Ultimate Oscillator (UO)

Description

Today, there is more and more interest in trading, which offers the possibility of fairly easy earnings on the Internet. In addition, you can get your first income in as little as 30 seconds if you work with turbo trading. Despite the quick income from express options, traders try to go further, explore the possibilities of medium and long-term trading, pay attention to reliable tools, study indicators and new strategies to maximize income.

To make learning simple and comfortable for you, the Internet portal INVESTMAGNATES.COM offers you reviews of indicators, an up-to-date rating of brokers, news and much more. Today we will talk about the Final Oscillator.

The Ultimate Oscillator (UO) is a technical indicator of binary options, developed by the legendary trader and analyst Larry Williams in 1985.

This trading tool allows you to accurately determine the divergence and overbought-oversold signals by comparing the price indicator with the past prices of three periods. Despite the fact that it is less common in trading, in fact, it has its advantages and deserves attention from traders. Unlike other technical indicators, it is able to show the results of calculations of three candlestick periods at once, speaks of measuring market volatility, determining the lows and highs of the price.

Standard oscillators for comparison take a smoothed price indicator, as well as the value of past periods. Once L. Williams noticed that the effectiveness of the signal is influenced by how many periods the trader uses in his work. He decided to create an indicator showing the weighted indicator of three oscillators with different calculation periods.

The main idea of the tool was to minimize the impact of arbitrary selection of periods for which data is calculated. To reduce the impact of this choice of period indicators, three different periods are used at once: short, medium and long. Each such period gets its weight.

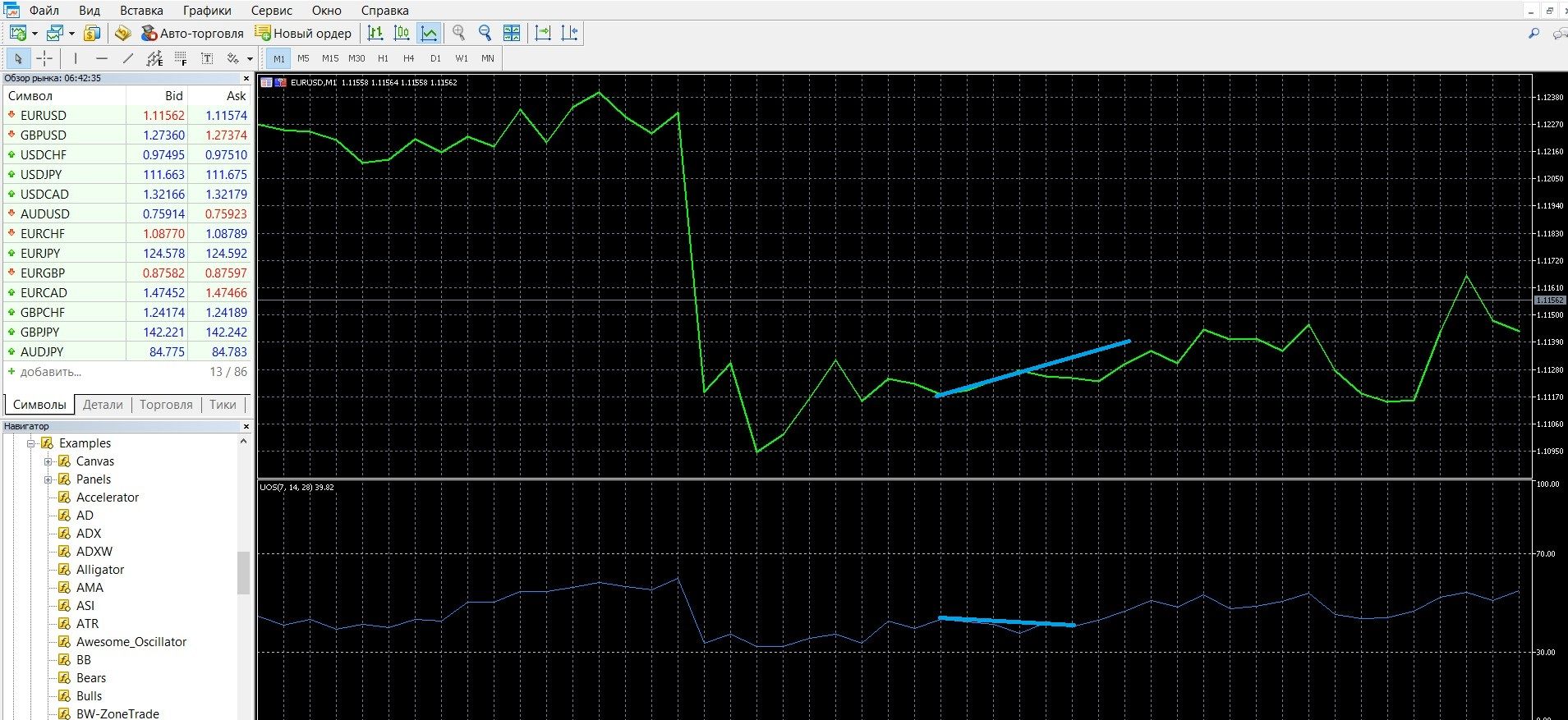

You can see how the UO oscillator is visually represented on the MetaTrader 4 (MT4) platform in the image below. You can also download the MetaTrader 4 platform and get acquainted with this tool in practice.

What is the working principle of the Ultimate Oscillator indicator?

The principle of operation of the oscillator lies in the comparison of the price indicator with the analysis of the values of the past three periods. The fact that it combines such information about the state of the market is its great advantage.

The results of the indicator are the calculation of the values of three different periods:

- fastperiod – fast,

- middleperiod – average,

- slowperiod – slow.

As a standard, this indicator in installations is: 7,14,28. Interestingly, all time periods overlap each other, including adjacent intervals, which allows even for the shortest time interval to use the calculation three times, which gives a good result in determining the state of the market.

The formula for calculating the UO indicator:

Determine the current “True Low” (TL). TL is the lowest of the current low or previous closing price.

TL (i) = MIN (LOW (i) || CLOSE (i – 1))

Calculate the current “Buying Pressure” (BP), which is equal to the difference between the current closing price and the current true low.

BP (i) = CLOSE (i) – TL (i)

Define a “true range” (True range, TR). This is the largest of the differences: the current high and low; the current high and the previous closing price; the previous closing price and the current low.

TR (i) = MAX (HIGH (i) – LOW (i) || HIGH (i) – CLOSE (i – 1) || CLOSE (i – 1) – LOW (i))

Calculate the sum of BP values for all three calculation periods:

BPSUM (N) = SUM (BP (i), i)

Calculate the sum of the TR values for all three calculation periods:

TRSUM (N) = SUM (TR (i), i)

Calculate the “raw value” of the Ultimate Oscillator (RawUO):

RawUO = 4 * (BPSUM (1) / TRSUM (1)) + 2 * (BPSUM (2) / TRSUM (2)) + (BPSUM (3) / TRSUM (3))

Calculate the value of the Ultimate Oscillator (UO) using the formula:

UO = ( RawUO / (4 + 2 + 1)) * 100, where:

MIN – minimum value;

MAX – maximum value;

|| – logical OR;

LOW (i) – the minimum price of the current bar;

HIGH (i) – the maximum price of the current bar;

CLOSE (i) – closing price of the current bar;

CLOSE (i – 1) – closing price of the previous bar;

TL (i) – True minimum;

BP (i) – Buying pressure;

TR (i) is the true range;

BPSUM (N) is the mathematical sum of BP values for period N (N equal to 1 corresponds to i = 7 bars; at N = 2, i = 14 bars; at N = 3, i = 28 bars);

TRSUM (N) is the mathematical sum of TR values for period N (N equal to 1 corresponds to i = 7 bars; at N = 2, i = 14 bars; at N = 3, i = 28 bars);

RawUO – “raw value” of the Final Oscillator;

UO is the value of the Final Oscillator.

Info taken from www.mql5.com website

Signals of the Ultimate Oscillator indicator:

Reliable trading signals, according to the recommendations of L. Williams, are:

Overbought-oversold signals:

- If the indicator comes out of the oversold zone (mark 30 or less) and then rises above 50, you can buy a CALL option (up),

- If the indicator comes out of the overbought zone (mark 80 or more) and falls below 50, you can buy a put option (down).

Divergence and convergence signals:

If there is a discrepancy between the data and the price, if the oscillator indicator does not reach the highs and lows that the price chart shows at a particular moment:

- With a signal of divergence, manifested in an uptrend, you can buy CALL options (up),

- With a convergence signal manifested in a downtrend, you can buy put options (down).

Do you need to install the UO indicator in your platform?

The indicator is not included in the standard set of tools and in order to work with its data, you need to download UO and install it in your program. Also, the oscillator must be installed in MetaTrader 4.

You can download the UO Indicator for MetaTrader 4 for free here. You can read the instructions for installing indicators in the MetaTrader 4 platform here.

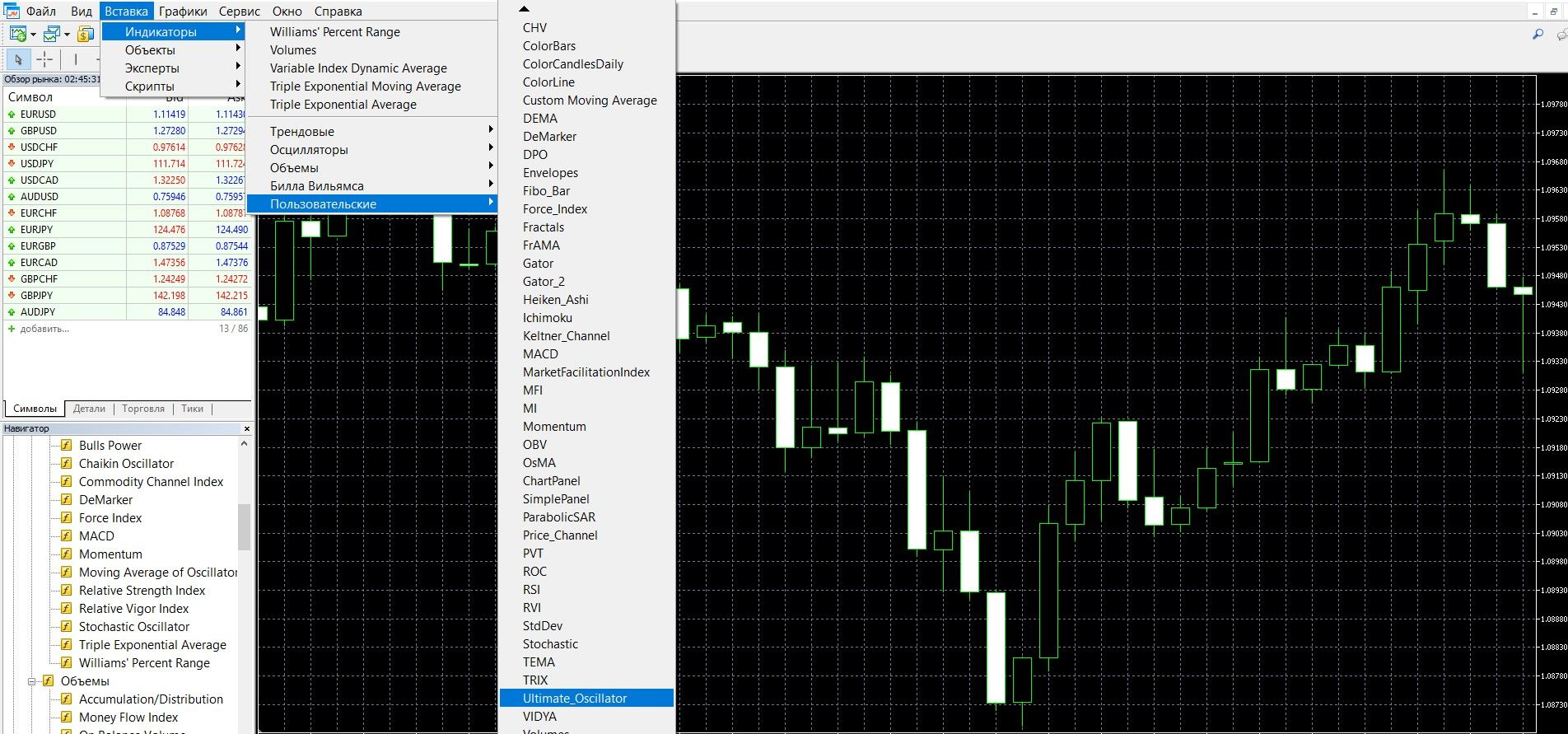

Next, to work with the Ultimate Oscillator, you need to add it to the price chart by doing the following:

- Click the “Insert” tab in the top menu of the platform

- Select the tab “Indicators” – “Custom” – “Ultimate Oscillator”. The tool has been added to the chart, you can start working with it.

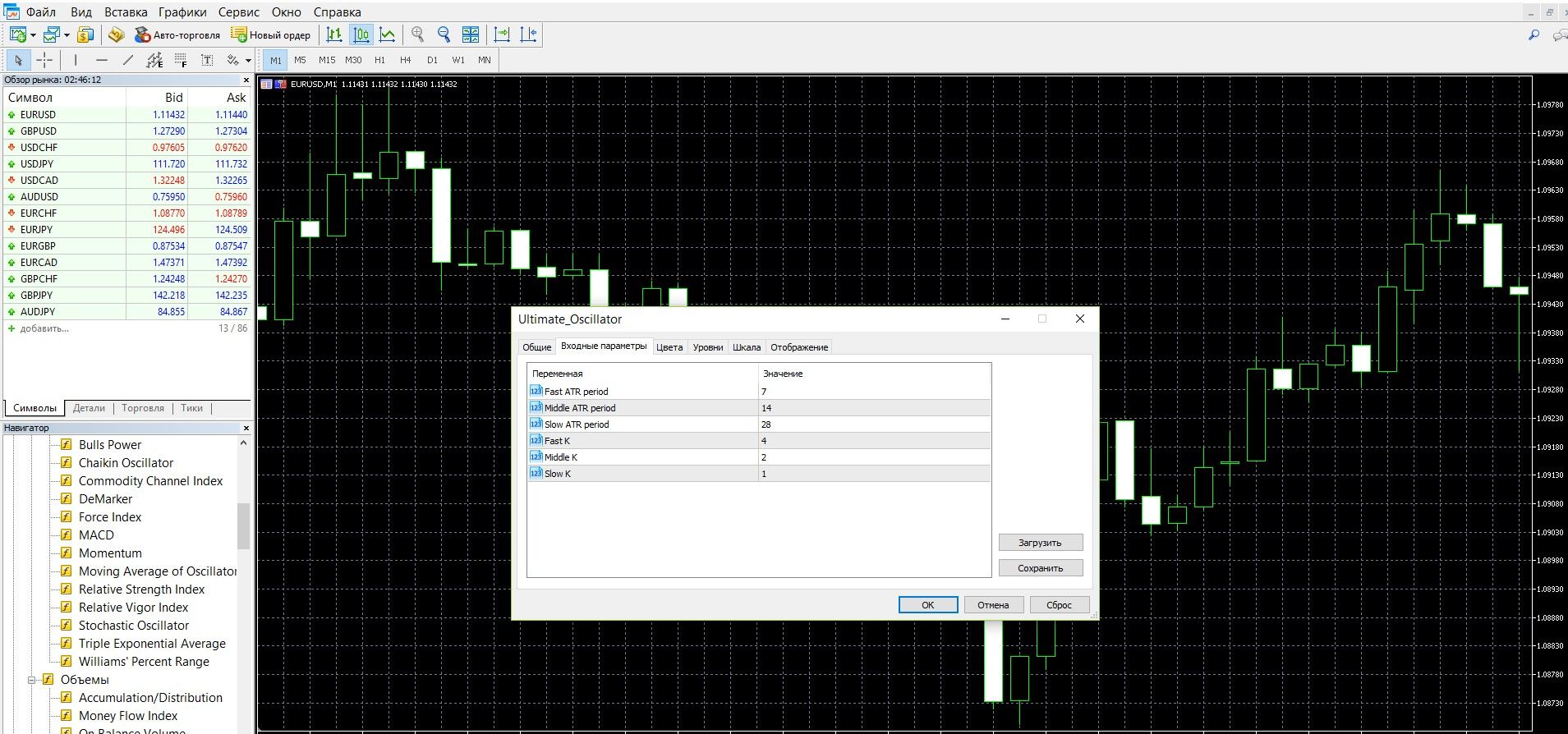

The main settings of the instrument are with the “Periods” parameter. Standardly, this indicator is indicated: 7 – 14 – 28 (fast, medium and slow periods of time). You can change this data for your strategy.

Application of the indicator for binary options

The indicator is based on comparing the price indicator with past data from three periods. The final values range from 0 to 100, when the value falls below 30, it is an oversold market situation, when the value rises above the 70 mark, the market is overbought. The overbought-oversold signals generated by the UO are considered to be the best and most reliable.

The author of the indicator advised to use it when searching for one of the basic concepts of options – divergence and convergence. Divergence, as you already know, is the discrepancy between the price indicator and the indicator data.

One of the significant advantages of the Final Indicator is that the trader does not need to fine-tune the periods in order for the signals to generate income. Now you can start trading right away. In terms of properties, the oscillator is similar to other instruments that identify areas of excess supply and demand of the market (for example, StochRSI, Stochastic, Williams %R , etc.).

At the same time, unlike, say, Williams %R, in addition to accurately displaying the overbought-oversold areas, UO generates signals much faster, so it can be safely recommended as a useful tool for conducting a comprehensive market analysis.

The final oscillator is useful for the trader and can take its rightful place in the set of indicators. It is very flexible for settings, which allows the trader, working with the tool, to achieve the maximum, for example, when building his profitable strategy. The oscillator is especially useful when working on intraday, daily, weekly or monthly time intervals. To obtain clear signals, it is recommended to use it in conjunction with other technical analysis tools.

Despite the fact that the limit indicator is less common among traders, its capabilities in data analysis are several times superior to other popular indicators.

Rules for concluding transactions (screenshots)

Trading with an overbought-oversold signal

The UO shows some of the most accurate overbought-oversold signals. The asset is overbought, when the indicator line has reached or exceeded the value of 80, you can place a PUT ( down) bet. In the image below, you can observe the upward trend of the market on the MetaTrader 4 platform:

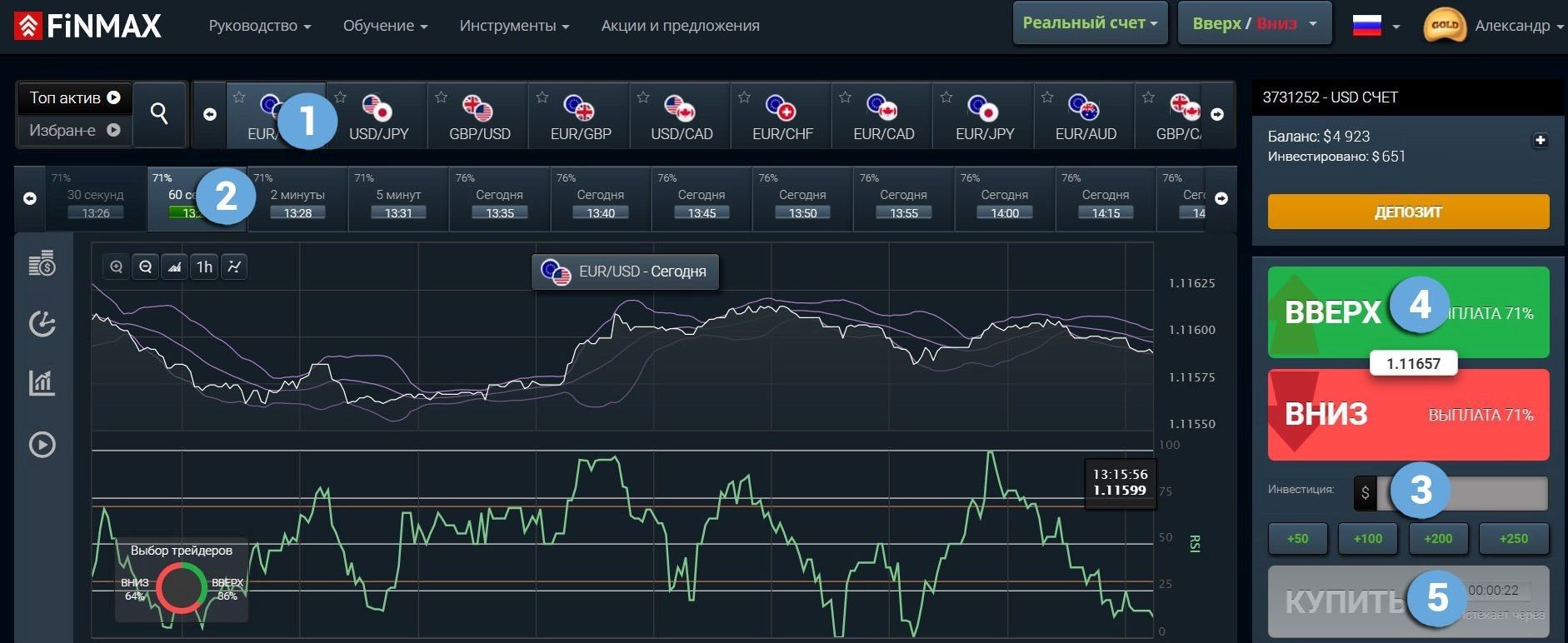

Take advantage of the uptrend of the market and make a PUT ( down) rate with one of the best Finmax brokers. To do this, you only need to go to the broker’s website finmaxbo.com and prepare an option, indicating:

- Type of option

- Expiration

- Bet amount

- Movement forecast: DOWN

- Click the “buy” button and wait for the results:

When the UO line is below the 20 pip level, this is an oversold market situation, you can place a CALL ( up) bet. In the image below, you can observe the downward trend of the market on the MetaTrader 4 platform:

Take advantage of the moment of the downtrend of the market and place a CALL (up) bet with one of the best Finmax brokers. To do this, you only need to go to the broker’s website finmaxbo.com and prepare an option, indicating:

- Type of option

- Expiration

- Bet amount

- Movement forecast: UP

- Click the “buy” button and wait for the results

Trading with a divergence signal

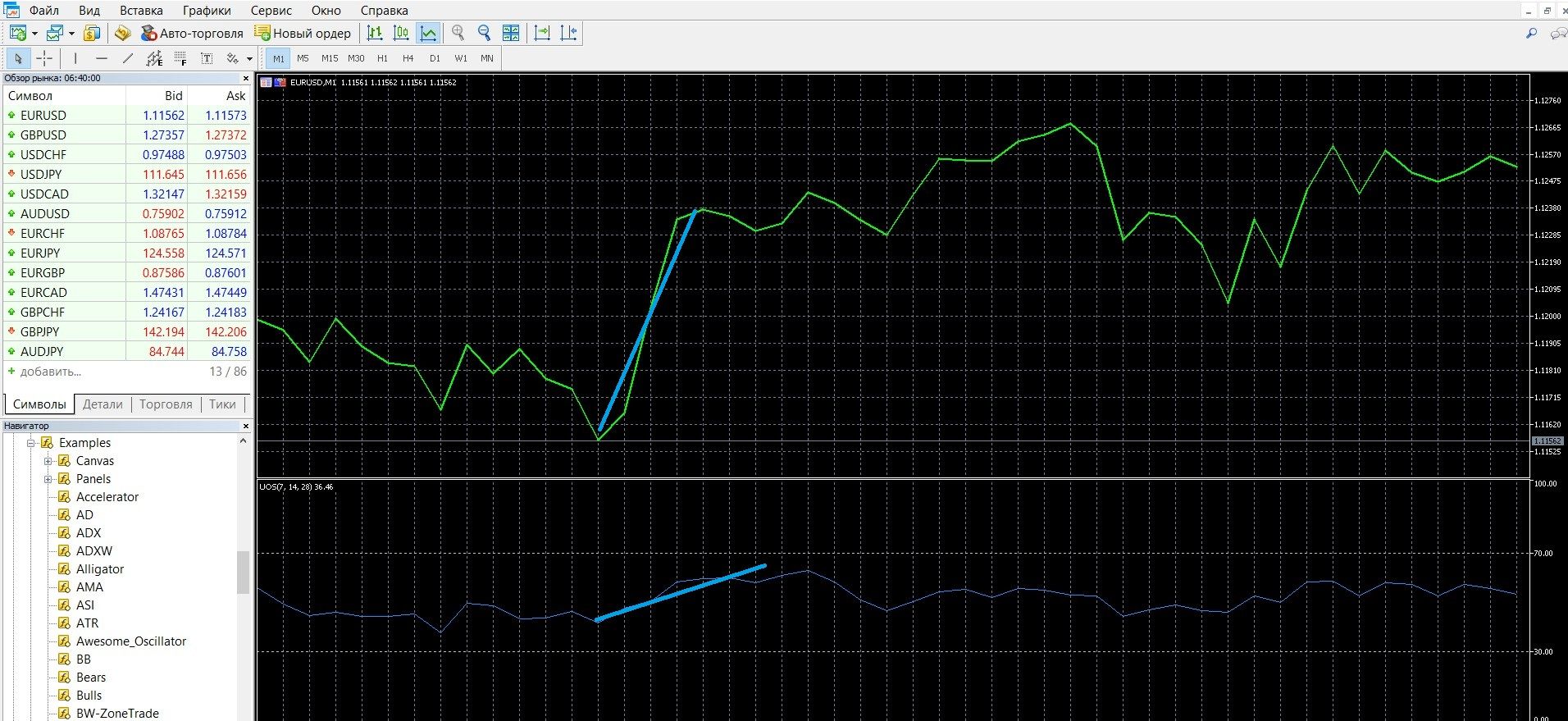

The UO divergence signal occurs in an uptrend, when the price tends in one direction, and the indicator tends in the opposite direction, this is a signal of an imminent trend change. The image below shows a divergence signal from on the MetaTrader 4 platform (you can place a CALL bet on the broker’s website finmaxbo.com, the instructions are listed above):

Convergence trading

The UO convergence signal occurs on a downtrend when the price tends to new peaks, and the indicator line, on the contrary, does not, it is also a signal of a change in the market trend. The image below shows the UO convergence signal on the MetaTrader 4 platform (you can place a PUT bet on the broker’s website finmaxbo.com, the instructions are listed above):

Money management

Every professional trader should remember the basics of money management, especially at a time when market participants are thinking about obtaining a stable income. It is also recommended that newcomers to options understand and implement these basics as early as possible. The advantage of money management rules is that they allow you to build an effective work of money management on a deposit. How to work consciously and economically with the money in the account, how to use it in such a way that it is always preserved – it is money management that will give you answers to these and other important questions.

Basics of money management:

Trading with a minimum of money: it is recommended to use the lowest possible amount for trading; to participate in the option, bet no more than 5% of the account amount; Participate in options trades that are much less than the amount of your account. Keep these guidelines in mind and you’ll save your money.

Trading with a minimum deposit: it is recommended to use minimum deposit amounts; do not bet the entire account on one trade; it is always worth remembering that the funds may be useful to you; When working with a deposit, be sure to build a thoughtful work, determining the free limit that can be used in trading, then you will only have to go beyond it. Keep these guidelines in mind and you’ll save money in your account.

Trading with a minimum number of assets: it is recommended, mainly for beginners in trading, to use the initial capabilities of 2-3 assets; Only when you become more confident and experienced, you can gradually complicate the volume of assets, working with several transactions at once. Keep these recommendations in mind, and you will initially work with options productively.

Trading without emotions: it is recommended, working in the market, to tune in to serious work; it is worth remembering that the mood will determine a lot in dynamic and unpredictable trading; Emotions can interfere, make you inattentive, interfere with concentration and track of the deposit. Keep these guidelines in mind and you will be able to achieve your goals in options trading.

Expiration

Like the rules of money management, this is one of the leading concepts of trading. Expiration is the moment of expiration of the option, when all bidders find out the results of their forecasts and whether there will be a profit on their account. With a well-thought-out serious approach, expiration will become your reliable strategy. If you are thinking about getting a stable profit, a conscious attitude to expiration is the first step towards your success.

Types of options:

- Ultra-short options – 30 seconds – 5 minutes.

- Short-term options – 10 minutes – several hours.

- Medium-term options – a day – a few weeks.

- Long-term options – a month – six months.

Is it allowed to extend the expiration of the option?

It is allowed if suddenly during trading you realize that an incorrect result is indicated. Not every broker is allowed to extend the expiration.

Expiration rules:

- Those traders who are just starting to work with options are advised to pay attention to the long expiration, which is more stable, which allows you to reduce the percentage of risks several times.

- Those traders who are already professionals in options are advised to pay attention to the time period at which you will be comfortable working. Choose a broker that allows an increase in expiration during trading, which will minimize losses in case of an incorrect forecast.

- Those traders who came to the market to receive instant income are advised to work with a short-term (minute – several hours) expiration, which will allow you to receive income in 30 seconds. You should always remember about the unpredictability and riskiness of turbo trading.

- Those traders who came to the market to obtain a stable permanent income are advised to work with long-term expiration, which, unlike express options, is characterized by calm trading, more predictable and profitable, but less risky.

Expiration in strategies with Ultimate Oscillator

Strategy for oversold-overbought signals

Short-term trading: is possible, despite the fact that trading is risky in turbo trading, with the UO indicator it is easier to see accurate profitable signals, and by making several positive trades within an hour, you can achieve a result that you would achieve when trading on large time intervals.

Medium-term expiration: also possible; because. UO shows fairly accurate signals, you can earn decent money, but at the same time risk a deposit much less than with turbo trading.

Long-term expiration: also possible; because. UO will allow you to get high-quality market entry signals that will bring you a good income.

Strategy for divergence and convergence signals

Short-term trading: is possible, and although express trading is quite risky and unpredictable, UO will make your job easier, it is easier to see accurate profitable signals with it, and by making a few positive trades within an hour, you can achieve the result that you would achieve when trading on large time intervals.

Medium-term expiration: also possible; because. UO shows accurate profitable signals, you can earn decent money, but at the same time risk a deposit much less than with turbo trading.

Long-term expiration: also possible; because. The UO generates accurate profitable divergence-convergence signals that will make you decent money.

Expiration in the “Final Trading” strategy

An interesting and profitable strategy using the UO indicator and EMA. For UO, the following parameters are needed: FastPeriod – 12, MiddlePeriod – 24, SlowPeriod – 48; for EMA: the period is 21, the calculation is applied to the closing price. In the strategy, the EMA will play a confirmatory role as UO signals. The main signal is the crossing of the 50 mark from the bottom up, as soon as the signal is received, we wait for confirmation from the EMA and open a buy trade.

Short-term trading: is possible, and although turbo trading is risky and unpredictable, UO will make trading easier, it is easy to see accurate profitable signals with it, and by making a few positive trades within an hour, you will achieve the result that you would achieve when trading over large time frames.

Medium-term expiration: also possible; because. UO shows accurate profitable signals, you can earn a decent income, but at the same time risk a deposit much less than with express trading.

Long-term expiration: also possible; because. The UO generates accurate profitable divergence-convergence signals that will make you decent money.

When trying your hand at options trading, try to determine the expiration that is comfortable for you. You can work with expiration most quickly and conveniently with a reliable broker Finmax. Among the advantages of the broker: the presence of a modern convenient terminal, a simple personal account, a huge selection of options, the ability to choose expiration dates (from 30 seconds to six months). To get started, you need to go to the finmaxbo.com website.

Downloads

MetaTrader 4 (MT4) platform – download.

Ultimate Oscillator indicator for the MT4 platform – download.