Trying your hand at trading, you study binary options oscillators, test profitable strategies and other tools that will help you achieve more in trading. To ensure that the materials you need are always there, we publish detailed reviews of indicators on the INVESTMAGNATES.COM portal. You can learn the features of the instruments, the rules of trading with them and a lot of useful information. In today’s publication, we will talk about the Keltner Channel indicator.

The Keltner Channel indicator is one of the simplest and most effective binary options tools, developed in 1960 by trader C. Keltner. For the first time, the author mentions the indicator in the book “How to make money on the stock exchange”. This oscillator is ideal for working in options, where it has long been popular due to its simple and understandable operation. The market volatility of a particular price channel is the main element of the Keltner Channel, which allows for a qualitative analysis of the current state of the market. The advantage of the tool is that it indicates trends and sideways movements. On the website This is a scam, you can find an overview of the MFI trading strategy in the Keltner Channel (https://eto-razvod.ru/blog/strategy/mfi-keltner-channel/).

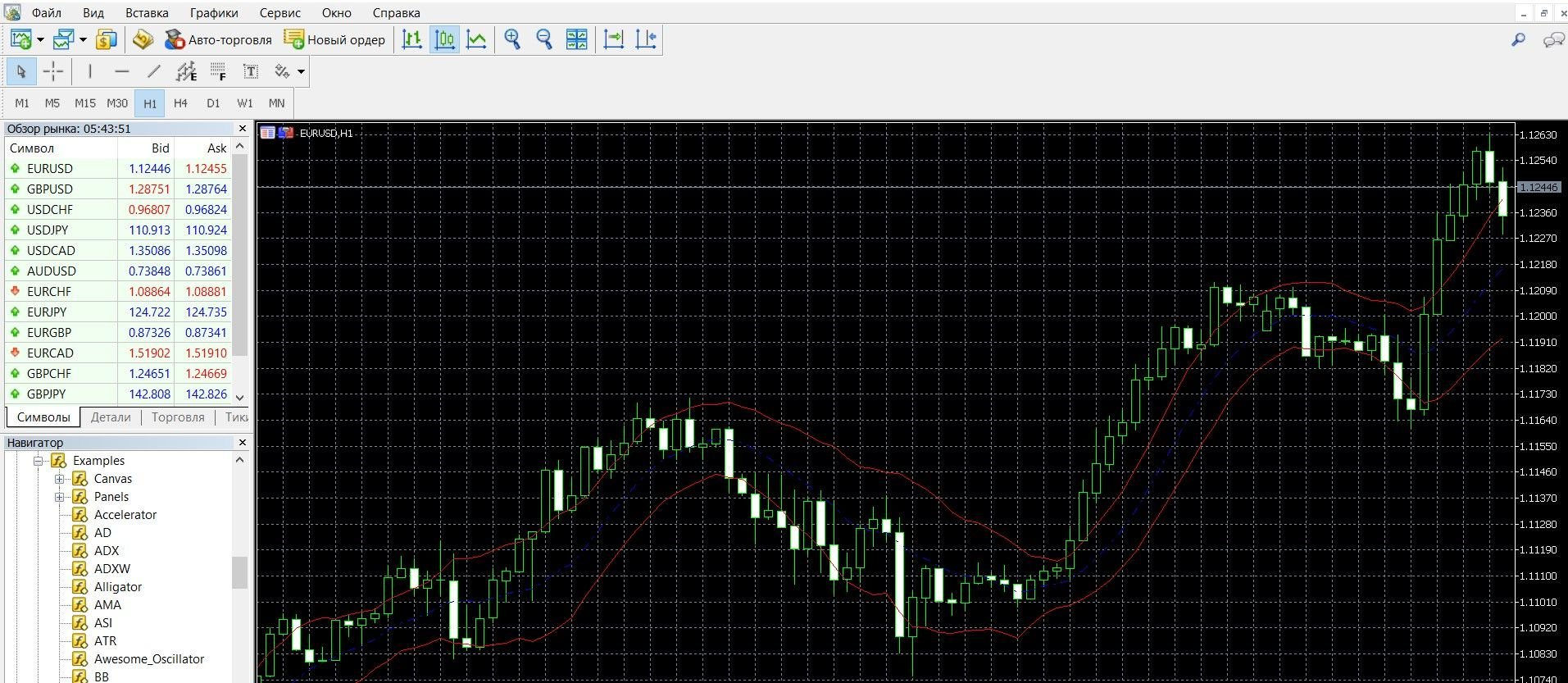

Working with the oscillator, traders make decisions based on the data of three moving averages, which are lined up at the maximum, minimum and closing price. The Keltner Channel is very similar to the Bollinger Bands and Envelopes (Envelopes indicator) in that the average is calculated for extremes. Mastering the work with it will not be difficult for beginners in trading. You can see how the Keltner Channel visually looks on the MetaTrader 4 (mt4) platform in the image below. You can also download the MetaTrader 4 platform and get acquainted with this tool in more detail.

What is the working principle of the Keltner indicator?

The Keltner channel is a powerful but very simple tool for work. With its help, you can accurately determine the moments when there is a trend or flat state in the market, it signals quite qualitatively about profitable moments to enter the market. Among the advantages of the Keltner indicator are: simplicity and ease of operation, increased sensitivity to price dynamics, a small percentage of false signals (unlike, for example, Bollinger Bands). The Keltner channel is the price envelopes or bands above or below the EMA(10). It uses three chart lines formed around the price chart. The middle line is a 10-day simple moving average based on typical prices (high + low + close)/3), around which the following are formed:

- the line located at the top of the middle (the upper border of the channel);

- located at the bottom of the middle (lower border of the channel).

These lines, the so-called channels, are obtained by adding and subtracting the moving average of the daily price range (the difference between the High and Low) from the middle line. The channels are very interesting, because. They are based on two successfully connected oscillators: the exponential moving average and the ATR. The average line is formed from the moving average (period 20, sometimes 10). In the formation of the upper and lower boundaries, the difference between the readings of the minimum and maximum prices for a specific time is applied.

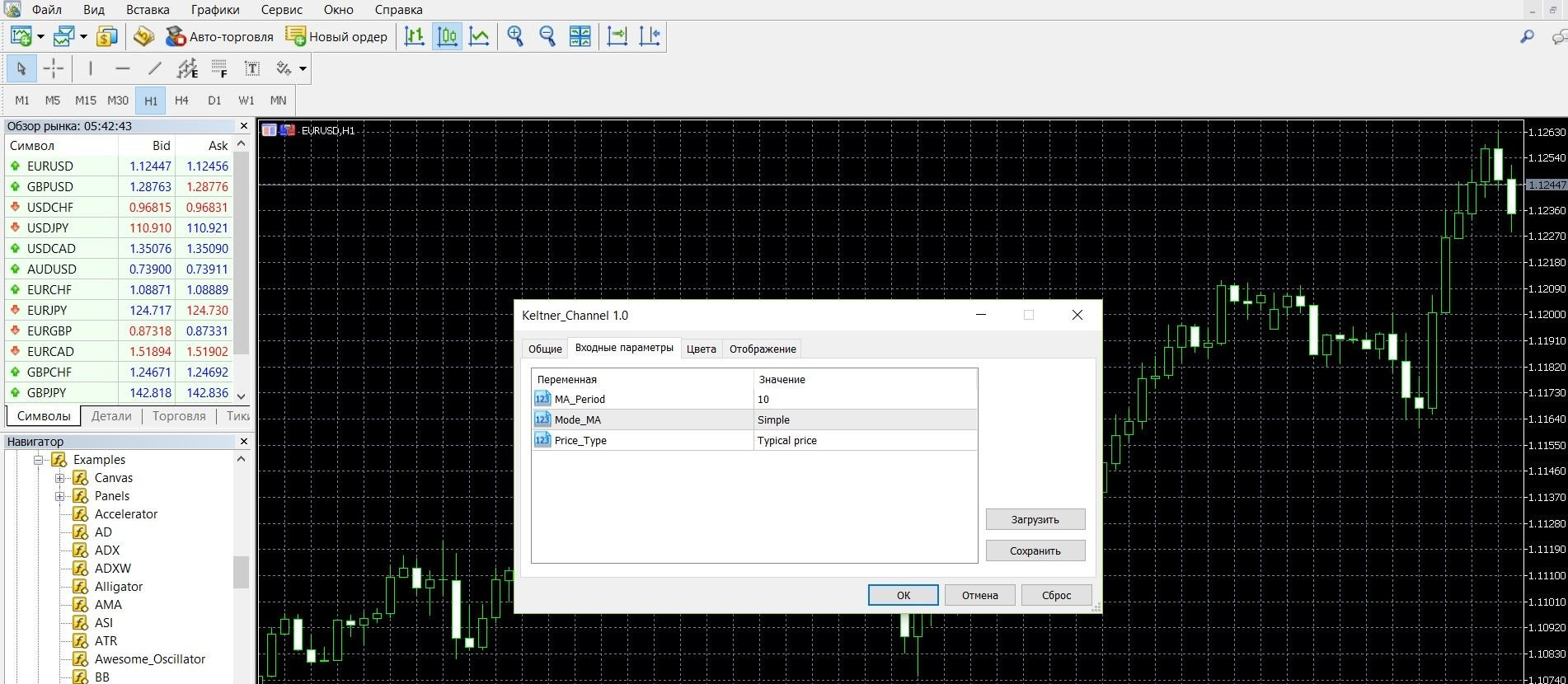

Input parameters of the indicator:

- MA_Period (default = 10) is the period of the moving average (average line).

- Mode_MA (default = MODE_SMA) is a type of moving average (average line).

- Price_Type (default = PRICE_TYPICAL) is the type of prices for the moving average (average line).

Emerging buy or sell signals generate prices that first move inside the channel and then go beyond it. A better moment to enter the market will be a situation where the candlestick that formed the signal completely blocks the upper or lower border of the Keltner Channel with its body, so you will avoid false signals.

Calculation formula:

KC Middle = MA(Price, n, Type).

KC Upper = KC Middle + MA(ATR, n, Type) * Dev.

KC Lower = KC Middle – MA(ATR, n, Type) * Dev, where

Price — the price of the current period (when opening, closing, etc.);

ATR is the true range;

Dev is the rejection multiplier.

Signals of the Keltner Channels indicator:

Trading in flat moments:

- When the price has approached or crossed the upper line of the channel, there is a signal to buy a call option.

- When the price has approached or crossed the lower line of the channel, there is a signal to buy a PUT option.

Trading in trend:

- When the price has broken through the upper level of the channel, there is a signal to buy a call option.

- When the price has broken through the lower line, there is a signal to buy a put option.

Do I need to install the Keltner indicator in your platform?

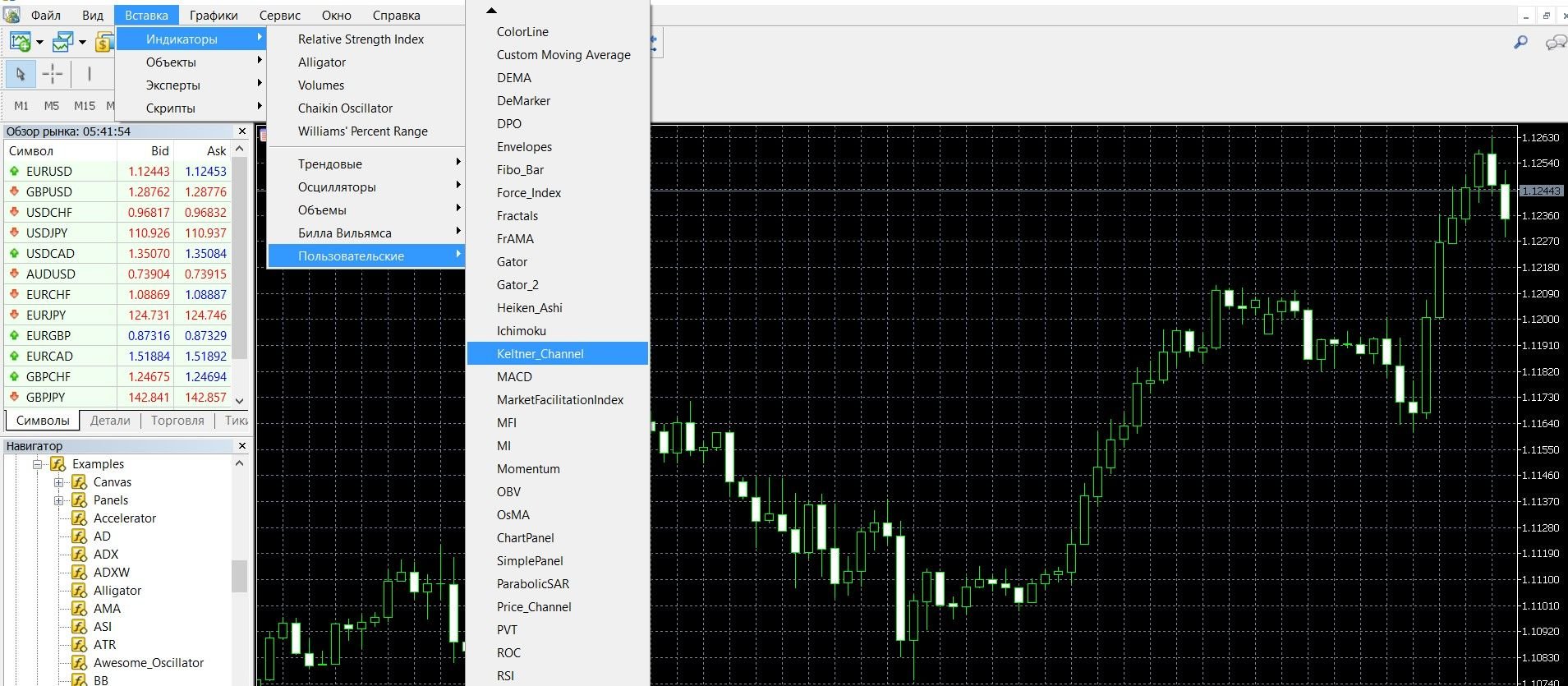

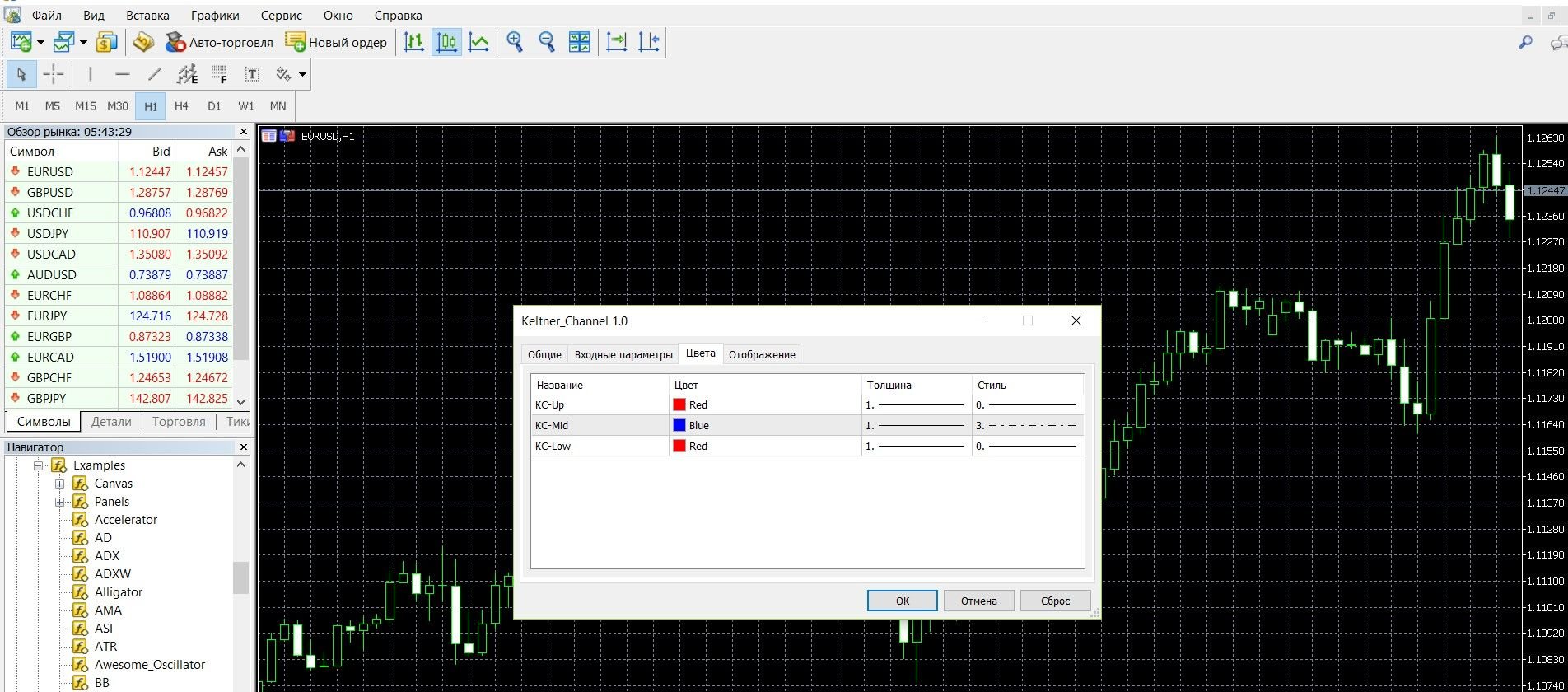

The Keltner Channel is a non-classical tool for analyzing the market situation, it is not in the toolbox of the MetaTrader 4 platform.To start working with it, you need to install it in MT4 by downloading it for free here. You can read how to install the downloaded file in MetaTrader 4 here. After installing the indicator, add it to the price chart, take the following steps:

- Click on the “Insert” tab in the top menu of the platform.

- Select the tab “Indicators” – “Custom” – “Keltner Channel”. The indicator has been added to the chart, you can start working with it.

The following indicator settings are available to you:

Period – that is, the number of candles with which the construction takes place (this can be any value, but 10 or 13 are used for classical technical analysis). As the period increases, the oscillator will give more accurate signals. By decreasing this parameter, the indicator will produce fewer market fluctuations, but false signals will appear. Moving average type – you can choose SMA and EMA, which often depends on your strategy. Construction prices: you can use a typical price and different price options.

Application of the indicator for binary options

In binary options trading, most reliable trading systems are based on trend entry, because Buying options at strong highs and lows is a profitable investment. Such an indicator that allows you to get accurate and high-quality buy signals at trend moments is the Keltner Channel. In this case, the lines will perform the function of support and resistance, their breakout is a reliable signal of the great strength of the trend.

Using the signals of the instrument, you can trade with the trend and in a flat. The difference between Keltner Channels and other indicators is that its signals are much better, it shows more pronounced trends and gives fewer false signals. As mentioned above, the author of the indicator is C. Keltner, later it was modified by trader Linda Bradford Raschke, supplementing the tool with the ability to analyze a large amount of data. Due to its work, the indicator uses the exponential moving average as the average line and ATR (Average True Range) as the channel boundary settings.

So, EMA determines the direction of the channel, and ATR determines its width. It is this version of the indicator that is used today in trading. The Keltner Channel trend indicator resembles technical indicators such as “Bollinger Bands”, “Donchian Channel“, “Silver Channel”, which also take into account the values of price extremes. The trading strategy for binary options based on the Keltner Channel indicator is very simple. Nevertheless, it is recommended to use additional indicators to confirm market entry signals and correctly determine the market phase. The Keltner Channel is based on moving averages, which are considered lagging indicators, which means that the Channel itself will lag behind, so it is not recommended to use it alone.

Rules for concluding transactions (screenshots)

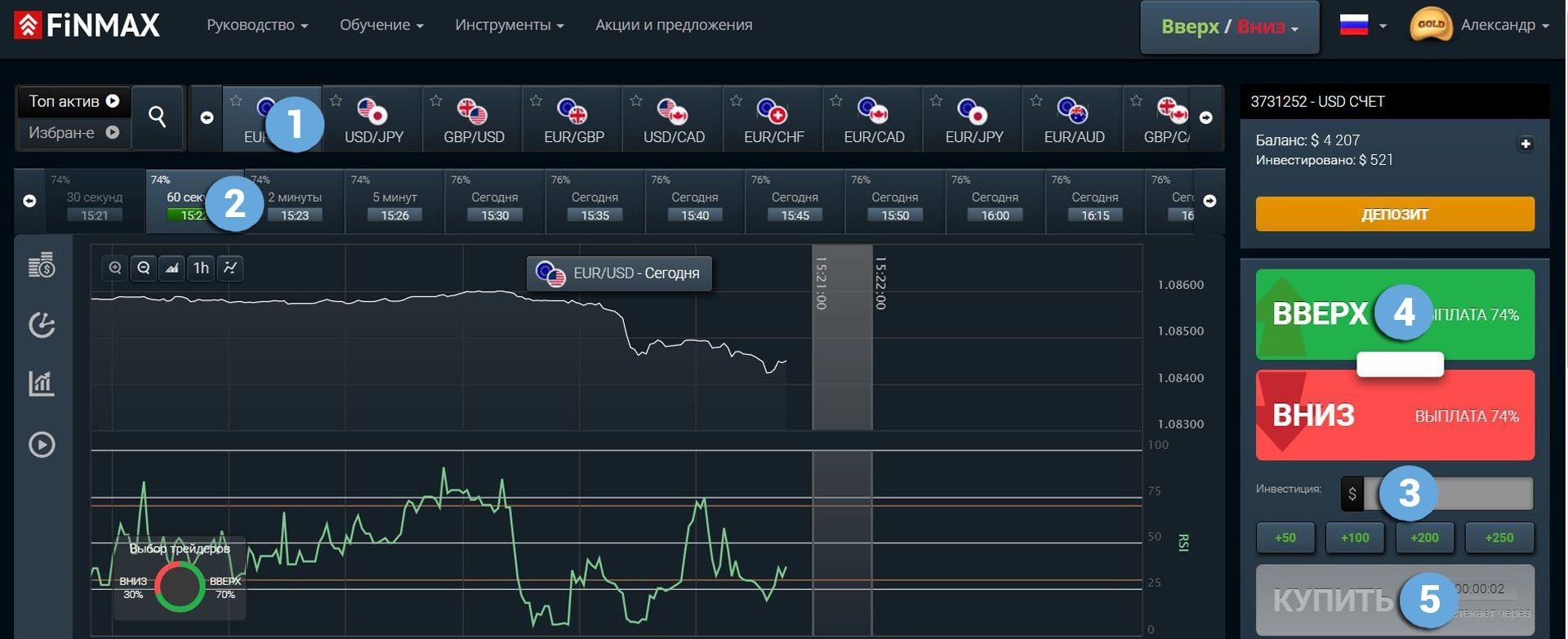

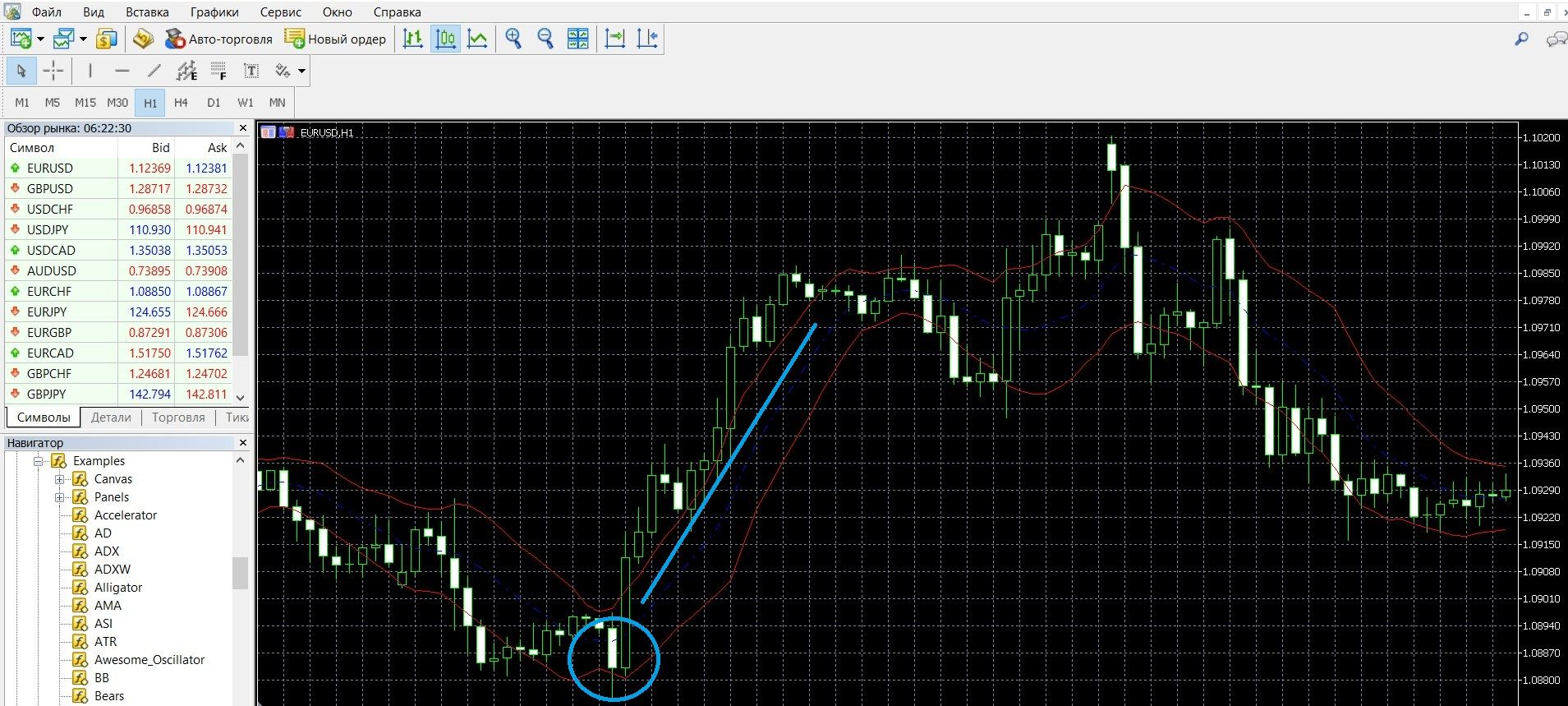

Trading when there is a trend signal

When the price has broken through the upper level of the Keltner Channel, this is an uptrend, a signal to buy a call option. In the image below, you can observe the upward trend of the market on the MetaTrader 4 platform:

Take advantage of the uptrend opportunities and place a CALL (up) rate with the Finmax broker. To do this, go to the broker’s website finmaxbo.com and prepare an option, indicating:

- Option.

- Expiration.

- The amount of the bet.

- Movement forecast: UP.

- Click the “buy” button and wait for the results.

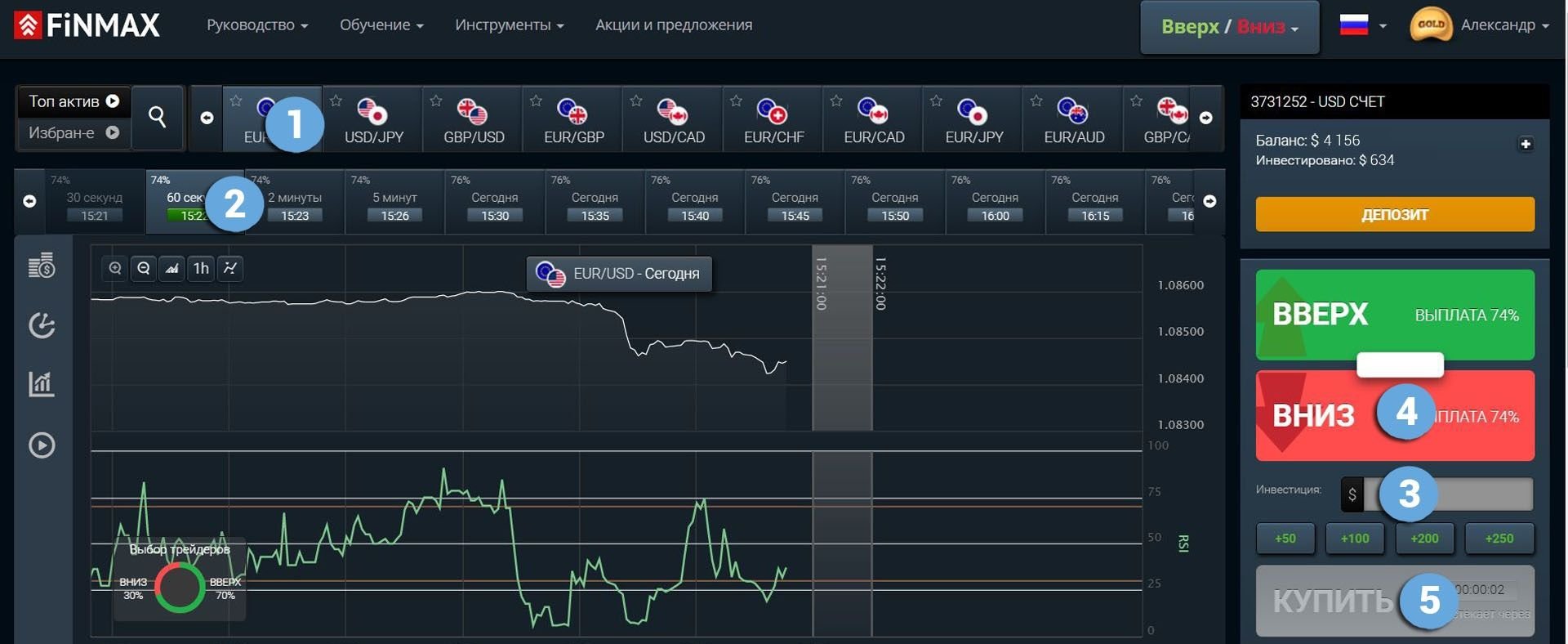

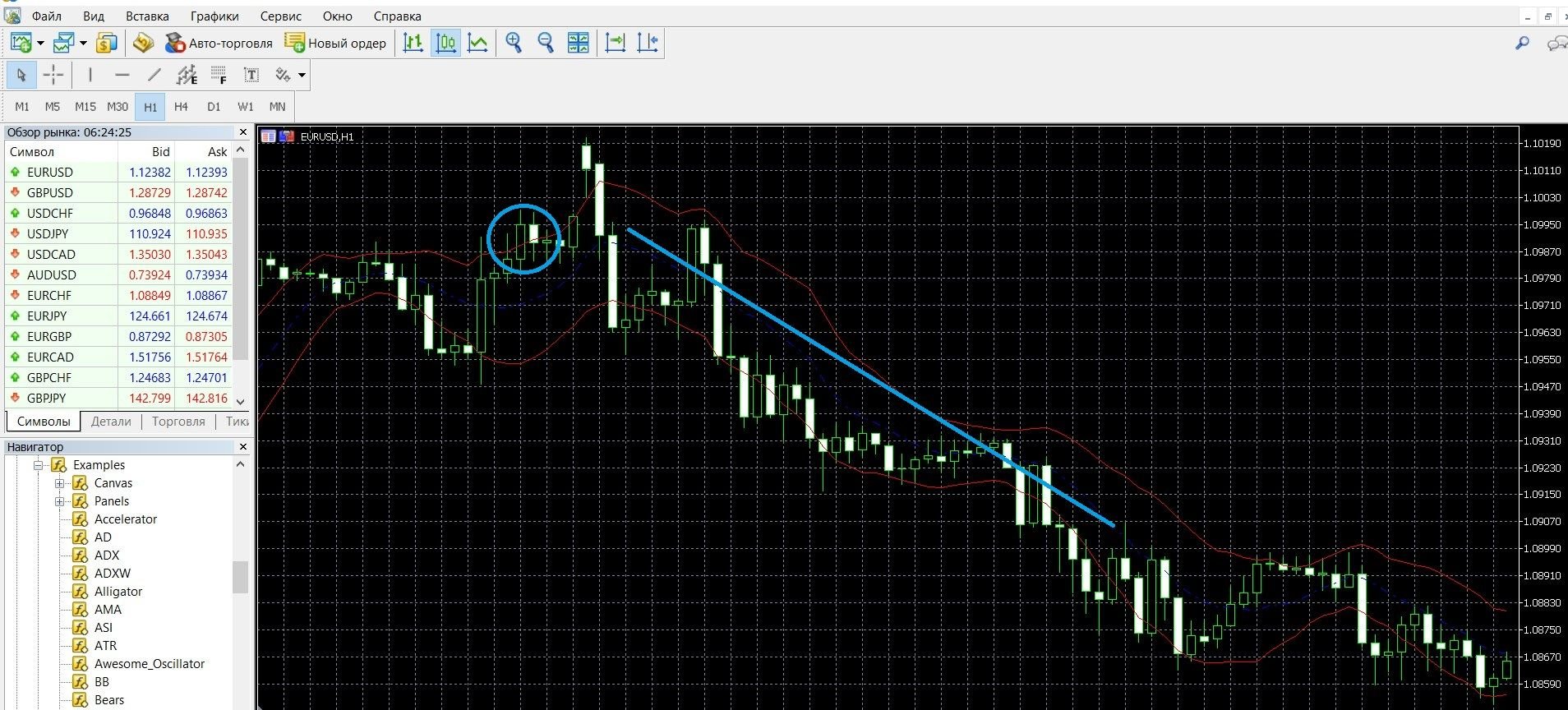

When the price has broken through the lower line of the Keltner indicator, it is a downtrend, a signal to buy a put option. In the image below, you can observe the downward trend of the market on the MetaTrader 4 platform:

Take advantage of the downtrend opportunities of the price and make a PUT rate (down) with a reliable broker Finmax. To do this, go to the broker’s website finmaxbo.com and prepare an option, indicating:

- Option.

- Expiration.

- The amount of the bet.

- Movement forecast: DOWN.

- Click the “buy” button and wait for the results.

Trading in flat moments

When the price has approached or crossed the upper line of the Keltner Channel, there is a signal to buy a call option. In the image below, you can observe the upward trend of the market on the MetaTrader 4 platform (you can buy a CALL option on the broker’s website finmaxbo.com, the instructions are listed above):

When the price has approached or crossed the lower line of the Keltner Channel, there is a signal to buy a PUT option. In the image below, you can observe the downward trend of the market on the MetaTrader 4 platform (you can buy a PCI option on the broker’s website finmaxbo.com, the instructions are listed above):

Money management

It is generally accepted that professional traders who already have trading experience and, moving to a new level of working with options, are interested in how to get a stable income can use the basics of management. And yet, the sooner you begin to learn and implement the basics of money management, the faster your work will become effective. The concept of money management means an effectively built strategy for managing personal capital. This concept helps to solve the issues of conscious use of the deposit, as a result of which you can not only save money in the account, but also increase their number. If you want more from trading, follow the rules of money management:

- Trading with a minimum of money: it is recommended to spend a minimum of funds on trading; bet on options no more than 5% of the funds on the deposit; participate in options, the value of which is less than your funds; Work with a broker who will guarantee you a decent income. Follow these guidelines and you will be able to save your capital.

- Trading with a minimum deposit: it is recommended to work with the minimum possible deposit; do not bet all your funds on trading one option; you may still need your funds to recoup; Work with the deposit thoughtfully, to do this, allocate a free limit of funds that are permissible to trade and do not go beyond it. Follow these guidelines and you will save your capital.

- Trading with a minimum number of assets: recommended especially for beginners in trading, try your hand at 2-3 assets, and then gradually complicate the amount of work. Follow these guidelines and you’ll be productive.

- Trading without emotions: it is recommended to start working in the market with the right attitude; it is the mood that decides a lot – both success and your attitude to trading; Unnecessary emotions will interfere with concentration and make the right decision. Follow these guidelines and you’ll get the most out of your trading.

Expiration

Like money management, this is one of the leading concepts of trading. Expiration is the moment when the option expires and market participants find out the results of trading and understand whether the deposit will be replenished with funds. Properly built expiration affects the effectiveness of the strategy. If you are thinking about getting a stable income, consciously approach the choice of expiration.

Types of options:

- Ultra-short options – 60 seconds – 5 minutes.

- Short-term options – 15 minutes – several hours

- Medium-term options – from 6 hours – a day

- Long-term options – a day – several months.

Is it possible to extend the expiration of options?

You can extend the expiration if you realize during trading that you have indicated an incorrect forecast. Not every broker allows you to extend the expiration, remember this.

Expiration rules:

- If you are new to binary options, try to use a long expiration, which will reduce the risks of trading.

- If you are a trading professional with good trading experience, try to work with expiration that will be convenient for you. Choose brokers that allow you to increase expiration during trading, which will reduce your losses in case of an incorrect forecast.

- If you want to earn quick money, use a short-term (a minute – a few hours) expiration, which will give income in a minute. Remember the unpredictability of such express expirations.

- If you want to receive a stable income from trading, take advantage of long-term expiration, which will bring you a stable profit.

Expiration in Keltner Channel Strategies

Trading when there is a trend signal

Short-term trading: from 5 minutes to 30 minutes; It is not recommended when working with this indicator, because. It’s easy to confuse signals with false data.

Medium-term expiration: from 1 hour to several hours; Recommended; It is easier and more efficient to catch signals on long time intervals.

Long-term expiration: allowed; It will allow you to see high-quality signals to enter a trade and achieve a good profit.

Trading with a flat signal:

Short-term trading: from 5 minutes to 30 minutes; It is not recommended when working with this indicator, because. You can confuse signals with false data.

Medium-term expiration: from 1 hour to several hours; Recommended; You will be able to see high-quality signals and earn good profits.

Long-term expiration: allowed; It will allow you to see high-quality signals to enter a trade and achieve good results.

Keltner Channel + ADX Strategy

One of the simple and popular strategies based on the Keltner Channel, which also uses the ADX indicator as a false signal filter. Market entry signals: the price should break through the upper Keltner band from bottom to top, enter the opening of the next candle; the main ADX line is above the level of 25, +D above -D, it is desirable that the ADX line goes up, this gives strength to the signal:

Short-term trading: from 5 minutes to 30 minutes; It is allowed in this strategy, because. a reliable false signal filter is used; It is worth remembering the unpredictability of such an expiration.

Medium-term expiration: from 1 hour to several hours; Allowed; You will be able to see more than one high-quality signal and earn a decent income.

Long-term expiration: also allowed; It will allow you to see high-quality signals to enter a trade and achieve good results.

Scalping strategy “Keltner Channel + MA”

A simple but effective and profitable scalping-focused strategy that uses the Moving Average and Keltner Channel indicators. The strategy is very similar to the “Envelopes + MA” system. Buy signal: the moving 8 EMA should cross the upper line of the Keltner Channel from bottom to top when a candle is formed on which the intersection occurred) we make an entry into the market at the opening of the next candle

Short-term trading: from 5 minutes to 30 minutes; recommended in this scalping strategy, will give a good income; It is worth remembering the unpredictability of such an expiration.

Medium-term expiration: not allowed; With long expirations, it is difficult to work with such strategies and find high-quality signals.

Long-term expiration: not allowed; With long expirations, it is difficult to work with such strategies and find high-quality signals.

Scalping strategy “Double Keltner Channel”

A very interesting strategy, which, in combination with the Keltner Channel and Stochastic , gives good results.

Buy entry signal: the price should touch or break through the lower Keltner line, while at the same time the Stochastic indicator should be in the oversold zone, below level 20. Next, we wait for the price to rise above the lower Keltner line, and the signal candle becomes bullish and closes above the line; check the Stochastic value, and if its solid line %K crosses the dotted %D from bottom to top (or rises above level 20), we buy on the next candle.

Short-term trading: from 5 minutes to 30 minutes; recommended in this scalping strategy, will give a good income; It is worth remembering the unpredictability of such an expiration.

Medium-term expiration: not allowed; With long expirations, it is difficult to work with such strategies and find high-quality signals.

Long-term expiration: not allowed; With long expirations, it is difficult to work with such strategies and find high-quality signals.

Choose the expiration that is convenient for you, having studied in practice its options. To do this, we recommend using the platform of a reliable broker Finmax by going to the finmaxbo.com website. Among the advantages of the broker: work on a platform that meets modern trading trends, ample opportunities to use expiration (from 30 seconds to six months), a clear personal account, a set of tools for a trader.

Downloads

Tagged with: Binary Options Indicator