DeMark Lines Indicator (DeMarker, DeM)

Description

Published detailed reviews of binary options oscillators will help you learn more about trading tools, tell you how to use indicators correctly so that it gives a stable profit. Today’s article is devoted to the technical Demark Line Indicator, one of the most interesting tools in options. What is its principle of operation, what are its advantages and how to apply it in practice, as well as a lot of useful information about expiration and money management – all this you will learn from the material.

The DeMarker line indicator is a tool that was developed to determine the signals of overbought-oversold zones. Such data is based on an assessment of market demand and the level of risk. The oscillator shows the zones quite accurately, fixing the boundaries of the “depletion” of the market for this. This allows you to see market reversal signals. In addition, Demark predicts prices for both long-term and short-term periods, which will allow you to plan transactions at any expiration with minimal risk.

The author of the indicator is an outstanding analyst and trader Thomas Demark. When he created DeMarker, he wanted to see a perfect solution that was different from other similar ones on the market. In his oscillator, T. Demark formalized the choice of points necessary for constructing data, which made it possible to eliminate subjectivity and make options trading easy and simple. For the first time, they learned about the tool in Demark’s book “The New Science of Technical Analysis”.

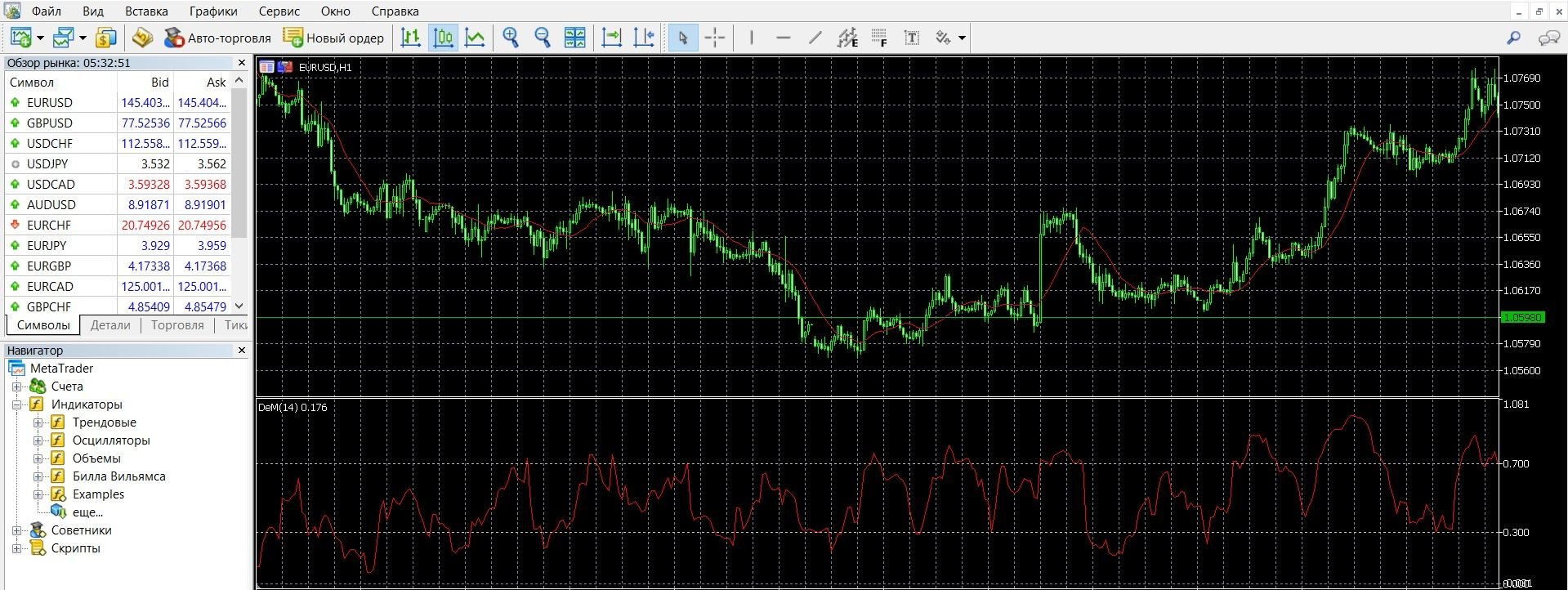

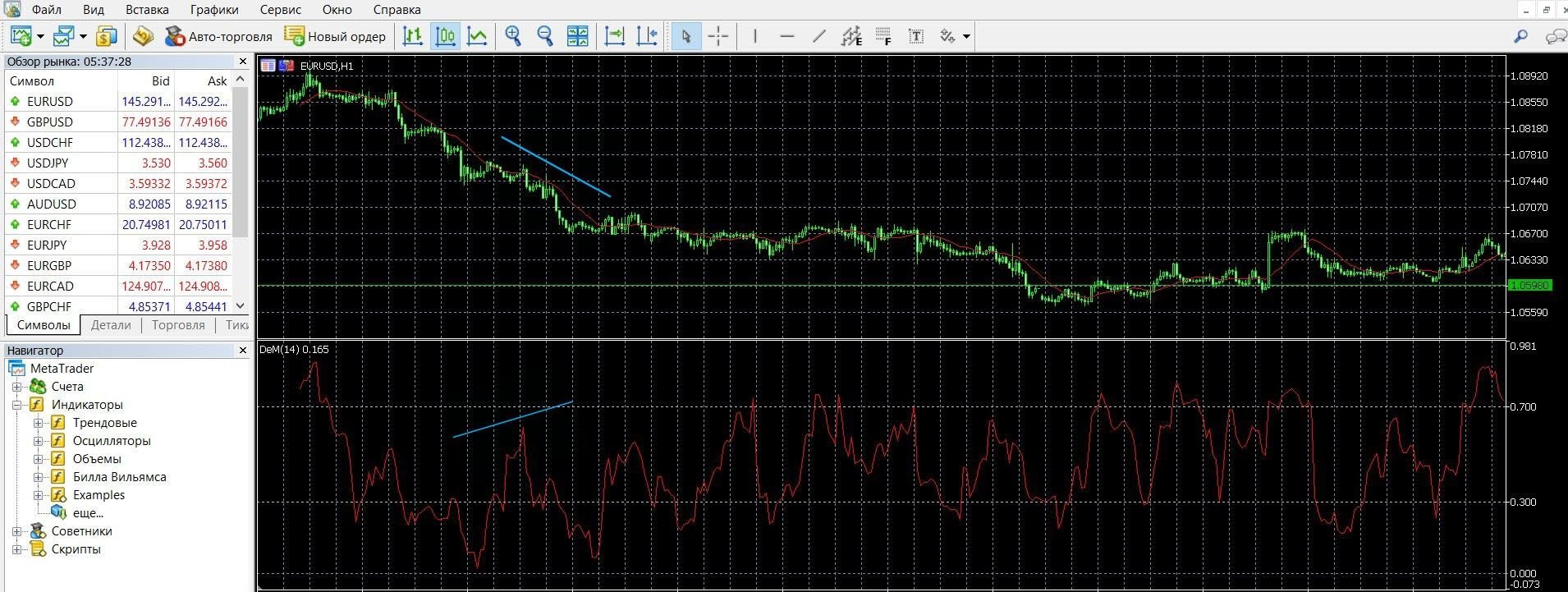

You can see how the Demark Indicator works on the MetaTrader 4 (MT4) platform in the image below. In addition, you can download the MetaTrader 4 platform and get acquainted with the oscillator in operation.

What is the principle of operation of the indicator?

The Demark Lines indicator can be confidently called one of the most useful solutions for identifying market reversals. The meaning of the Demark indicator, due to its increased sensitivity, is the accurate detection of overbought-oversold zones. Being leading, it gives signals earlier than the data of the main chart.

Demark’s work is based on comparing the highs and lows of the price for a specific time period. The ability to identify moments of “exhaustion” means that a trend reversal will definitely follow. For work, market players can use the period settings in order to see a high-quality signal.

It is recommended to use DeMarker together with other oscillators to see the confirmation of signals and make correct predictions. The entry into the market will be an upward movement of instruments in one direction. With the advent of DeMarker, traders have access to a simple and understandable tool that can signal low and high risk areas in a high-quality and timely manner.

Indicator signals:

This oscillator accurately gives the following signals:

Overbought-oversold:

- If the line crosses the 0.7 level from top to bottom, leaving the overbought zone – this signals a decrease, you can buy a PUT option,

- If the line crosses the 0.3 level from bottom to top, leaving the oversold zone, this signals an increase, you can buy a call option.

Divergence and convergence:

- Divergence is a divergence between the indicators of the main price chart and DeMarker data, which works on an uptrend.

- Convergence means the same thing, but it works on a downtrend.

Do you need to install Demark in your platform?

The Demark indicator is a classic tool for working with binary options, it is available in almost all popular trading platforms, including MetaTrader 4. The oscillator is a separate curved line, which is located separately from the price chart.

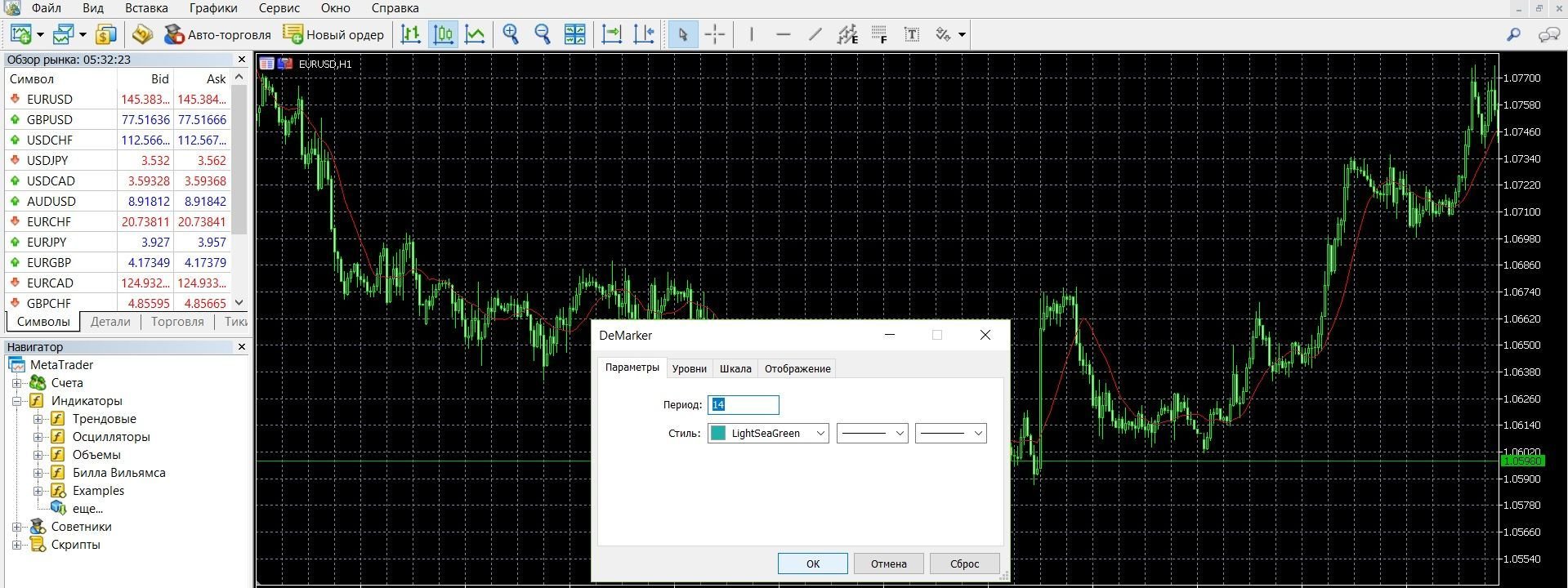

Before work, it is worth identifying the overbought (0.7) and oversold (0.3) zones. Another parameter is available for adjustment – the period, which, with different numerical values, gives different sensitivity to the oscillator. The standard value is 14, but based on the goals and strategy, this number can be changed:

- When the value decreases, the instrument will be very susceptible to price fluctuations, that is, it will transmit many signals, including false ones.

- With an increase in the value of the period, the instrument will be less sensitive to market dynamics, that is, there will be fewer signals, but their quality will be better.

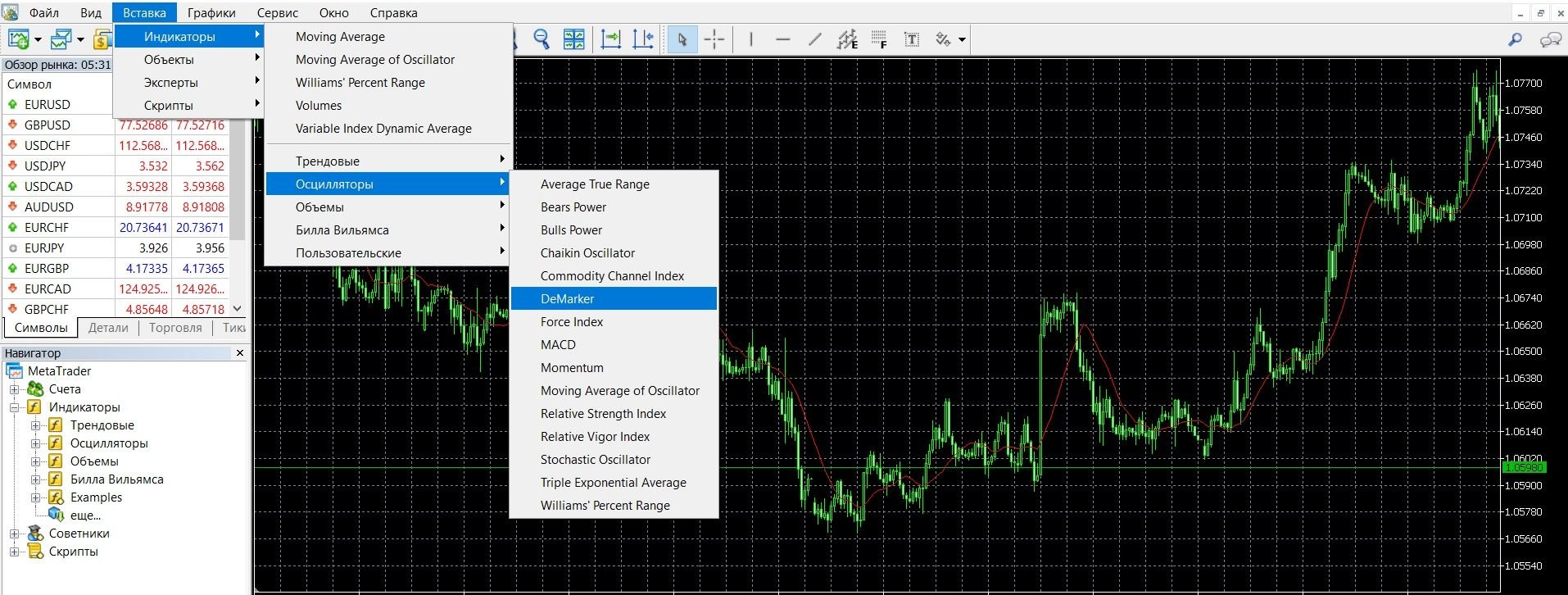

To add the Demark indicator to the main price chart on the MetaTrader 4 platform, you need to perform the following steps:

1. Click the “Insert” tab in the top menu of the platform

2. Select the “Indicators” tab

3. In the drop-down menu that opens, select the “Oscillators” tab

4. In the drop-down menu that opens, select DeMarker. You can get started.

If your platform doesn’t have the Demark oscillator, you can download it here.

Application of the indicator for binary options

- The oscillator is quite popular among traders and is included in a large number of strategies. The main advantage of the instrument is the accurate identification of overbought-oversold zones (as well as convergence-divergence) that follow the “exhaustion” phase of the market.

- DeMarker works more efficiently when ranges appear, but when a strong trend develops, it is recommended to check its signals. Based on the indicator data, the trader will receive good signals for the purchase and sale of options. And yet, in order to be sure of the quality of trends, it is worth using auxiliary oscillators to confirm the data (MACD, RSI or Parabolic SAR).

- The author of Demark, who created many indicators, set himself the goal of making an ideal tool for trading. With the right setup and proper interpretation of signals, the oscillator can bring good results.

- In general, the indicator is now successfully used for trading on Forex, binary options, and other financial instruments. Thanks to its simple operation and convenient setup, DeMarker is perfect for both a trading professional and a beginner.

The formula for calculating the DeMarker indicator:

DeMax (i) is calculated. If HIGH (i) > HIGH (i – 1), then:

DeMax (i) = HIGH (i) – HIGH (i – 1)

otherwise

DeMax (i) = 0

DeMin (i) is calculated. If LOW (i) < LOW (i – 1), then:

DeMin (i) = LOW (i – 1) – LOW (i)

otherwise

DeMin (i) = 0

The value of the Demark Indicator is calculated:

DMark (i) = SMA (DeMax, N) / (SMA (DeMax, N) + SMA (DeMin, N)), where:

HIGH (i) — the maximum price of the current bar;

LOW (i) — the minimum price of the current bar;

HIGH (i – 1) — the maximum price of the previous bar;

LOW (i – 1) — the minimum price of the previous bar;

SMA is a simple moving average;

N is the number of periods used for the calculation.

Information from the www.metatrader5.com website

Rules for concluding transactions (screenshots)

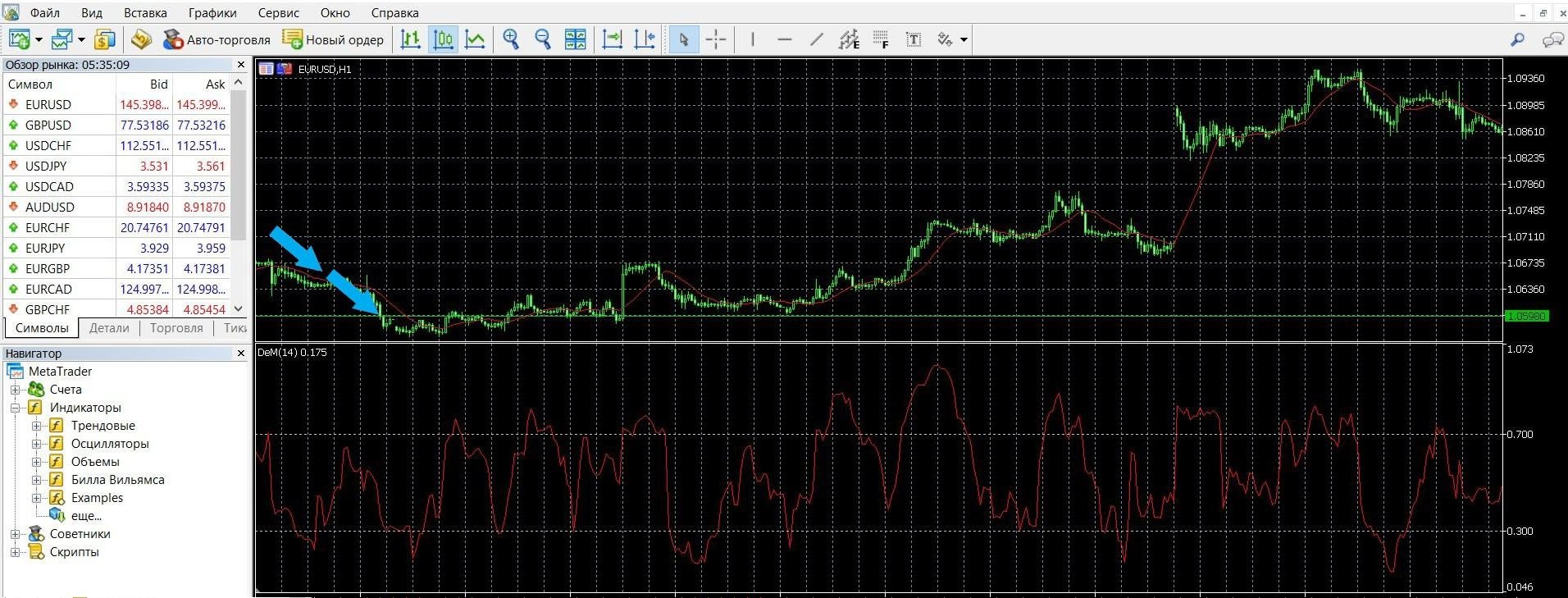

Overbought-oversold trading

If the line crosses the 0.7 level from top to bottom, leaving the overbought zone – this signals a fall in the trend, you can buy a put option. In the image below, you can see the downward trend on the MetaTrader 4 platform:

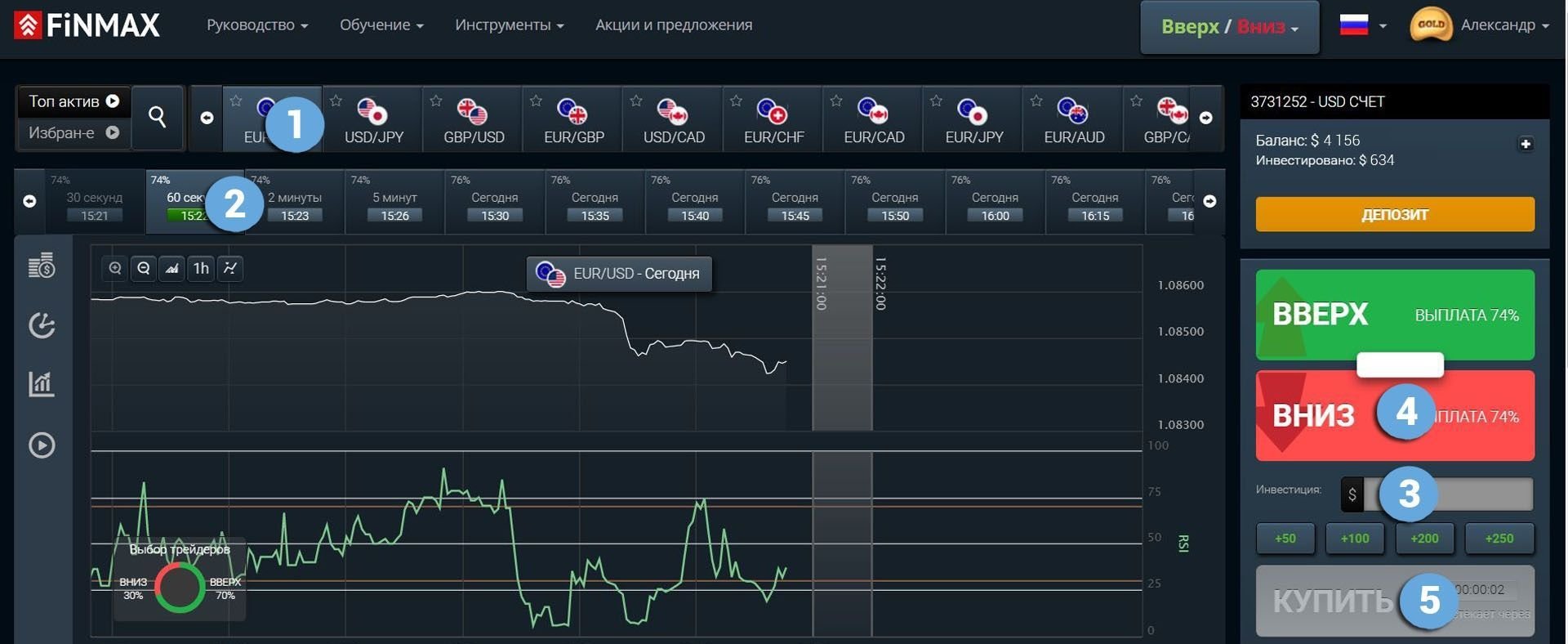

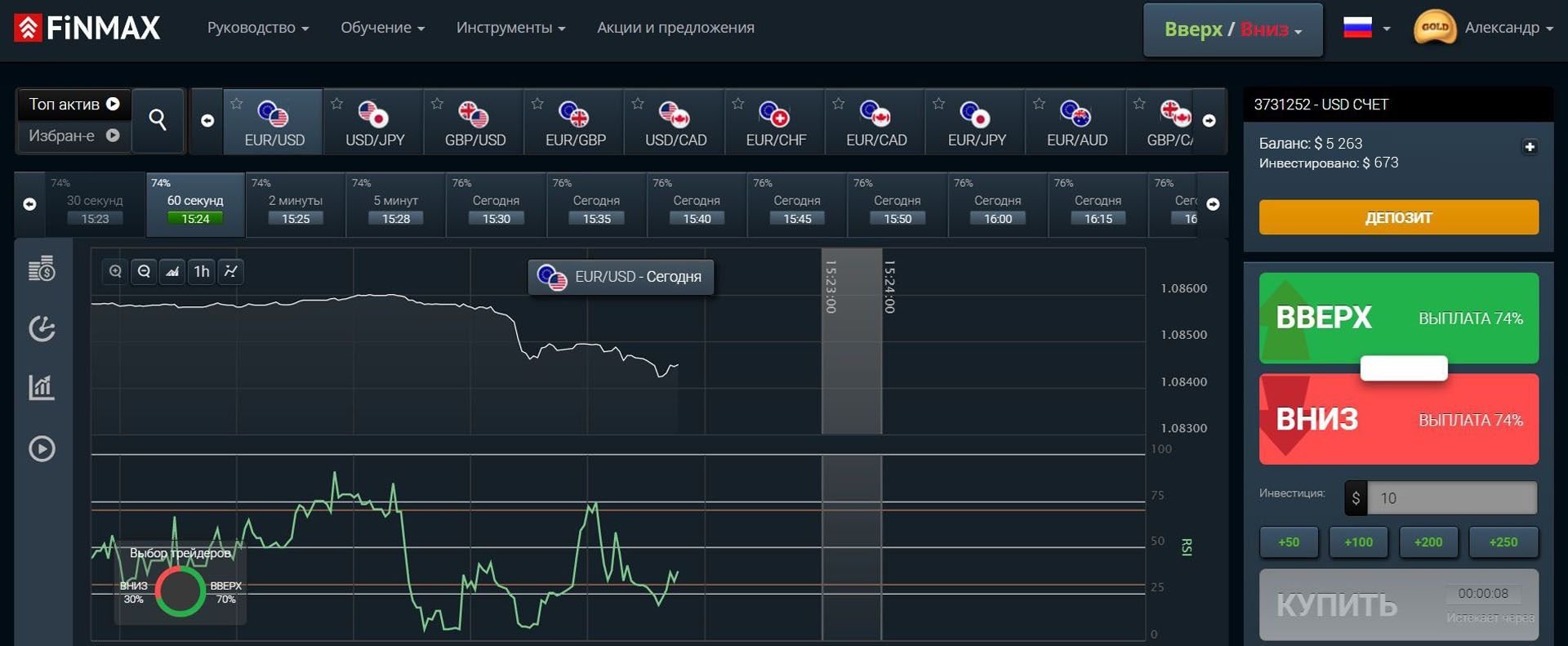

Take advantage of the downward trend in price and make a PUT (down) rate with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and prepare an option, indicating in the system:

1. Type of asset

2. Expiration

3. Bet size

4. Movement forecast: DOWN

5. Click the “buy” button and wait for the result.

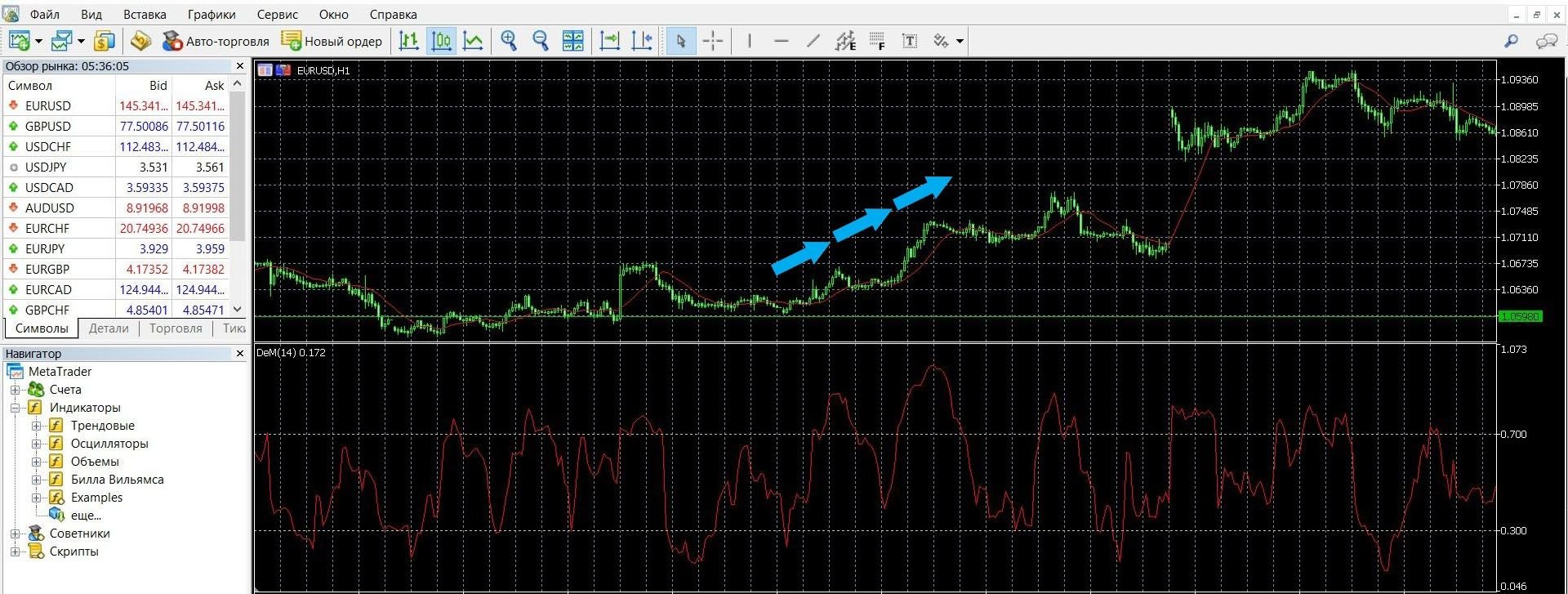

If the line crosses the level of 0.3 from bottom to top, leaving the oversold zone – this signals an increase in the trend, you can buy a call option. In the image below, you can see the upward trend on the MetaTrader 4 platform:

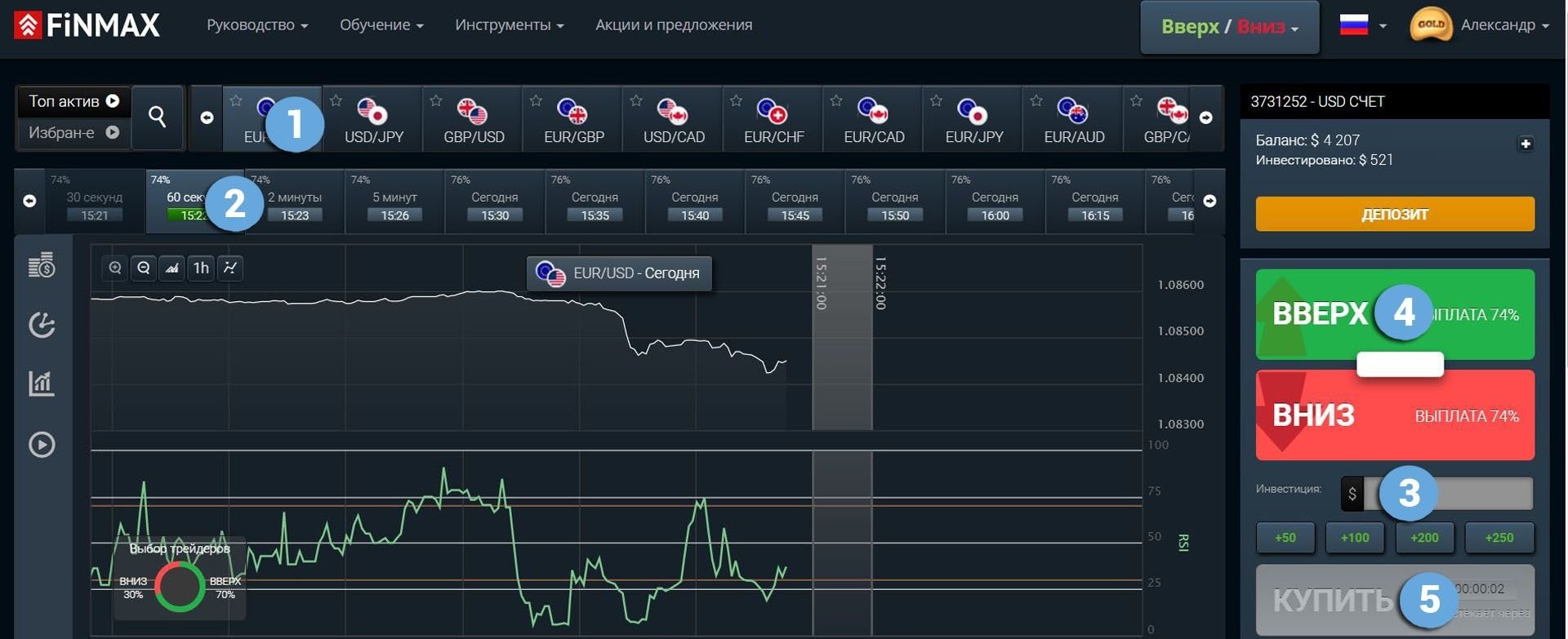

Take advantage of the upward price trend and place a CALL (up) rate with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and prepare an option, indicating in the system:

1. Type of asset

2. Expiration

3. Bet size

4. Movement forecast: UP

5. Click the “buy” button and wait for the result.

Trading in divergence

Divergence is a discrepancy between the indicator readings and the price, which occurs in an uptrend:

Take advantage of divergence opportunities and place your bet with a reliable Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and prepare an option, indicating in the system:

1. Type of asset

2. Expiration

3. Bet size

4. Forecast of price movement

5. Click the “buy” button and wait for the result.

Convergence trading

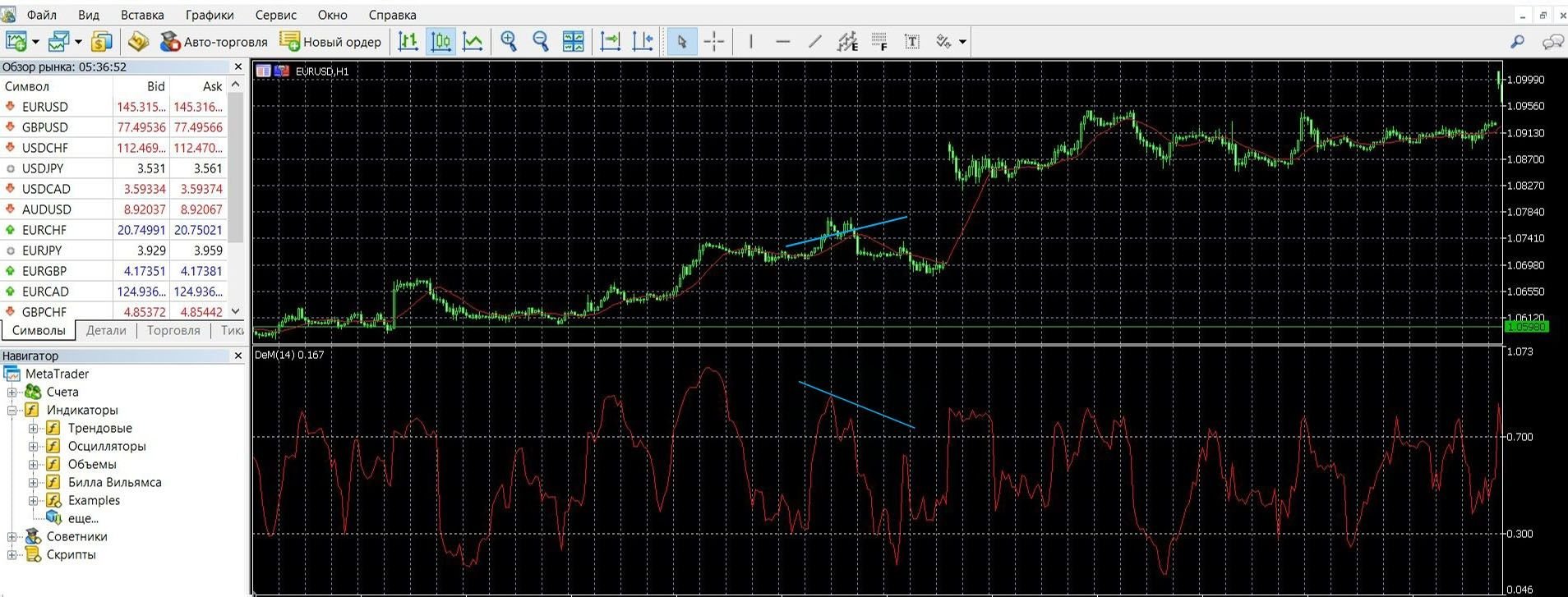

Convergence is a discrepancy between the indicator and price readings that appears in a downtrend:

Take advantage of convergence opportunities and place your bet with a reliable Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and prepare an option, indicating in the system:

1. Type of asset

2. Expiration

3. Bet size

4. Forecast of price movement

5. Click the “buy” button and wait for the result.

Money management

When trading binary options, most professional traders think about how to make trading not just profitable, but bringing a stable income. And although trading has great risks, experienced players, even if they lose, remain “in the black”. How to optimize the work with personal funds in such a way as to reduce losses and save the deposit?

To solve these serious issues, there is the concept of “money management” – a powerful strategy that allows you to effectively manage capital, which is recommended for beginners in options. Effective work with capital is based on the basic rules of money management:

Minimum bets. Minimum funds

It is worth starting trading with a minimum of funds. It is better to bet on a specific option no more than 5% of the amount on the deposit. Participation in lots, the value of which is lower than the amount of funds in the account, will also allow you to save funds. A competent choice of a broker will also be able to optimize costs. Always trust your funds to the platform where you will be guaranteed a good income. So, following these rules, you will save funds on deposit and continue trading.

Minimum deposit

It is worth starting trading with a minimum deposit. It is better to transfer a minimum of funds to the account. It is not recommended to put all the capital on auction at once. The definition of a free limit, within which it is allowed to spend a certain amount on options, will also save money. So, if you follow these simple rules, you will always have funds in your account.

Minimum assets

It is worth starting trading with a minimum number of assets. To begin with, it is better to trade 2-3 assets to give yourself time to get used to the system and then work with greater efficiency. It is recommended to gradually increase the load on the deposit. By participating in a large number of assets at once, you run the risk of not noticing the state of the account and losing funds. So, following these simple rules will allow you to organize the work efficiently and get a good result in the auction.

Minimum emotions

It is worth starting trading with a serious attitude, consider trading as analytical work, where balanced actions, in-depth analysis, and the need to remember the risks are important. Remember that excessive emotionality will prevent you from concentrating and making the right forecast, which will affect your capital. So, following this rule, you build your serious attitude to options trading and work more efficiently.

Expiration

Being one of the leading concepts of trading, expiration directly affects the income from transactions, and hence the success in options trading. Inattention to expiration will reduce the chances of success by half.

Expiration (from the English Expiration, “expiration, expiration”) – the term of the transaction; The moment of the end of the transaction, when market participants learn about the result of trading, the forecast led to a win or loss. In order for options to bring the maximum, it is important to take into account the basics of money management in your work, work with a trusted broker, build a successful oscillator strategy, and always remember about expiration.

Types of options:

- Ultra-short options – 60 seconds-5 minutes,

- Short-term options – 15 minutes – several hours,

- Medium-term options – from 6 hours – a day,

- Long-term options – a day – several months.

Is it possible to extend the expiration of options?

Can. Remember that this is not allowed by all marketplaces.

Expiration rules:

1. If you are just starting to work in trading, it is recommended to choose a long expiration. So, you will receive a guarantee of minimizing the risks that are distinguished by quick expirations.

2. If you are already thinking about how to reduce risks, it is recommended to carefully choose a broker, and opt for sites with the possibility of increasing the expiration period.

3. If you want to get income as quickly as possible, it is recommended to choose a short-term (minute – several hours) expiration, but always remember the risks.

4. If you want to receive a stable income, it is recommended to choose a long-term expiration, this will guarantee a good income.

Expiration in strategies with DeMarker

Strategy for oversold-overbought signals

Short-term trading: not recommended, in many ways similar to a lottery, characterized by unpredictable trading results.

Recommended expiration: from 5 minutes to several hours; You will have time not only to get used to a specific market situation, but also use the data of indicators, such a balanced approach will help you get a good income.

Long-term expiration: also recommended; It is quite comfortable for traders, you can have time to analyze the price dynamics, study the news, the influence of other factors on the market.

Strategy for divergence and convergence signals

Short-term trading: allowed, able to bring good results with a serious approach; It is characterized by unpredictable results.

Recommended expiration: from 5 minutes to 30 minutes; You will not only see the dynamics of the trend, but also feel the mood of the market, its dominant forces, and you will be able to study the signals of oscillators.

Expiration of more than an hour: also recommended, to make a decision you can use not only technical analysis, but also study the external situation that affects the price dynamics: news, economy.

EMA + Murrey + DeMarker + Momentum Strategy

A strategy that works with “accumulation” zones that are considered reliable for predicting the market. Murrey’s price levels are rarely used due to the apparent complexity of this indicator, but if you understand it, you can significantly improve your results in options trading. The strategy requires the following indicators: EMA (9), EMA (31); DeMarker: Murrey; Momentum.

You should buy when: EMA(9) crosses EMA(31) from bottom to top; Momentum is located above 100; the price, breaking through the Demark line, is fixed for it; The Murray oscillator confirms the upward signal. It is worth selling when: EMA(9) crosses EMA(31) from top to bottom; the Momentum indicator is located below 100; the price, breaking through the Demark line, was fixed for him; Murray lines signal an upper signal.

Short-term trading: not recommended, very risky, difficult to achieve a positive result.

Recommended expiration: from 30 minutes to 1 hour; The ideal time during which you can study the price dynamics, refer to the data of the oscillators and make the correct forecast.

Long-term expiration: also recommended, you can use technical analysis to make a decision, study the external situation that affects the price dynamics (news, economics, statements by top officials of companies, the release of new versions of equipment).

Strategy “DeMarker + RSI”

Even though both indicators are almost identical and interpret the low and high signals almost identically, they have a difference: the RSI uses an exponential moving average, while the Demarker uses a simple moving average. Still, it is possible to combine them, and this strategy gives a good result, reducing the number of false signals. The following indicators are required in the strategy: RSI, DeMarker. The latter acts as a confirmation of the RSI data. You should buy when the RSI indicator has left the overbought-oversold zones; DeMarker is in the 0.3-0.7 area.

Short-term trading: it is allowed, it is possible to make a profit in case of a correct forecast; It is important to remember about the unpredictability of trading.

Recommended expiration: from 5 minutes to 1 hour; The most suitable time during which you will feel the price dynamics, study the signals of oscillator strategies.

Long-term expiration: not recommended; indicators in the strategy are focused on minimum expiration; Expiration of more than 1 hour is not desirable, because. There will be fewer high-quality signals, you can only lose time waiting for trends.

“DeMarker + EMA + Momentum” Strategy

A very simple but powerful strategy along trend lines, the author of which is T. Demark. Allows you to get a good income. The strategy requires the following indicators: Demarker; EMA 9, EMA 30; Momentum.

You should buy when the EMA 9 crossed the EMA 30 upwards; Momentum is located above the value of 100; the price line broke DeMarker upwards. You should sell if the EMA 9 has crossed down the EMA of 30; Momentum is located below the value of 100; the price line has broken the Demarker down.

Short-term trading: not recommended, very risky, difficult to achieve good results.

Recommended expiration: from 30 minutes to 1 hour; A good time during which you can study the price dynamics, turn to the indicators and make the right prediction.

Long-term expiration: also recommended, you can use technical analysis to make a decision, study the external situation that affects the price dynamics (economics, statements by top officials of companies, the release of new versions of equipment).

You can test in practice all the expiration options specified in the strategies. To do this, you can use the platform of the reliable broker Finmax by going to the finmaxbo.com website. The advantage of the broker is that you have a choice of expiration from 30 seconds to six months. Here you will not only get acquainted with the strategies, find your successful one among them, but also be able to get a good income.

Downloads

MetaTrader 4 (MT4) platform – download.

DeMarker Oscillator for MT4 platform – download.