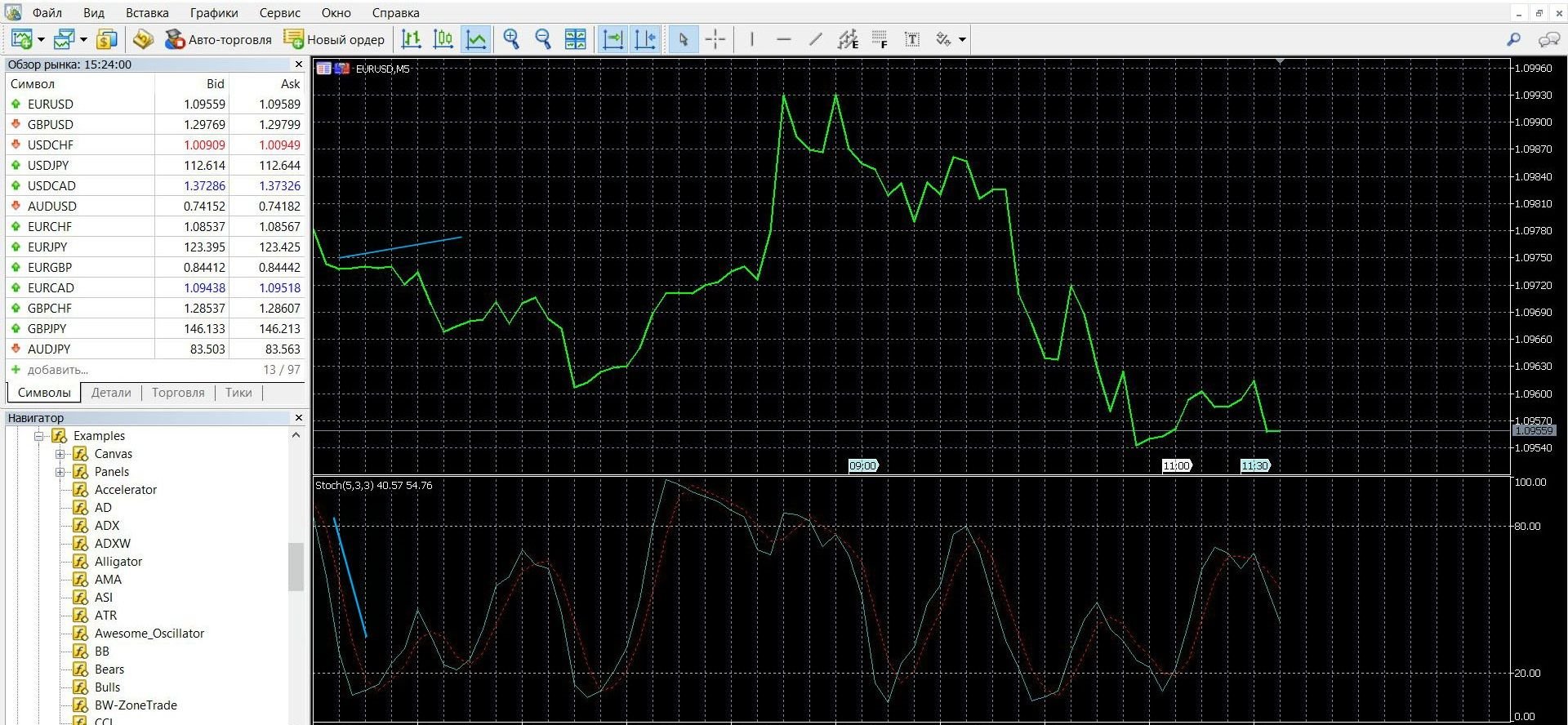

You can see what StochRSI looks like on the MetaTrader 4 (MT4) platform in the image below. In addition, you can download the MetaTrader 4 platform, add the indicator to the chart and work with it.

What is the principle of operation of the indicator?

The StochRSI technical indicator works with Stochastic and RSI data in order to result in a more accurate indicator that allows you to clearly identify periods of excess supply and demand.

When working with a hybrid, it is necessary to remember that when its value is in the zone of excessive supply or demand, it is not a signal to immediately act, sell or buy. Do not act hastily, it is better to wait for confirmation signals.

In general, the benefits of a hybrid for a player with options are obvious, being created in order to smooth out the shortcomings of some oscillators by others, it does not interfere with clear work, does not clutter up the price chart.

It is worth remembering that StochRSI reacts quickly enough to market dynamics, which can give a lot of false signals. Traders recommend making the hybrid a confirmatory rather than a signal indicator of your strategy. So, StochRSI will become an additional trigger to action, which will give you good results in binary options trading.

Indicator signals

Overbought-oversold signals:

- Both lines are located below 20, in the oversold zone there is a signal to open a call option.

- Both lines are located above 80, in the overbought zone – a signal to open a PUT option.

Divergence

Stoch RSI gives excellent divergence signals – that is, a divergence between the price and the indicator indicators in an uptrend.

Convergence

The oscillator also shows convergence signals, this is also a divergence between the price and the indicator indicators, but, unlike divergence, in a downtrend.

How to calculate StochRSI

In order to calculate StochRSI, it is necessary to determine the period, which is a universal parameter of most oscillators.

StochRSI = (RSIn – RSImin.n)/(RSImax.n – RSImin.n), where

RSIn is the current average direction index

RSImin.n — the minimum RSI value for the period

RSImax.n is the maximum RSI value for the period

n is the period of calculation of the indicator.

Do I need to install StochRSI on my platform?

The oscillator is a classic indicator in binary options trading, it is present in almost all modern trading platforms, users of the MetaTrader 4 platform can work with its data without installation.

The indicator is located below the main price chart and consists of two lines:

%D is the smoothing line. SMA or Simple Moving Average. By default, the value is set to 3 days.

%K is a short line, which is calculated according to the formula (Current C is the smallest C) / (Highest C is the smallest C), where C is the price.

To build an indicator, specify the following parameters:

The RSI period is standard 14.

The Stochastic period is standard 14.

The values of %K and %D are standard 3 (both). So, both indicators are plotted on the chart, which are taken into account in the calculations.

To add StochRSI to the price chart on the MetaTrader 4 platform, follow these steps: click the “Insert” tab – select the “Indicators” tab – then “Oscillators” – Stochastic RSI.

If your platform doesn’t have the StochRSI oscillator, you can download it here.

You can read how to install the indicator in the MetaTrader 4 platform here.

Application of the indicator for binary options

StochRSI includes the best of the two tools, which are good separately as well. The indicator was created in order to get more accurate signals, simplify the work and interpretation of trends: oversold-overbought, divergence and convergence.

Thanks to simple operation, no less simple installation and clear signals, both beginners and professional traders can work with the hybrid oscillator. Despite the fact that the main advantage of StochRSI is an even higher sensitivity compared to RSI, the hybrid also has a drawback – false signals. It is worth using several indicators at once during trading to confirm signals.

We can safely say that StochRSI is one of the most reliable indicators of technical analysis of the market, accurately showing periods of excess supply and demand. In order for his data to bring you a good income, remember that a deep technical analysis of the situation is necessary.

Rules for concluding transactions (screenshots)

Trading with an overbought-oversold signal

From 0 to -20 – overbought zone. If the oscillator line breaks through the -20 mark from top to bottom, you can open a CALL option:

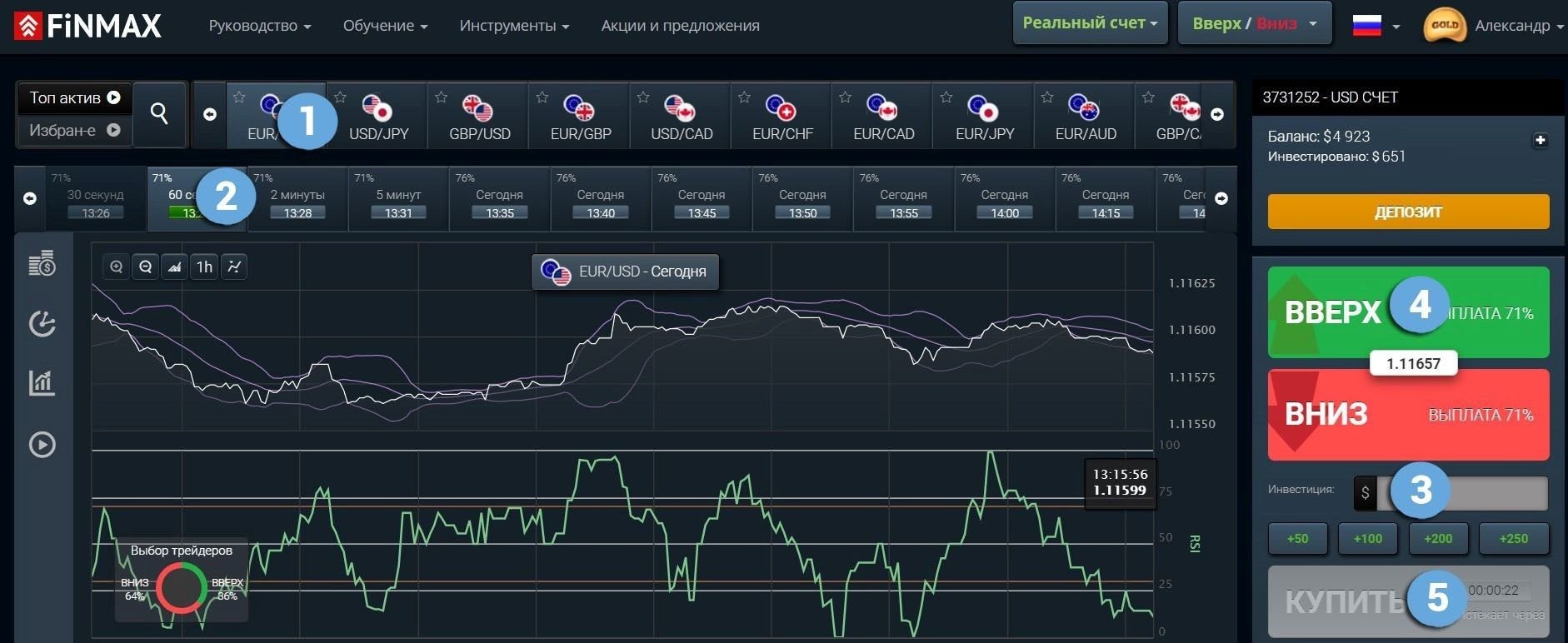

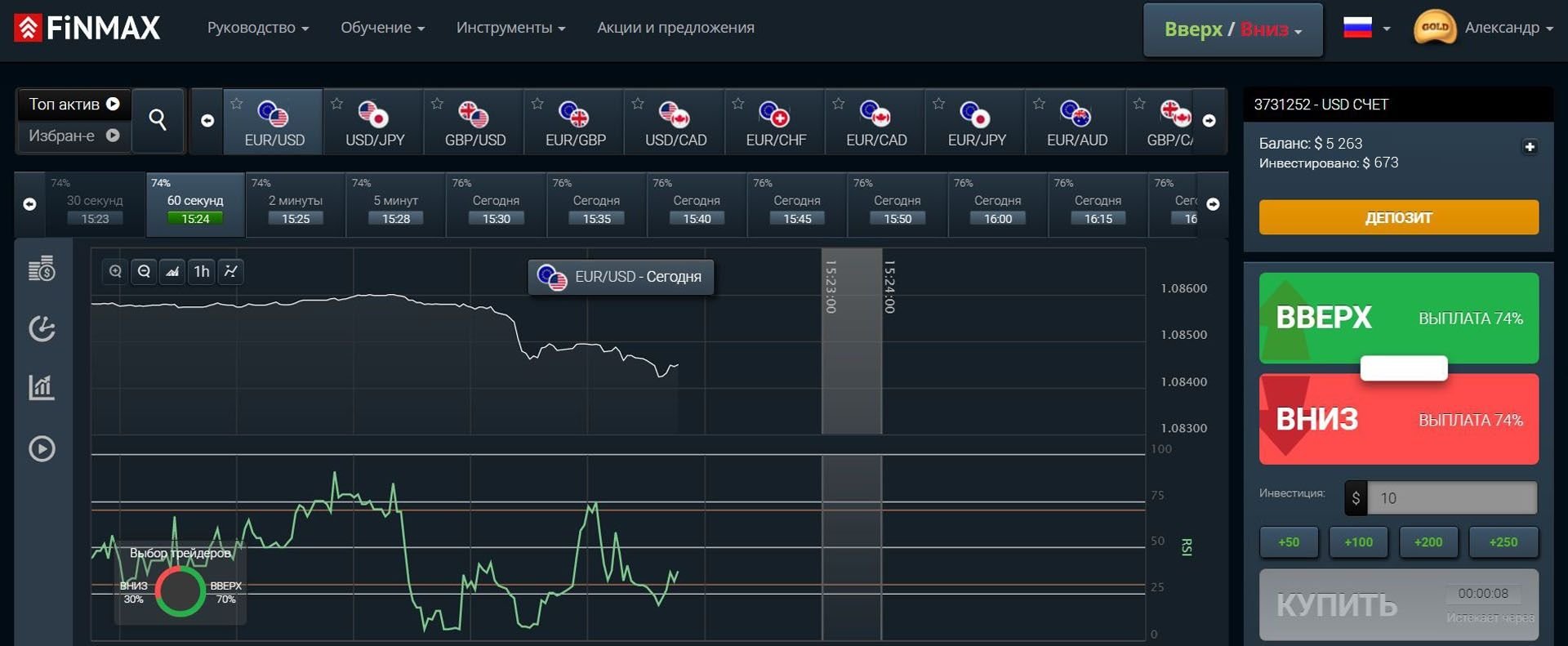

Take advantage of the downtrend opportunities and place a CALL bet with a trusted broker Finmax. To do this, follow these steps:

Go to the finmaxbo.com broker’s website and prepare an option, to do this, specify in the system:

1. Type of asset

2. Validity of the option

3. Bet size

4. Forecast of quote movement: UP

5. Click the “buy” button and follow the results of currency movements on the chart.

From -80 to -100 is the oversold zone. If the oscillator line breaks through the -80 mark from bottom to top, you can open a put option:

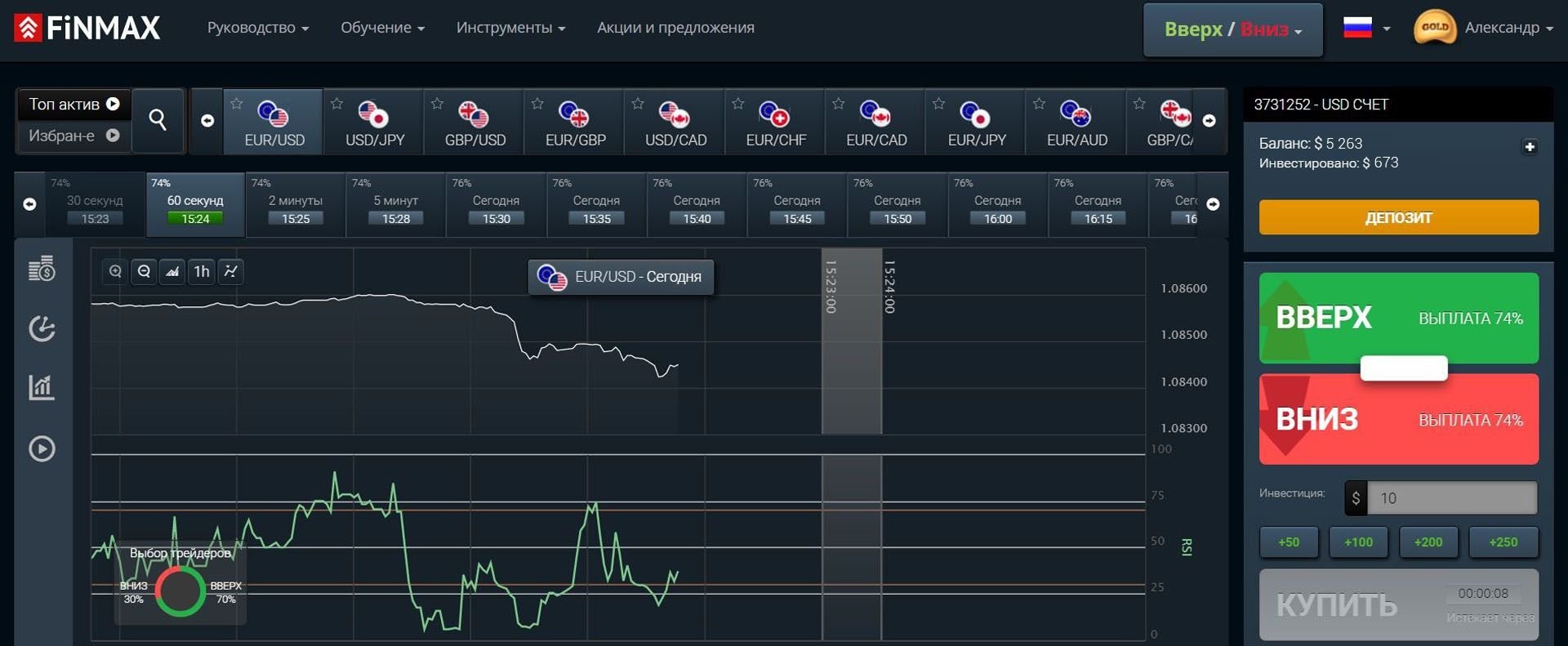

Take advantage of the uptrend opportunities of the price and place a PUT bet with a trusted broker Finmax. To do this, follow these steps:

Go to the finmaxbo.com broker’s website and prepare an option, to do this, specify in the system:

1. Type of asset

2. Validity of the option

3. Bet size

4. Forecast of quote movement: DOWN

5. Click the “buy” button and follow the results of currency movements on the chart.

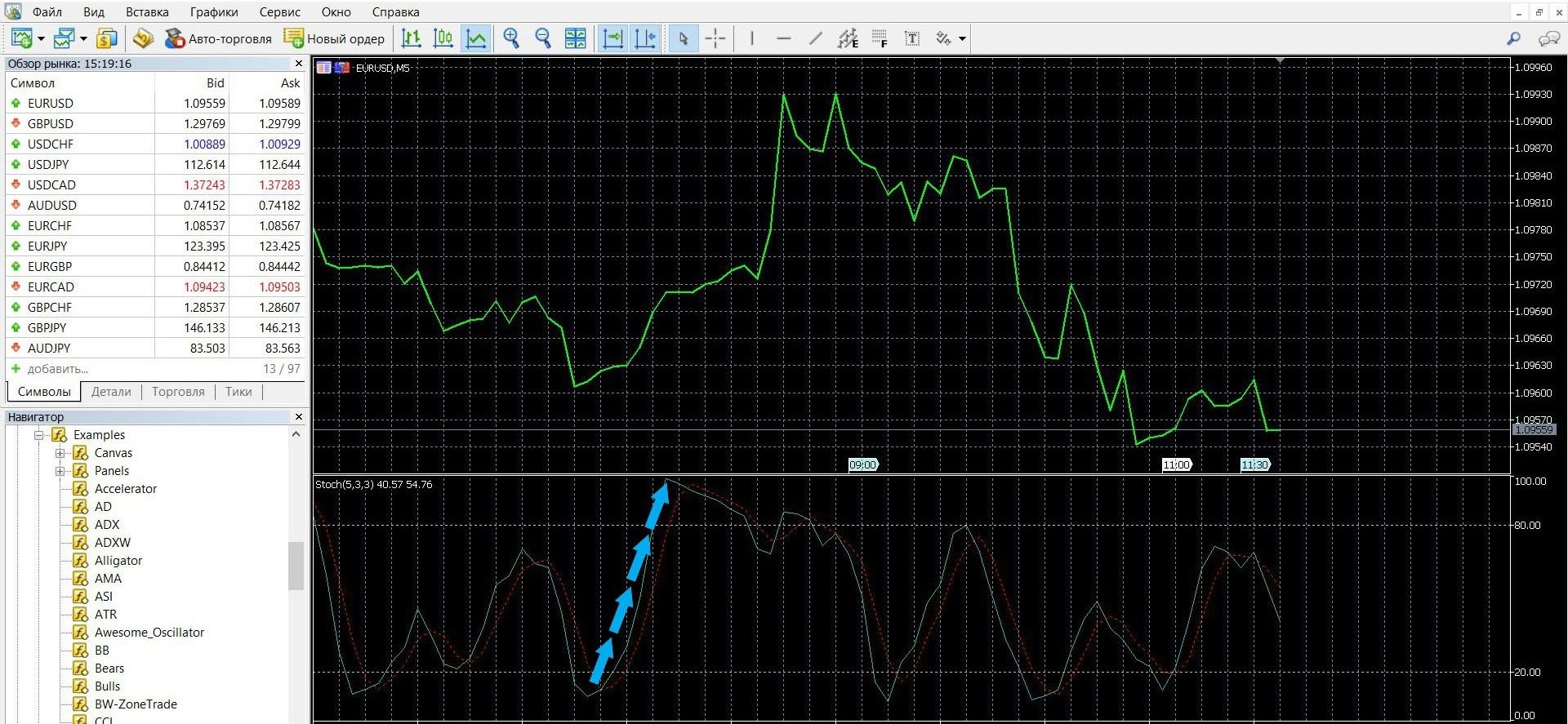

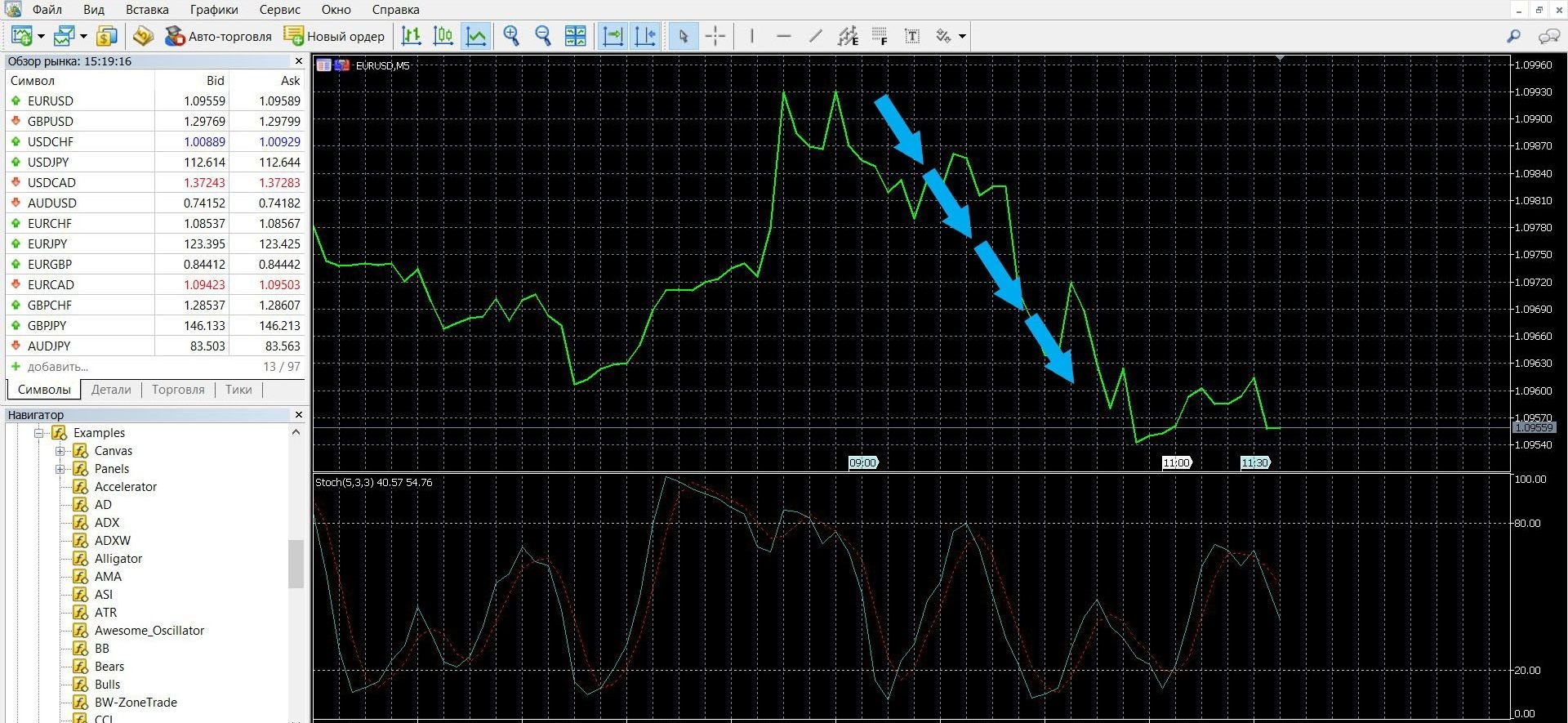

Trading with a divergence signal

Divergence is a discrepancy between the indicator readings and the price. Divergence occurs in an uptrend. When the price goes in one direction in an upward position, and the StochRSI lines in the other, this is a signal that the price movement will soon change:

Take advantage of divergence opportunities and place a bet with a trusted Finmax broker. To do this, follow these steps:

Go to the finmaxbo.com broker’s website and prepare an option, to do this, specify in the system:

1. Type of asset

2. Validity of the option

3. Bet size

4. Forecast of quote movement

5. Click the “buy” button and follow the results of currency movements on the chart.

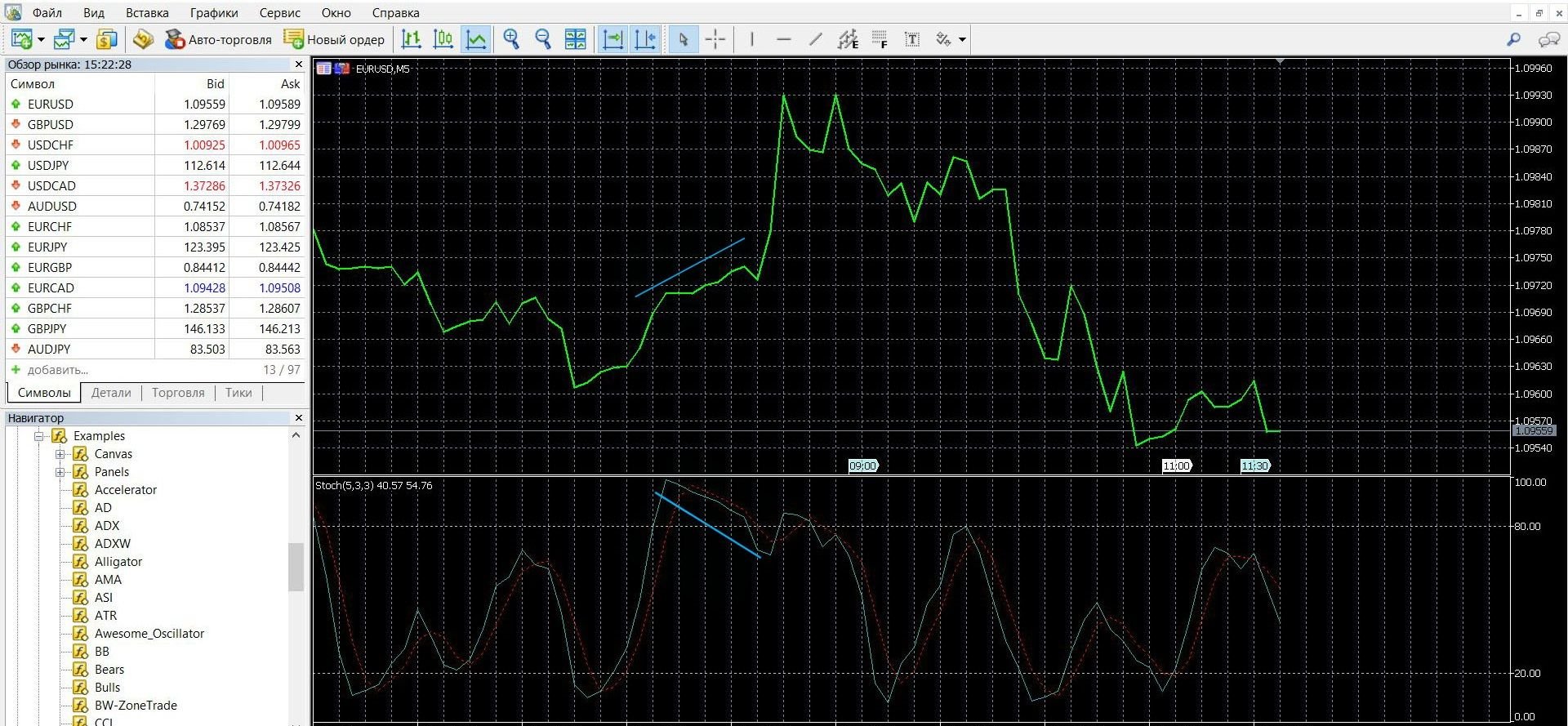

Convergence trading

Convergence is a divergence between the indicator and price readings, which appears on a downtrend, when the price goes in one direction and the StochRSI lines in the other, this is a signal that the price movement will change soon:

Take advantage of convergence opportunities and place a bet with a trusted Finmax broker. To do this, follow these steps:

Go to the finmaxbo.com broker’s website and prepare an option, to do this, specify in the system:

1. Type of asset

2. Validity of the option

3. Bet size

4. Forecast of quote movement

5. Click the “buy” button and follow the results of currency movements on the chart.

Money management

No program will be able to effectively manage your capital on its own. You yourself must work with your funds so that they are always there. In trading, a stable profit is possible with a stable income. Your first goal in binary options trading is to make a steady profit from the results of transactions. The rules of money management play a big role in this case, they will include your capital in one powerful strategy that will be effective.

Money management is a thoughtful management of your capital, which obeys the goal: not to lose money on a personal deposit and increase their number by following the basic rules of money management:

Minimum bets. Minimum funds

When participating in the auction, bet the minimum amount on the option – no more than 5% of the deposit. Do not trade lots that are higher than the amount of funds in your account. Also, only trust your capital to a trusted broker that guarantees the best returns in the market. Try to spend your money carefully, and, in case of an incorrect forecast on your part, you will still have money to continue trading.

Minimum deposit

When bidding, work thoughtfully with your account. Do not transfer a large amount to the deposit at once, because. There is a high risk of losing everything at once. It is worth transferring a minimum of funds, and, to begin with, determine the free financial range that can be disposed of and spent on bets. When working in the options market, always remember the risks, save money in order to continue the game.

Minimum assets

Participating in trading, and even more so if you are new to trading, gradually increase the number of assets. Do not bet on a large number of assets at once, this will not lead to a good result. The more trades, the greater the burden on your funds, the more likely it is that you will not track the loss of money.

Great options trading opportunities will always beckon, and only following the strategy will save you from an imminent loss of funds. It is correct to start trading gradually, with two or three assets, then you can increase the number of traded assets.

Minimum emotions

By participating in the auction, set yourself up for work, for serious work, where thoughtfulness and balanced decisions are important. Learn to turn off emotions, do not play in a bad mood – all this can interfere with concentration. Experienced traders are distinguished by sobriety and clarity of thought, always keep in mind not only the prospects of the transaction, but also the probability of risks.

The reliable rule of three, which came to Forex options, will help discipline you. As statistics show, three failed or successful transactions, and you are immersed in emotions, your mind is turned off, there is only an acute desire to return the lost, in case of failure, or multiply the winnings many times. In this case, you risk losing all the funds of the deposit. Correctly tell yourself a strict “stop” and leave the market after three trades, then you will save your capital and be able to achieve more.

Expiration

Expiration in binary options trading is one of the main terms that significantly affects success in trading. Without knowing this concept and not understanding its role, you will not be able to achieve a positive result. When predicting a transaction, that is, whether the price will rise or, on the contrary, fall, the trader is waiting for the expiration moment in order to understand whether his prediction has come true, whether his funds in the account will be replenished.

Expiration is the expiration date of the transaction, which can lead to both winning and losing, depending on what the player’s decision will be. In general, the success of trading largely depends on your strategy, and this strategy includes not only the choice of oscillators, a proven broker, but also the choice of a specific expiration.

Options are:

- Ultra-short – 60 seconds – 5 minutes

- Short-term – 15 minutes – several hours

- Medium-term – from 6 hours – a day

- Long-term – a day – several months.

Is it possible to extend the expiration of options?

Can. It is worth remembering that this is not allowed with all brokers.

Expiration rules:

1. For beginners in options trading, it is better and more profitable to choose an expiration with a long term. These are lower risks, there is no such unpredictability as express expiration.

2. Choose a broker carefully, work where it is allowed to increase the expiration period. This minimizes your losses.

3. If you need a quick income, try yourself in a short-term (from a minute to several hours) expiration, but it is worth remembering about the big risks.

4. If you need a stable income, try your hand at long-term expiration. If you win, you will have a good income.

Expiration in StochRSI strategies

Strategy for oversold-overbought signals

Short-term trading: not recommended, characterized by increased risks and unpredictability; The income is minimal.

Recommended expiration: from 5 minutes to several hours; will allow you to calmly analyze the situation, weigh all the data and make the right forecast; Income is several times higher than with short-term trading.

Long-term expiration: also recommended; will allow not only to analyze the dynamics of prices in a similar time period, but also to predict the dynamics of the market depending on the news, economic and political situation; The income is high.

Strategy for divergence and convergence signals

Short-term trading: allowed, can bring a good result; It is necessary to remember about the high degree of risks and unpredictability.

Recommended expiration: from 5 minutes to 15 minutes; will allow not only to develop the trend, but also to show itself in full force; The income is average.

Expiration of more than an hour: also recommended, it will allow you to analyze the dynamics of the market in a calm atmosphere and predict the outcome of trading based on technical analysis (refer to other reasons affecting price movements: news, economy, etc.); The income is high.

“StochRSI + half candle” strategy

Candlestick analysis is generally interesting, combining it with an effective indicator, we get good data. The strategy uses: StochRSI; candlestick chart.

Short-term trading: allowed, will bring a good result in case of a correct forecast; It is important not to forget about the risks and unpredictability of the outcome.

Recommended expiration: from 5 minutes to 1 hour; will allow you to show yourself to the trend in full force, analyze the dynamics of the market; The income is average.

Long-term expiration: also recommended; It will allow not only to connect a technical analysis of the situation in a similar time period, but also to suggest the behavior of the market based on macroeconomic data.

Strategy for beginners “EMA + StochRSI”

A special strategy using simple tools: two EMA moving averages; StochRSI. Suitable for beginners in trading, as it is easy to understand and quite easy to generate income. The main signal for entering the market is the data of the EMA indicator, StochRSI acts as a confirmation of the trend.

Short-term trading: allowed, can bring a positive result if you make the right prediction; do not forget about risks and unpredictability; Income is below average.

Recommended expiration: from 5 minutes to 1 hour; will allow you to feel the dynamics of the market and see the trend in full force; The income is average.

Long-term expiration: recommended; It will allow you to slowly connect technical analysis to a specific situation, suggest market behavior based on macroeconomic data. It is worth remembering that the greater the expiration, the more clearly the signal is shown.

StochRSI + CCI Strategy

A fairly simple strategy that works with oversold-overbought zones. Both a professional and a beginner in trading will be able to put the strategy into practice. Tools used: StochRSI; CCI (Commodity Channel Index).

Short-term trading: not recommended, it is worth remembering the risks and unpredictable outcome of the transaction; Income in the near future, minimal.

Recommended expiration: from 5 minutes to several hours; will allow you to calmly analyze the situation, weigh all the information and make a correct forecast; The income is higher than with short-term trading.

Long-term expiration: recommended; will allow not only to analyze the price movement in a similar time period, but also to accurately determine the dynamics of the market; Above-average income.

To test all expiration options in practice, we recommend using the Finmax broker platform, just go to the finmaxbo.com website. The advantage of this platform is that you have a choice of expiration from 30 seconds to six months. Here you can not only check the strategies listed in the review, but also find your comfortable one among them and get a stable income.

Downloads

MetaTrader 4 (MT4) platform – download.

StochRSI Oscillator for MT4 platform – download.

Tagged with: Binary Options Indicator • RSI