Linear Regression Channel (LRI) indicator

Description

Binary options trading has been gaining momentum lately, today it is one of the most reliable ways to make money on the Internet and lead a full life as a freelancer. First of all, trading attracts with the possibility of the fastest type of earnings on the network. To become a successful trader, market participants study not only the possibilities of express trading, but also test profitable strategies, new indicators, and discover more and more market opportunities.

On our portal you will find a lot of useful material, reviews of oscillators, current ratings of brokers , etc. Learn the basics of trading, become a pro and achieve more in options. Today we will talk about the Linear Regression Channel indicator.

The Linear Regression Indicator (LRI) is a simple and effective tool for technical analysis in binary options, the author of which is the trader Gilbert Ruff (LRI first appeared in 1991). The tool helps to better predict price dynamics, which is why it is so popular and is used not only in options, but also, for example, in Forex.

The indicator has the form of a channel formed by two parallel lines equidistant from the trend. The width of the so-called corridor depends on the selected timeframe. Both professionals and beginners of options can use LRI, it is a very convenient auxiliary tool that greatly facilitates the work of a trader. You can use it on any charts, with any oscillators.

The indicator allows you to trade on a channel strategy based on support and resistance levels, which is the most common options trading system. It is easy and convenient to work on it, the tool itself builds a channel based on the specified settings.

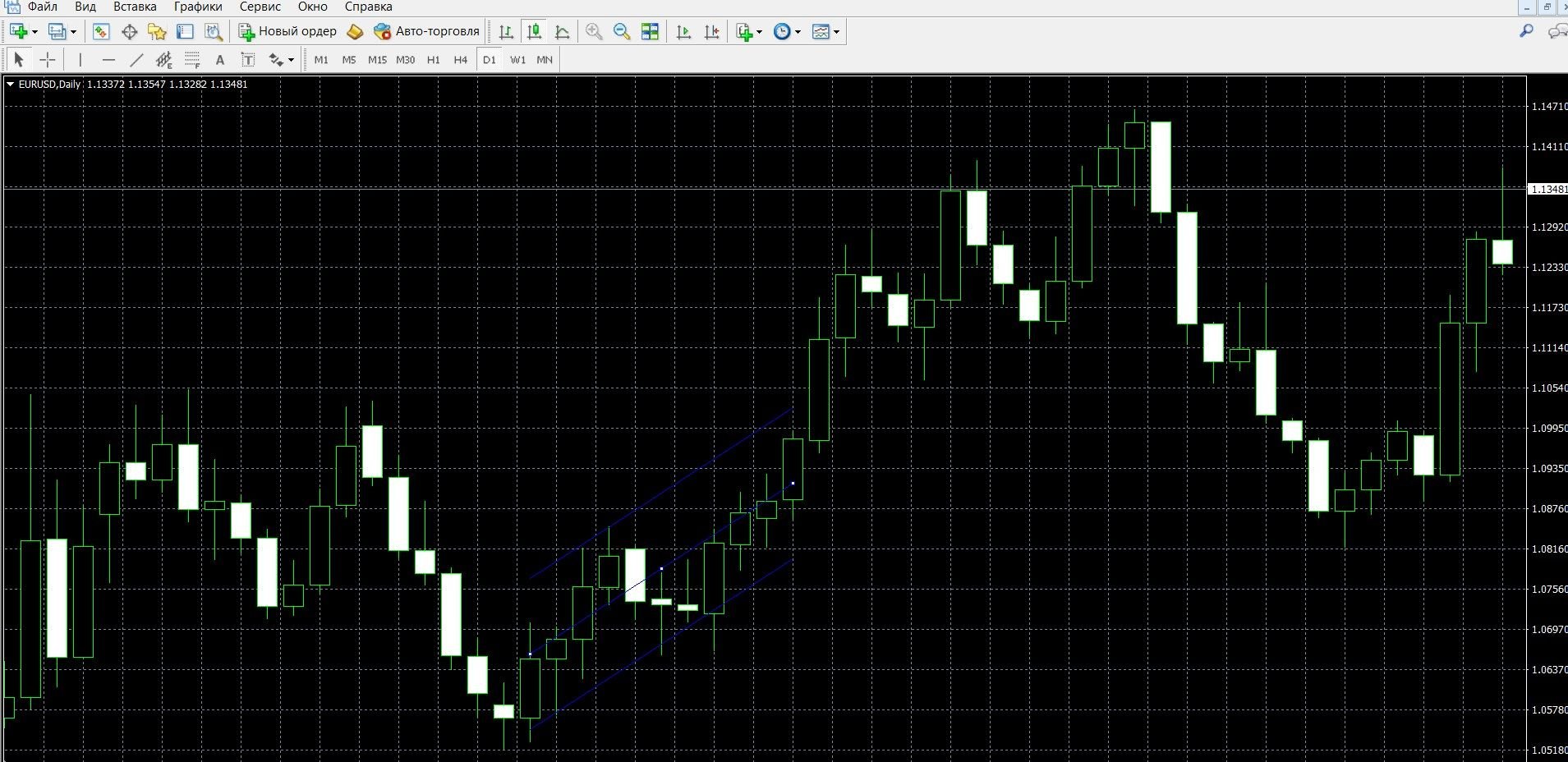

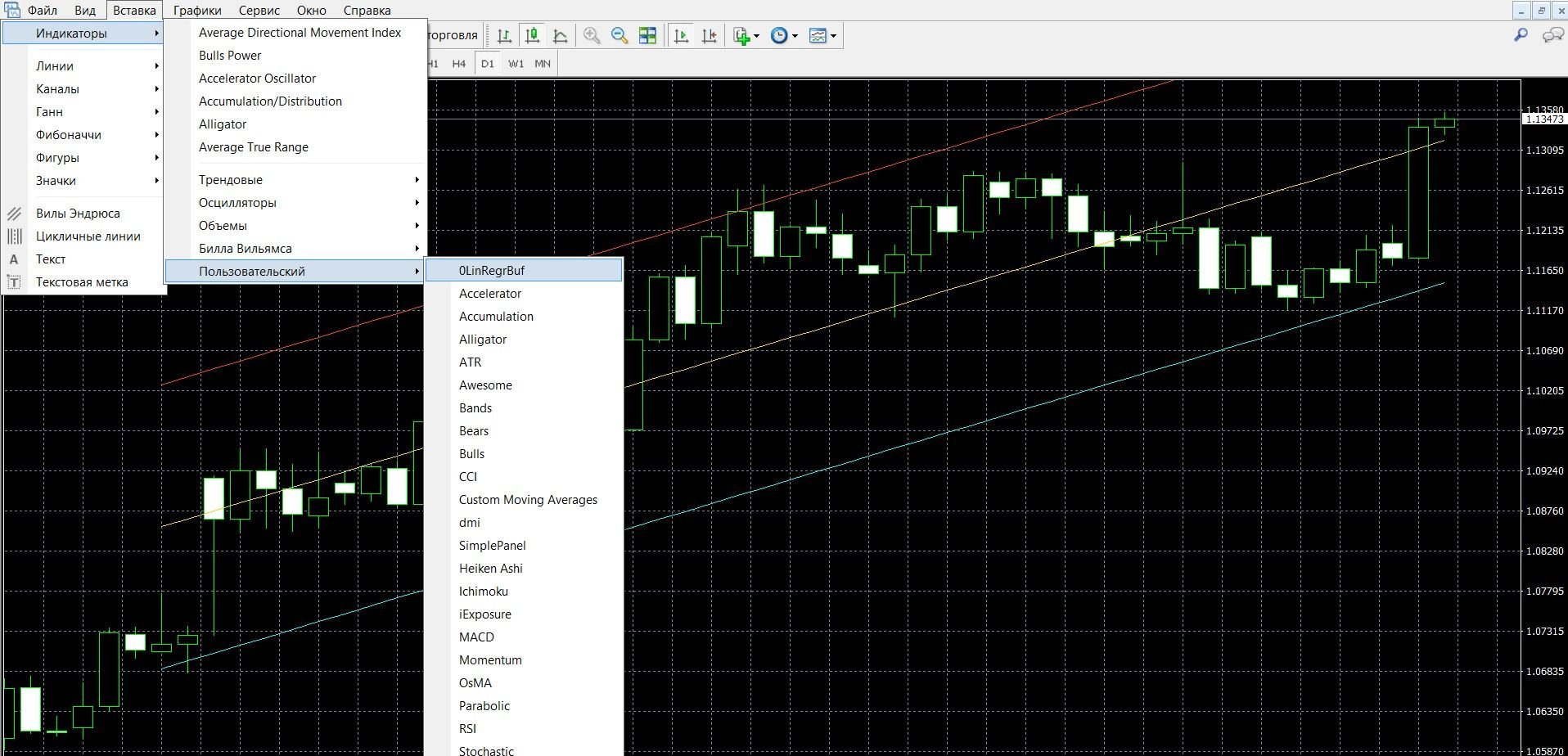

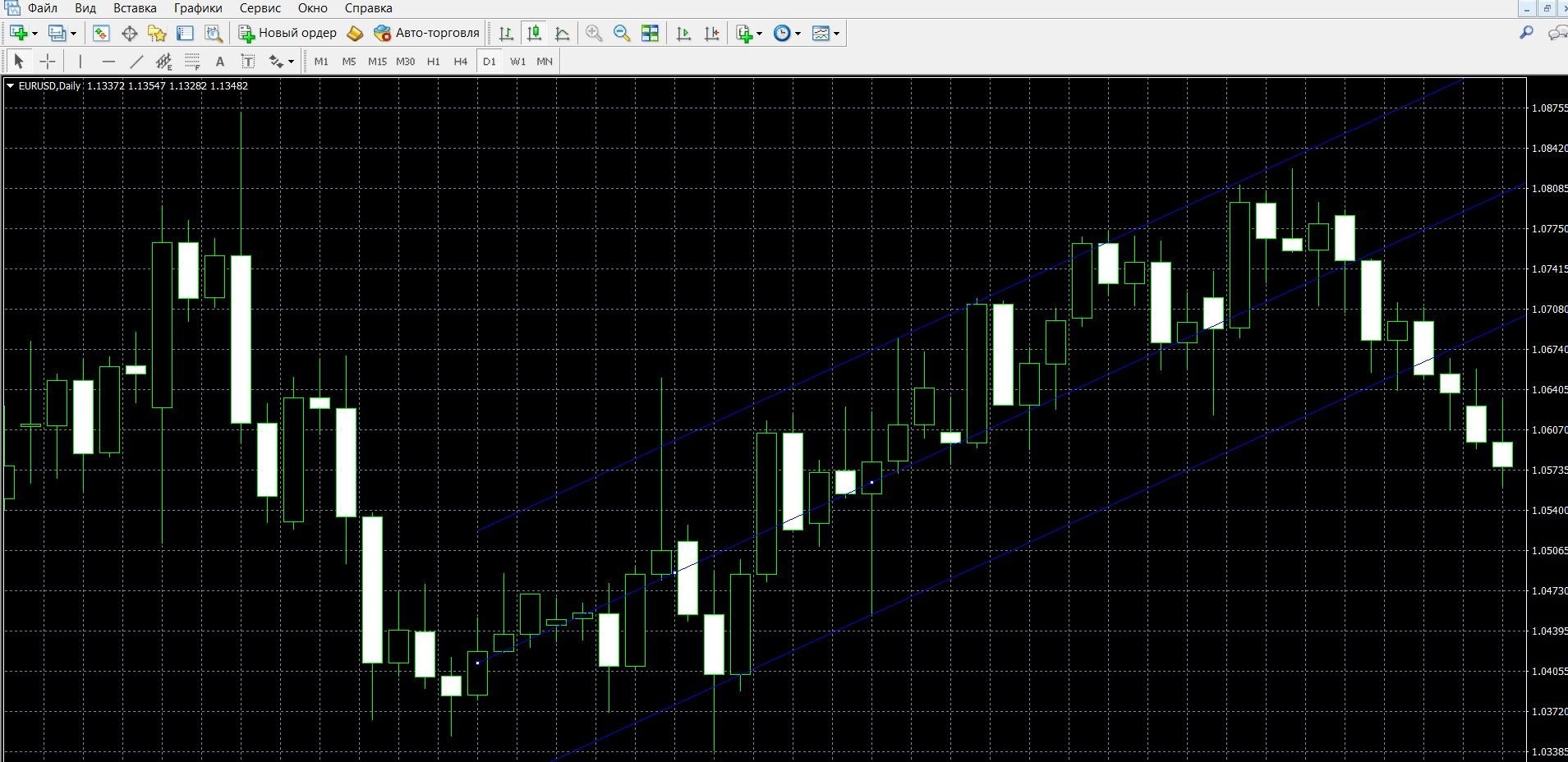

You can see what LRI looks like on the MetaTrader 4 (MT4) platform in the image below. You can also download the MetaTrader 4 platform and get acquainted with this tool in practice.

What is the principle of operation of the Linear Regression Channel indicator?

The linear regression channel is a standard statistical tool of any science, its purpose is to accurately search for the dependence of two parameters, in options it is the dependence of price on time. The indicator uses channels within which you can trade quite successfully. The price, moving at the resistance and support lines, is repelled from them, gives a clear understanding of the market situation.

By forming a clear price corridor that can be narrowed or expanded, LRI generates appropriate trading signals. Working with it, the trader does not need to independently look for significant extremes in order to build a channel, this indicator itself builds the necessary lines on any timeframe. LRI is easy to operate and consists of three 3 lines:

- The support line located at the top corresponds to the maximum deviation of the price from the center line,

- The resistance line located at the bottom corresponds to the maximum deviation of the price from the center line,

- The centerline, which is better known as the trend line, which facilitates visual perception.

Due to its effectiveness, this indicator quite easily allows you to carry out effective trading within the channel itself.

Signals of the Linear Regression Channel indicator:

Breakout signals:

- If the price has reached the upper limit, you can buy a PCI option,

- If the price is located at the bottom, it is worth buying a CALL option.

Reversal trading:

- If the price approaches the upper limit, it is worth buying PUT options,

- If the price approaches the lower limit, it is worth buying call options.

Trend trading:

- If the regression looks down, buy PUT options,

- If the regression looks up, we buy call options.

Do I need to install the indicator in your platform?

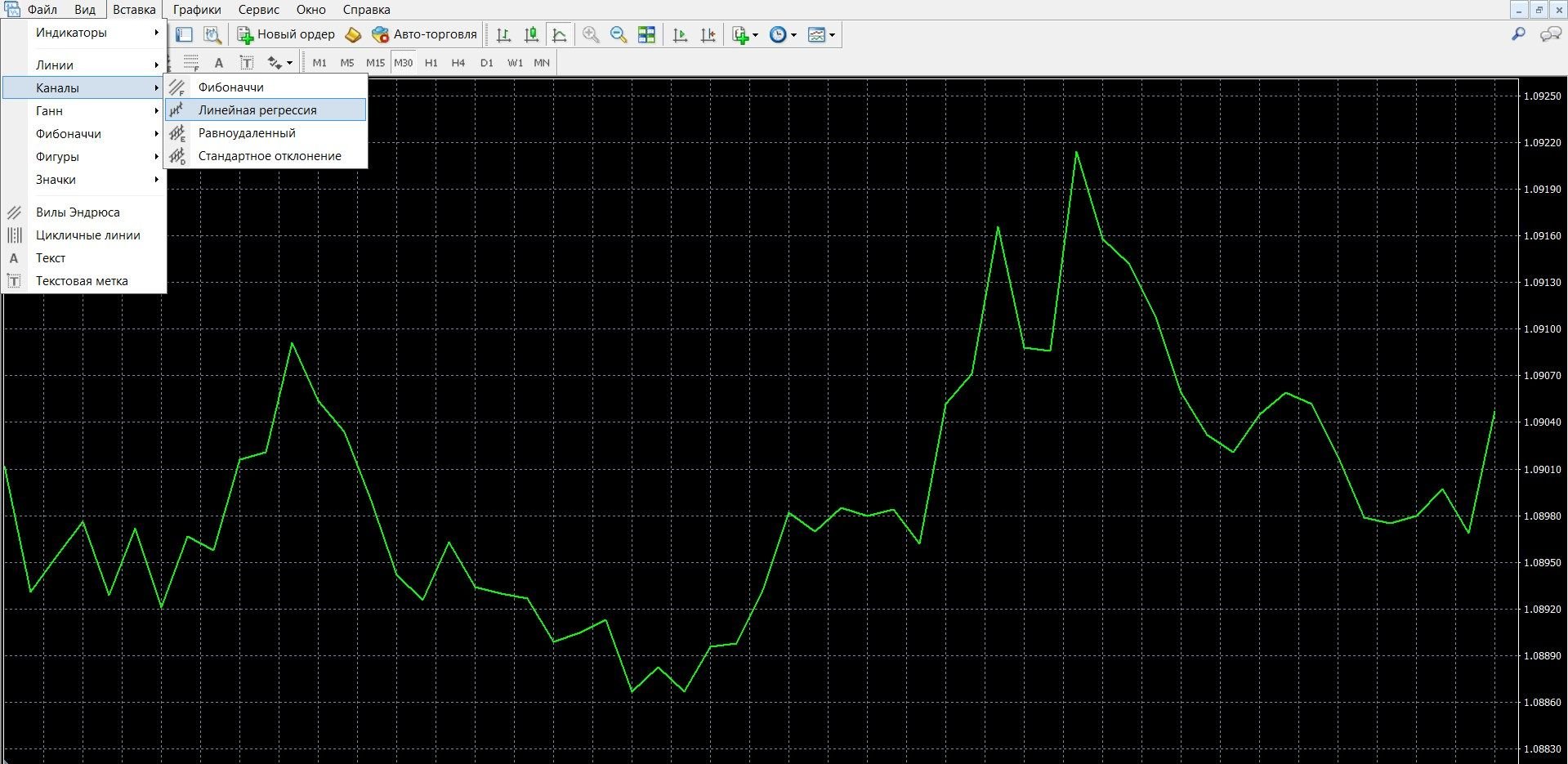

The linear regression channel is a standard indicator presented in most modern trading platforms, and it is also available in MetaTrader 4. To add an oscillator to a price chart, do the following:

- Click the “Insert” tab in the top menu of the platform

- Select the “Channels” – “Linear Regression” tab.

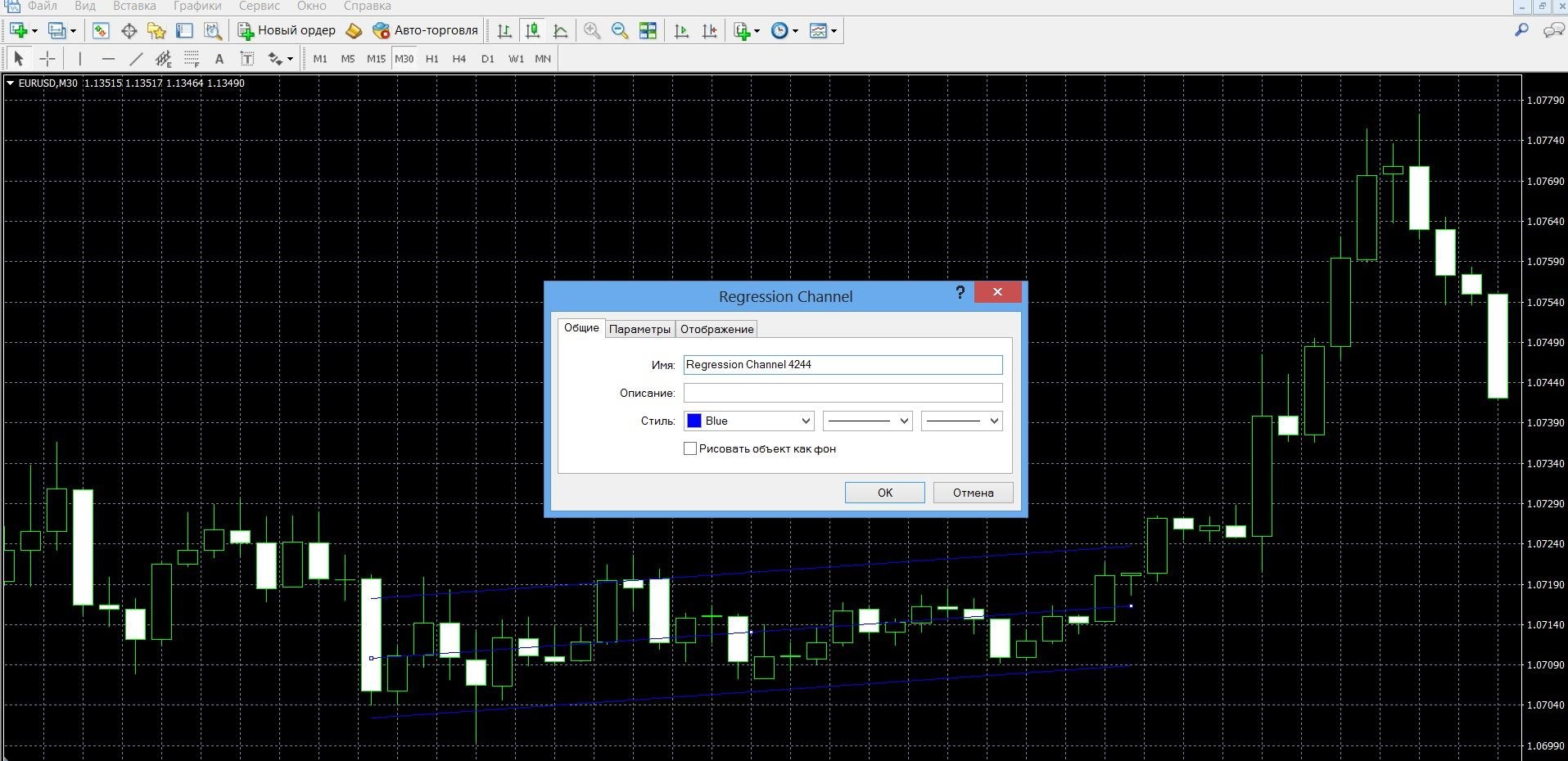

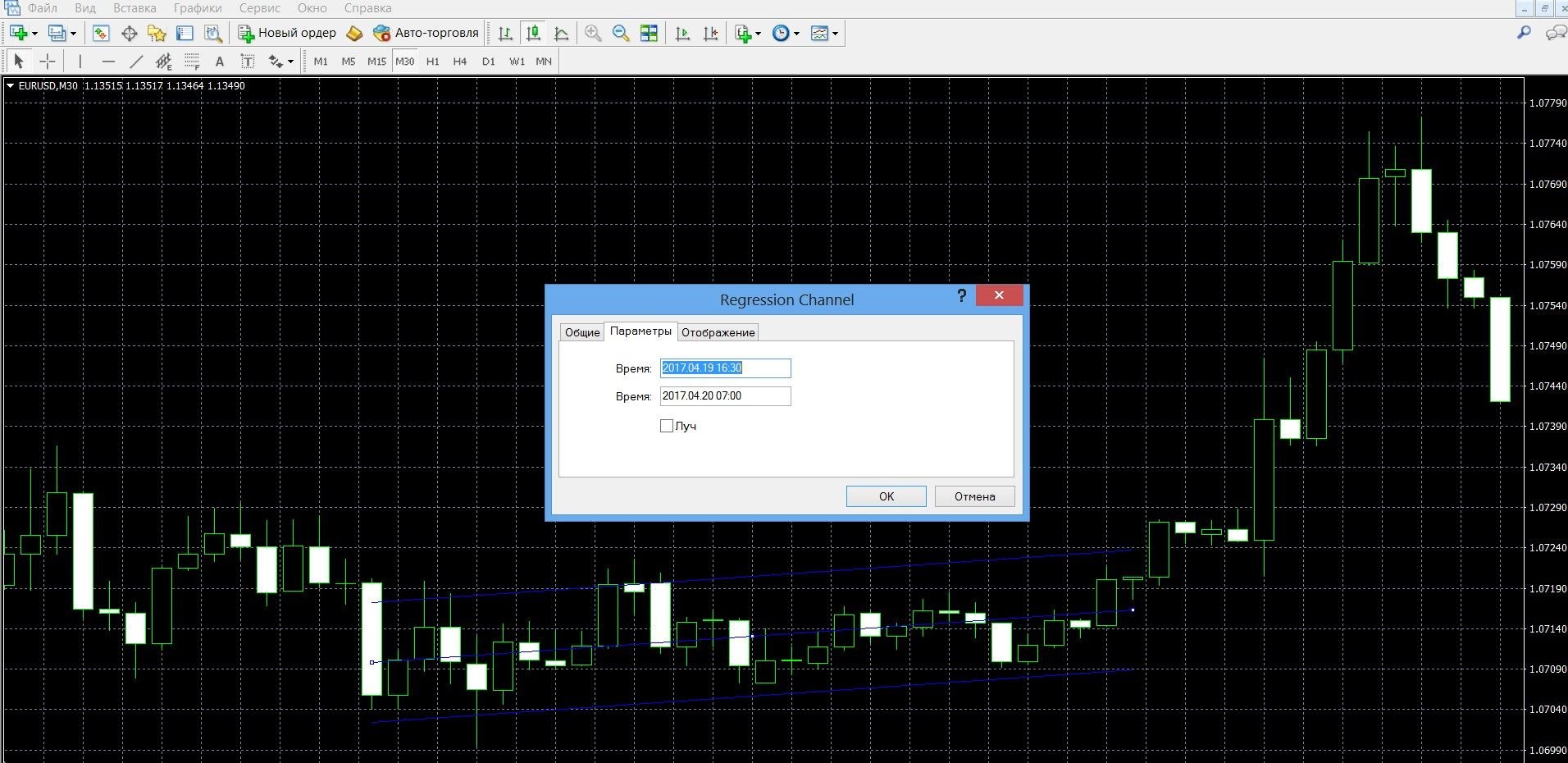

Next, to apply a channel to the chart, left-click on the chart and, without releasing the mouse button, draw the channel in the desired direction, setting its length. The channel has three points that can be moved with the mouse:

- the first and last points change the length of the channel in directions;

- The middle one is responsible for the rapid movement of the channel along the price chart without changing its size.

Indicator parameters:

- Date is the first point of the channel,

- Date is the last time point of the channel,

- Beam – the possibility of an infinite continuation of the channel to the right or left,

- Fill — enables and disables the fill of the internal background of the channel.

If you don’t have the standard version of LRI, you can download the free version of the iRegr indicator here.

You can read how to install the tool in the MetaTrader 4 platform here.

iRegr will allow you to build a linear channel. Its main difference from the standard one is in the automatic calculation of the data of the last bars of the chart, as well as in the absence of the possibility of its independent movement on the chart.

Application of the indicator for binary options

Linear regression is a standard trading channel that is used in all markets, most often in binary options, as well as in Forex. This trading strategy is one of the most common and profitable. For work, a certain channel is built, within which you can work successfully. In options, LRI is used in the following cases:

- Trading on the breakdown of the channel is the most common principle of operation, according to which it is necessary to wait until the price approaches the upper or lower border and open a position when it crosses this level. If the price has reached the upper limit, you can buy a PUT option. If it is located at the bottom, it is worth buying a CALL option. Trades in this case are opened in the direction of the breakout – this is a classic but reliable trading method.

- Reversal trading is one of the most common principles of operation, the opposite of trading on a breakout. Here, the trader does not wait for a breakout, trades are opened when the price chart approaches the upper or lower boundary. Positions are opened in the opposite direction. If the price approaches the upper limit, it is worth buying PUT options, if to the lower limit, it is worth buying CALL options.

- Trend trading – this principle of operation does not differ from reversal trading, but trades are opened only in the direction of the trend: if the regression looks down, we buy PUT options: if it looks up, we buy CALL options. This is a profitable and easy way to work with the tool.

Using these three simple and reliable strategies in options trading, you can not only significantly facilitate trading, but also get a decent income. When working with the indicator, it is necessary to remember that it is similar to moving averages and is a lagging tool, so it is always worth combining it with other instruments, for example, with Elliott Waves.

Rules for concluding transactions (screenshots)

Trading with a breakout signal

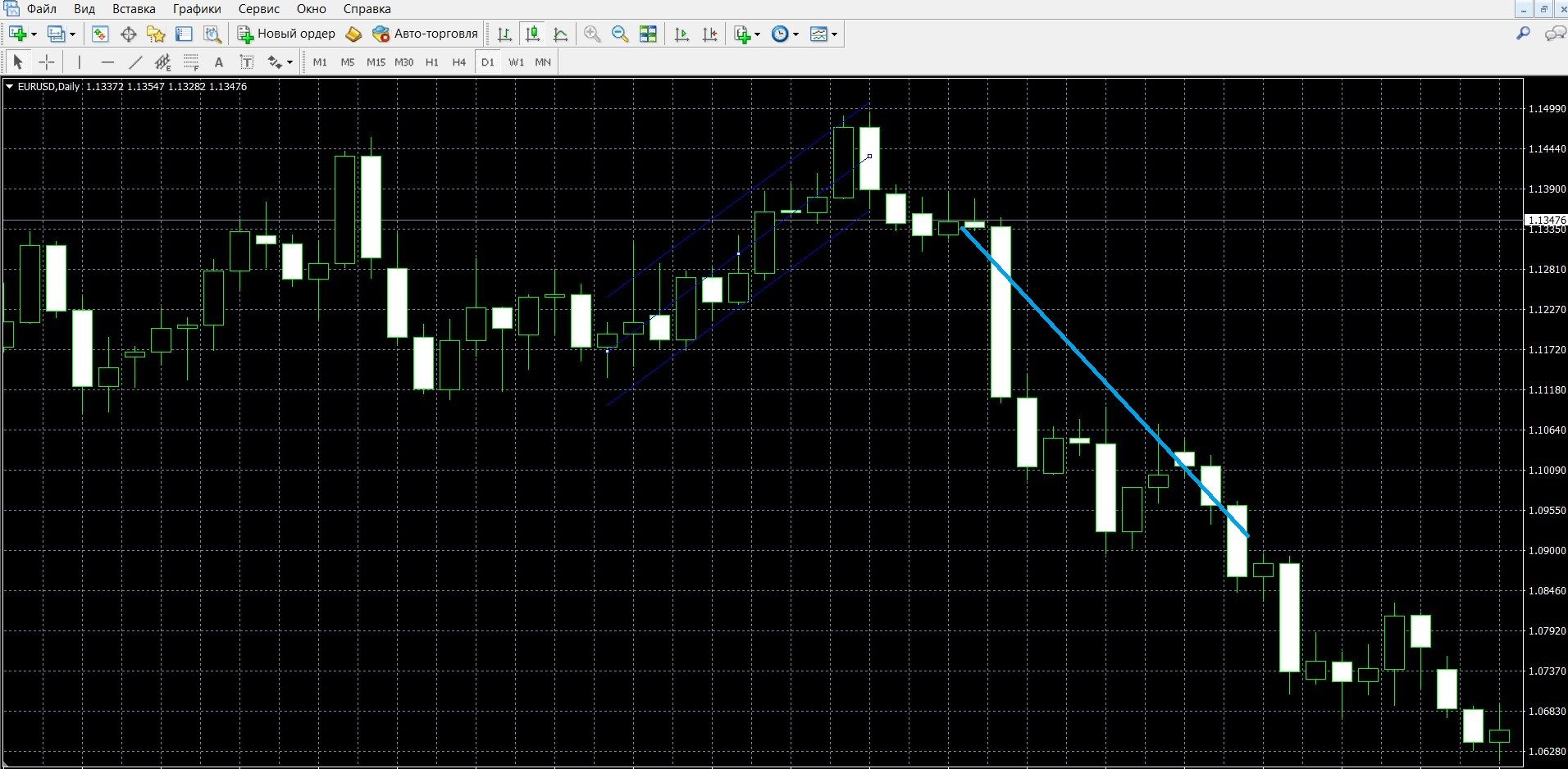

If the price has approached the upper limit of the Linear Regression indicator, you can buy a PCI option. In the image below, you can see the downward trend on the MetaTrader 4 platform:

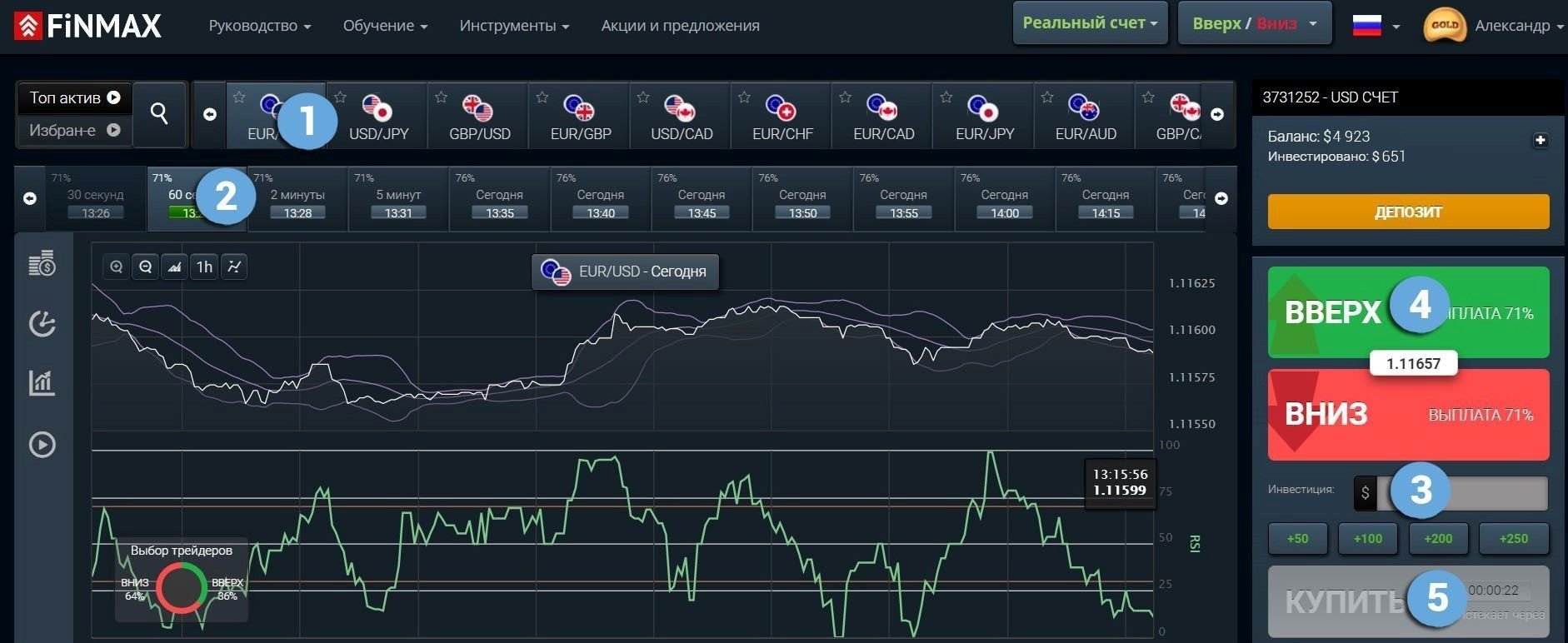

Taking advantage of the situation, you can make a profitable PCI bet with the Finmax broker by going to the finmaxbo.com website and preparing an option, indicating:

- Option

- Expiration

- Amount

- Prediction: down

- Next, it remains only to click on the “buy” button and wait for the results:

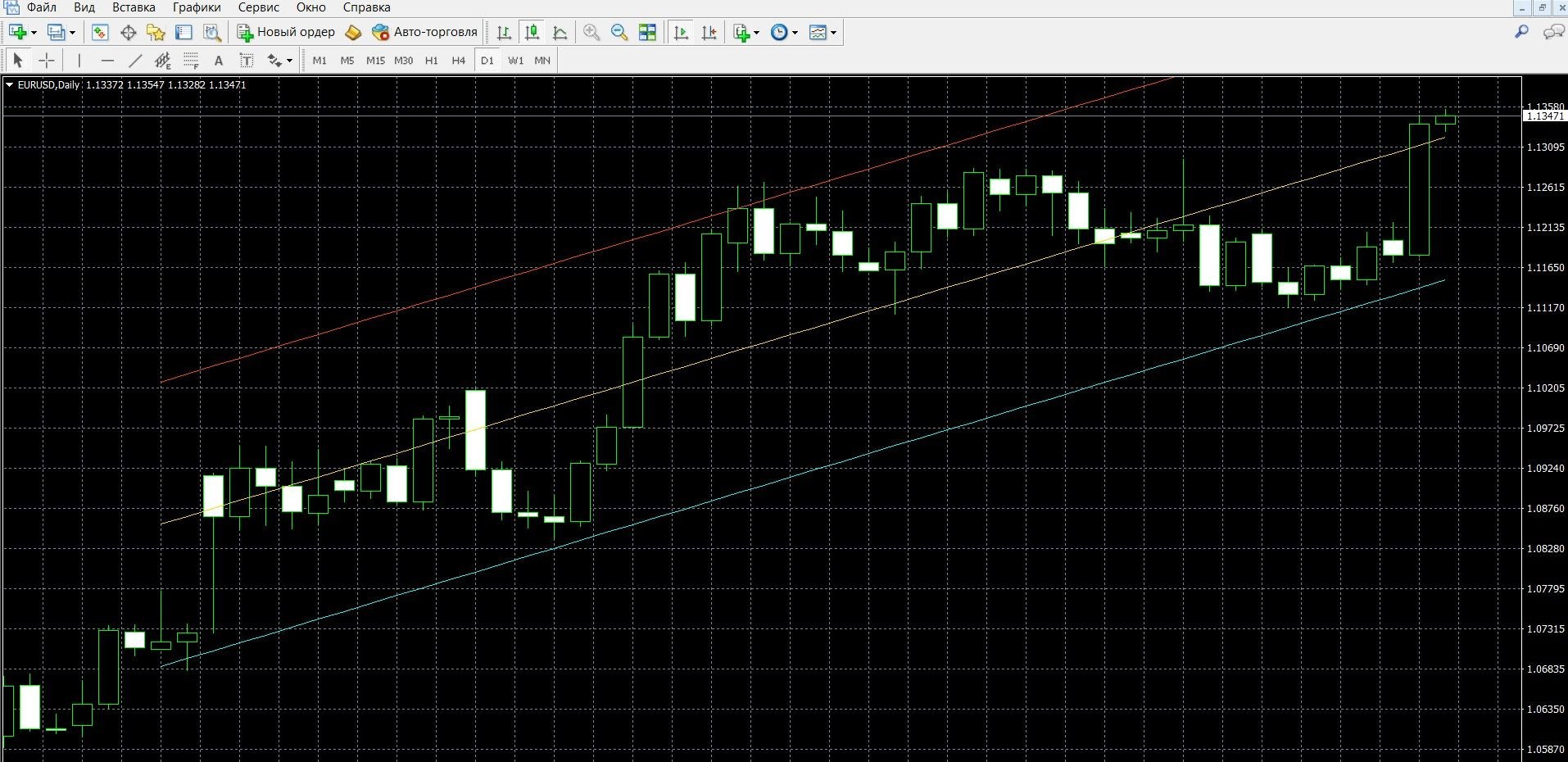

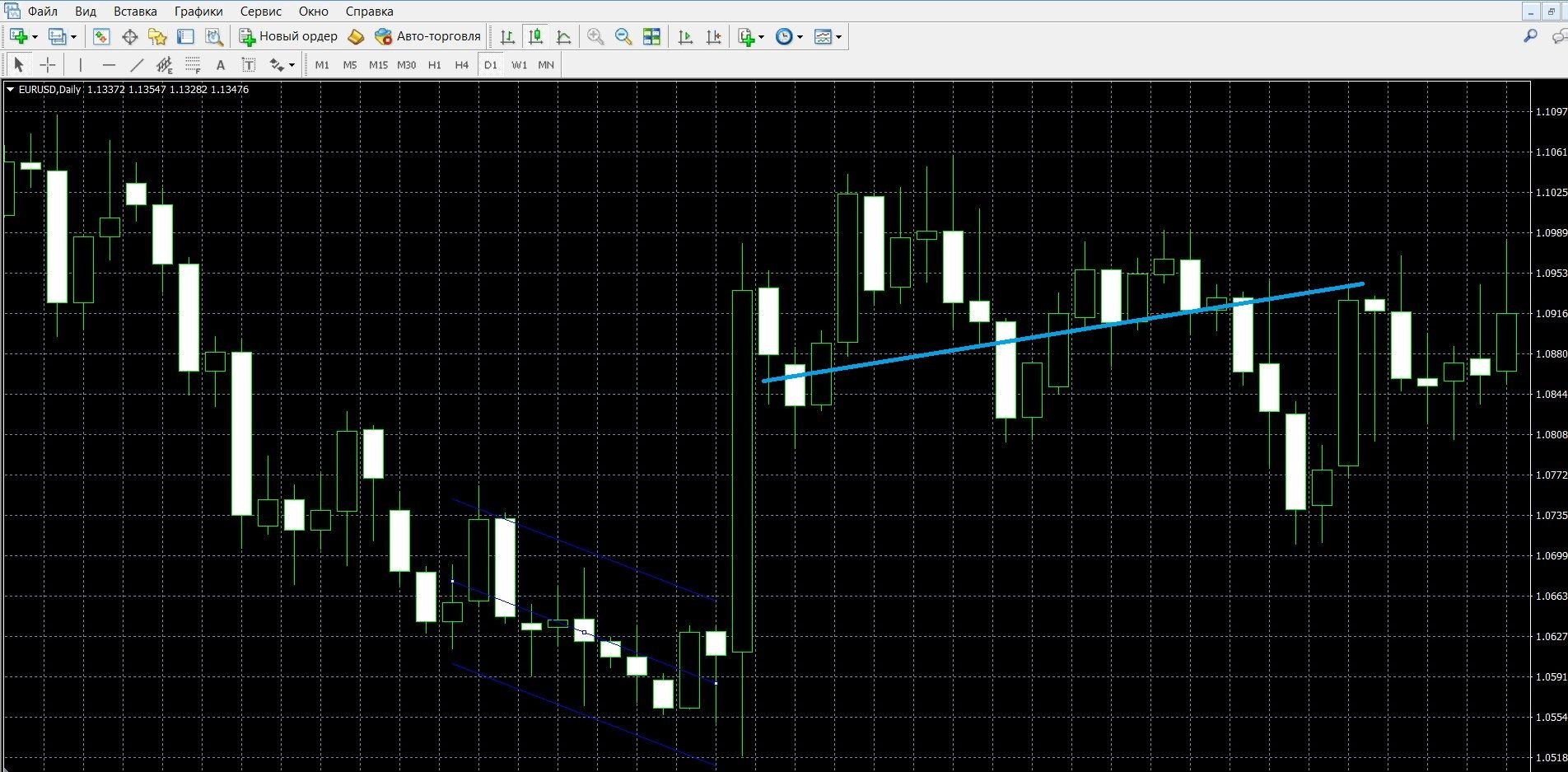

When the price is located at the bottom of the Linear Regression indicator, it is worth buying a CALL option. Below in the image you can see the upward trend on the MetaTrader 4 platform:

Taking advantage of this situation, you can make a profitable CALL rate with the Finmax broker by going to the finmaxbo.com website and preparing an option, indicating:

- Option

- Expiration

- Amount

- Prediction: up

- Next, it remains only to click on the “buy” button and wait for the results:

Trading on a reversal signal

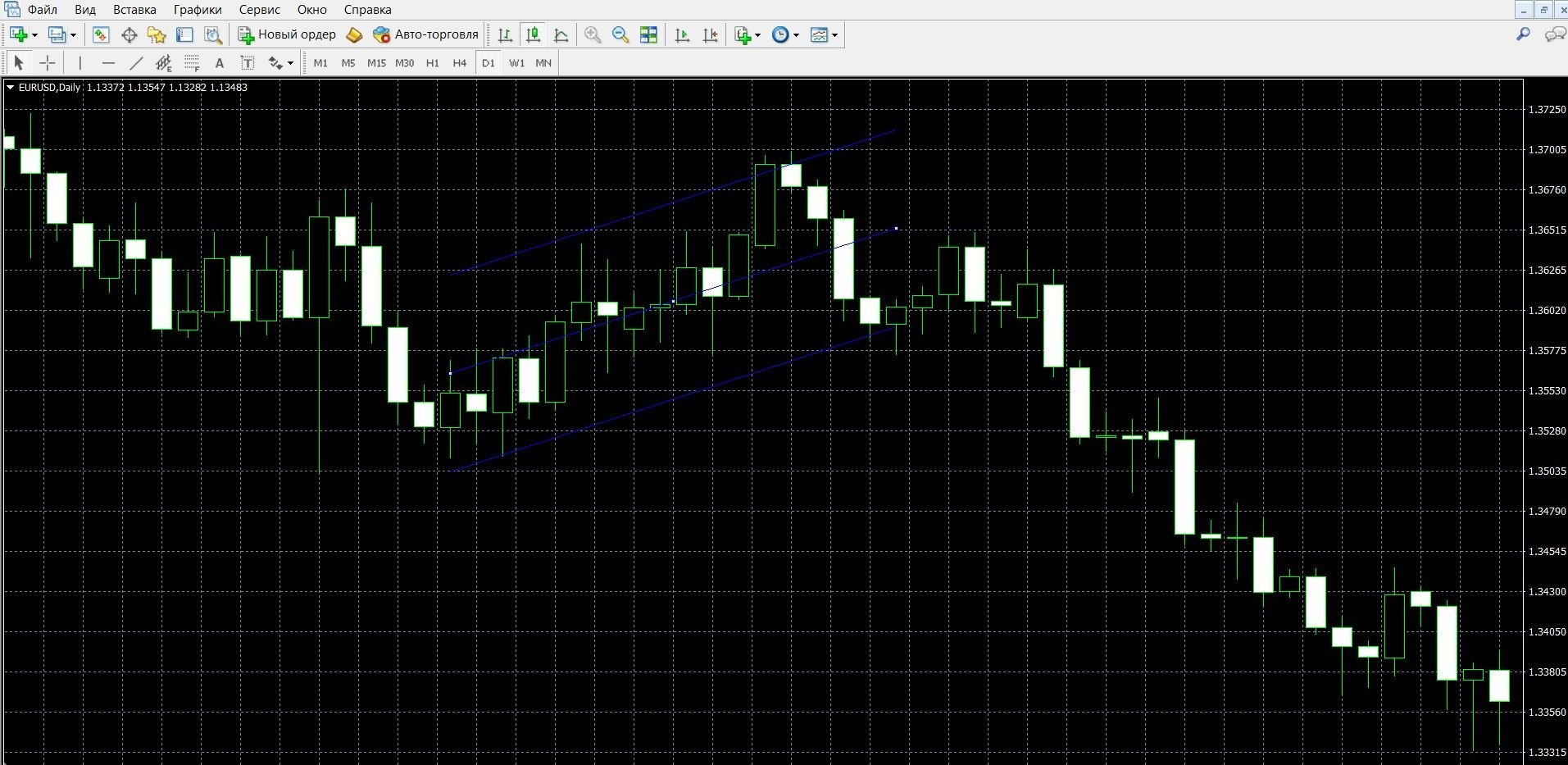

If the price approaches the upper limit of the Linear Regression indicator, this means that soon the trend will turn in the opposite direction, it is worth buying PUT options. In the image below, you can observe a downtrend on the MetaTrader 4 platform (take advantage of the situation and place a PUT bet on the broker’s website finmaxbo.com, instructions are presented above):

If the price approaches the lower limit of the Linear Regression indicator, this means that soon the trend will turn in the opposite direction, it is worth buying call options. In the image below, you can observe an uptrend on the MetaTrader 4 platform (take advantage of the situation and place a CALL bet on the finmaxbo.com broker’s website, instructions are presented above):

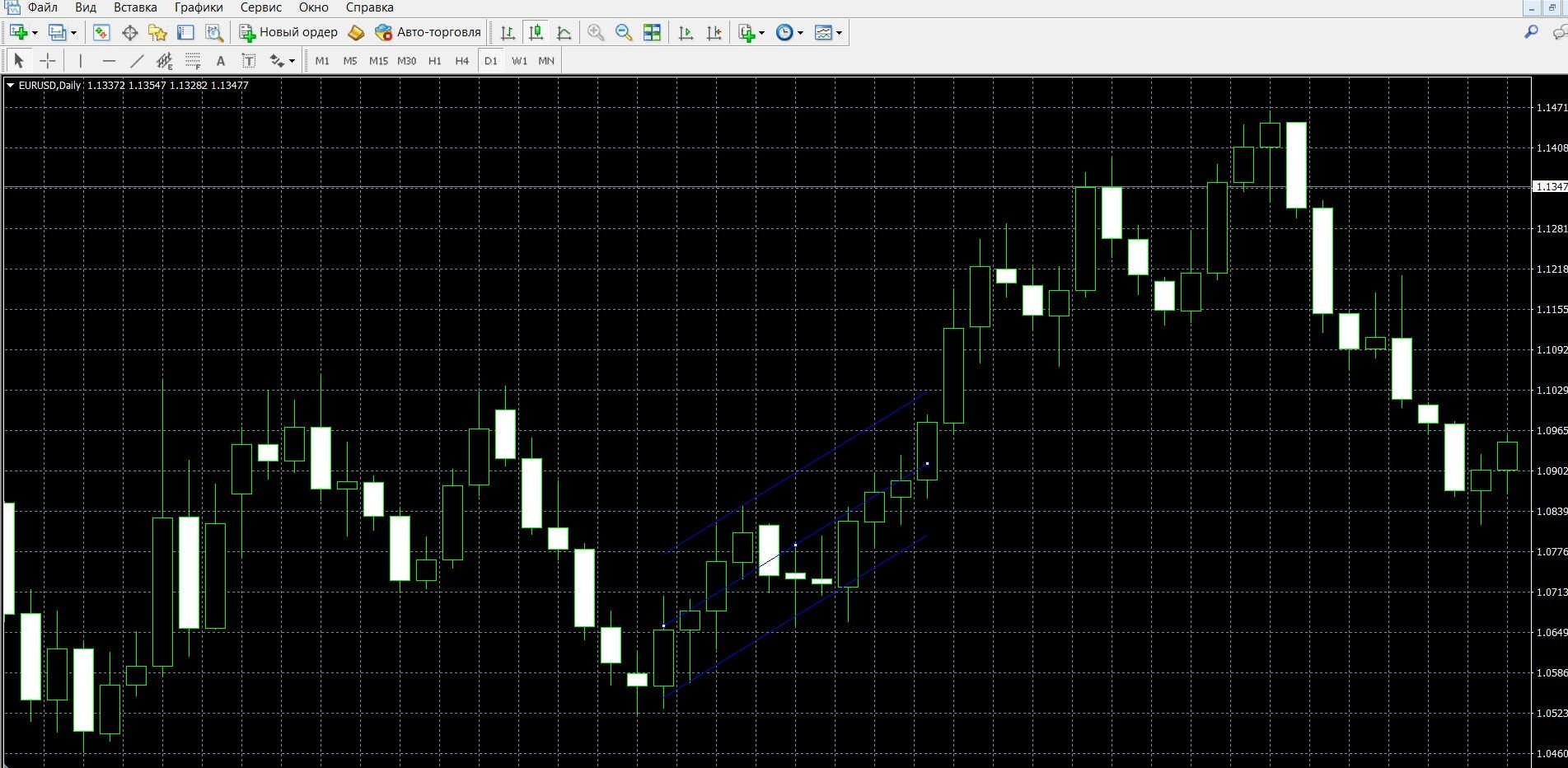

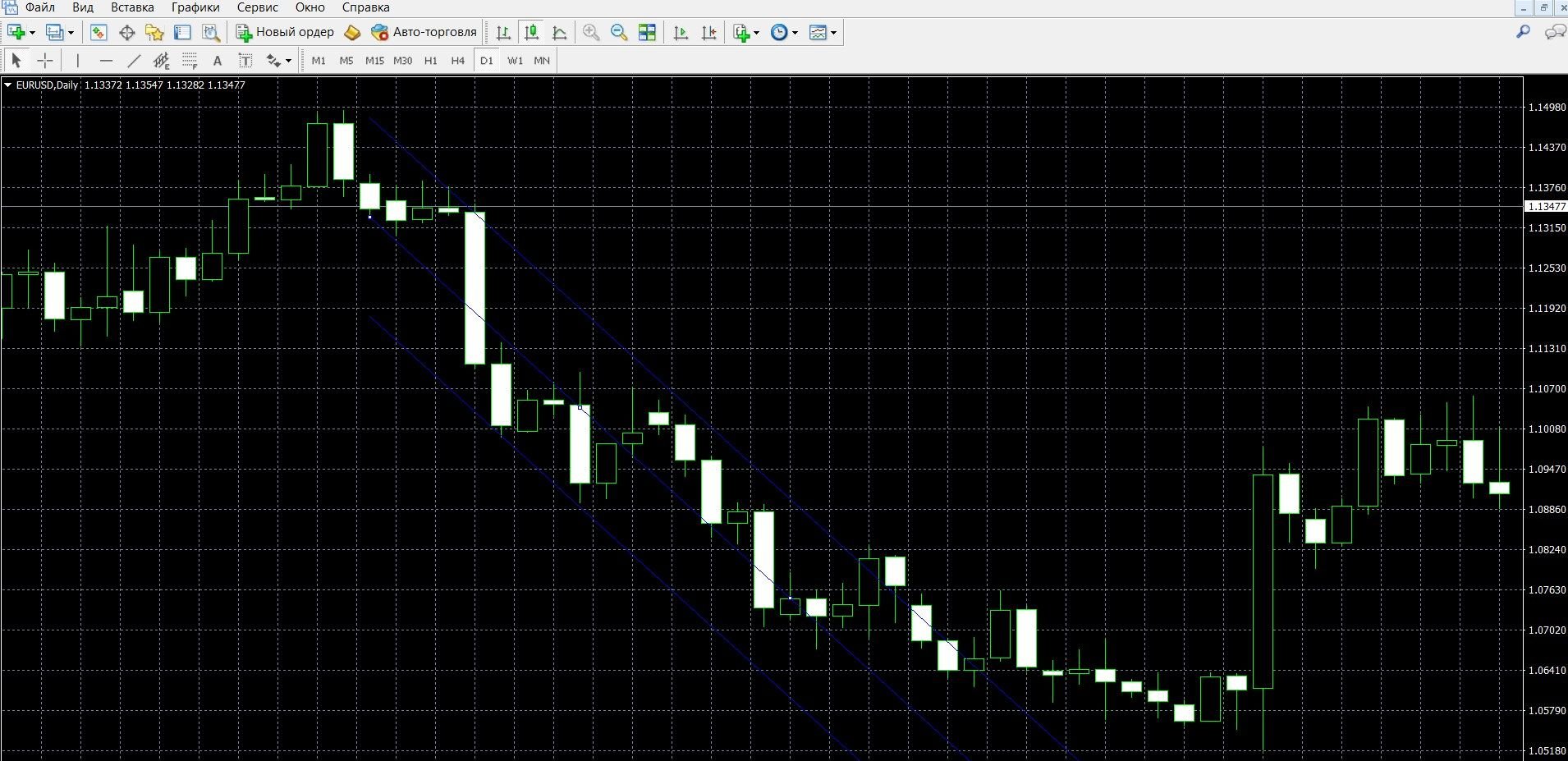

Trading with a trend signal

If the indicator looks down, we buy PUT options. In the image below, you can observe a downtrend on the MetaTrader 4 platform (take advantage of the situation and place a PUT bet on the broker’s website finmaxbo.com, instructions are presented above):

If the indicator looks up, we buy CALL options. In the image below, you can observe an uptrend on the MetaTrader 4 platform (take advantage of the situation and place a CALL bet on the finmaxbo.com broker’s website, instructions are presented above):

Money management

Money management can be fully considered a factor in the key to successful work with options. This is the first thing you should use if you want to earn stable capital from trading. Knowledge of money management dreams favorably distinguishes traders, and it doesn’t matter if you are a professional or still a beginner in trading, implement these simple rules in your work:

Trading with a minimum of money: spend a minimum capital on the purchase of an option, not exceeding more than 5% of the amount of your deposit; Work with options whose price is less than the state of the account. Apply these simple rules in trading, and you will be able to save your funds.

Trading with a minimum deposit: spend a minimum deposit; you should not bet all the funds on the purchase of one option; always remember that the tools will be useful for work; After transferring funds to the deposit, think about how to work with it so that it does not end at the wrong time, determine the free limit that you can use in trading and do not go beyond its limits. Apply these simple rules in trading, and you will be able to save deposit funds.

Trading with a minimum number of assets: work, especially if you are just starting to work with options, initially only with 2-3 assets; Having become more experienced, you can safely expand your investment portfolio by trying several transactions at once. Apply these simple rules in trading, and you will be able to work more productively.

Trading without emotions: work with options in a serious mood; It should be borne in mind that, in addition to having experience, the mood is something that gives your work a lot, including positive results; Emotions make it difficult to concentrate and draw the right conclusions in relation to the dynamics of the market. Apply these simple rules in trading, and you will be able to achieve success in options.

Expiration

It is also one of the leading concepts in options trading. Like the rules of money management, expiration is a serious factor determining the success of work. Expiration is the moment when all its participants learn about the results of their forecasts. A well-thought-out attitude to expiration is a whole strategy and, if you need a stable income, expiration, then. That will help you quickly reach your goal.

Types of options:

- Ultra-short options – 30 seconds – 5 minutes.

- Short-term options – 10 minutes – several hours.

- Medium-term options – a day – a few weeks.

- Long-term options – a month – six months.

Is it allowed to extend the expiration?

It is allowed, not on all trading platforms. If during the auction you understand that the forecast is incorrect, simply extend the expiration and thereby reduce your possible losses.

Expiration rules:

- Traders who are only beginners in options should start with long-term trading, which provides stability and minimal risks.

- Traders who are professionals should, when choosing expiration, choose a comfortable trading style. When choosing a broker, find out whether it will be possible to increase the expiration during trading, which further minimizes losses in case of an incorrect result.

- Traders who need instant income should work with short-term (a minute – a few hours) expirations that can bring real money in 30 seconds.

- Traders who need a stable income should choose long-term trading, characterized by a calm style, greater predictability and minimal risks.

Expiration in strategies with the Linear Regression Channel

Expiration at breakdown signal

Short-term trading: allowed in this case, although it is considered one of the most risky and unpredictable on the market; In order to avoid false signals, use additional indicators.

Medium-term expiration: allowed; The indicator will help you better study the dynamics of the market and allow you to earn a decent income, risking much less capital.

Long-term expiration: also possible; Thanks to a convenient indicator, you can understand the direction of market dynamics, use fundamental analysis and get a decent income.

Expiration at a reversal signal

Short-term trading: allowed, although it is considered one of the most risky and unpredictable on the market; Use additional indicators in order to avoid a large number of false signals.

Medium-term expiration: allowed; The indicator will help you study the dynamics of the market and allow you to earn a decent income, risking your capital much less.

Long-term expiration: possible; Thanks to the convenient principle of the indicator, you can understand the direction of market dynamics, use fundamental analysis and get a decent income.

Expiration at a trend signal

Short-term trading: allowed, despite the fact that it is considered one of the riskiest in the market; Trend trading is considered one of the most reliable, if you use additional indicators, you can get a high income per session.

Medium-term expiration: allowed; The indicator will help you accurately determine the market trend and earn a decent income on it, risking your capital much less.

Long-term expiration: possible; Thanks to the convenient principle of the indicator, you can understand the direction of market dynamics, use fundamental analysis and get a decent income.

Expiration in the “Linear Regression Channel+RSI”

A simple productive trading strategy using the Linear Regression and RSI indicators. The RSI will accurately show oversold-overbought situations.

Short-term trading: allowed in this fairly profitable strategy, you can take advantage of more than one high-quality signal and earn decent capital.

Medium-term expiration: allowed; It will allow you to get a good income with calmer trading, using two high-quality tools.

Long-term expiration: also allowed; such trading, in addition to being able to work with reliable RSI signals, will allow you to use all the knowledge in the field of fundamental and technical analysis, which will give you a decent income.

When diving into trading, pay special attention to the expiration possibilities in order to achieve the best results from trading. To do this, work on the convenient platform of the Finmax broker, the advantages of which are: a functional trading platform, a convenient personal account, a wide range of options and expiration dates (from 30 seconds to six months), etc. Build a profitable strategy now by going to the finmaxbo.com broker’s website.

Downloads

MetaTrader 4 (MT4) platform – download.

Linear regression channel indicator for the MT4 platform – download.

Tagged with: Binary Options Indicator