Trendless Price Oscillator (DPO)

Description

We continue the review of binary options oscillators for our readers. What is it for? Knowing the features of indicators and using them correctly in practice will make your trading successful.

Today we will talk about one of the most interesting technical indicators – the Trendless Price Oscillator. You will find a detailed overview of the possibilities of working with it, which will help to achieve positive results in options trading.

A trendless price oscillator (or even a detrend oscillator) is a technical indicator that shows buy-sell, oversold-overbought signals. It can be used for both Forex and binary options.

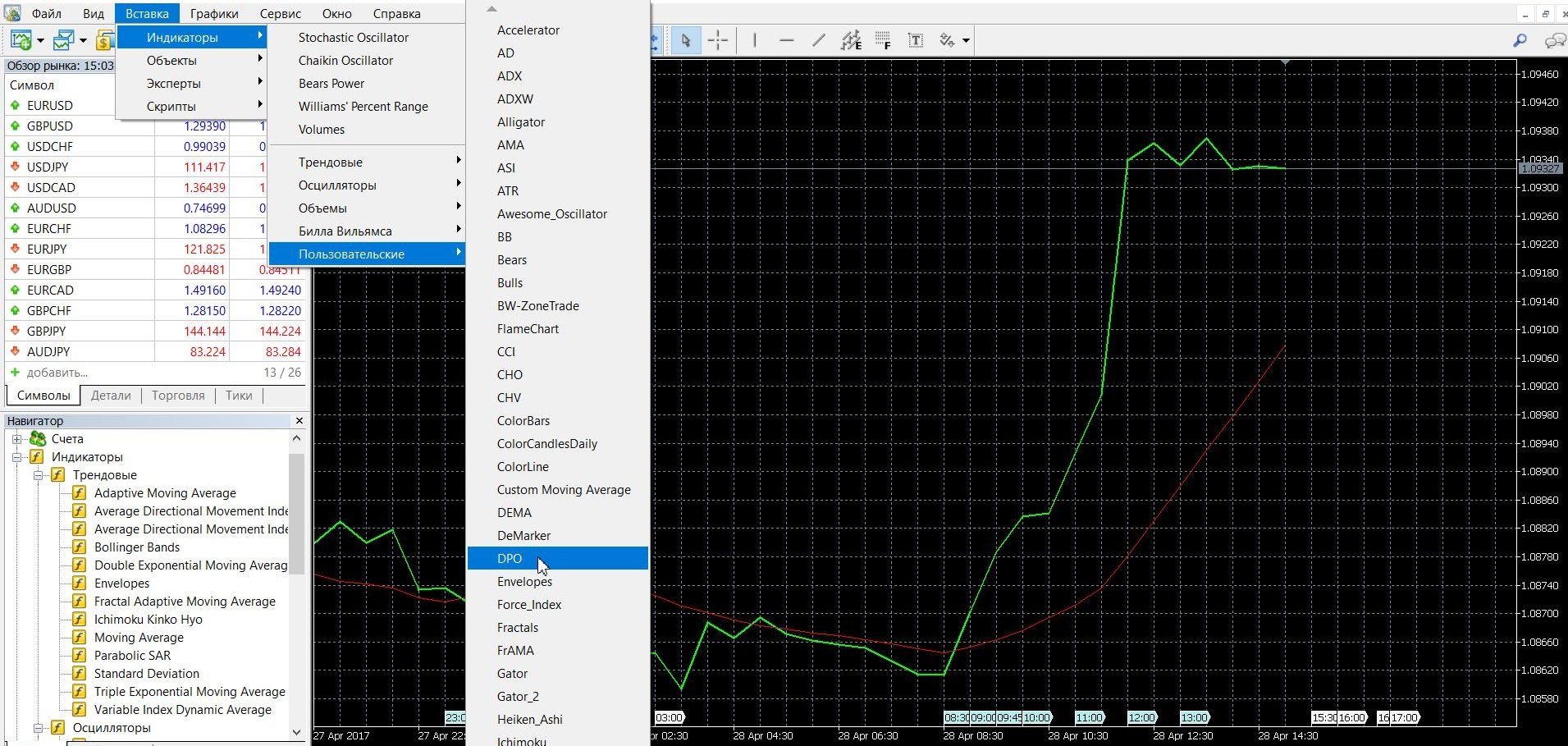

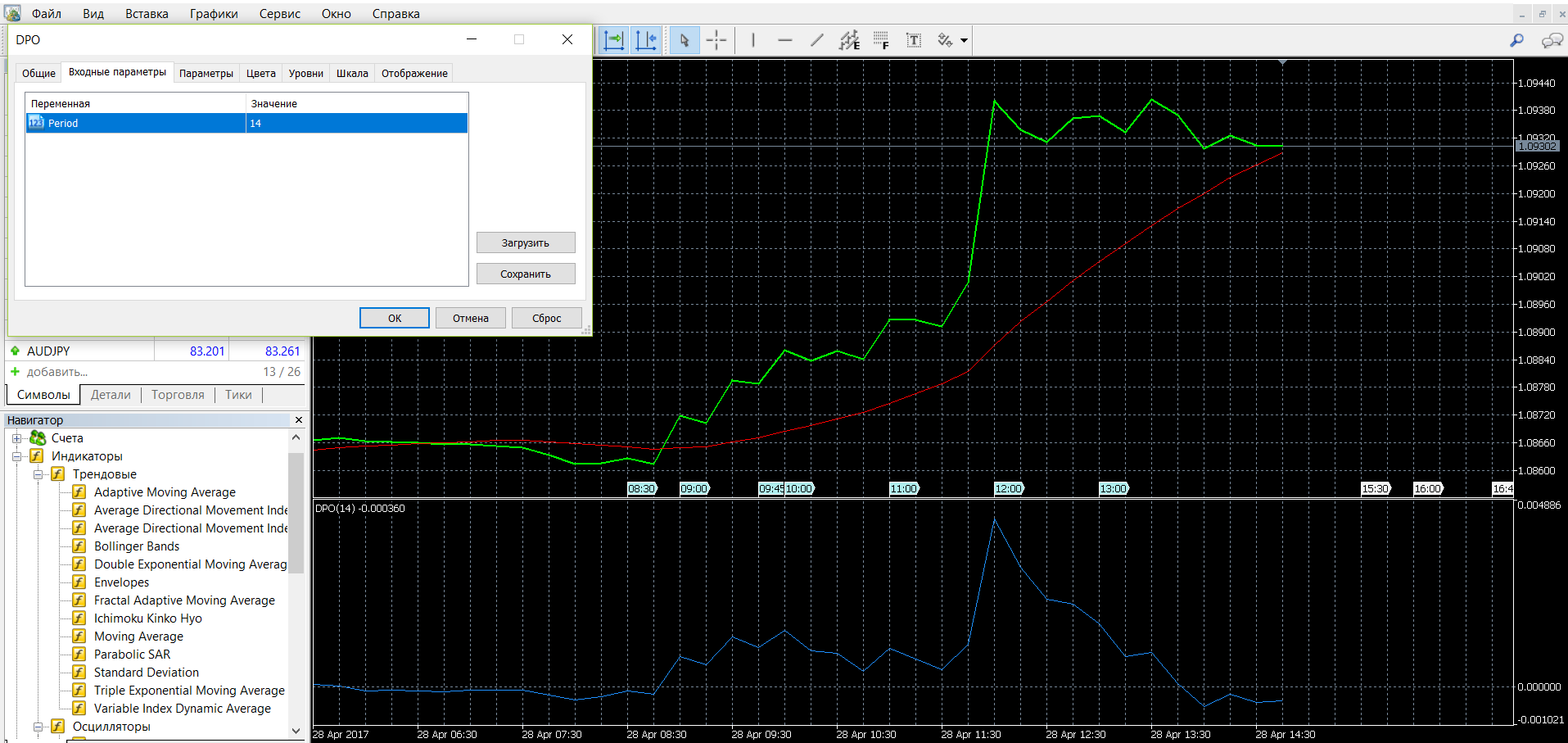

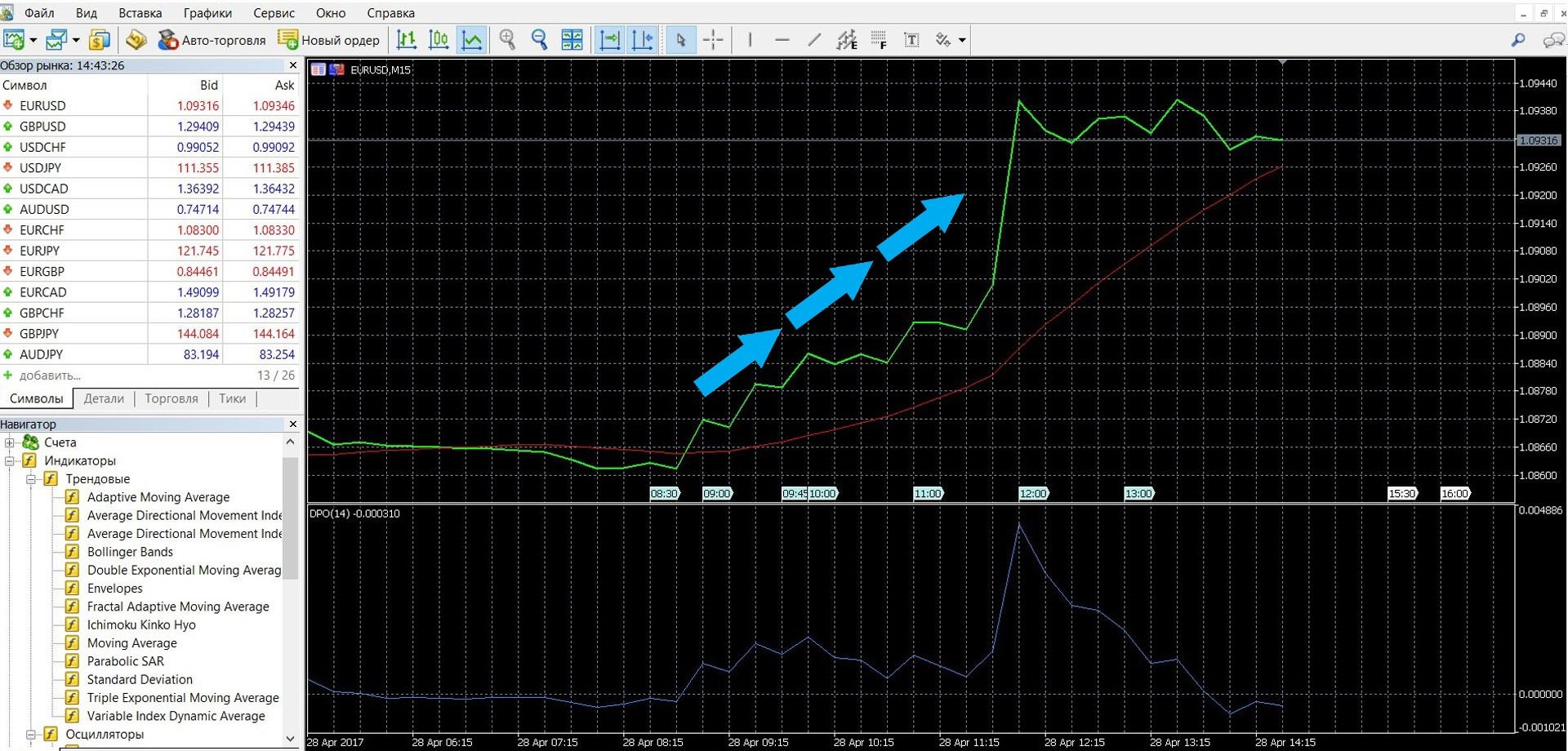

DPO has simple functionality and easy settings, displayed in a separate window under the price chart in the form of a curve. You can see how the indicator looks on the MetaTrader 4 (MT4) platform in the image below.

You can also download the MetaTrader 4 platform and work with the oscillator.

What is the working principle of the DPO oscillator

As you know, market cycles consist of short-term cycles that cannot be ignored in trading. The use of such brief price impulses helps to see the reversal points of long-term cycles and trends. The Detrend Price Oscillator makes it easier to analyze cycles and market dynamics. The main advantage of the DPO indicator compared to other instruments is that it shows more reliable data on short-term price changes in the market.

That is, the bidder will compare favorably with other traders in that he will be able to have accurate information about the minimum price fluctuations and will be able to work effectively with short-term options. Repeating price fluctuations, the oscillator curve is calculated with an offset by a period. The data is built around the zero level, touching the positive and negative zones, signaling the rise and fall of the market.

We can say that this is an analogue of a trend tool, but only without clear entry points. The oscillator filters trends and helps to focus on the main cycles of price dynamics: the moving average becomes a straight line, price changes and their position (below-above the moving average) become a price oscillator.

To calculate the oscillator, the following formula is used:

DPO = close – (Moving Average “(N/2 + 1)” days ago), where:

close – closing price

Moving Average – moving average

N is the period of the cycle.

Trading signals

The DPO signals overbought-oversold and buy-sell.

Pivot points of long-term cycles:

High trough on the chart, then you should wait for the price reversal upwards.

If the peak is lower than the previous one, then prices will fall.

There are two interpretations of buy and sell signals.

A buy signal when

1. The detrend price oscillator crosses the zero line upwards.

2. The detrend price oscillator is in the oversold area confirmed by the previous lows. And there is a breakout of the upper line of the corridor and the Detrend price oscillator and the price limiting the downward price movement.

A sell signal when

1. The detrend price oscillator crosses the zero line downwards.

2. The detrend price oscillator is in the overbought area confirmed by the previous highs. And the DPO and the price break through the support line of the uptrend.

Info taken from enc.fxeuroclub.ru website

Do you need to install a DPO oscillator in your platform?

The oscillator is integrated into most platforms for traders, including the MetaTrader 4 platform, and is widely used by trading participants who prefer an automated trading process.

To add this oscillator to the main price chart in the MetaTrader 4 platform, you need to perform the following steps:

1. Click the “Insert” tab in the top menu of the platform.

2. Select the “Indicators” tab.

3. In the drop-down menu, select the “Custom” tab.

4. In the drop-down menu, select DPO.

5. In the active window, do not change the parameters of the “Period” value.

6. The schedule is formed, you can work with the material.

Standard settings of the DPO oscillator:

MAPeriod Moving Average: 14

To smooth the indicator, increase the period.

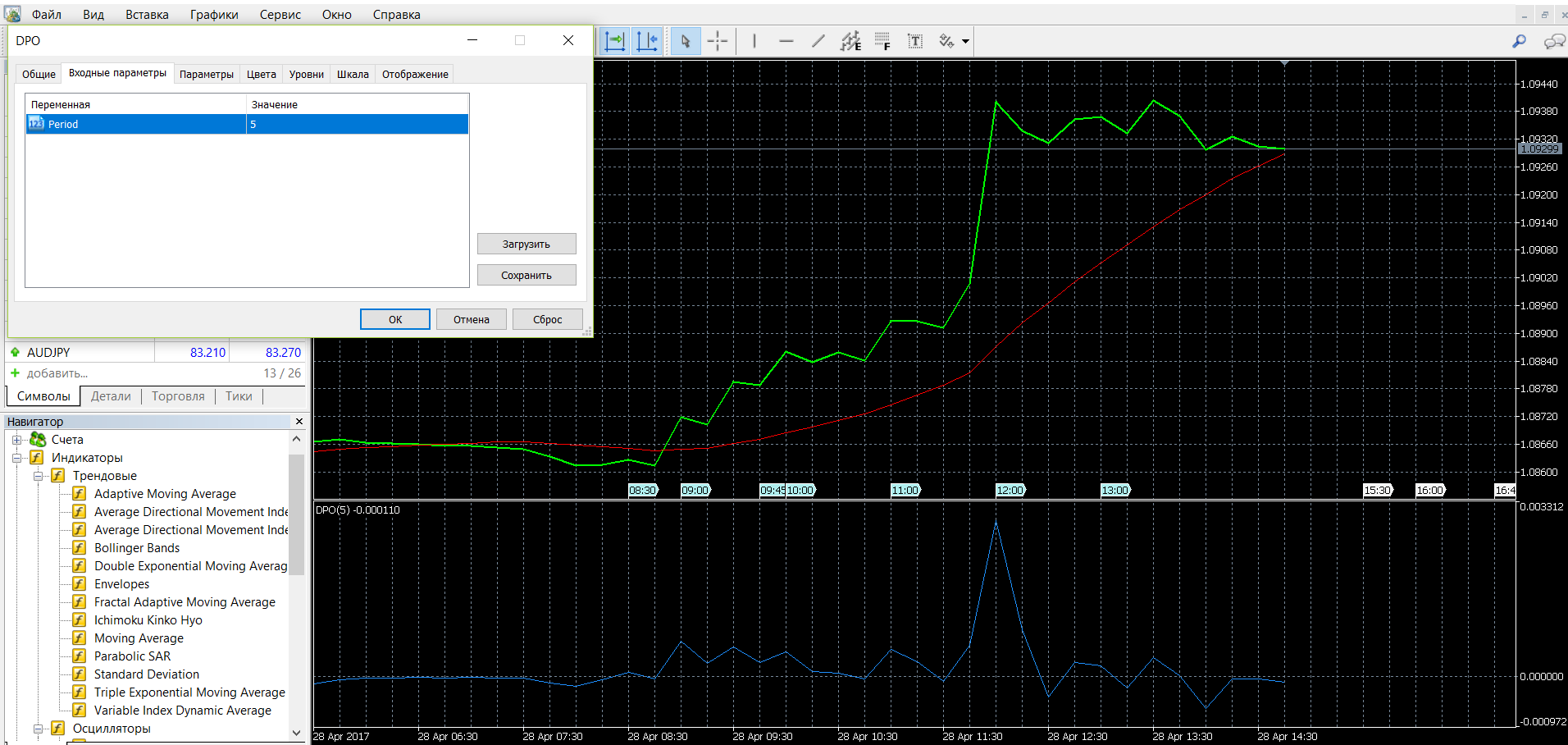

To see short-term signals and a sharp reaction to market dynamics, reduce the period.

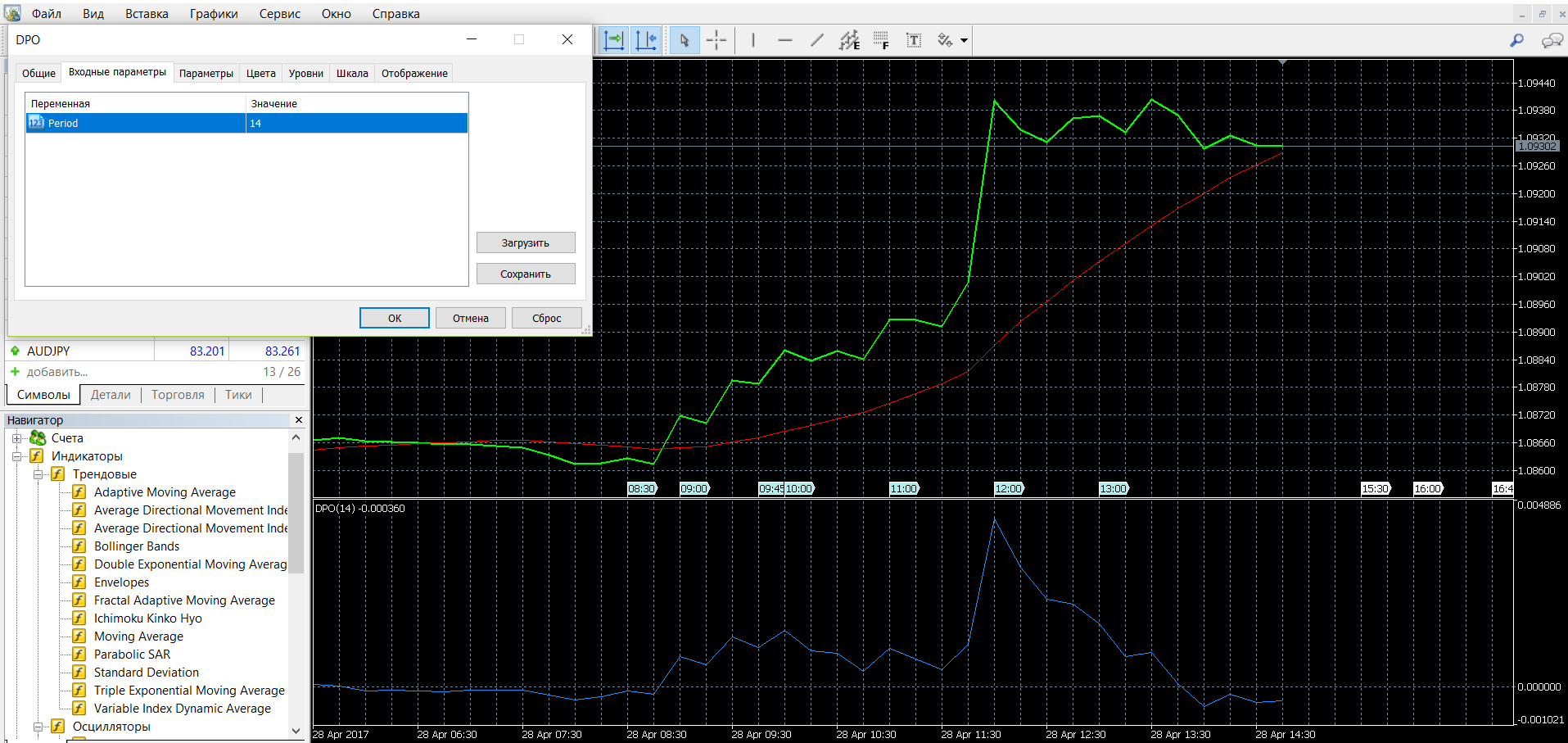

Working with the oscillator settings, you can adjust them to your goals every time. By changing the parameters, you will get a curve of varying degrees of smoothness, as can be seen in the images below:

BarstoCount (bars): 400

The last 400 bars are used for calculations. This number gives the smoothness of the line, all short price fluctuations are displayed.

To increase the accuracy of the signal, you need to reduce the indicator. In this case, remember that in this case you risk missing the main pivot points. That is why traders use the oscillator as an auxiliary, combining it with other instruments.

If your platform doesn’t have a DPO indicator, you can download it here.

Application of the indicator for binary options

1. The value of the DPO oscillator for binary options is large. The information it will give you will help you achieve more in trading. It is recommended to use it in order to see brief price impulses and, accordingly, the development of trends and long-term impulses.

2. Use oscillators to the fullest – this will give you a good income. Work with the DPO settings, see how the schedule will change when you change the standard settings to others. Adjust the capabilities of the indicator to your goals: to feel and see the dynamics of the market, to understand how trends are formed.

4. Use for trading binary options those indicators that will make the process easier and more efficient. The purpose of these tools is to give you the opportunity to control the situation on the market, see its dynamics as early as possible, and draw the right conclusions.

Rules for concluding transactions (screenshots)

Trading with a signal for a rise and fall in prices

In the images below, you can see what the upward trend of the market looks like on the MetaTrader 4 platform:

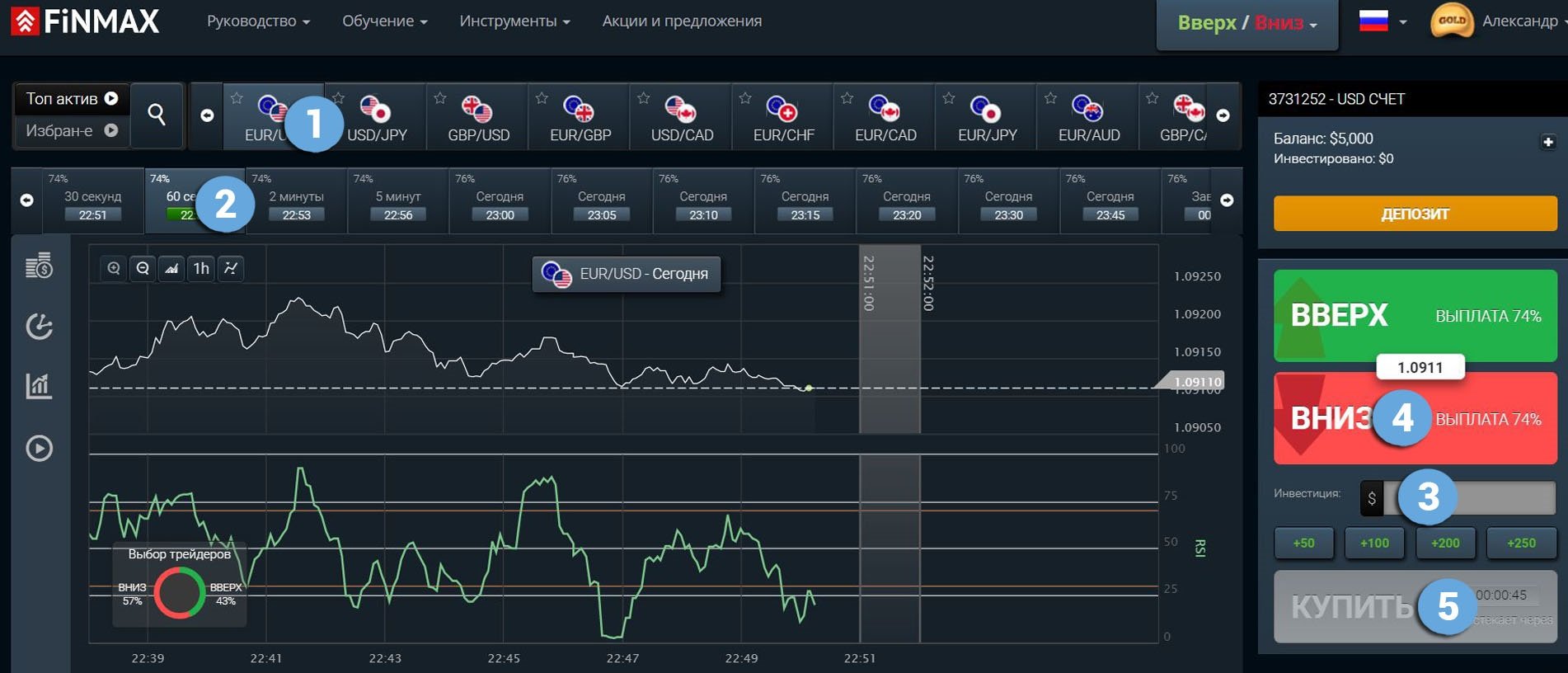

You can take advantage of the uptrend opportunities in price and place a CALL (up) rate with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and take the following steps:

Prepare the option data, for this we indicate:

1. Type of asset

2. Validity of the option

3. Bet size

4. Forecast for the movement of the quote: UP

5. Click the “buy” button and monitor the results of the movement of currencies on the chart.

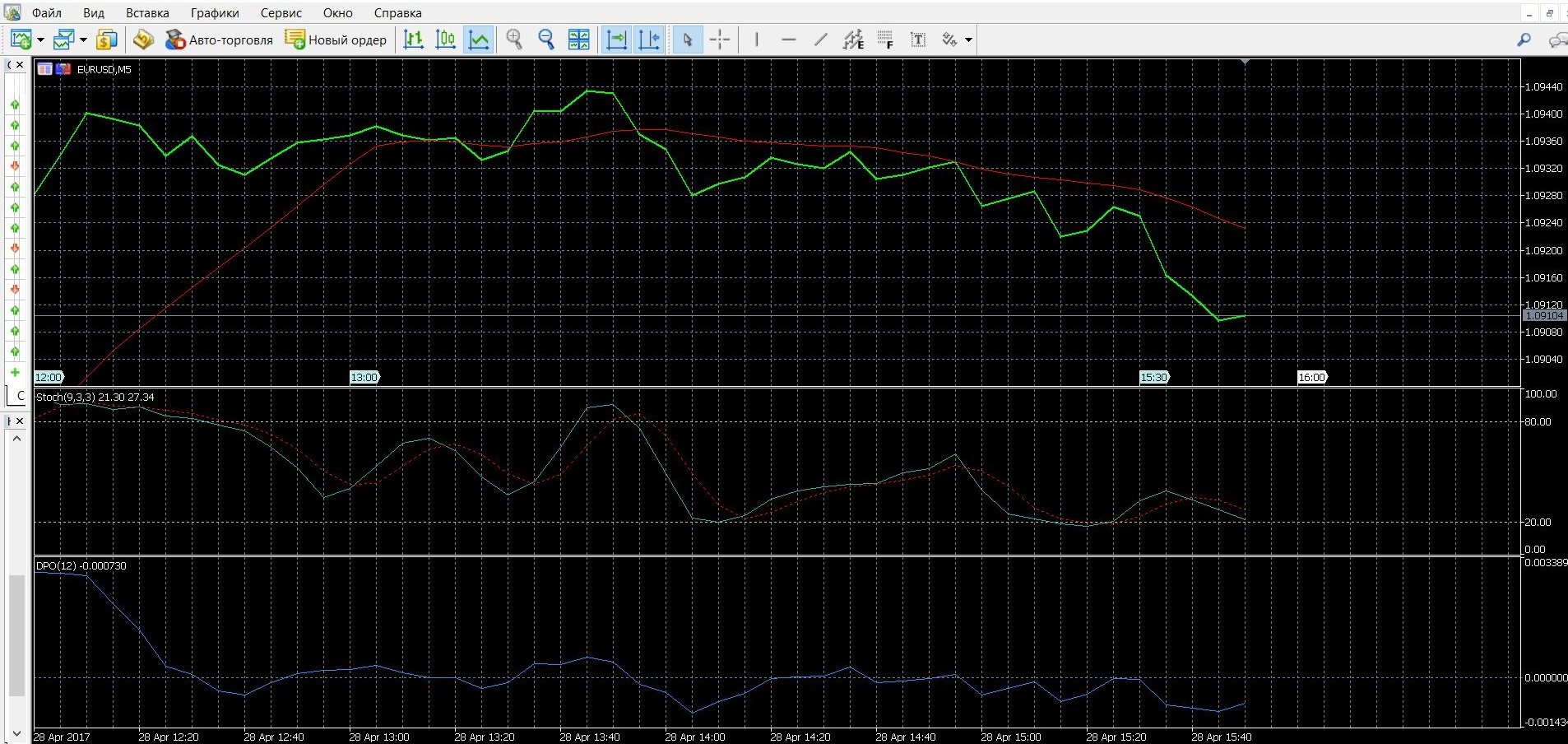

In the images below, you can see what the downward trend of the market looks like on the MetaTrader 4 platform:

You can take advantage of the downward trend in price and place a PUT (down) rate with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and take the following steps:

Prepare the option data, for this we indicate:

1. Type of asset

2. Validity of the option

3. Bet size

4. Forecast for the movement of the quote: DOWN

5. Click the “buy” button and monitor the results of the movement of currencies on the chart.

Trading with an overbought-oversold signal

We also recommend using the indicator to buy binary options in cases where it falls into the overbought-oversold zones:

If the indicator line is located above the 80 mark, then moves to the range between 20 and 80, this is a signal to buy a put option:

You can take advantage of the downward trend in price and place a PUT (down) rate with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and take the following steps:

Prepare the option data, for this we indicate:

1. Type of asset

2. Validity of the option

3. Bet size

4. Forecast for the movement of the quote: DOWN

5. Click the “buy” button and monitor the results of the movement of currencies on the chart.

To buy a call option , the signal is mirrored opposite (the line is below the 20 mark, then moves to the range of 20-80):

You can take advantage of the uptrend opportunities in price and place a CALL (up) rate with the Finmax broker. To do this, you need to go to the broker’s website finmaxbo.com and follow these steps:

Prepare the option data, for this we indicate:

1. Type of asset

2. Validity of the option

3. Bet size

4. Forecast for the movement of the quote: UP

5. Click the “buy” button and monitor the results of the movement of currencies on the chart.

Money management

The DPO oscillator, thanks to its capabilities, will become your reliable assistant in binary options trading. And yet, remember the rules of money management, which will make your work safe and effective:

1. Start trading with a low

The minimum amount for the transaction and the minimum deposit amount in your account. Learn to manage your capital carefully, not to risk the entire amount of funds at once. So, in case of a possible failure in trading, you can continue to trade.

2. Distribute the deposit wisely

Trading in one transaction should not exceed 5% of the deposit amount and no more than 15% of the deposit of all your transactions at the same time. You should not bet all your funds on one trade, otherwise you risk being left with an empty account. Work with a minimum budget, in case of possible failure, you will have money to continue working and succeed.

3. Optimize your asset management

Use a reasonable amount of assets to trade, especially if you are a beginner. The market is dynamic, only a professional can keep track of the movement of a large number of different assets. Start work calmly and soberly assess the situation, so you will save money in your account. When trading binary options, do not rush. As soon as you feel that you have enough experience, you can gradually expand your investment portfolio, work with new assets.

4. Control yourself

Remember the “rule of three”, do not allow large losses, do not try to recoup and keep the situation under control. Emotions are what start to get in the way when you are completely committed to the process.

Only three failed trades and the player begins to lose control and tries to return the losses as soon as possible. Or another situation: three successful deals, and the player is inspired by success, loses concentration and attention. Learn to tell yourself to stop after three trades, save money. While trading, try to keep an even emotional background, this will save your money.

When you start trading, remember these rules and achieve the highest result!

Expiration

In binary options trading, the term “expiration” means the expiration date of the transaction. When buying an option, you must specify the time after which you want to close the transaction, this is the expiration time. You can choose any time that is allowed by your broker – from 30 seconds to several months. Your trade will close at the time you specify.

The importance of expiration should not be underestimated – the result of your transaction depends on it. Expiration dates affect profits and risks. The expiration dates are different: these are ultra-short (from 30 seconds) and periods of a month or more. The longer the expiration, the greater the profitability.

Expiration rules:

1. If there are doubts about the choice of the end time of your transaction, indicate a long term. This will allow you to see the full picture of the market, analyze trends.

2. If you prefer risk, try intraday (several hours a day) or short-term (minutes) trading. Such trades are chosen by beginners, as you can increase your income in a minute, but the behavior of the market in this case is unpredictable.

3. If you decide on short-term trading, remember that in many ways this is a game of roulette, a coincidence. There is a lot of noise on small timings, the situation is unpredictable. It is impossible to give an accurate forecast of how the market will behave, the analysis of macroeconomic indicators will not help.

Is it possible to change the expiration?

You can, in the following situations:

1. If, while participating in the auction, you begin to realize that you will not achieve the desired result, the broker can close the transaction ahead of schedule.

2. If, while participating in the auction, you are not sure about the term of the option, you can extend its term by paying the required amount to the broker.

Downloads

MetaTrader 4 (MT4) platform – download

DPO Oscillator for MT4 platform – download