Обзор

Обзор

A successful microfinance organization that offers term loans of money online and installment payments for regular customers.

Читать полный обзорОтзывы трейдеров

Детали

| Брокер | |

|---|---|

| Адрес сайта | |

| Демо счет | |

| Брокер с сигналами | |

| Общий балл |

Полный обзор

The history of Zymigo begins in 2013 (reviews about the MFC “Zaimigo” read on the website This is a divorce™). For 6 years of work, the company has won the trust of customers, has become a competitive and reliable lender. But there are still skeptics who do not trust microfinance organizations.

Is it worth bypassing MFIs ? What is Zaymigo hiding? Is she honest with clients? We suggest that you familiarize yourself with a full-fledged review of the lender in order to form your own opinion about the company.

Why Zaymigo

The Zaymigo online service is a quick way to get a loan without visiting the office. Customer questionnaires are reviewed by employees, not robots. The company focuses on the fact that the service is not automated. On the one hand, information is processed by the same people as borrowers, on the other hand, the human factor comes into play and the risk of miscalculation increases.

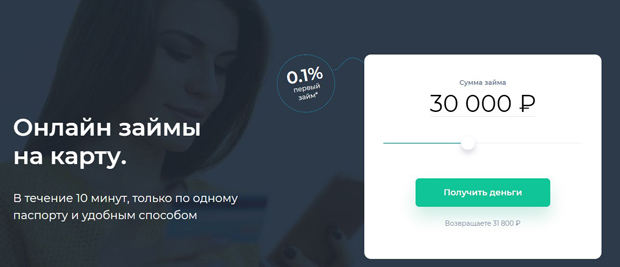

What else distinguishes MFIs is high credit limits. Usually, microloans reach 30-50 thousand rubles. Zaimigo draws up loans of up to 70,000 rubles. Regular and trusted customers can borrow such an amount. The limit for new borrowers is 12,000 rubles. After each debt repaid, it increases. So it makes sense to repay borrowed funds on time and avoid delays.

With the help of the service, you can improve your credit history. Information on repaid debts is received by the BCI. If you have proven yourself well in cooperation with Zaymigo, then you have a good chance of getting a bank loan on favorable terms. The credit bureau receives data on restructuring programs. If the debt is repaid in full, the MFI will provide information free of charge.

Zaimigo also offers installments. The client repays the debt without interest, in equal amounts according to the payment schedule. This option is available only to regular borrowers. Beginners will have to earn trust in order to arrange an installment plan. Zaymigo has a system of discounts. If you enter a promo code, the interest on the loan will decrease. Quite an interesting offer, most MFIs do not have this.

Urgent loans of money from “Zaimigo”

You can use the services of the service on the official website of the company zaymigo.com. To receive money, fill out the form and enter your personal data. Only consultation is available by phone. An adult can become a borrower, there are no other age restrictions. Zaimigo is loyal to customers and makes services available to the majority of the population.

Conditions for granting money loans

To get a loan of up to 70,000 rubles, you will need a Russian passport and phone number. MFIs rarely request information on solvency, litigation and bankruptcy. You can get loans up to 3000 rubles only with a passport. The conditions for obtaining a loan from Zaimigo are as follows:

- money is issued to adult and fully capable citizens;

- the loan is not issued if there are debts in other MFIs and banks;

- Borrowed funds can only be used in a legal way.

If the company’s employees approve the application, the borrower will receive the money in cash (at the points of issue “Golden Crown” and Contact) or by online transfer to a personal bank card of any bank. If the client has not repaid the debt to Zaimigo, but wants to get another loan, you will have to wait. Such applications are processed within a few days. If there are no debts in the last 20 days, the company will approve a new loan. If there are delays, then the waiting period increases to 7 days. MFI offers to issue one of the following loans:

- One-time debt repayment. 1000 – 12,000 rubles, term – from 1 to 30 days. The daily rate is 1.5%. If you repay the debt on time, the credit limit will increase by 100% of the overpayment amount.

- Recurring payments every 2 weeks. The loan amount is from 15 to 50 thousand rubles. The refund period is from 6 to 20 weeks. The rate is 1% per day.

- Restructuring program. It is assigned in case of delay in payment. The client pays a 30% penalty. Half of the amount goes to pay for the service. After the down payment, fines and interest are not charged, the amount of debt is fixed. Further calculation is made every 2 weeks. The borrower pays 2000 rubles until he fully repays the debt.

The service also offers other services (free of charge – for respectable customers, for a fee – in case of delay):

- Access to the P2P platform. The borrower gets to the credit exchange, where you can find a lender. The service acts as an intermediary: it controls the legality of transactions, checks the reliability of the parties, and regulates legal issues.

- Additional features of the personal account. The borrower gets access to the advanced functionality of the site.

How to apply for a loan of money?

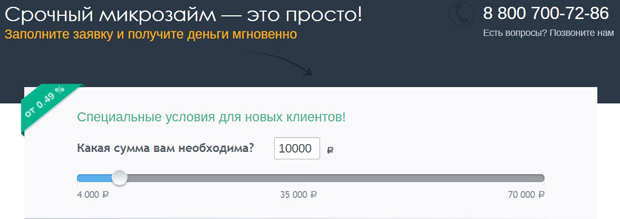

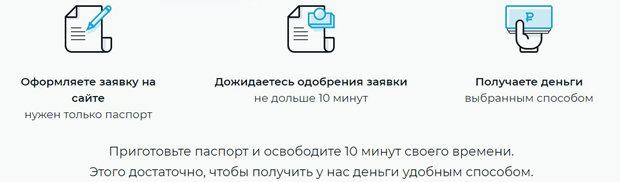

The procedure for filling out the application is standard. Go to the official website of the zaymigo.com, on the start page, specify the loan amount and the debt repayment period. The system will calculate the interest and the total amount of debt. If you are satisfied with the result, register on the site. Without registration, you cannot send an application. To create an account, enter your phone number, enter the code from the SMS message, and create a password. Now you can fill out the form:

- Enter your full name, gender, place and date of birth, enter your passport details. You will need a registration and residence address, as well as an email.

- Select a social status. If you are employed, enter your employer information. Specify the position and work phone number.

- List past credits (including active credits). Indicate where and when they were taken.

- Enter the payment details of the card.

In order for the company’s employees to consider the application, agree with the rules of the service and the policy of the MFI. It takes a few minutes to process the information. A good credit history speeds up the process. You can check the status of the application in your personal account.

How to return money to MFI “Zaimigo”?

The client repays the borrowed funds according to an individual payment schedule. The document is drawn up taking into account the type of loan. There are two options for repaying the debt:

- one-time payment of debt with interest by a certain date;

- repayment of debt in equal installments every 2 weeks.

To repay loans, go to your personal account and select a payment method. There are several options:

- Bank cards (commission 3.7%);

- Offices and terminals “MTS”, “Beeline”, “Euroset”, “Svyaznoy”, KARL, Contact (commission fee 1%);

- Service points of payment systems “City”, “Golden Crown”, “Frisbee” (commission 1%);

- Transfer from a bank account (additional costs are calculated according to the bank’s tariffs).

- The interest-free method of debt repayment is carried out through the QIWI EPS. To pay off the debt in this way, you need to register an electronic wallet. In “Zaimigo” you can return the money ahead of schedule. If you pay off the debt 2 weeks after receiving the loan, avoid commissions and save on interest. The bet is recalculated.

The Zaymigo service extends the debt repayment period if the client cannot return the money on time. The service is paid and available in strictly defined cases. The borrower must have sufficient grounds for prolonging the loan. A list of such circumstances is listed in the General Terms and Conditions of the Consumer Loan Agreement. If you decide to extend the term, prepare 30% of the loan amount: 15% – payment of the penalty, 15% of the principal debt.

Complaints about zaymigo.com

Zaimigo has negative ratings. Borrowers complain about the misbehavior of the company’s employees. The staff insults customers, violates the law. In case of late payment, threats are received. Employees of MFIs are rude not only to debtors, but also to guarantors.

Other complaints are related to the interest rate. Many borrowers believe that it is unreasonably overstated, and some customers even accused the company of obtaining personal data for their further distribution. There are also positive comments. Users noted the fast processing of applications and a high chance of obtaining approval, a wide range of ways to receive and return funds.

Regulation and licenses of Zaimigo MFK LLC

To make sure of the integrity of the lender, customer reviews are not enough. It is necessary to check the status of the MFI. Does Zaymigo have official permission from the Central Bank? Does the company have the right to provide services in the field of microcredit? To verify the legality of the activity, we turn to the unified register of MFIs. If there is a record of the Zaimigo service, the lender is operating legally. If there is no data, the activities of MFIs are illegal.

License & Regulator

The Zaymigo service is the property of Zaymigo MFK LLC. The organization is included in the register of MFIs by decision of the Central Bank of the Russian Federation. The company has been assigned a 5260355389 number. The activities of the service are regulated by the federal laws “On Consumer Credit (Loan)”, “On Microfinance Activities and Microfinance Organizations”.

- Read Federal Law No. 151-FZ of July 2, 2010 “On Microfinance Activities and Microfinance Organizations” as amended on the websites: consultant.ru, garant.ru;

- State Register of Microfinance Organizations (download from website cbr.ru, Zaimigo MFK LLC – line 415);

- Documents from the zaymigo.com website: “General Terms and Conditions of the Consumer Loan Agreement” (view), “Rules for Granting Loans” (view), “Personal Data Processing Policy” (view), “Information for Recipients of Financial Services Provided by Zaimigo MFK LLC” (view).

Zaimigo Support Service

Borrowers can contact customer service from 8:00 a.m. to 5:00 p.m. There are 3 communication channels:

- E-mail: [email protected].

- Phone: 8 (800) 700-72-86.

- Feedback form.

Before contacting customer support, take a look at the FAQ section on the zaymigo.com website. It analyzes the most common situations and popular questions from users.

User Agreement zaymigo.com

Usually, MFIs develop and publish a user agreement, but the service does not have such a document. But there are rules for granting a loan. Another important document is the General Terms and Conditions of the Consumer Loan Agreement. We recommend that you familiarize yourself with the company’s policy in advance. If the rules do not suit you, do not cooperate with MFIs and do not apply for loans. Let’s consider the main nuances of cooperation with Zaimigo. The company takes into account the day when the money came to the MFI’s account. If you sent money on the 4th, and they came on the 5th, the MFI will take into account the last date. Payment processing takes up to 3 business days. Don’t keep this in mind when making recurring payments. Otherwise, there will be a delay, and this is an additional financial loss.

The next rule concerns debt restructuring. To use this program, you need to fulfill the requirements of the service. If this is not done, the restructuring agreement is invalidated.

And the last point concerns non-payment of interest. If the delay reaches 5 days, the lender has the right to terminate the loan agreement unilaterally. The borrower must repay the debt in a lump sum. If you do not return the money in full, you will have to pay a penalty.

Is Zaymigo a scam?

The Zaymigo service captivates with rich functionality, but it is difficult to understand the rules of MFIs, especially for a beginner. To get an increased credit limit and other benefits, you need to fulfill a number of requirements. Users prefer to be credited to more loyal organizations. In addition, the work of the Zaimigo staff leaves much to be desired. Rudeness, carelessness and manipulation do not like anyone. Of course, the Zaymigo service cannot be called a scam, but you need to cooperate with such an organization carefully.

Conclusion

The Zaimigo service deserves 6 points out of 10. MFIs have created a user-friendly website, developed a wide range of functionality, but this is not enough for a high rating. The service needs to be optimized and refined, the list of requirements and the interest rate reduced, and the company’s employees should be taught friendly and polite communication with customers. Only such an approach will ensure the development of the service, the influx of new borrowers and reaching a new level in the field of microcredit.

Брокер